Weekly Index

Weekly Headlines

Car Manufacturers’ Delivery Volume in April Amidst the Pandemic

April was undoubtedly a special month just past, the outbreak of the Omicron pandemic brought Shanghai into an extraordinary period. Shanghai residents endured more than 30 days of difficult lockdown life. The stagnant logistics not only made it extremely difficult to buy daily necessities, but also cut off the industrial blood vessels of this automotive city, making it suffer from a severe shutdown.

On May 1st, various car makers announced their delivery volumes for April. The following are the manufacturers that have published their delivery volume data for April:

-

Xpeng: 2,137

-

Li Auto: 4,167

-

NIO: 5,074

-

WM Motor: 8,813

-

XPeng Motors:9,002

-

SERES: 9,087

As the brand with the highest delivery volume, Leapmotor delivered a total of 9,087 vehicles in April, with a year-on-year increase of more than 200% for 13 consecutive months. Although it decreased by 10% compared to March, it was still the brand with the smallest decrease among all new forces except Jinko. Leapmotor CEO Zhu Jiangming gave a courteous explanation: “When the epidemic was not very serious in the first half of the month, we tightened up.”

As the brand with the highest delivery volume, Leapmotor delivered a total of 9,087 vehicles in April, with a year-on-year increase of more than 200% for 13 consecutive months. Although it decreased by 10% compared to March, it was still the brand with the smallest decrease among all new forces except Jinko. Leapmotor CEO Zhu Jiangming gave a courteous explanation: “When the epidemic was not very serious in the first half of the month, we tightened up.”

In addition, Leapmotor just held the CTC Battery Chassis Integration Technology Conference last week and announced more information about the upcoming flagship sedan C01. After the supply situation further improves and new products are introduced, Leapmotor with new product lines will also embark on a growth path.

Among the three new forces, LI delivered 4,167 vehicles in April, a month-on-month decrease of 62.2%, which is surprisingly large. According to past on-risk data, the average monthly on-risk level of LI in Shanghai is about 500-600 units. Even according to this data, the delivery volume in April is still far from recent delivery data even if the delivery volume lost due to Shanghai’s inability to deliver is added. Starting from the end of March, LI’s new car delivery was blocked due to the supply chain and logistics issues caused by the epidemic. Then, on April 1, Ideal ONE’s price was increased by 11,800 yuan, followed by the delay of L9’s launch due to the epidemic. These reasons led to a significant decrease in LI’s delivery volume in April.

NIO delivered 5,074 vehicles in April, a 49.2% decrease month-on-month, with the biggest problem also being affected by the supply chain. NIO delivered 1,878 ES6s, 1,252 ES6s, 1,251 ES8s this month, and only 693 ET7s were delivered in April, which welcomed its first complete delivery month. The on-risk level of NIO in Shanghai in March was 836 vehicles, and this part was basically cleared in April. It is estimated that in April, NIO’s delivery due to the impact of the epidemic outside Shanghai is about 3,000 vehicles.

XPeng delivered 9,002 vehicles in April, a month-on-month decrease of 41.6%. Although the decline was as high as 40%, it still performed the best among the top three new forces in April, and the absolute delivery volume was almost equivalent to the sum of the other two. The delivery volumes of the three available models are P7 3,714, P5 3,564, and G3i 1,724. From the supply side analysis, it is not difficult to find out that XPeng is located in Guangzhou, which is relatively less affected by the Yangtze River Delta automotive supply chain compared to NIO and LI. It has geographical advantages for delivery in Guangdong and surrounding areas, and now with a dual-factory status, the inventory and production have a little sense of “dual redundancy”.

Quick Comment:In the first half of April, top mainstream automakers such as Tesla and BYD continued to experience a month-on-month growth trend. However, in the second half of the month, with the further spread of the epidemic, logistics were hindered, the economy declined, and the undesirable phenomenon of both supply and demand tightening has begun to appear.

According to the statistics of the China Passenger Car Association, the domestic passenger car sales volume in April may reach 1.1 million, which could be the lowest point after the outbreak of the epidemic in 2020. The overall drop may exceed 30%.

On April 16th, Shanghai released the first list of 666 companies that will ensure supplies. Many key suppliers in the automotive industry unsurprisingly appeared on the list. Tesla, which had stopped production for three weeks since March 28th, officially restarted its closed production on April 19th.

It is now May, and the turning point of the epidemic has passed. As orderly resumption of work continues, the recovery of the automotive industry is underway. However, the recovery of the automotive market needs to be aligned on both ends. Retailers need to cushion their return to business. Not only do car buyers need to be cautious in choosing vehicles, but they also need to closely observe market trends. This process will be slower than the recovery of the supply side.

For China’s new energy market, which is still in the growth stage, Q2 will be a quarter of collective adjustment. After the successful holding of several large auto shows, the entry of a large number of new cars, and the rise in consumer desire, the market in the second half of the year will find momentum to continue rising.

Starting at RMB 190,000, the Smart Fortwo #1 is officially launched

On the evening of April 25th, at the Asia Smart Launch Conference, Smart announced the price and related configuration benefits of the Fortwo #1. The Smart Fortwo #1 is available in two configurations, with the Pro+ version priced at RMB 190,000, and the Premium version priced at RMB 230,000.

Both models are equipped with a 66 kWh ternary lithium battery. Due to the Premium version’s use of SiC power module permanent magnet synchronous motor and heat pump air conditioning, the cruising range under CLTC conditions can reach 560 km, which is 25 km more than the Pro+ version without SiC. However, there is no difference in power configuration between the two, both have a peak power of 200 kW and a peak torque of 343 N · m, and can achieve a 0-100 km/h acceleration in 6.7 seconds.

The Smart Fortwo #1 has a total of 11 body colors and 4 interior colors to choose from. Particle white, quiet black, and cyber silver are standard car paints, and Pro+ can be equipped with 3 extra car paints. The remaining 5 car paints are only available for the top-of-the-range models to choose from, including pink, which is popular among women. In addition to car paint, three additional bi-color roof colors are also available.

Regarding the infotainment system, all models of smart EV #1 are equipped with a 9.2-inch LCD instrument cluster and a 12.8-inch central infotainment screen, paired with Qualcomm Snapdragon 8155 chipset, providing 12GB of RAM + 128GB of storage.

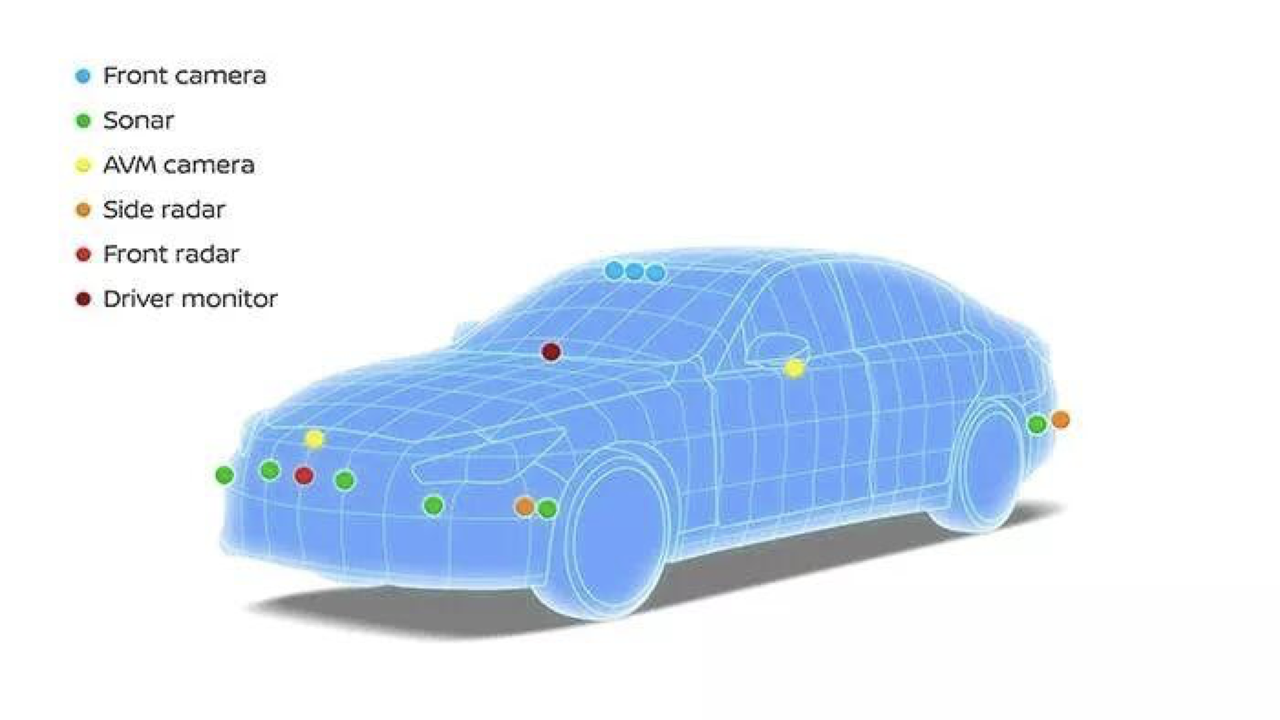

On the advanced driver assistance system, all models of smart EV #1 are equipped with smart Pilot system, the Pro+ version only offers basic safety features such as ACC and LKA, while the Premium version offers advanced safety features including highway assist, automatic lane change, front and rear collision avoidance, and automatic parking.

There are slight differences between the two configurations in terms of advanced driver assistance system hardware:

-

The Pro+ version has 8 ultrasonic sensors, 1 millimeter-wave radar, 4 surround-view cameras, and 1 forward-facing camera;

-

The Premium version has 12 ultrasonic sensors, 5 millimeter-wave radars, 4 surround-view cameras, 1 forward-facing camera, and 1 cabin-facing camera.

Quick Comment:

With a price range of 190,000 to 230,000 yuan, smart EV #1 offers a great surprise in terms of pricing, with the Pro+ version already being well-equipped, while the 40,000 yuan more expensive Premium version offers even richer configurations.

With a price range of 190,000 to 230,000 yuan, smart EV #1 is competitive, and is even more advantageous than the 180,000 yuan ID.3 in terms of brand, power level, range, and interior atmosphere. Compared to Tesla Model 3, smart EV #1 has advantages in interior design, material quality, and price.

Smart EV #1 is now available for pre-order. It is expected that this small car with a reasonable price and balanced configurations may have a good market performance after delivery.

Musk’s Official Acquisition of Twitter

On April 25th, Twitter’s board of directors decided to accept Musk’s proposed acquisition offer of $54.20 per share, with a total price of approximately $44 billion.The offer of $54.20 per share is 38% higher than Twitter’s closing price on April 1, 2022, which is considered as an “offer that can’t be refused”. Musk is not making the trade in the name of Space X or Tesla, so Twitter will become a privately held company after the deal is completed.

The U.S. Securities and Exchange Commission first revealed on April 1 that Musk had purchased more than 9% of Twitter’s shares, becoming the largest shareholder of Twitter, followed by a more than 25% increase in Twitter’s stock price. Then on April 11, Musk said he would not join Twitter’s board of directors, and the Twitter stock price fell in response. On April 14, Musk proposed an offer of $54.20 per share in hopes of acquiring 100% of Twitter’s equity, causing Twitter’s stock price to rise by 12%. Finally, on April 25, Twitter officially announced its sale to Musk, and the curtain fell.

Chari Bret Taylor, a member of Twitter’s board of directors, said, “The Twitter board has carefully considered this, and we believe it is the best path forward for Twitter shareholders.”

Musk said, “Free speech is the cornerstone of democracy, and Twitter is a digital town square where we should discuss things that are vital to the future of humanity.”

Regarding Twitter’s future prospects, Musk stated, “I also want to enhance Twitter’s utility through new features and open-source these algorithms. I will also eliminate spamming robots through human-machine verification, which will make Twitter better than ever. Twitter has enormous potential, and I look forward to exploring this potential with the company and its users.”

Quick Comment:

In addition to the celebration among Musk’s fans, some people who have had problems with Musk quietly left Twitter after the news broke: Henrik Fisker, CEO of electric vehicle manufacturer FISKER, learned of Musk’s acquisition of Twitter and announced his move to Instagram, deleting and canceling his Twitter account; Mike Levine, Ford’s North American product public relations manager, also announced he was moving to Instagram.

Musk’s opinion on this is, “Don’t do that, I think even those who have treated me poorly should stay on Twitter because that’s the meaning of free speech.”

As for whether Musk can push Twitter to realize his idea of a “free speech platform,” we still need time to answer that question.

Japanese Pure Electric SUVs Enter Chinese Market

Last week, Honda, Toyota, and Nissan coincidentally brought their first pure electric SUVs to the Chinese market, marking the official competition between Japanese automakers in the pure electric field and these players in the Chinese market.

Dongfeng Honda e:NS1

On April 26th, Dongfeng Honda e:NS1 was officially launched. The new car has a total of 4 models, with a subsidized price range of 175,000 to 218,000 yuan. e:NS1 adopts the “e:N Design” language, and Honda’s logo can be illuminated. The length, width, and height of e:NS1 are: 4,390 x 1,790 x 1,560 mm, with a wheelbase of 2,610 mm.

Two different versions of e:NS1’s motor and battery configuration:

- The e-typed version and e-Chi version are equipped with 134 kW and 310 N·m motors, and 53.6 kWh batteries, with a CLTC operating range of 420 km;

- The e-Motion version and e-Region version are equipped with 150 kW and 310 N·m motors, and 68.8 kWh batteries, with a CLTC operating range of 510 km.

The official claims that “the motor’s control program integrates more than 20,000 scene algorithms, which is more than 40 times that of ordinary pure electric vehicles,” and is manifested in “no motion sickness” and easier control. At the same time, in the sports mode, “Honda EV Sound” acceleration roar is added. From the energy consumption data announced by Dongfeng Honda, both models of e:NS1 are at 13.6-13.8 kWh/100 km.

GAC Toyota bZ4X

On April 28, 2022, Toyota’s first electric bZ4X model based on the e-TNGA platform was released for pre-sale at a pre-sale price of 220,000-300,000 yuan. bZ4X is designed based on the e-TNGA platform, with dimensions of length, width, and height of 4,690 mm × 1,860 mm × 1,650 mm, and a wheelbase of 2,850 mm.

bZ4X uses a 72.8 kWh ternary lithium battery pack developed in cooperation with CATL, supporting up to 150 kW DC fast charging. A 90 kW charger can charge the battery to 80% capacity in 40 minutes, while a standard charger (200 V, 6 kW, 30 A) can fully charge it in about 12 hours. The range in CLTC test mode is 615 km.

As for the motor, the bZ4X front-wheel drive version has a single permanent magnet motor with a power of 150 kW and a peak torque of 265 N·m. The dual-motor four-wheel drive version has a dual permanent magnet motor front and rear with a power of 80 kW each and a peak torque of 336 N·m.

The bZ4X is equipped with Toyota TSS 3.0 intelligent driving safety system as standard, including rear-cross-traffic alert for exiting vehicles, full-speed-range adaptive cruise control, lane departure warning, and pre-collision safety system. It adopts Subaru’s four-wheel drive X-MODE technology and can be fitted with a One-motion (yoke-style) steering wheel, achieving a Lock-To-Lock steering angle of about 150 degrees.

Nissan Ariya

On April 27, Dongfeng Nissan’s pure electric SUV, the Ariya, began blind ordering. The new car is positioned as a compact SUV, with exterior dimensions of 4,603 x 1,900 x 1,654 mm and a wheelbase of 2,775 mm. It is Nissan’s first truly pure electric platform model in China, based on the Renault-Nissan-Mitsubishi alliance’s CMF-EV electric platform.

In terms of power, the ARIYA has two versions: front-wheel drive and all-wheel drive. The front-wheel-drive model adopts a front motor structure, which is divided into high and low power. The maximum power is 160 kW/178 kW, and the peak torque is uniformly 300 N·m. The 0-100 km/h acceleration is 7.6 s/7.5 s, and the maximum speed is 160 km/h.

In terms of power, the ARIYA has two versions: front-wheel drive and all-wheel drive. The front-wheel-drive model adopts a front motor structure, which is divided into high and low power. The maximum power is 160 kW/178 kW, and the peak torque is uniformly 300 N·m. The 0-100 km/h acceleration is 7.6 s/7.5 s, and the maximum speed is 160 km/h.

The all-wheel-drive version is equipped with front and rear dual motors and the Nissan e-4ORCE dual-motor all-wheel control technology. With the torque distribution system, it can achieve a maximum power of 250 kW/290 kW, peak torque of 600 N·m, 0-100 km/h acceleration of 5.4 s/5.1 s, and a maximum speed of 200 km/h.

In terms of battery, the ARIYA provides two battery specifications of 63 kWh and 87 kWh. The official claimed that the entry-level model meets the WLTC standard endurance of 430 km, and the highest version exceeds 610 km.

In terms of driving assistance, the Nissan ARIYA is equipped with ProPILOT 2.0 intelligent control navigation technology, which supports remote intelligent parking, automatic emergency braking, navigation-assisted driving, and other functions. The perception hardware includes:

-

10 cameras;

-

5 mm-wave radars (1 forward radar + 4 corner radars);

-

1 Luminar-supplied lidar;

-

high-precision map.

Currently, blind booking is available through the ARIYA WeChat Mini Program, with a deposit of 88 yuan, but the official sales price has not been announced yet. The North American selling price ranges from 38,000 US dollars to 51,000 US dollars, equivalent to about 250,000 to 334,500 yuan. It is estimated that the domestic price will be similar to that of the Volkswagen ID.4, which is about 200,000 to 280,000 yuan, and the official pre-sale will start within the year.

Quick Comment:

Japanese automakers are considered to have “got up early, but missed the last bus” in the field of new energy. Due to their investment in hydrogen energy and hybrid fields, traditional Japanese automakers are obviously lagging behind in the field of pure electric. This time, the three Japanese automakers brought their own new pure electric products, objectively speaking, their product power is remarkable, especially Toyota’s bZ4X. However, choosing to enter the Chinese market in 2022, they will face not only domestic new energy vehicle companies with increasingly excellent performance, but also traditional automakers like Volkswagen who have entered the market early.

In the era of gasoline cars, Japanese automakers relying on technological barriers won Chinese consumers’ favor with high reliability and comfort. In the era of electrification, the differentiated advantages are no longer obvious, and the actions of the latecomers in the Japanese system to capture consumers’ minds are also very slow. As the Chinese traditional gasoline car market gradually shrinks, the Japanese electrification battle will not be easy.### Porsche Taycan Cross Turismo/GTS open for pre-sale

On April 27th, Porsche released the Taycan Cross Turismo and Taycan GTS models in China, with the Cross Turismo being the so-called Taycan hunting version, and the GTS being positioned between the 4S and Turbo models. The Taycan series released this time includes five models:

-

Taycan 4 Cross Turismo starting at RMB 968,000;

-

Taycan 4S Cross Turismo starting at RMB 1,208,000;

-

Taycan Turbo Cross Turismo starting at RMB 1,538,000;

-

Taycan Turbo S Cross Turismo starting at RMB 1,838,000;

-

Taycan GTS starting at RMB 1,392,000.

The starting price of Taycan Cross Turismo is RMB 968,000. Compared with the starting price of RMB 898,000 for the Taycan (sport version), it is RMB 70,000 more expensive. However, the entire series comes standard with a high-performance battery upgrade worth RMB 53,100, which expands the total energy of the standard 79.2 kWh (total energy) single-layer high-performance battery to 93.4 kWh (net energy: 83.7 kWh). In other words, the price difference between Taycan Cross Turismo and Taycan is only RMB 17,000, so there is little difference in price between the hunting version and the sport version.

The Taycan 4 Cross Turismo, which is RMB 1,700 more expensive, has 50 kW more maximum output power than the rear-wheel drive Taycan, and its acceleration from 0 to 100 km/h is even 0.3 seconds faster, reaching 5.1 seconds. The power output of the Taycan 4S Cross Turismo is also 30 kW higher than that of the Taycan 4S, and the power output of the Taycan Turbo/Turbo S Cross Turismo is exactly the same as that of the Taycan Turbo/Turbo S.The headroom of the second-row seats of the Taycan in hunting gear version has increased by 47mm, and the trunk not only has better expandability but also 39L more space. The highlights of the Taycan Cross Turismo also include an increased ground clearance of 30 mm and newly added gravel specification, which can ensure the Cross Turismo model’s off-road driving on unpaved roads. The black edge of the wheel arches can also protect some of the car paint accordingly.

The Taycan GTS is priced at 1.392 million yuan. The Taycan GTS has already been sold in overseas markets with a maximum power output of 440 kW, and the acceleration time of 60 mph (96 km/h) is 3.5 seconds. The overall performance and price are between the 4S and the Turbo.

Quick Comment:

As Porsche’s first pure electric coupé, the Taycan has been very successful in terms of sales, with a global delivery volume of 9,470 units in Q1 2022 alone, even surpassing Porsche’s flagship 911 with 9,327 units. The sales of Taycan in 2021 exceeded 911 as well, with 41,296 units sold in 2021 compared to 34,428 units for 911.

The introduction of Taycan Cross Turismo and GTS to China has further allowed global customers to experience the fun of driving a pure electric vehicle. As one of Porsche’s highest-selling models globally, the Porsche Macan EV is also undergoing intense testing. We can expect updated and fresh blood for Porsche’s pure electric product line with the launch of Macan.

CARIAD China Strategy Launch by Volkswagen Software Department

On April 28th, Volkswagen held the “CARIAD China Strategy Launch” in China, marking the first time Volkswagen has publicly revealed the work and situation of its CARIAD China subsidiary.

In less than a year from last year until now, CARIAD China has already formed a team of 600 people and is expected to double the number of its staff before the end of 2023, with more than 90% being local software talents. Meanwhile, CARIAD China is setting up its R&D unit in Beijing, Shanghai, Chengdu, and Hefei, with the aim of building a nationwide distributed R&D network.

In less than a year from last year until now, CARIAD China has already formed a team of 600 people and is expected to double the number of its staff before the end of 2023, with more than 90% being local software talents. Meanwhile, CARIAD China is setting up its R&D unit in Beijing, Shanghai, Chengdu, and Hefei, with the aim of building a nationwide distributed R&D network.

With regards to different Volkswagen pure electric platforms, CARIAD matches different software, while the mission of CARIAD China is to develop and adapt software for different platforms:

-

Volume software platform (volume), applicable to MEB platform models, will realize software remote online updates, i.e., OTA, on specific models. The Chinese team will take the lead in implementing OTA of the ID. family series in China. The first update is expected to be achieved in the second half of 2022.

-

Premium software platform (premium), applicable to the PPE platform, is planned to be launched within the next two years. It will support advanced informational entertainment systems and advanced driving assistance systems based on Android open-source system, and will also support remote online updates of some Audi and Porsche brand models.

The new “unified and scalable software platform” introduced in the press conference will be applicable to all brands under the Group and will support the Volkswagen’s self-developed operating system VW.OS and will be connected to Volkswagen’s cloud VW.AC. This can be understood as the exclusive software of Volkswagen SSP platform that will be launched around 2025, and will be pre-equipped with L4-level autonomous driving technology.

The Chinese team will lead and participate in 70% of the R&D work in the new software platform technology stack and product line, including local R&D and adaptation. At the same time, the Chinese team will also develop data backends that comply with the data compliance requirements in China, i.e., Volkswagen’s cloud VW.AC, and implement a series of connected services.

Quick review:

Volkswagen has a total of 660,000 employees, including factory workers, software developers, and tens of thousands of middle and senior managers among them. Half of them are still engaged in traditional car production.

Diess’s innovation has moved from hardware to software, and CARIAD, as the leader of Volkswagen’s software reform, is given an annual fund of €2.5 – 3 billion from Volkswagen.In this reform, it is clearly impossible to train ICE position employees to adapt to the software. The number of IT talents in Europe is also difficult to meet the public’s ambition for intelligence. As the first step to go global, the CARIAD China subsidiary has provided many substantive functional outputs in less than a year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.