Author | Tian Hui

Editor | Qiu Kaijun

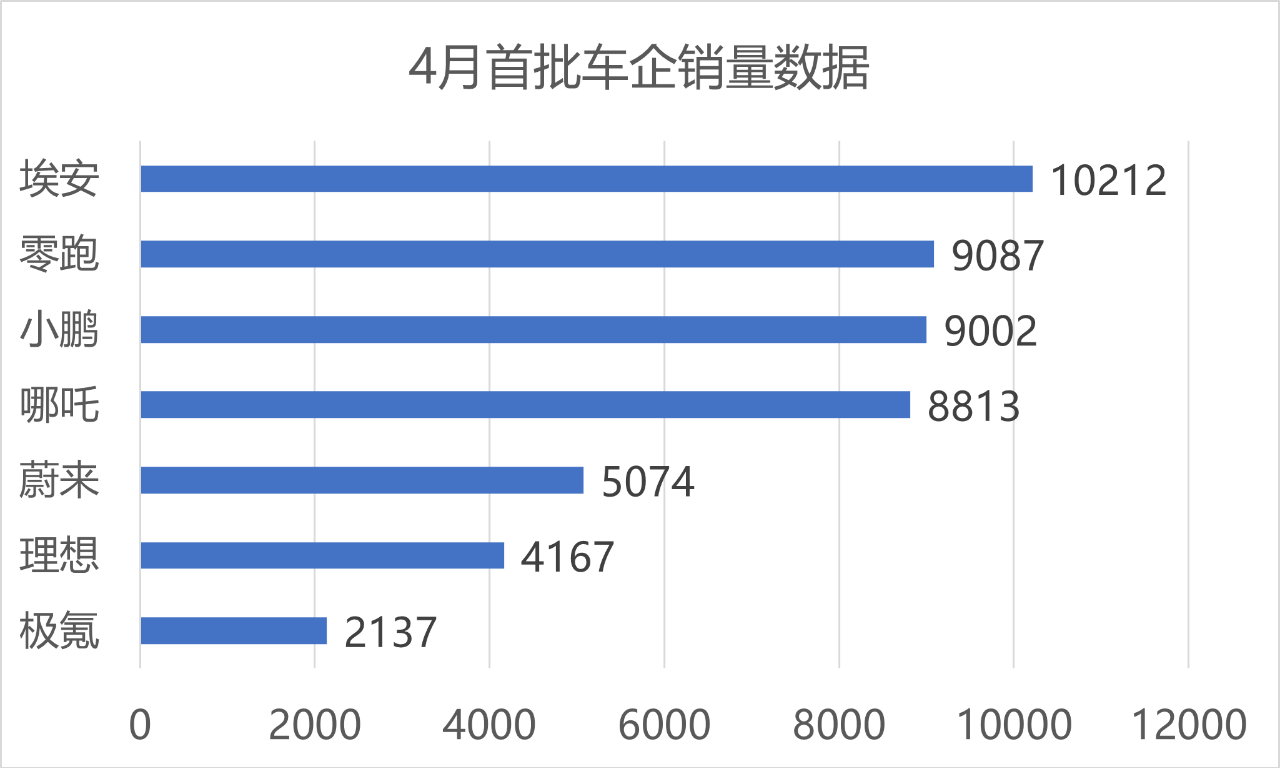

Affected by the pandemic, the car companies that announced their April sales figures first all experienced a comprehensive decrease in monthly sales data.

Among the three most popular brands, NIO and Xpeng saw a slight over 50% month-on-month decline in sales. However, electric vehicle start-ups NIO and Li Auto, which were previously ranked among the second tier of new carmakers, caught up in April, and NIO even took the first place in the new energy vehicle sales ranking.

Looking at the sales figures that have already been released, the drop in April sales is attributed to two characteristics:

First, the pandemic has had a clear impact.

Second, car companies with certain production capabilities have relatively better sales figures.

At present, many large car companies have not yet released their April sales figures, but it is expected that the sales situation of each car company will conform to the above two characteristics.

Serious impact of the pandemic

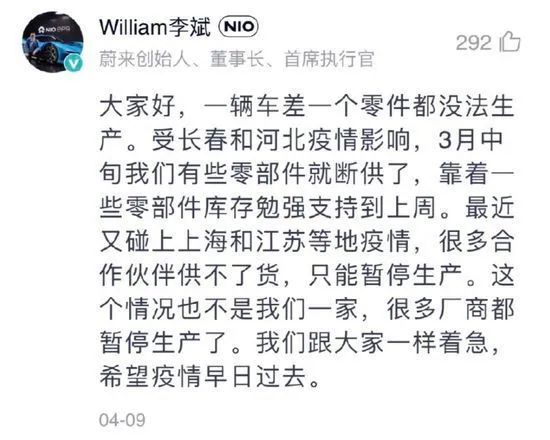

A car cannot be produced without a part.

Li Bin, the chairman of NIO, repeatedly apologized to users in his own APP, but there is no other ideal way.

NIO’s production base is located in Hefei, Anhui Province, far away from Shanghai. According to Li Bin, starting in March, due to the pandemic in Changchun and Hebei, some parts were in short supply. The strict pandemic control measures in Shanghai that began in April and the subsequent outbreak in Jiangsu directly led to NIO having to stop production.

In April, NIO’s sales dropped to 5,074 units, a 50% month-on-month decline.

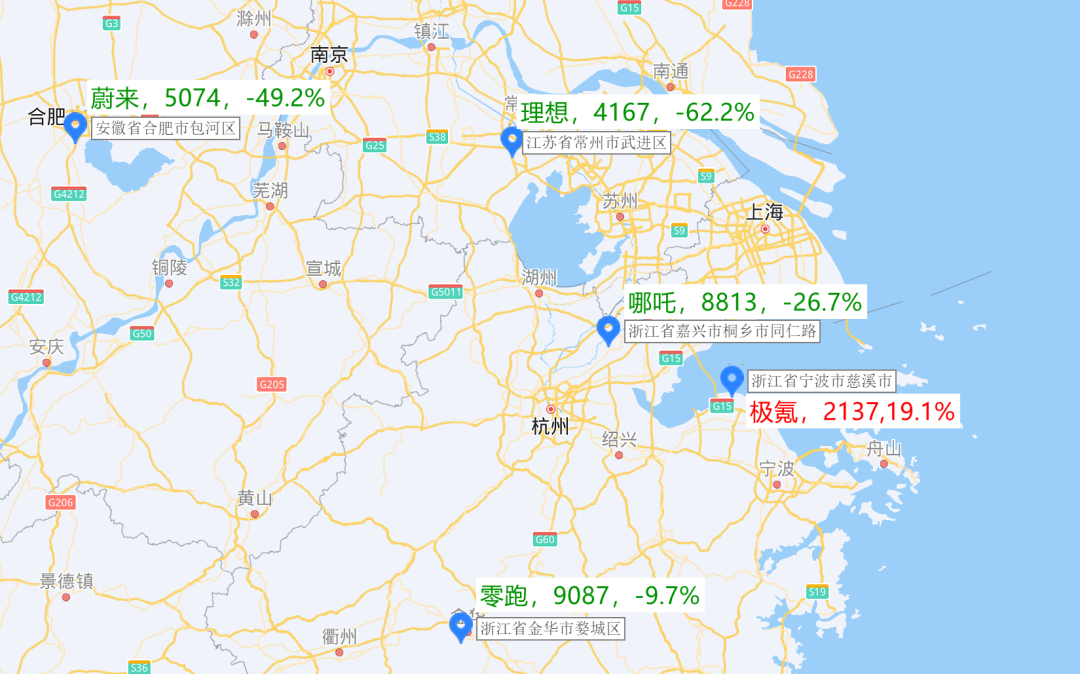

Almost all the car companies in the Yangtze River Delta were affected, similar to NIO.

Among the sales data that have been released, Li Auto and NIO, which are closer to Shanghai, have been affected to a greater extent, while electric vehicle start-up Leapmotor, which is far from Shanghai, has been affected to a lesser extent.

However, Jidu Auto maintained positive sales growth among many car companies in the Yangtze River Delta in April. However, this is related to Jidu Auto’s production capacity being limited by a lack of chips in March.

Looking at the sales data that have been released, it is not optimistic regarding the sales situation of other car companies in the Yangtze River Delta in April. Especially for local car companies in Shanghai, the long shutdown time is worrying for their monthly sales figures, such as Tesla.

Car companies in the Pearl River Delta have also been affected by the pandemic.

Guangzhou AEV and XPeng Motors saw a more than 40% month-on-month decline in sales, which is closely related to the pandemic that broke out in Guangzhou in late April, affecting the production of both companies.

Although Shanghai currently has the strictest pandemic management measures, the impact of the Shanghai outbreak on the automotive industry has surpassed regional restrictions, and new energy vehicle companies in the Yangtze River Delta and the Pearl River Delta have all fallen into supply chain challenges.Currently, various new energy vehicle companies are not lacking orders. In April, Zeekr announced that their orders had surpassed 10,000 vehicles. However, these companies have been affected by various factors such as battery shortages, semiconductor shortages, battery price increases, and the pandemic, resulting in a supply shortage. The actual production capacity of these companies will directly determine their sales.

It is predicted that in the coming months, the pandemic will still be the biggest uncertainty factor. The impact of pandemic control measures on vehicle production and logistics will directly determine the sales of these companies.

Ensuring supply security, even through self-production, may become a development trend for these companies.

In the first sales ranking of new energy vehicle companies for April, the sales decline of Leapmotor Motors was not significant, only -9.7%. This is partly due to the pandemic control measures in Jinhua, Zhejiang and also linked to the product mix and material production situation of Leapmotor.

Currently, Leapmotor’s main models are the T03 micro electric vehicle and the C11 mid-size pure electric SUV, with the T03 being the main seller.

The number of vehicle components in the T03 micro electric vehicle is significantly less than that of high-price vehicles sold by other companies such as NIO and Li Auto, making supply chain security less difficult than these two companies.

Furthermore, inside Leapmotor’s manufacturing plant in Jinhua, Zhejiang, a three-electric system factory has been established to produce electric motors and battery packs. Under pandemic prevention and control measures, the normal production within the plant can be maintained.

These are some of the fundamental reasons why Leapmotor only experienced a sales decline of less than 10% in April.

Another company whose production was not heavily impacted is BYD. According to weekly insurance data, BYD had 81,854 insured vehicles from March 28th to April 24th, with an average daily sales of 2,923 vehicles. This is only a decrease of 13.5% from the daily sales volume announced by BYD’s wholesale figures in March.

From the situations of BYD and Leapmotor, with core components under pressure from the pandemic and the supply chain, these companies may strengthen their self-sufficiency ratio to ensure supply security.

Currently, Guangqi Aion has established a small-scale power battery production line inside their factory. XPeng Motors and NIO have been able to self-produce battery packs.

Given the actual situation of reduced production due to the pandemic, various companies may change their pattern of building new factories elsewhere. Pursuing an efficiency-oriented industrial division of labor pattern may lead to the development of larger and more comprehensive factories.

It is not ruled out that the supply chain structure of the automotive industry may undergo changes as the pandemic develops.

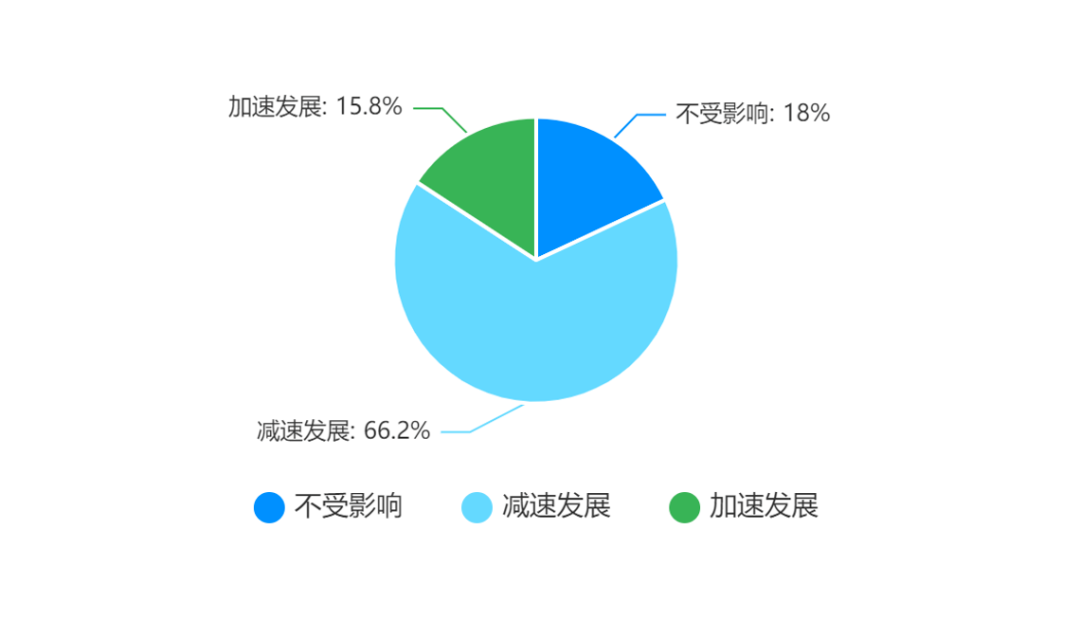

The pandemic will accelerate changes in consumer buying habits.

Research data from the “Electric Vehicle Observer” regarding the Shanghai pandemic showed that 66.2% of the surveyed professionals believe that the development of new energy vehicles will slow down. However, the trend of the share of new energy vehicles in the market continuing to rise will not change.

According to the data, most professionals in the new energy vehicle industry are not optimistic about the future, but even more pessimistic about fuel vehicles.

Affected by the pandemic, carmakers such as SAIC Volkswagen have substantially ceased production in April, and their fuel vehicle production has been significantly impacted. However, what worries carmakers more than production shutdowns is that consumers’ enthusiasm for fuel vehicles is declining.

Under pandemic control measures, consumers’ willingness to travel long distances has decreased, and fuel vehicle sales have declined significantly.

At the same time, the new retail model widely adopted by new energy vehicle companies has begun to exert its advantages under pandemic control policies. New energy vehicle companies currently hold a large number of orders, most of which are obtained online.

However, traditional fuel vehicle companies such as Volkswagen, Toyota, Honda, and General Motors have not yet established a complete online ordering system, and most of their stores are still using traditional order collection models. Under pandemic control measures, the order volume will undoubtedly be impacted.

An example is that the popular Toyota models, such as the Highlander and Sienna, were in short supply after their launch, and stores were generally in a premium sales state. However, they have recently started selling at regular prices, and the delivery cycle has significantly shortened.

At present, international oil prices are running high, and pandemic control measures have reduced the demand for cross-city travel, which has already weakened the fuel vehicle purchasing intent. The advantages of new energy vehicle companies in new retail and usage costs will accelerate the transformation of consumption trends.

Taking all factors into consideration, the market share of new energy vehicles will continue to rise in April.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.