On May 10th, 2022, Li Auto, the leader of the new energy vehicle start-ups, released its Q1 financial report in the new energy vehicle market.

During the first quarter of 2022, Li Auto delivered a total of 31,716 vehicles, with an increase of 152.1% compared to the same period of the previous year, but a decrease of 10% quarter-on-quarter compared to Q4 of 2021. The total revenue was 9.56 billion CNY, with an increase of 167.5% YoY, and a decrease of 10% QoQ.

The Chinese auto industry was challenged by multiple factors in Q1, such as the off-season of the Spring Festival, the subsidy cuts, and the rising cost of raw materials. Furthermore, the outbreak of COVID-19 at the end of Q1 had a significant impact on the entire auto industry in China. As the risks and uncertainties became more intense in the market, concerns about L9’s launch postponement and this year’s new energy vehicle market prospects prevailed in the conference call. Nonetheless, the official representative announced that there will be another new EV model in the 200,000 to 300,000 CNY price range next year.

Now, let’s take a look at the key information from Li Auto’s Q1 financial report, starting with the financial summary.

Financial Summary

In the CEO and CFO’s comments on Q1, both of them used the word “steady” to describe the financial report, which, I think, would be the first impression of most people.

Main Indicators

-

Total revenue was 9.56 billion CNY, with an increase of 167.5% YoY and a decrease of 10% QoQ;

-

Automotive business revenue was 9.31 billion CNY, with an increase of 168.7% YoY and a decrease of 10.3% QoQ. The decrease in sales revenue is mainly due to the reduced delivery volume caused by the Spring Festival holiday;

-

Total gross profit was 2.16 billion CNY, with an increase of 250.9% YoY and a decrease of 9.1% QoQ;

-

Overall gross margin was 22.6%, compared to 17.3% in the same period last year, and 22.4% in the previous quarter;

-

Gross margin per vehicle was 22.4%, compared to 16.9% in the same period last year, and 22.3% in the previous quarter;

-

Sales costs were 7.4 billion CNY, with an increase of 150.1% YoY and an increase of 10.2% QoQ, due to the impact of the volume of vehicle deliveries;

-

Net loss was 10.9 million CNY, compared to net profit of 295.5 million CNY in the previous quarter;

-

Operating cash flow was 1.83 billion CNY, with an increase of 98% YoY and a decrease of 52.2% QoQ, and the free cash flow was 502 million CNY;

-

As of March 31st, 2022, total cash resources (including cash and cash equivalents, restricted cash, and short-term investments) was 51.19 billion CNY, compared to 50.16 billion CNY in the previous quarter.- Ideal Automobile’s R&D expenditure in Q1 was ¥1.37 billion, a year-on-year increase of 167% and a quarter-on-quarter increase of 11.7%, the increase in R&D spending was mainly due to the increase in R&D personnel and investment in new product development;

-

Sales and management expenses were ¥1.2 billion, a year-on-year increase of 135.9% and a quarter-on-quarter increase of 6.8%, the increase in expenses was mainly due to the personnel growth, salary increase, as well as venue rental and marketing activities associated with the company’s expansion.

In terms of financial data, the most impressive is probably the Q1 gross margin per vehicle, which remains at a relatively high level of 22.4%, even slightly higher than the historical best level of 22.3% in Q4 2021. Considering the industry-wide rise in raw material prices, it can be said that Ideal’s ability to maintain its gross margin is quite rare. The net loss of ¥10.9 million should be within expectations, as Q1 was affected by three unfavorable factors: Chinese New Year, price hikes, and the pandemic.

The Chinese New Year holiday had a significant impact on both production and deliveries, and also affected potential customers’ decision to purchase cars. Traditionally, most consumers do not tend to make large purchase decisions around the Lunar New Year period, resulting in a decrease in orders in February and a decrease in deliveries in March. This reflects on financial data, as deliveries, automotive revenue, and total revenue all decreased by 10% quarter-on-quarter.

Regarding the price hike issue, Li Xiang mentioned the collective reasons for the industry-wide price hike on Weibo in March and explicitly stated that contract prices would increase significantly in Q2. There was no mention of cost increases in this quarter’s financial report, and the overall gross margin and gross margin per vehicle were almost the same as last quarter, indicating that the price hike did not affect Ideal. This was also confirmed in the conference call. As for Q2, Ideal chose to offset the corresponding impact with a price increase of ¥11,800.

Since mid-March, the impact of the pandemic on the automotive industry has become increasingly prominent, especially since the end of March, and Ideal’s Changzhou plant in the Yangtze River Delta region has also been somewhat affected. However, the main impact will be seen starting from April, and the impact on Q1 is not significant, as reflected in the delivery guidelines for the next quarter.

It is worth noting a significant decrease in operating cash flow, with operating cash flow of ¥1.83 billion in Q1, a year-on-year increase of 98%, but a sharp quarter-on-quarter decline of 52.2%. The main reason for the cash flow tightening was the decrease in revenue, and another potential factor that cannot be ignored is the upcoming launch of the new model L9, which requires preparations and capital investment in the supply side.

Q2 Business Outlook

Given the current impact of the pandemic, Ideal Automobile has given a relatively conservative delivery guidance compared to previous years.

- It is expected to deliver 21,000 to 24,000 vehicles, an increase of approximately 19.5% to 36.6% compared to Q2 2021.- The estimated total revenue is between 6.16 billion yuan and 7.04 billion yuan, an increase of about 22.3\% to 39.8\% compared to Q2 2021.

The total delivery volume of IDEAL ONE in the whole first quarter was 31,716 units, with a year-on-year growth of 152.1\%, and has been the champion of the mid-to-large-sized SUV sales chart for 11 consecutive months. According to the delivery guidance and the previously announced delivery data of 4,167 in April, the total task volume of the second quarter in May and June is about 17,000-20,000 units. Considering that one-third of May has passed, the epidemic situation in Shanghai and the entire Yangtze River Delta region has not fully recovered, this goal still faces certain challenges, so there will be considerable pressure on IDEAL in June.

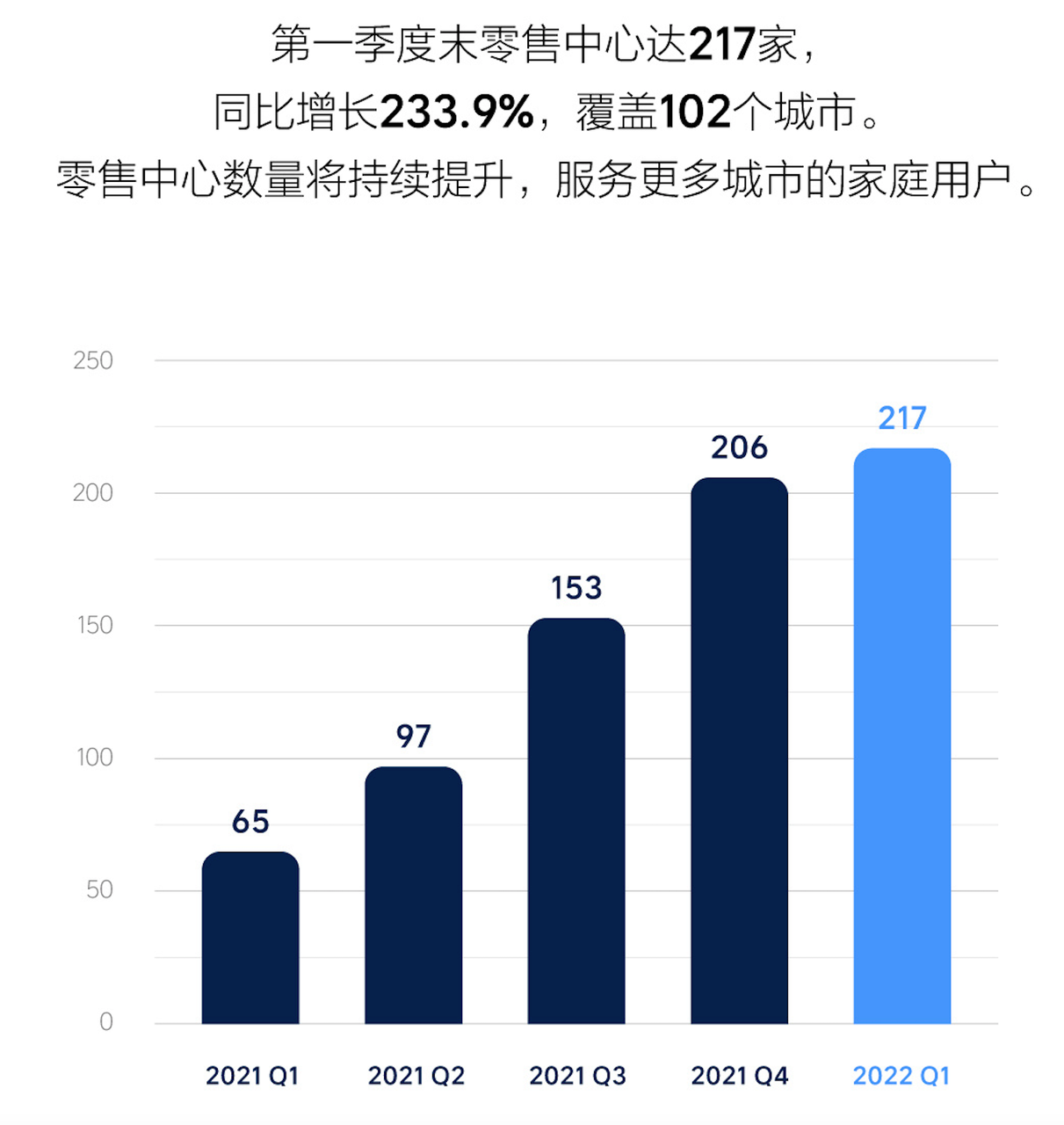

In terms of the number of stores, the increase was relatively slow due to the impact of the Spring Festival and the epidemic. However, in the telephone Q&A session, the management explicitly mentioned that although the epidemic had a great impact on offline stores, stores are the key to supporting larger sales, and the future will continue to promote the expansion of store numbers.

Conference call: new cars, charging stations, and market strategy

Opening statement

In the opening statement, the management mentioned the rapid development of China’s new energy market and the achievements of IDEAL ONE as a popular model. At the same time, the severe epidemic has had a huge impact on China’s automotive industry. 80\% of IDEAL’s suppliers of parts are located in the Yangtze River Delta region, and IDEAL’s Changzhou factory is located in the center of the Yangtze River Delta industry. The supply and logistics have been severely affected by this epidemic, which is the main reason for the decline in deliveries in April.

In terms of products, IDEAL users’ usage rate of NOA (openable road sections) reaches 61.3\% on highways, which is of great significance for subsequent technological iterations. The subsequent L9 model will be equipped with a new generation of intelligent driving system equipped with lidar and self-developed controllers. In addition, despite the impact of the epidemic, IDEAL is still actively communicating with various supply chains, and the plan to deliver L9 in the third quarter will not change.

IDEAL is also continuously investing in the research and development of the next generation of high-voltage pure electric platforms in addition to extended-range models, including high-rate charge and discharge batteries and high-voltage fast charging technologies.

Q&A session

The Q&A session mainly focused on the impact of new cars and the epidemic on supplies and markets, and Li Xiang personally answered the Q3 question about product market strategy, which is worth paying attention to.

Q1: What is the basis for IDEAL Q2 delivery guidance, and when will L9 be released?

A1: The basis for the delivery guidance mainly depends on the recovery of supplier production and a sufficient number of orders, and the only concern now is the potential decrease in market consumption desire. L9 will be released according to plan in Q3.Q2: What are Ideal’s production strategies in the face of the domestically-mandated zero-covid policy, and will further fluctuations in the price of raw materials lead to adjustments in Ideal’s prices?

A2: Ideal has contacted numerous suppliers to develop multi-channel supply solutions while also increasing short-term supply reserves. Long-term supply chain management strategies will not change significantly. The recent pricing adjustments have taken into account the trend of raw material prices for a period of time to come, and currently, there are no plans to adjust prices any further. Ideal will continue to keep an eye on market trends.

Q3: What is Ideal’s market outlook for the latter half of this year, and how will the company continue to create popular products with their new product release cycle?

A3: Ideal is confident in the market’s recovery performance, and orders outside of Shanghai have rebounded normally. If not for the continued impact of the epidemic on the economy, Ideal ONE will still perform well in terms of sales.

In terms of products, in 2021, Ideal ONE has achieved a market share of over 30% in the price range of 300,000-400,000 yuan for new energy vehicles. As a good popular product, this market share is actually reasonable. The following summarizes our product plans:

Firstly, two different power sources will use two different body types.

We believe that SUVs are the best body type for extended range vehicles. For the level of product we want to create, sedans are not the most efficient and MPVs are also not the most efficient. SUVs are a very good form.

For pure electric vehicles, we believe that a large size SUV is not highly efficient, so for pure electric vehicles, we have a completely new form, which is specially designed for the special form of pure electric vehicles. Within the next two years after we release our products, everyone will find that we have created a pure electric product that is different from any other form of product on the current market.

Therefore, we use completely different forms for different power sources, and there will be no competition between the two forms, but rather, both will work together to tap into the 200,000-500,000 yuan market we face.

The second level is to adopt different prices. We will release a popular product within each 100,000 yuan price range, including the 400,000-500,000 yuan range. Our starting point is good, as the Ideal ONE is placed in the 300,000-400,000 yuan range. We can either move up to the 400,000-500,000 yuan range, or explore the 200,000-300,000 yuan price range. We will essentially have a heavyweight product in each price range to meet the needs of users in that range. There will also be both pure electric and extended range products in the same price range, but with different form factors. Behind this, there will be greater cohesion, such as the platform technology for extended range products, from product performance to supply, which will be shared with pure electric vehicles; including our automatic driving, intelligent cabin, and electronic architecture, which will form a more effective module for product combination.So this is our rough product plan. To be more clear, our product plan is very similar to the iPhone. With the help of an effective technology platform, we will launch different models such as the iPhone 12 Pro Max, iPhone 12 Pro, iPhone 12, and iPhone 12 Mini, targeting different price ranges and meeting different consumer needs accurately. This is the product strategy of Ideal Cars. We will also evaluate the product power provided by each price range and whether it can become the absolute leader in this price range. This is the entire product logic of Ideal Cars.

Q4: Will the rise in battery raw material prices affect the development of new energy vehicles? Will the price increase persist for a long time? Will it affect market demand and reduce store openings? What are the considerations for the layout of charging piles for pure electric products?

A4: Battery prices will remain high this year, but in the long run, they will decrease. In fact, orders are still strong since the price increase of the Ideal ONE. Stores are the key to supporting sales, so we will continue to open stores no matter how the epidemic situation is. Ideal currently has a dedicated team layout for charging stations, focusing on building stations on highways between cities. The site selection for building stations within cities will be more cautious.

Q5: What are the negotiation methods and progress of battery cost? There are many pure electric cars on the market priced around 200,000 yuan. What is Ideal’s view on this market?

A5: Ideal has a framework agreement with the battery supplier, so cost fluctuations will not be very frequent. Ideal’s products will continue to focus on families with children until 2025, and all products will have four-wheel drive and excellent intelligent configuration. The price will focus on the price range of 200,000 to 500,000 yuan. This year to next year, including L9, there will be three new products, including a new generation of extended range products and BEV high-voltage platform products. Ideal will have new products priced around 200,000 to 300,000 yuan next year.

In the Q&A session, in addition to the analysis of the rise in power battery prices earlier, the biggest highlight is the heavyweight information revealed by CEO Li Xiang regarding product planning. Two power forms correspond to two body forms, and there will be three new products launched next year.

As we all know, the only product of Ideal currently, as well as its biggest selling point, is the extended range power form. The concept of using electricity for short trips and oil for long trips has deeply resonated with people, and we can even say that Ideal ONE has ignited the extended range route. Li Xiang’s view on the best matching of power forms and body forms once again shows his grasp of product concepts.

Efficiency is considered when matching power forms and body forms, rather than simply aiming to go electric. This approach is somewhat like “adapt to local conditions”. Therefore, Li Xiang pointed out that the efficiency of the pure electric form on SUVs is not high. Their pure electric products will be a new species that is different from existing products on the market, which means that it is not a sedan or SUV, nor is it an MPV.Considering what Li Xiang mentioned, within the 200,000 to 500,000 pricing range, for each 100,000 yuan interval, there will be two types of powertrain models invested. This means that in the long-term future, at least six different models of varying levels, body types and powertrain forms will be available. This product line gives people a feeling of “land, sea, air + walking on two legs”, which is quite exciting.

In the short term, from now until next year, ideal will launch three models, including the L9 and a pure electric vehicle priced between 200,000 and 300,000. The L9 is an extended range power SUV priced at 450,000 to 500,000 and is already well known. The 200,000 to 300,000 model is a high-voltage pure electric vehicle, which is a new message that has never been revealed before.

Currently, although NIO does not have a model priced below 300,000, there is news that Anhui Economic Development Zone and NIO signed a new agreement today, preparing to import NIO’s new high-end brand, which will be put into production in 2024. Meanwhile, Xpeng’s main selling price for the P7 models is in the 200,000 to 300,000 pricing range. If ideal releases a high-voltage pure electric vehicle in this price range next year, the competition between NIO and Xpeng will be even more exciting.

As for the unknown model among the three new models, what will it be?

Li Xiang’s three car plan seems to be not completely consistent with the vehicle plan in this Hong Kong Stock Exchange recruitment book, or Li Xiang did not mention all the vehicle plans for 2023. Bold speculation, if a latest technology-equipped L9 and a pure electric vehicle are respectively launched in the relatively high-end and low-end price ranges, will the other new car be the new successor to the ideal ONE in the middle price range? After all, the ONE, which made outstanding contributions to ideal, has been on the market for almost three years.

In conclusion

The first quarter of the year was a tough test for any new energy vehicle company, including Ideal, due to the Spring Festival, costs and the epidemic.

However, Ideal’s performance, which is largely in line with expectations, has also brought a little surprise. The decline in delivery volume and revenue by 10% on a month-on-month basis is expected, but the year-on-year increase and the 22.4% profit margin that is basically stable on a month-on-month basis is truly impressive.

Ideal is relatively flexible compared to other new forces in terms of not being bound by technical routes and choosing electric or extended range power train as appropriate. The product layout of at least six models in three price segments and three new models that can be launched next year, combined with precise positioning for family vehicles and a downswing that surpasses same-level competitors, makes it possible for ideal’s sales to further increase.

Suddenly, I am looking forward to the participants in the new energy vehicle market in 2023.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.