Author | Zhu Shiyun

Editor | Qiu Kaijun

In June, Dirk Hilgenberg, CEO of CARIAD, the software company of Volkswagen Group, will give a speech titled “German-made software: Why we take an uncomfortable path” at the “Transformation Now” technology conference.

After tasting bitterness in Germany, Volkswagen wants to make the road of “manufacturing software” in China as comfortable as possible.

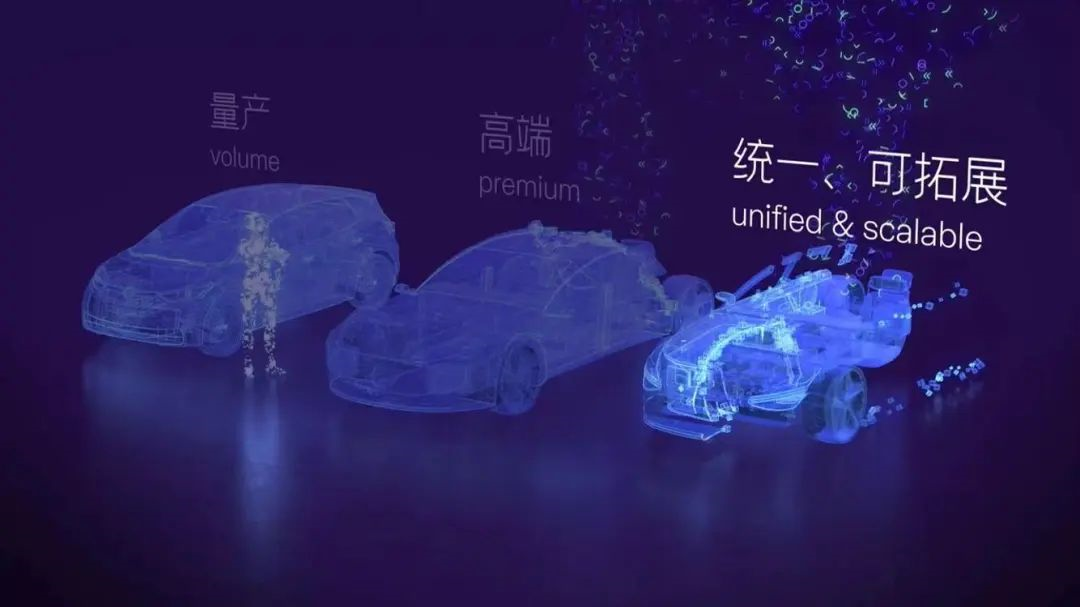

On April 28th, the Chinese subsidiary of CARIAD, the new software company under Volkswagen Group, was officially established. The Chinese team will focus on Chinese market demand and jointly develop a unified, scalable new software platform, advanced driver assistance systems and autonomous driving, as well as next-generation intelligent interconnect functions with the headquarters.

This is CARIAD’s first overseas subsidiary outside of its European headquarters. The gradual global development mode of traditional automobile manufacturing industry has obviously become unsuitable for the software industry. Volkswagen hopes to achieve everything at once in China this time.

Three Steps

CARIAD’s mission in China by 2025 will be achieved in three steps.

In the first stage, the E³1.1 software system on the MEB platform will be the main focus of OTA updates in China, and the first update is expected to be realized in the second half of 2022.

In the second stage, in addition to realizing the OTA of the E³1.2 software system on the PPE platform in 2023, specific applications tailored to the Chinese market will also be developed for its supported Android entertainment system and advanced driver assistance system.

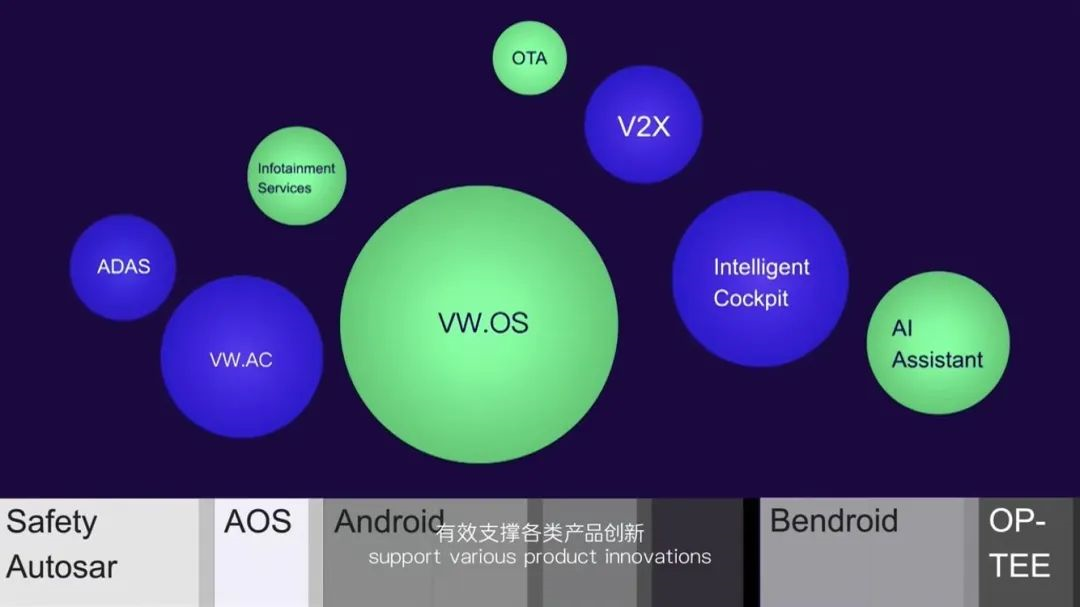

In the third stage, in 2025, Volkswagen will launch the self-developed VW.OS operating system and the VW.AC car cloud for the SSP platform, and it will be pre-installed with L4 level autonomous driving technology.

The Chinese team will be in charge of 70% of the R&D work related to the brand-new software platform technology stack and product line, including local R&D and adaptation.

In addition, the Chinese team will also develop compliant data backends, including data collection, uploading, training, iteration, and downloading applications.

“Our R&D work not only ‘develops in China, innovates for China’, but also is committed to ‘developing in China, innovating for the world’. By 2030, the technology stack developed by CARIAD will run on more than 40 million Volkswagen Group cars worldwide, and achieve the huge synergies and economies of scale expected by the Group’s 2030 NEW AUTO strategy.” said Chang Qing, CEO of CARIAD China, in his speech.

In July last year, Volkswagen Group announced its 2030 NEW AUTO strategy, aiming to accelerate the transformation into a software-driven mobile travel service provider. According to Dirk Hilgenberg, software based on autonomous driving technology will become the main source of income for the entire automotive industry by 2030. By that time, the brand new and unified software platform version 2.0 covering digital interconnection functions and deployed throughout the entire group with the SSP platform will open up a completely new ecosystem and a new data-based business model at the same time.

Why Set up a Subsidiary in China?

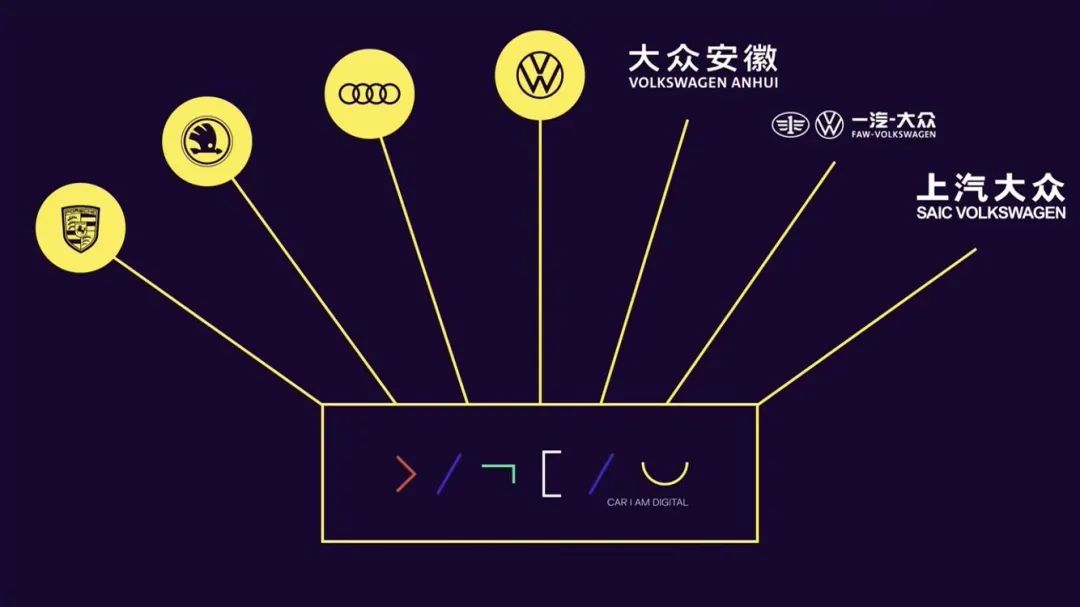

CARIAD China may be the fastest overseas subsidiary ever set up in the history of the automotive industry. CARIAD was established by Volkswagen Group’s software department: Car.Software-Organisation (CSO) in 2020, which was transformed into CARIAD last year. The goal of Volkswagen Group has always been the same, whether it is CSO, CARIAD, or CARIAD China: to develop a full-stack, self-developed, unified, and scalable software platform that can meet specific needs of different markets, for all of the group’s brands.

As early as 2019, when Volkswagen’s first pure electric platform MEB was introduced, the brand-new electronic and electrical architecture E³ and the VW・OS concept based on domain control mode were introduced simultaneously. However, the development of software and hardware was not synchronized.

When MEB produced multiple ID models for Volkswagen, the Porsche Taycan was a commercial success on the J1 platform, and the FAW Audi PPE factory had already been built. But software for Volkswagen’s electrified models was still plagued with bugs.

Recently, when the European ID. models were upgraded to version 3.0 software via OTA, the vehicles had to be taken back to dealerships for processing by factory-trained technicians. The reason was that the vehicles needed to obtain version 2.4 software at the dealership before upgrading to version 3.0 via OTA.

Therefore, it is not difficult to understand the reason for setting up a software subsidiary in China.One: Cross-border software system upgrades involve legal requirements related to data, intellectual property, and road safety in different countries. Therefore, local teams are needed to adapt products to local needs.

Furthermore, as mainstream software systems are still not mature, every OTA update is a practical battle to fix bugs.

As a result, CARIAD China, which was just established, already has over 600 employees, and it is expected to double this number before the end of 2023, with over 90% being local software talent. At the same time, it is also building research and development capabilities in Beijing, Shanghai, Chengdu, and Hefei, gradually constructing a nationwide distributed R&D network.

Two: The significant differences in demand for automotive intelligent technology between Europe and China have been repeatedly demonstrated through user surveys and market practices abroad. A local team is required to develop software applications that meet the needs of the Chinese market.

XPeng and Tesla are prime examples. Electric Vehicle Observer found that XPeng’s intelligent cockpit has better human-machine interaction and higher scores in driving assistance experience, even though both sides have very similar actual functional performance.

“Some experts believe that if Tesla does not improve its intelligent cockpit in China, it will undoubtedly be a problem.”

Three: For agile and compliance requirements in high-end intelligent driving assistance based on closed-loop data, a localized team is almost a mandatory requirement.

At the press conference, CARIAD China gave examples of three developed intelligent networked functions: traffic signal light information (TLI), danger information warning (LHW), and danger information suggestion (LHI). This includes the collection, application, and distribution of urban signal light information, road conditions, and surrounding vehicle information.

V2X is just the beginning, as the Volkswagen Group has frequently stated that it will also develop its own driving assistance/autonomous driving system. “We are gradually creating a vertically integrated ADAS/AD (intelligent driving assistance/autonomous driving) technology stack, which is one of the key elements for the future of CARIAD and the entire group’s success,” said Dirk Hilgenberg in a recent interview.

Previously, self-driving truck company TuSimple split in two, becoming two separate companies in China and the United States, respectively. Tesla has also begun to establish research and development centers in China. In preparation for Volkswagen’s self-developed autonomous driving capabilities, the establishment of CARIAD China can be seen as being prepared for the future.

How to get everything done at once?Currently, CARIAD has approximately 5,000 engineers and developers globally. In addition to providing feature updates for MEB platform vehicles and developing software and technical platforms for PPE, their core mission is to develop a unified and scalable software and technical platform, E³ 2.0, for all eight brands under the Volkswagen Group including Volkswagen, Skoda, Audi, and Porsche, and to cover all four major regional markets globally: Europe, North America, South America, and Asia Pacific. This platform will support all intelligent vehicle features, such as intelligent cockpit, intelligent driving, and whole vehicle OTA.

CARIAD is committed to making the Volkswagen Group a vertically integrated car company capable of full stack self-development, similar to Tesla and XPeng Motors, by building E³ 2.0. On April 20th at the Volkswagen Group’s “New Car” strategic seminar, Volkswagen listed Tesla, XPeng, and Nio as their competitors.

But, how can everything be accomplished all at once? CARIAD China disclosed some clues at its release conference.

“To build a comprehensive software platform, a comprehensive set of tools is needed first.” PMT – Process, Method, Toolchain – is the integrated platform consisting of more than 50 customized and self-developed tools, supporting various technology stacks and development languages for automotive software development. Additionally, it has highly automated capabilities.

“Let our engineers seamlessly develop automotive operating systems, in-vehicle applications, and cloud services with the same set of PMT platforms,” said Sun Wei, CTO of CARIAD China. “Our goal is to enable teams to provide high-quality software and different operating versions to all customers throughout the product lifecycle, ensuring that the product complies with all relevant policies and regulations.”

In addition, a product development process that adapts to the pace of software iteration is needed.

Sun Wei cited CARIAD China’s “Forward” innovation program, highlighting their quarterly rolling product innovation plan and development approach. They choose innovative products, integrate them into the digital lifecycle management process and system of the electric-electronic architecture product line at the appropriate time, and then push them to the market via relevant vehicle models after completion.

Finally, money and systemic support are of course necessary.At the end of last year, Volkswagen Group released Round 70 (2022-2026), which plans to invest 89 billion euros in electric and digitalization, accounting for 56% of total investments. Among them, the cost of product and company digital transformation has reached 30 billion yuan (approximately 215 billion yuan) and increased by 10% compared to the previous plan.

In terms of system, cooperation acquisition is all within Volkswagen’s options except for CARIAD’s self-development.

In January of this year, CARIAD established a comprehensive partnership with Bosch for the standardization platform of intelligent driving assistance/highly automated driving technology cooperation research and development. Recently, CARIAD also took over the automotive business of Intenta GmbH in Germany, which mainly deals with image processing, data fusion, recognition and detection.

Moreover, Volkswagen has deployed hundreds of customized development fleets in Germany, the United States and other countries, equipped with high-performance sensors and network computing platforms, and provided the ability to process real-time data to accelerate the development process of the E2.0 software platform.

CARIAD China is a critical step for Volkswagen to achieve the goal of “one-stop-shop”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.