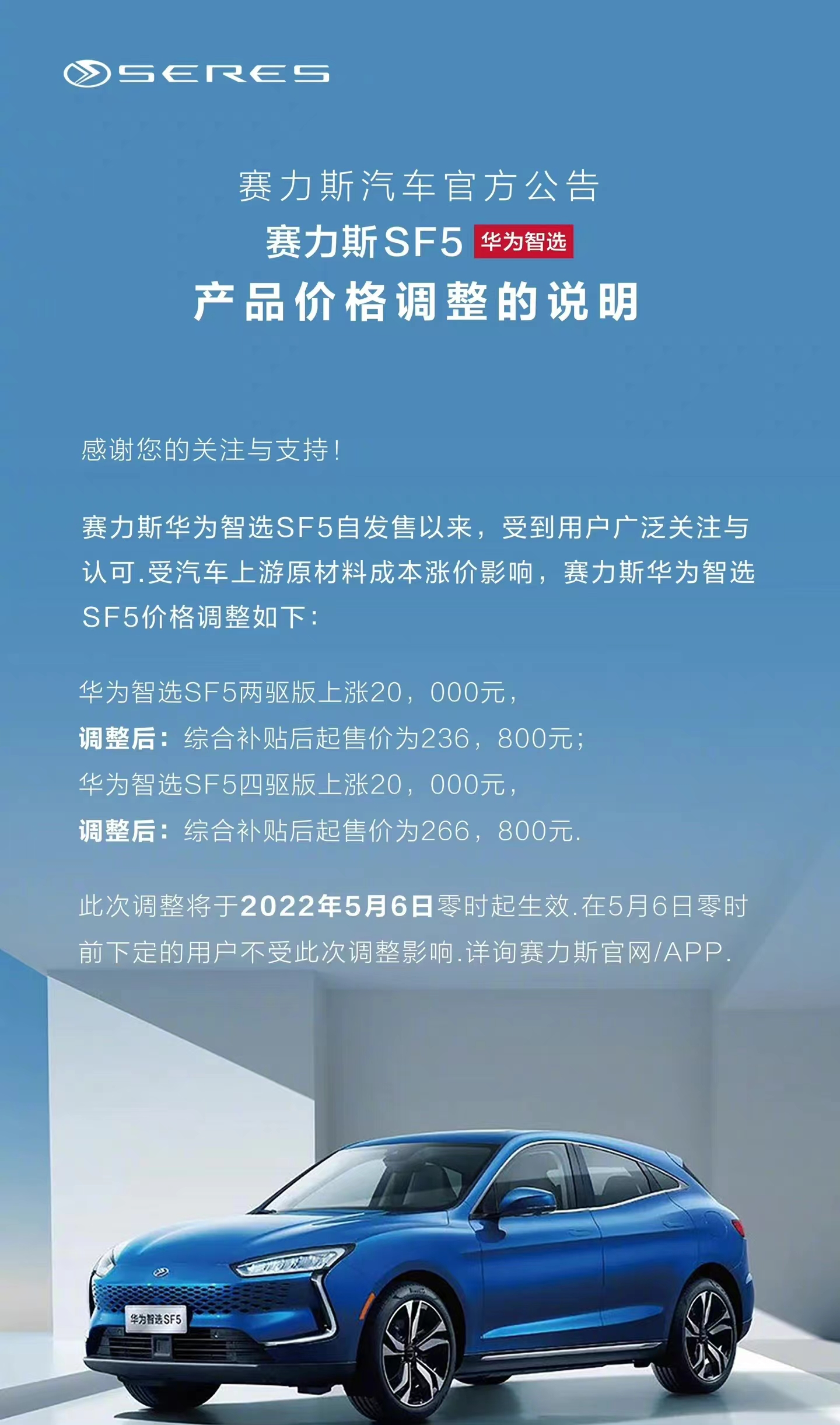

Today, Seres officially announced that it will increase the price of its Huawei-selected SF5 due to upstream raw material cost increases. The prices for the modified versions are as follows:

- 2WD: 236,800 yuan

- 4WD: 266,800 yuan

Seres SF5 has been lukewarm in the market. After the price increase, the SF5’s retail price even overlaps with that of the WM Motor EX5. This has added further difficulty to an already challenging situation for SF5.

About Seres

Seres is a brand owned by Chongqing Jinkang Seres Automotive Co., Ltd., which belongs to Chongqing Sokon Industry Group Co., Ltd.

In April 2021, Huawei and Seres announced their cooperation at the Shanghai Auto Show, and the Huawei-selected SF5 went on sale. In addition to Seres’ own channels, Huawei-selected SF5 could be reserved through Huawei’s experience stores and the Huawei Mall.

Afterwards, Sokon’s stock price soared. On September 17, 2021, Sokon’s stock price even reached 85.19 yuan. At the beginning of the launch, Seres claimed that the SF5 received over 3,000 orders in two days and over 6,000 orders in a week. Everything seemed to be going smoothly, and there was a bright future ahead for cooperation with Huawei.

However, the fact is that in the entire year of 2021, Seres sold only over 7,000 Huawei-selected SF5 vehicles, which is even less than the monthly sales of some of the new emerging brands.

On December 23, 2021, at the Huawei Winter Flagship Product Launch, Huawei officially launched the first car model of the new brand “AITO” they cooperated in, the “WM Motor EX5” launch conference. Rumors about “Seres being a Huawei OEM factory” started to circulate, causing the stock price of Sokon, the parent company of Seres, to plummet, almost halving the highest point compared to the lowest point.

However, with the WM Motor EX5, Huawei’s investment paid off. As of the end of April 2022, the WM Motor EX5 has sold 8,483 units, with a single-month sales of 3,439 units in April, a year-on-year growth of 1,248.63%.

Yu Chengdong had stated:

Currently, Huawei’s brand marketing ability, retail channel ability, product competitiveness, and other factors can support an annual sales target of 300,000 units.It is not difficult to see that the SF5 from Xpeng has contributed limitedly to the goal, and the heavy burden has fallen on the shoulders of the Weltmeister. Despite facing the epidemic and supply chain shortages, the sales of the Weltmeister M5 have still increased significantly, and the new mid-to-large-sized SUV Weltmeister M7 has been approved by the Ministry of Industry and Information Technology and is expected to be released in the near future.

In contrast, Xiaokang has been somewhat “led by the nose” by Huawei in the Weltmeister brand, and the SF5 from Xpeng has not given up either. However, given the large gap between its product strength and the Weltmeister M5, and the price differences are not significant, it is indeed a question of how long the SF5 from Xpeng can hold on.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.