Jia Haonan posted from the Copilot Temple

Intelligent vehicle reference | WeChat official account AI4Auto

Autonomous vehicle chips have made significant new progress.

“New” in the product type, the automotive high-reliability control chip MCU has achieved autonomous design for the first time.

The importance lies in the precise product positioning, the key type, unique in China, and available in stock soon.

Especially for the automotive industry in the Yangtze River Delta that has almost come to a standstill due to the impact of the pandemic, MCU is a “quick-acting medicine” that can solve the urgency better than AI chips.

The company that prescribes this medicine is called Xinchijishu, a startup company specializing in vehicle chips with an increasingly well-known reputation.

Xinchijishu’s new moves

There are three questions that need to be clarified for Xinchijishu’s new product:

What is it? What are its capabilities? What are its benefits?

Let’s take a look at them one by one.

The E3 series chip is an automotive low-level MCU responsible for executing control instructions for the vehicle. These instructions include the implementation of ADAS low-level functions such as steering, braking, and acceleration and deceleration.

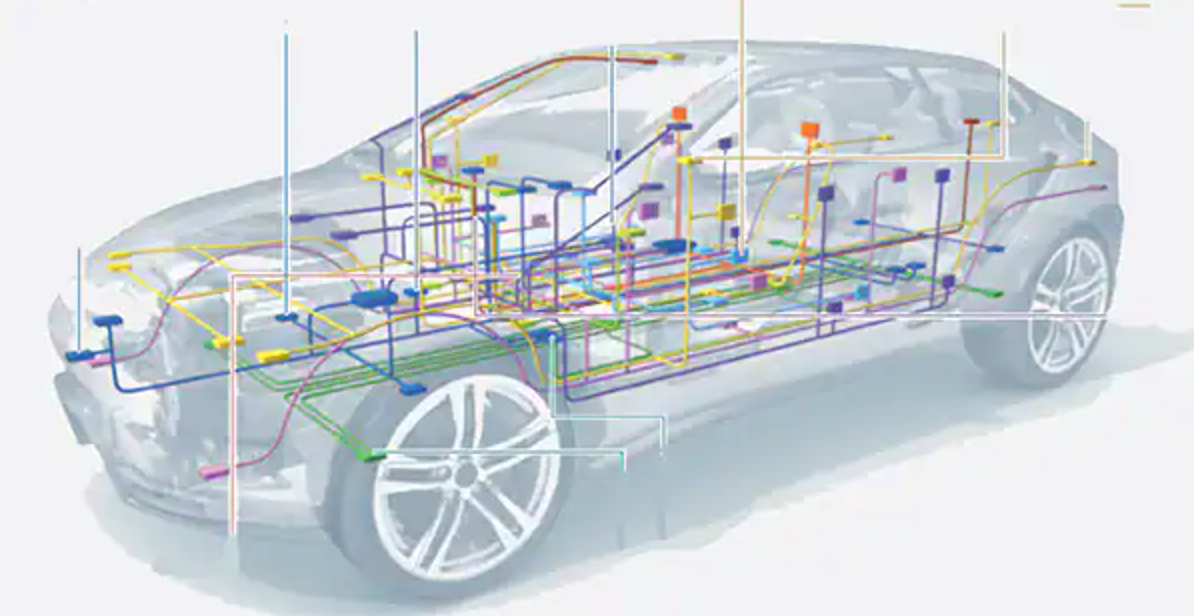

This type of product is a type of chip with an extremely high demand in the automotive industry. The requirements for semiconductor process technology are not as high as those for AI and mobile phone chips, but there are at least dozens of different MCUs on a car in the past.

In addition, the supply chain of this type of product has already become highly mature, and the suppliers are none other than Infineon, Bosch, Renesas, NXP, and so on, which account for more than 90% of the market in China.

The chip shortage that began last year was mainly caused by low-priced chips like this blocking the production line of the entire vehicle.

The E3 chip from Xinchijishu is currently the only domestically produced high-performance and high-reliable autonomous vehicle MCU that will soon be in production.

As for specific performance, Xinchijishu claims that the E3 series has surpassed foreign supplier products. Based on TSMC’s 22nm vehicle-grade process, the chip architecture is based on ARM Cortex-R5F, and the CPU frequency can reach up to 800MHz, which is the highest among all vehicle-grade MCUs at present.

As a comparison, the majority of vehicle-grade MCUs have a main frequency of 100MHz, and 200-300MHz can already be called high-performance MCUs.

In addition to performance, Xinchijishu emphasizes the trait of vehicle-grade high reliability.Xinchuan Technology is currently the first “four-certified” vehicle regulation semiconductor enterprise in China, including ISO26262 ASIL D level functional safety process certification, AEC-Q100 reliability certification, ISO26262 functional safety product certification, and national security certification.

The four safety certifications are the highest level certifications in both international and domestic standard systems, and in order to pass the certifications, a series of technical indicators must be met.

For example, the E3 series has a maximum configuration of 6 CPU cores, including 4 cores that can be configured as dual-core lockstep or run independently. The so-called dual-core lockstep means that the two cores are redundant backups to each other, improving reliability.

When the two cores run independently, the highest design performance can be achieved.

In addition to dual-core lockstep, the E3 series configures error checking and correction (ECC) on all SRAM (static random access memory) and end-to-end (E2E) protection on safety-related peripherals.

These technical features and certifications enable E3 series chips to be used in most automotive application environments with an ambient temperature range of -40°C to 125°C and maintain a 99% error diagnostic coverage for the chip core.

In terms of specific functions, the E3 series MCU can realize multiple functions in the fields of braking control, wire-controlled chassis, ADAS/autonomous driving motion control, body control, gateway, T-Box, HUD, LCD instrument, and streaming visual system CMS.

It can even be said that at the current point in time, Xinchuan is the only Chinese semiconductor enterprise that can provide ASIL D level MCU, filling the gap in the domestic high-end and high-security level vehicle regulation control chips.

According to Xinchuan, 20 customers had already started supporting R&D work for the E3 before its official release.

Of course, this is one of the unique characteristics of Xinchuan Technology. Its business logic and strategic choices will be analyzed later, but first let us understand the background of this enterprise.

What kind of company is Xinchuan?

Xinchuan Technology was established in Nanjing in 2018 by Zhang Qiang and Qiu Yujing, who had worked in European and American automobile semiconductor companies for over 20 years.

Qiu Yujing, the CEO of Xinchuan Technology, studied wireless engineering at Southeast University for her undergraduate degree and obtained a master’s degree from the University of Wisconsin-Madison.

Qiu Yujing has successively joined the listed company Neomagic, co-founded Catamaran, which is focused on fiber optic communication chip development, and participated in ServerEngines, which is engaged in network processor development. After joining Freescale in 2011, she led the R&D team to develop the product with the highest market share in the global automotive-grade processor.

Her work experience covers the R&D and production stages of integrated circuits from the front to the back end.

Therefore, this can also explain why Qiu Yujing was able to produce mass-produced products within 2 years after founding X-Chips Technology.

Since its establishment, X-Chips Technology has raised funds up to Series B, with a disclosed amount of 1.5-1.6 billion yuan, and an additional amount of hundreds of millions of yuan for Pre-A rounds.

By this calculation, X-Chips Technology has raised nearly or even exceeded 2 billion yuan so far.

Investors include financial funds such as Sequoia China and Redpoint China, industry players such as Lenovo Capital and NINGDE TIMES, as well as semiconductor investment industry famous names like Walden, and “national brand” funds such as National Investment Fund for Technology Innovation.

It is rumored that there will be investment from well-known automakers and Tier 1 backgrounds in the future.

Capital’s pursuit reflects the scarcity of the market.

So what exactly is X-Chips Technology doing?

In addition to the MCU for low-level control introduced just now, X-Chips Technology’s product line includes all the chips needed in a car.

The E3 series is a control chip, and there are also X9 series that support intelligent cockpit, V9 series that serve automatic driving computing needs, and G9 series, which are responsible for communication between various functional modules in cars.

Among them, the intelligent cockpit chip, gateway chip, and automatic driving chip have been put into mass production and delivery, covering 70% of domestic car companies and 250 companies in the supply chain.

In addition, X-Chips has already obtained 60 mass production orders, covering international brands, local brands, and new players in automobile manufacturing.

Among them, the intelligent cockpit chip, which is the main product delivered, is said to have beaten Qualcomm in bidding for a new car model of a well-known joint venture brand.

X-Chips Technology claims to have a grand dream of “global No. 1 in automotive chips,” and its product layout is also broad and comprehensive, but the first mass-produced product is not the most high profile or technically difficult automatic driving chip.

There are many companies making chips for cars, but it is rare for companies like X-Chips to have such a layout. What is the consideration behind it?

Hot market for car chips, what is X-Chips’ ecological position?The product layout and business strategy of Xinchitech are closely related to the current status of the Chinese automotive semiconductor market. The first major background is the long-term tightness of the automotive industry supply chain. This has been the norm since last year, but domestic OEMs were still caught off guard. According to Strategy Analytics, automotive chips are mainly divided into three categories: MCU, sensor chips (such as CMOS), and power semiconductors. As we have mentioned before, the largest demand and the most mature supply chain for chips in the automotive industry is actually MCU, which is not as cutting-edge as AI chips. In the current automotive industry, where sales of fuel vehicles still account for the majority, the value of MCU is the highest, reaching 23%, while vehicle-mounted AI chips are classified as “others”, with a negligible proportion. In the Chinese automotive market, 90% of MCU’s share is held by foreign suppliers. The seven major overseas finished products have had stable supply for many years, and there is no risk of being sanctioned for these non-cutting-edge chips. Therefore, for domestic OEMs, MCU being in short supply was never expected. Most domestic chip manufacturers are targeting higher-end autonomous driving chips, and no one wants to produce this type of products. However, last year, due to the frequent outbreaks of epidemics and natural disasters and the production halt of several international giants, delivery cycles have been as long as 8 months, and chips with prices of dozens of yuan were skyrocketed to thousands of yuan on the black market. Therefore, Xinchitech’s current position in the entire vehicle chip industry is different from that of Horizon and Black Sesame, which are striving for in-vehicle AI computing chips. As shown in the figure above, the target of Xinchitech is an urgent need of vehicle manufacturers that is not supplied by giants and is also not considered by other startups. Moreover, Xinchitech itself has the buffs of autonomy and ecosystem openness. You may ask, even if there is a chip shortage in the past few years, there will be times when there is no shortage in the future. Will Xinchitech inevitably face strong enemies? This is true, but how can Xinchitech compete with giants? This can be explained from the product layout and industry background. This is automation. In the Internet technology companies, the intelligentization of automobiles involves factors such as algorithms, software, and data capabilities. However, in semiconductor companies, the requirements are completely different.

In addition to the high reliability required for automotive-grade, semiconductor companies must think ahead and provide corresponding product matching for the gradually integrated automotive electronic and electrical architecture.

Currently, X-Chips Technology divides the chip planning for the entire vehicle into four parts: Smart Cabin, Smart Driving, Control, and Communication.

For example, in the past, controlling features such as windows, air conditioning, and body functions on a car required one or even several processors, but now they can be integrated into a SoC for implementation.

For the performance of the vehicle itself, integration greatly reduces latency and complexity in information communication within the car, enabling various intelligent functions to be realized.

For example, if the driver has a smoking habit, after taking out a cigarette, they must manually heat up the lighter, and then turn on the air conditioning, window, and ashtray inside the car.

However, with highly integrated cabins, all of these actions can be automatically completed by capturing the smoking behavior through a single sensor such as a camera.

This is the experience improvement that highly integrated automotive-grade chips give to users.

Service for intelligent cars is why X-Chips Technology does not make low-end substitutes for foreign products, and instead implements a MCU main frequency of 800MHz which far exceeds the competitor’s level.

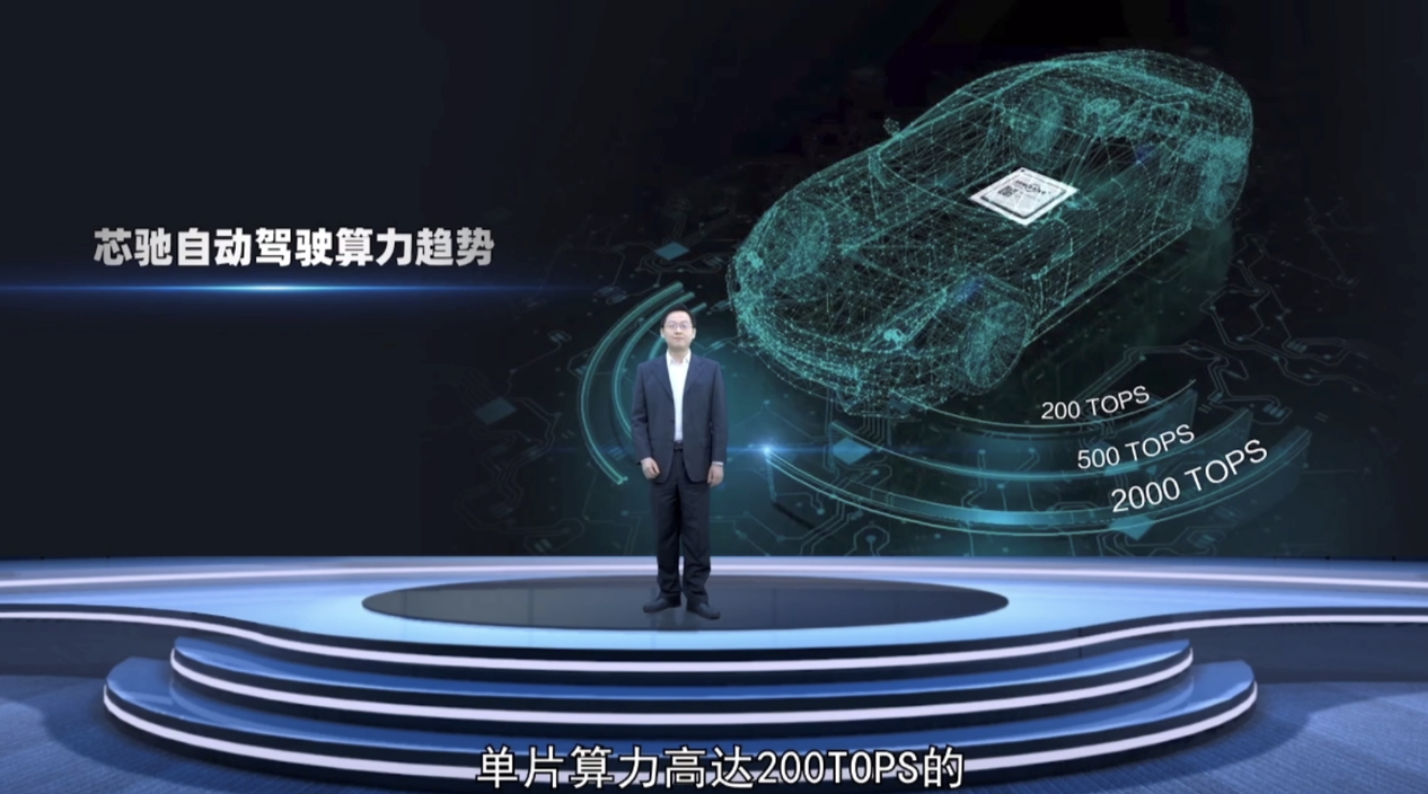

As for the critical autonomous driving chip, X-Chips is targeting the trend of increasing computing power:

In the second half of this year, X-Chips Technology will launch an autonomous driving chip with a single-chip computing power of 200T, which is actually in sync with the product planning of competitors such as NVIDIA and Horizon.

Moreover, X-Chips Technology believes that because they started later, their technical solutions are more flexible and advanced. This can be seen from the fact that their entire product line uses ARM architecture. For traditional automotive semiconductor companies, switching to ARM from self-developed architectures requires a very long time and a high cost.

Therefore, after the giants recovered, X-Chips Technology’s differentiation advantage in competition lies in its more advanced technology stack and clearer focus on intelligentization.

Based on this strategy, X-Chips Technology officially provides the following main competitive advantages:

First, the product line is clear and reduces the complexity of managing the automotive supply chain for manufacturers. Reducing procurement categories can also reduce the risks faced by companies during supply chain tension.The products of Xinchiji Technology have both high performance and integration. Xinchiji claims that while purchasing foreign products may require two chips to achieve the same function, Xinchiji only needs one chip, and it also provides better support for intelligent functions.

Furthermore, Xinchiji’s open collaboration is also an important factor in attracting automakers. Whether it is autonomous driving or underlying architecture, Xinchiji has a supporting team to verify it in advance, and then assigns a workgroup to work closely with the customer for joint development.

Finally, of course, Xinchiji’s advantage as a Chinese enterprise is its independence and controllability.

What is the touchstone of semiconductor manufacturing with 1,000 companies in China?

“Independence and controllability” is an expression from the perspective of supply chain security for OEMs, while from the supply side, semiconductors, especially automobile chips, are in vogue.

Since 2018, there have been over a thousand registered semiconductor companies in China, and in the field of automobile chips, players in autonomous driving, automakers, and industry veterans have successively entered the race. This year, news of successful financing and tape-out has emerged one after another.

However, in the eyes of industry giants, the current situation is far from being truly prosperous and healthy.

The problem raised by Yu Kai, founder of Horizon Robotics, the leading automotive chip company in China, is actually a hardcore measure of semiconductor manufacturing:

Can it be mass-produced?

From this perspective, there are only a few domestic chip start-ups that meet the standard out of over 1,000.

However, experts in the industry that Intelligent Vehicle Consultation consulted pointed out that chips are actually a higher threshold and require more capital than car manufacturing technology.

The failure of a chip that invested hundreds of millions of dollars would seriously dampen enthusiasm in capital markets.

Therefore, for start-ups, “tape-out success” is an important disclosure of information to maintain investor confidence, and in the current hot start-up stage, it is indeed difficult for outsiders to distinguish authenticity.

However, the chip industry has its own cycle, and the companies that survive in the end will be those that are able to mass-produce and sell their chips after a successful tape-out.

— End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.