“Remembering the Sweetness and Bitterness” is Easy When There’s More Alone Time During Holidays

For those who have written technology news before, the past seems always sweet, with countless amazing products and the exquisite experiences that accompany them. But the future is always bitter, as new technologies and knowledge emerge endlessly. If we don’t study for three days, we face the self-doubt of “What is this? What is that?”

Take me, for example. My first time writing news for Intel dates back to 2010, when I was still a senior in college. But when I started writing my first long-form article on Intel’s financial report, I found myself back in the fog of ignorance like a student listening to a lecture for the first time.

Don’t believe me? Take a look at the notes I made below.

You Don’t Even Know How Many Ways Intel Can Make Money

DCAI, NEX, AXG, IFS.

What are those?

These are business units at Intel that are making money and accelerating in doing so.

If you add Mobileye, you might feel a little more enlightened.

For most of our readers, the first thing to understand is that Intel is no longer just a chip company, but a tech giant that covers most of the semiconductor, AI, and data center industries.

DCAI is Intel’s Data Center and AI business unit. Due to the rapid evolution and expansion of the application area, the demand for related computing power in the tech industry is also skyrocketing. Intel CEO Pat Gelsinger said during the earnings conference call that Intel has seen an urgent demand for such products from large-scale enterprises and government customers in this field this year.

In this area, Intel’s 10nm technology brings industry-leading low power consumption computing power, and from the earnings report, we can also see that Intel is accelerating its product and project landing in the data center field.At present, Ponte Vecchio GPU, a high-end product specially designed for high-performance computing and artificial intelligence, is providing samples to customers. Ponte Vecchio and Sapphire Rapids with high-bandwidth memory will support two Aurora supercomputers in the Argonne National Laboratory in the United States, each of which can perform tens of billions of floating point operations per second. In addition, our general-purpose data center GPU, Arctic Sound, designed for leading media, graphics, and artificial intelligence inference capabilities, will also be launched in the second half of this year.

NEX is Intel’s Network and Edge Computing Division. Pat Gelsinger stated in the earnings call, “We are in a unique and favorable position where we see the power of networking and edge as a particularly growing field.”

Intel believes that in the network field, oRAN and vRAN have reached a critical point and become the preferred mode for all future network deployments. Currently, almost all commercial deployments are based on Xeon processors and FlexRAN software. Intel has collaborated with major global operators over 10 times, and these cooperative projects are expected to undergo large-scale commercial deployments within the next two years. You can understand that Intel is leading the transformation of the entire network and gaining advantages.

How fast will this growth be? Pat Gelsinger said, “In Q1, our growth rate in this business far exceeded 20%. We expect our growth rate to exceed the market.” “This is good business for us.”

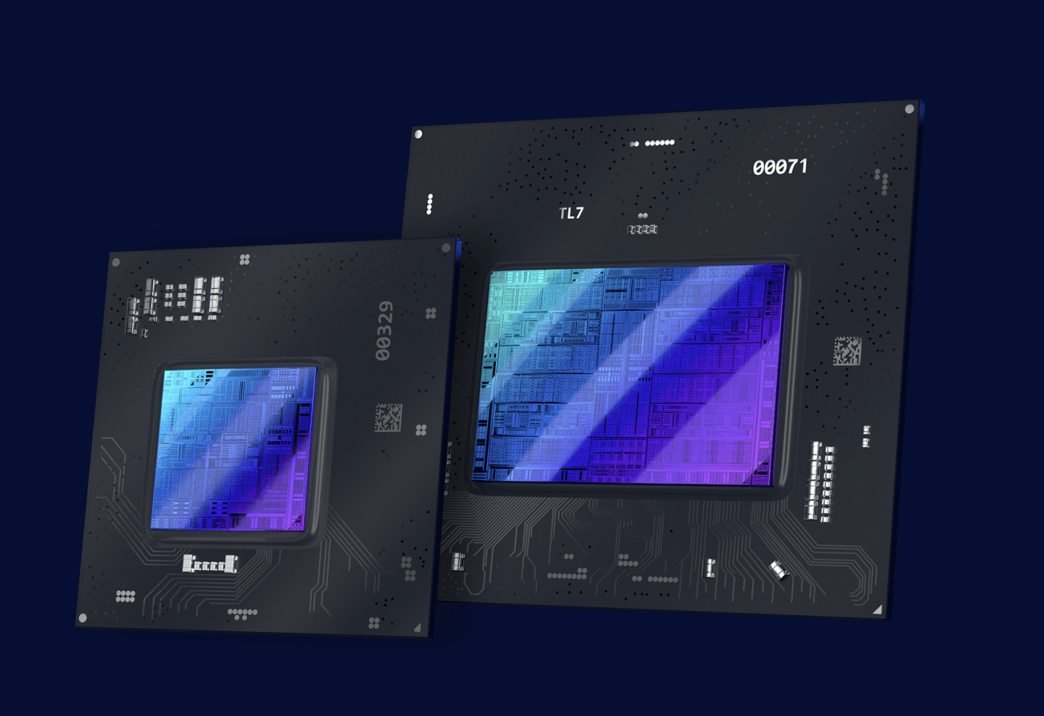

AXG is Intel’s Accelerated Computing Systems and Graphics Division, which is closely related to many products we use, but also includes many products that far exceed the needs of ordinary consumers.The long-rumored Intel discrete graphics card has finally arrived this quarter as the “Intel Arc Alchemist A Series” mobile discrete graphics card takes the lead, with a product performance improvement of up to 2x compared to integrated graphics. It also supports Deep Link technology, which can cooperate with Intel integrated graphics to improve application performance by up to 30%.

During the earnings call, Pat Gelsinger personally revealed the lineup of upcoming Intel products: “In addition to the mobile products we launched in the first quarter, we have all the subsequent derivative products.”

“Following closely are more powerful Intel Arc 5 and Intel Arc 7 designs, as well as desktop and workstation products later this year.”

Even some foreign media praised this part of Intel’s business as a guaranteed profit and aims to “disrupt a vast and growing market with a thriving open ecosystem”.

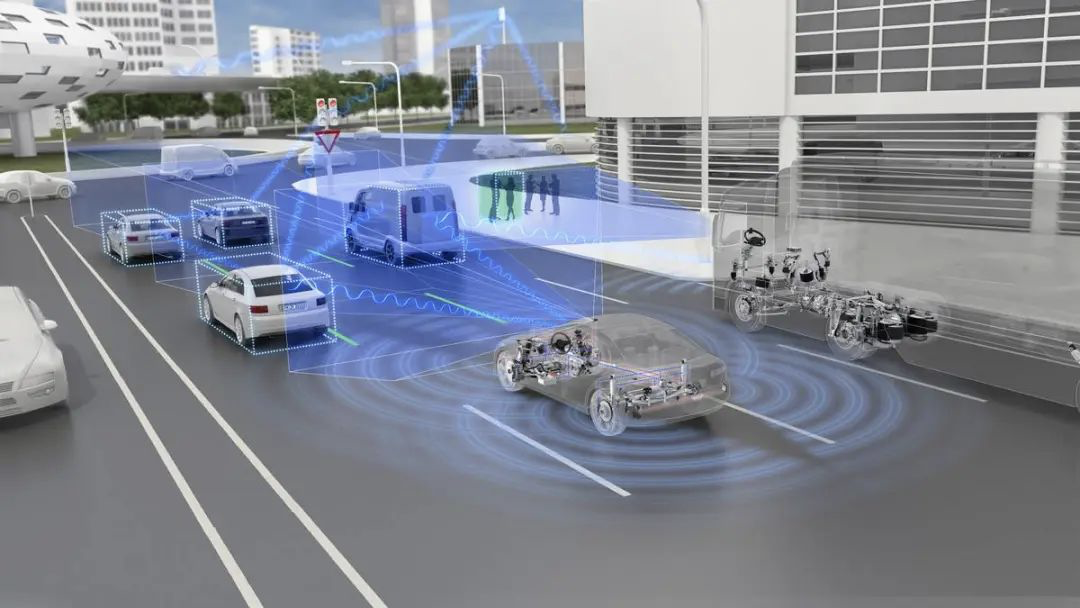

As for Mobileye, which is our most familiar area, it set a new record this quarter, preparing for its final IPO and spin-off from Intel, with revenue of $394 million, a 5% increase from the same period last year.

“We witnessed multiple Mobileye technologies this quarter, including the EyeQ 5 chip and eight million pixel cameras simultaneously installed in the BMW 7 Series, as well as the BMW Highway Assistant, which can achieve speeds up to 80 mph for autonomous driving.”

“Four years and five process nodes” may even be faster.

Compared with the first quarter of 2021, the above departments have achieved rapid growth in revenue. The only one that didn’t achieve it is the Client Computing Group (CCG), which is Intel’s most profitable business.This business unit’s first quarter revenue was 9.3 billion US dollars, even more than all the rest listed combined.

All kinds of computer processors that we are familiar with are in this business unit.

In the earnings conference call, the most frequently asked questions to Pat Gelsinger by analysts were related to the sales of PC processors.

In fact, the processor, which could be regarded as the infrastructure of the technological era, is very likely to be affected by any national events or incidents related to people’s livelihoods. The number of deliveries in this quarter was affected by a variety of factors, including international military conflicts and the suspension of production due to the Shanghai epidemic.

Pat Gelsinger also mentioned that the decrease in processor sales this quarter is somewhat related to the decrease in entry-level devices and the shrinkage of the education market. But if you look closely at the data, you will find that the decline is mainly concentrated in the field of notebook mobile processors.

This is actually quite interesting. On the one hand, this is related to the upgrade of the entire product line. The entire industry is waiting for the delivery of the 12th generation Core mobile processor, which will inevitably bring a sales wave due to the launch of new products in the next quarter. On the other hand, the 12th generation Core has made significant optimizations in terms of performance for mobile gaming laptops and mobile creative workstations, which is also where the most profitable subdivision of the entire industry lies.

“Widely recognized ecosystem consistently believes that the increase of PC density, update rate, and penetration rate promotes the sustainable development of the PC market in the long term, as PC is still an important tool for work, study, and entertainment. We see special advantages in the gaming and commercial PC areas, which is somewhat affected by consumer inflation pressure and customer inventory management slowdown.”

Pat Gelsinger’s evaluation of the entire processor product line is: “I just want to say that the product line is healthy. We are entering a stronger product cycle, which gives us more opportunities to provide higher value to our customers correctly.”# Intel’s Latest Developments in Processor Architectures and Manufacturing Technologies

Intel, which has previously suffered from process phobia, is now racing ahead in manufacturing technology and product performance. In the first quarter, the 12th generation Alder Lake series shipped over 15 million units, and in Q1, Intel also released the fastest desktop processor, the Core i9-12900KS. With the release of the latest vPro platform, Alder Lake will extend to various fields, including enterprises of all sizes.

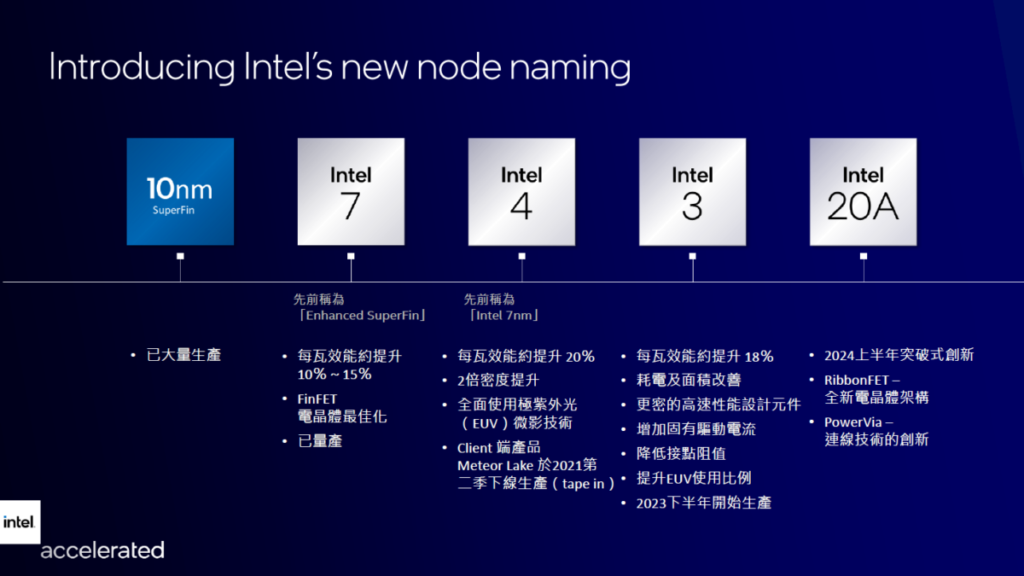

Moreover, Intel’s previous proposal of “4 years and 5 process nodes” seems to be even accelerating ahead of schedule now:

-

Mass production of Intel 7, which is used for Alder Lake, went very smoothly.

-

Based on Intel 4, Meteor Lake has successfully launched Windows, Chrome, and Linux.

-

Sierra Forest’s early pre-production wafers, based on Intel 3, will be trial-produced this year.

This means that Intel’s new products in the processor field will arrive on the scene faster than expected, and worries about insufficient firepower may be a thing of the past.

It also means that the workload of the media will become even heavier.

Chip Shortages and Production

There’s still one IFS that hasn’t been mentioned.

Indeed, my first impression of this abbreviation was the building in Chengdu with a panda butt on top.

But this time it’s not, as it refers to Intel’s foundry services.

The chip shortage, which has already shown its power in the automotive industry, is actually a common problem in the industry. According to Pat Gelsinger in an interview, he once said that the chip shortage would last until 2023, and now it looks like it could be extended for another year, as chip manufacturers struggle to purchase enough manufacturing equipment, which seriously affects their ability to increase supply.

However, Intel’s factories under construction and foundry business will serve as a barrier against risks.Intel’s foundry services division achieved a Q1 revenue of $283 million, a 175% increase compared to the same period last year when it was $103 million.

In this earnings report, Intel announced a new investment plan in Europe. The latest state-of-the-art factory in Oregon will be named “Ronler Acres Gordon Moore Campus” after the Intel founder who made unique contributions to advancing Moore’s Law through the factory. At the same time, Intel is also advancing plans to build several new factories in the United States and Europe.

This will achieve Intel’s geopolitical and production chain diversification in chip manufacturing and give it better support capabilities in the market under the trend of explosive demand for chips in the next few years.

“Currently, we are only at the beginning of the long-term growth cycle of the entire semiconductor industry. Overall, customers in the enterprise, cloud, artificial intelligence, graphics, and networking sectors continue to release strong demand signals. Semiconductors are the driving force behind innovation and transformation in all industries, and Intel is fully committed to meeting this challenge.”

After all, “semiconductors are the fuel for innovation and transformation in all industries.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.