Author: Rezz

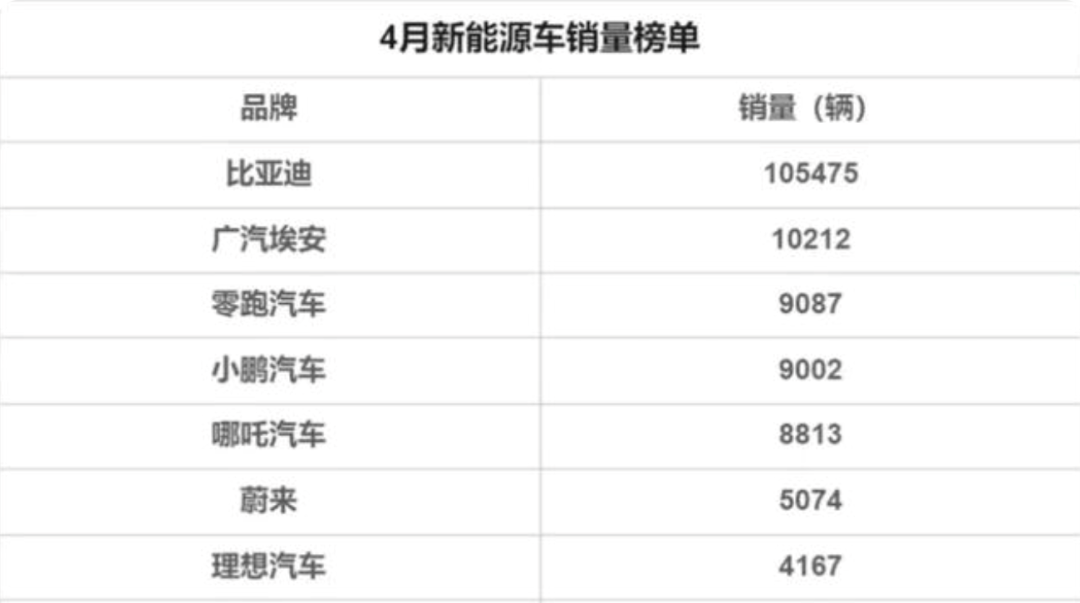

The May Day holiday is over, and on the first day of work, what caught my eye was that in the past few days, major domestic new energy companies have released their April sales figures, which are generally showing a downward trend. However, some enterprises can withstand the interference pressure brought by external environment and draw a perfect exclamation mark for their April sales accomplishments.

“WM Motor” Sales Figures in April Showed a Sliding Trend

Speaking of the new energy market, the first thing that comes to mind must be the “WM Motor” among the new car-making forces. However, in the overall sales figures of April, NIO, XPeng, and Li Xiang all showed a downward trend in sales. According to the sales data, NIO sold a total of 5074 vehicles in April, a decrease of 49.2% compared to the sales performance of 9985 vehicles in March.

XPeng’s sales performance in April was 9002 vehicles. As the highest-selling enterprise in the “WM Motor” group, its sales also showed a downward trend. Compared with the sales performance of 15,414 vehicles in March, it decreased by 41.6%.

Finally, Ideal Auto, who once claimed that one car was going to conquer the world, did not have an ideal sales performance this month. It sold only 4167 vehicles in the whole of April, a decrease of 62.2% compared to last month’s 11,034 vehicles.

Regarding the collective significant decline in sales of “WM Motor,” the first consideration is the cost increase caused by the rise in raw material prices, forcing them to increase the price. However, in addition to this, the fluctuation of the parts supply chain due to the epidemic situation may also be a major factor. According to Shen Yanan, co-founder and president of Ideal Auto, 80% of its supply chain is distributed in the Yangtze River Delta region, with a large part in Shanghai, Suzhou, and other places. Due to the impact of the epidemic, the suppliers in the region have been unable to supply or even shut down, causing a significant impact on Ideal Auto’s sales in April.

Not only Ideal, but NIO and XPeng were also affected by the supply chain not being smooth, causing them to be unable to continue production after the existing parts inventory was consumed. NIO also stated that it is currently actively overcoming the supply chain pressure brought by the epidemic, and the production is gradually recovering. The second production base located in Hefei New Bridge Intelligent Electric Vehicle Industrial Park is progressing smoothly and is expected to be put into operation in the third quarter.## BYD reached monthly sales of 100,000 units again in May

Similarly, the performance of the capital market is also worrisome: following Li Auto, NIO and XPeng were also included in the latest “pre-delisting” list by the US Securities and Exchange Commission (SEC) recently. According to the list of foreign companies under the Foreign Company Accountability Act updated on the website of the US Securities and Exchange Commission on May 4, a total of 88 Chinese companies were included in the “pre-delisting” list, including NIO and XPeng, both of which belong to the “new forces in the automobile industry”. As of now, 105 Chinese companies have been included in the “pre-delisting” list.

These 88 companies are the sixth batch of companies to be listed. The companies included in the “pre-delisting” list this time must provide evidence to the SEC before the hearing date on May 25 to prove that they do not meet the delisting conditions. Otherwise, they will be included in the final list. The companies included in the final list will be required to provide the documents they need to the SEC within three years. If they fail to submit them, they will be delisted in early 2024 after the annual report is disclosed in 2023.

Therefore, after the decline of the US stock market on May 5, NIO’s stock price fell by 15% on the same day, and 12% in Hong Kong stock market. XPeng’s stock price in the US stock market fell by 13.5% and by 9.3% in the Hong Kong stock market. On May 5, li Auto’s stock price also fell by 8.1% in the US stock market. The Chinese concept stock market was in mourning, and the market urgently needs a shot in the arm.

As the saying goes, some are happy while others are worried. At a time when new car-making forces are frowning, BYD has achieved impressive sales for two consecutive months with its excellent product strength, fully consolidating its position as a leading domestic enterprise in new energy. It can be said that BYD is currently in its best stage of development. In April, it sold more than 100,000 vehicles with a total of 105,475 vehicles sold, a year-on-year increase of 136.5%, including 57,430 pure electric vehicles and 48,072 hybrid vehicles. As of April 2022, BYD has sold more than 1.9 million new energy vehicles.

| Looking at cumulative figures, BYD’s new energy vehicles produced a total of 395,000 units from January to April this year, compared with a cumulative 82,700 units in the same period last year, an increase of 377% year on year. The company sold a cumulative 392,300 new energy vehicles from January to April this year, compared with a cumulative 80,400 units in the same period last year, an increase of 387.9% year on year. Among them, the sales of plug-in hybrid electric vehicles in April were 48,000, compared with only 8,900 in the same period last year, a year-on-year increase of 438.9%. The cumulative sales of plug-in hybrid electric vehicles from January to April were 189,500 units, with a year-on-year increase of 700%. | — | — |

|---|---|---|

| Model | Sales Volume | |

| BYD Song | 25,428 | |

| BYD Han | 13,421 | |

| BYD Han EV | 77.9% YoY Growth | |

| BYD Tang Family | 10,131 | |

| BYD Tang EV | 263.7% YoY Growth | |

| BYD Song Family | 25,108 | |

| BYD Song DM | 1299.5% YoY Growth | |

| BYD Qin Family | 23,520 | |

| BYD Qin Plus EV | 401.4% YoY Growth | |

| BYD Yuan Family | 15,168 | |

| BYD Yuan | 659.5% YoY Growth | |

| BYD Destroyer 05 | 2,040 | |

| BYD Dolphin Family | 12,040 | |

| BYD Dolphin | 7 Million+ Total Sales | |

| Total Sales of Chinese Brand New Energy Vehicles by Q1 2022 | 679,000+ | |

| BYD’s Sale of New Energy Vehicles in Q1 2022 | 282,000+ | |

| China’s Market Share of Chinese Brand New Energy Vehicles | 50%+ | |

| BYD’s Rank in the New Energy Vehicle Sales of Q1 2022 | 1st Place with 282,000+ Sales |

New Energy Vehicles have undoubtedly become a strong driving force in supporting the growth of domestic sales.

Terminal sales data shows that in the first quarter of 2022, domestic sales of new energy vehicles reached nearly 1.257 million, of which Chinese brand new energy vehicles reached 679,000, with a market share of over 50%. According to the statistics of China Passenger Car Association, BYD’s sales volume of new energy vehicles, including hybrid models, reached 282,000, surpassing Tesla’s 108,300 volume, which ranks second.

Why is BYD still able to achieve such outstanding sales results in an environment where the supply chain is not smooth due to the impact of the pandemic?

In my opinion, this is inseparable from BYD’s own relatively complete supply chain system, and the self-developed and produced blade battery is also indispensable. Secondly, the factories that BYD built in Shenzhen and Xi’an are less affected by the pandemic, so the overall production is relatively stable. Through early accumulation, BYD has already established a good reputation in the market, so it will have a stronger premium capacity compared to other brands.What makes a brand have strong pricing power? The primary factor supporting Chinese brand prices is the improvement of product strength. According to J.D. POWER’s China Vehicle Dependability Study, the quality gap between Chinese brands and mainstream foreign brands decreased from 9 PP100 (problems per 100 vehicles) in 2020 to 6 in 2021. The number of Chinese automakers on the list of automakers with more than the industry average PP100 increased from 6 in 2020 to 10 in 2021.

At the same time as the improvement in quality, Chinese automakers, with the industry advantage accumulated through electrification and intelligence, are expanding in the high-end new energy automobile market. For instance, BYD, taking the “bottom-up” approach, occupies the mid-to-low-end market with cost-effective models while introducing corresponding high-end models, Han and Tang, achieving coverage of high, middle, and low-price ranges. On the other hand, traditional automakers such as BAIC, GAC, Changan, and technology companies like Huawei are collaborating on intelligence and autonomous driving, launching high-end products.

According to the 2021 financial report data, BYD’s average single-car price exceeded that of SAIC Volkswagen for the first time, at 153,200 yuan. As the benchmark for Chinese joint-venture automakers, SAIC Volkswagen has long held the domestic sales champion. However, BYD’s surpassing SAIC Volkswagen in terms of single-car average price over the past year is self-explanatory: the upward path of Chinese brands is clear and unstoppable.

Price is the cornerstone supporting the upward movement of Chinese brands. As Chinese brands continue to move towards high-end, luxury automobile markets gradually see the presence of Chinese brands. According to the data collected by the Automotive Research Institute of Autohome, in 2021, the annual sales volume of Chinese brand vehicles above 200,000 yuan exceeded 900,000 units. Of these, the proportion of Chinese new energy vehicles above 200,000 yuan is 54%.

In general, electrification and intelligence are the fantastic racetracks for Chinese brands to move upward. This window of opportunity may only last for three to five years. In the first stage of electrification, sales volume is the basis for competition. Without sales volume, there is no foundation. Companies such as NIO, BYD, GAC Aion, and Geely LYNK & CO have already “run out” in this stage. I believe that with the understanding and careful study of Chinese users accumulated by Chinese brands over the past few decades, more Chinese automakers will stand out.

Turbulent April and Expectant May

For the new energy market, April was a turbulent month. Most automakers experienced a decline in sales due to the dual impacts of raw materials and the epidemic. However, the most severe period of the epidemic has passed, and how to maintain their sales advantage or reverse the trend is what companies should consider first. Nowadays, the supply chain of parts is gradually recovering, and May will be a competitive month.From 2017, when the State Council and the Ministry of Industry and Information Technology established China Brand Day and vigorously promoted the development of national brands, five years have passed. Whether Chinese automotive brands have achieved a critical leap in brand advancement is a matter of interpretation. According to 1-3 month terminal sales data this year, the market share of Chinese brands has already expanded to 42.9%. The increasing recognition of Chinese automotive brands among consumers has become an indisputable fact.

“The biggest challenge Chinese brands still face is joint venture car companies, as we have yet to achieve the premium pricing ability of foreign brands. In the long run, brand transformation is a very difficult process,” said Zhu Huarong, Chairman of Changan Automobile, on many occasions. It can be foreseen that when the Chinese auto market is constrained by “micro-growth,” the long-term competition between Chinese brands and joint venture foreign brands will inevitably be a narrow road encounter and a fierce battle.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.