Author: Su Qin

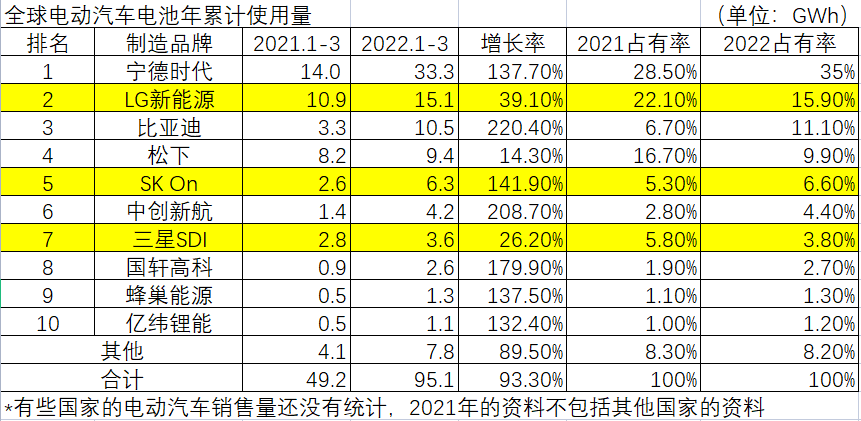

On May 2nd, SNE data, a South Korean market research firm, revealed that the global installed capacity of power batteries in the first quarter was 95.1GWh, up 92.7% from the same period last year, almost doubling.

CATL’s global installed capacity of power batteries in the first quarter reached 33.3GWh, up 137.7% year-on-year, maintaining its position as the world’s largest power battery manufacturer. At the same time, CATL’s market share in the first quarter was as high as 35%, an increase of 6.5 percentage points compared to the same period last year.

“Made in China” CATL leads the world

CATL achieved operating income of 48.678 billion yuan in the first quarter, up 153.97% year-on-year, with a net profit of 1.493 billion yuan, down 23.62% year-on-year. The main reason for the decline in profits was the increase in upstream raw material prices and huge pressures on the supply chain.

Despite these factors affecting CATL’s costs and gross profit, it still does not prevent CATL from being the world’s largest power battery company for five consecutive years and launching an attack on the sixth crown.

Since 2022, CATL has not only established the Future Energy Institute, a platform combining scientific research innovation and talent cultivation but also introduced the EVOGO battery swapping service. CATL has signed cooperation framework agreements with car companies such as Bestune and Aiways to jointly create a new benchmark for the battery swapping model.

While actively innovating and delving into industry development, honors have followed one after another. CATL won the “National Brand Light” top ten brand award at the Second “China Brand Power” summit, and was also included in the list of “The 100 Most Influential Companies” by Time magazine in the United States, CATL’s rise in the field of high-tech has laid a solid foundation for the development of China’s technology industry.

The market share of Chinese power battery companies generally increased

In addition to CATL leading the world, other Chinese power battery companies have also performed well. Among the global top ten, Chinese companies occupy six seats, and the year-on-year growth rate of the global power battery installed capacity of these six Chinese companies is all above 100%, and their market share is also increasing.

Among them, CATL ranks first, BYD ranks third, Contemporary Amperex Technology ranks sixth, Guoxuan High-Tech, SVOLT and EVE Energy rank eighth, ninth and tenth respectively. The overall market share of the top ten companies is 91.8%, and Chinese companies account for 55.7%.Byd’s global installed capacity of power batteries in the first quarter was 10.5GWh, a year-on-year increase of 220.4%, and the market share soared from 6.7% in the same period last year to 11.1%.

Cec market share has been climbing month by month, and the first quarter totaled 4.4%, reaching a historical high in the field of new energy passenger car supporting. Ganfeng Lithium’s revenue exceeded RMB10 billion for the first time last year, and its market share rose from 1.9% in the same period last year to 2.7%. In the first quarter, the market share of CATL was 1.3%, an increase of 0.2 percentage points compared with the same period last year. With a market share of 1.2%, EVE Energy surpassed Farasis Energy and ranked tenth.

The overall market share of Japanese and Korean battery companies is declining

LG New Energy, SK On, and Samsung SDI, from Korea, had a combined market share of 26.3% in the first quarter, compared to over 33% in the same period last year. Only Panasonic from Japan made it into the top list, with a market share of only 9.9% in the first quarter, not reaching 10%.

LG New Energy, as the strongest competitor of Ningde Times, ranked second, with a power battery installed capacity of 15.1GWh in the first quarter, an increase of 39.1% year-on-year. Its market share was 15.9%, down more than six percentage points.

As the second-largest battery giant in Korea, SK On’s market share has risen from 5.3% in the same period last year to 6.6%, keeping fifth place, and is currently planning to build a square battery pilot production line. Samsung SDI’s ranking dropped from sixth to seventh, with a market share of 3.8%, a decrease of 2 percentage points compared to the same period last year. Panasonic, the only Japanese company on the list, ranked fourth with a market share of 9.9%, down from 16.7% in the same period last year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.