Author: Michelin

Recently, Musk’s acquisition of his “main battlefield” Twitter has made headlines.

However, as someone in the automotive industry, I seem more interested in his other announcement at last week’s Tesla Q1 earnings call, the “car without brakes, without a steering wheel, and cheaper to use than a bus“.

Isn’t this just the Tesla version of Robotaxi?

For more than a decade, the autonomous driving industry has experienced several highs and lows. When ride-hailing was on the rise, Robotaxi almost rose at the same time, and for a while, start-ups in the autonomous driving industry all focused on Robotaxi’s business. However, as the reality of implementation difficulties became apparent, the Robotaxi market gradually cooled off.

Some of the companies that initially invested in it chose commercial scenarios, such as TuSimple, known as the “first autonomous driving stock”, which invested more energy in autonomous driving buses and trucks, and other companies such as Momenta and Hesai IMa that also chose this commercial scenario. Some chose multiple parallel lines, such as Wenrun Zhixing entering the field of autonomous driving buses and logistics vehicles in the park, and others chose to “reduce dimensions” and collaborate with vehicle manufacturers to apply autonomous driving technology to L2+ level auxiliary driving on mass-produced vehicles.

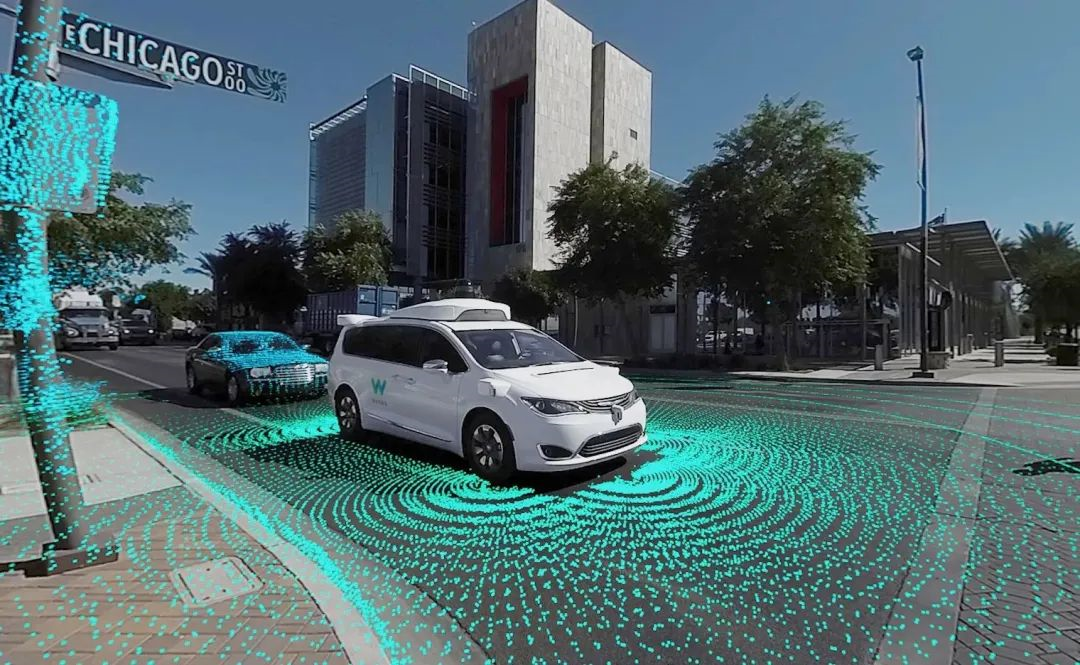

Those who are still sticking to the Robotaxi sector are almost “deep-rooted”. They include Waymo, Cruise, domestic players like Apollo, Pony.ai, ZOOX (acquired by Amazon) who joined the Robotaxi field after acquisition by Amazon, and the newly announced Tesla. Today, Robotaxi has almost become a new battlefield for the wealthy.

Robotaxi, the difficult exploration of commercialization on the edge, and the “game” of deep-pocketed players

“Autonomous driving is a marathon, and we’re not even at five kilometers.”

In a conversation with Li Yin, President of Bosch XC Division China, at the end of last year, he described the current status of autonomous driving in this way, which also represents the views of some people in the industry: autonomous driving is a long road.Because of the long journey, we see that many OEMs are not so eager and aggressive with mass-produced cars because there is still enough time to perfect them; but precisely because of the long journey, autonomous driving players are even more anxious, as they need to gather “nutrients” to support themselves through the entire journey. Commercialization is the best way to obtain “nutrients”, whether it is for commercial purposes or technological needs.

Therefore, trucks, industrial parks, and mines, which are relatively simple in terms of scenarios and have relatively fixed routes, have become the starting points for autonomous driving. By expanding the scope of autonomous driving products and lowering the threshold for landing, companies can ensure the continuous evolution of their algorithms.

However, these seemingly simple scenarios are not simple in practice. On the one hand, while the probability of unexpected scenarios for an autonomous truck may be low, when a vehicle carrying tens of tons of cargo encounters suddenly encountered obstacles, the system’s ability to respond urgently is challenged even more.

On the other hand, it must be said that the second demand for autonomous driving to land first: to continuously improve algorithms by iterating through multiple scenarios and back-feeding technology.

Autonomous driving is a highly scenario-based technology. For autonomous driving companies based on artificial intelligence algorithms, using data to “feed” algorithms is the best way to drive algorithm upgrades and iterations, especially requiring data diversification. Whether it is a truck, a mine, or a logistics park, the testing and operation scenarios of autonomous driving vehicles are obviously different from the usage scenarios of passenger cars.

In this light, Robotaxi represents not only the market prospects of ride-hailing and taxi services, but also the testing scenarios and technology that can be directly reused on passenger cars in the future, which is almost the only way for autonomous driving to be fully rolled out. It is not difficult to understand why Robotaxi has been sticking to this field with new players joining in, despite its ups and downs.

However, there is no such thing as a free lunch. Robotaxi may be good, but it is difficult to enter.As the leading company in autonomous driving, Waymo obtained the permission to offer fee-based passenger transport in San Francisco area last month. After accumulating a financing of 5.7 billion US dollars from 2016 to present, it seems to finally see the dawn of commercialization. Prior to this, Waymo could only conduct small-scale fee-based operation in Phoenix.

Baidu Apollo and Pony.ai, which have obtained the qualification for commercial testing in China, not only offer initial experience, but also provide a one-tenth discount to encourage people to experience it as well.

Compared with the investment of billions or tens of billions in the early stage of autonomous driving, the current small-scale commercialization seems more like a test of enterprise’s own operating capability, and it is too early to talk about genuine commercialization.

Therefore, it is essential for companies to have strong technical competence and solid financial resources to survive in this battleground, which is not so much a battleground for the wealthy as for those who can make it through with their superior technology and financial strength.

From 0 to 1 is difficult, but from 1 to 100 is even more challenging

In many fields, there is such a rule that it is difficult to go from 0 to 1, but once the threshold of 1 is surpassed, it is much easier to reach 100. Unfortunately, it does not seem to apply to commercialization of autonomous driving.

“Cars, technology, and operation are indispensable. ” Recently, the Head of a domestic autonomous driving company described the difficulty of Robotaxi commercialization to GeekCar in this way.

For any company engaged in Robotaxi, it needs to have excellent autonomous driving technology, a certain scale, reliable and cost-effective vehicle fleet, and operational ability that matches the demands of users.

Regarding the technical aspect, it is necessary to mention the evaluation criteria for autonomous driving at present: testing mileage, vehicle takeover count, and average takeover distance. According to the Autonomous Vehicle Disengagement Reports of 2021 released by the California Department of Motor Vehicles, 26 enterprises that submitted annual reports had driven more than 4 million miles in total, which doubled from the previous year. The average takeover distance of several leading players could reach several thousand or even tens of thousands of kilometers.

Thousands of kilometers do not require manual intervention, which seems to indicate that the system is intelligent enough to handle daily commuting. However, it is important to note that these indicators are mostly obtained through testing within defined parameters and routes. For autonomous driving, the size of the fleet, the complexity of different road test environments, and the scope of operation all impact system performance. Data obtained from small-scale tests cannot be generalized to cover a wider range, and it is the infrequent and unexpected scenarios in daily life that make up valuable and effective samples in current autonomous driving testing, which are often referred to as corner cases in the field.

Thousands of kilometers do not require manual intervention, which seems to indicate that the system is intelligent enough to handle daily commuting. However, it is important to note that these indicators are mostly obtained through testing within defined parameters and routes. For autonomous driving, the size of the fleet, the complexity of different road test environments, and the scope of operation all impact system performance. Data obtained from small-scale tests cannot be generalized to cover a wider range, and it is the infrequent and unexpected scenarios in daily life that make up valuable and effective samples in current autonomous driving testing, which are often referred to as corner cases in the field.

To obtain more effective samples, it is necessary to perform testing on a large scale across multiple scenarios, going from 1 to 100. Fortunately, in the past two years, there has been a “green light” for commercializing autonomous driving around the world.

As mentioned earlier, in the United States, in addition to Phoenix, which previously allowed commercial operation, Los Angeles and surrounding areas began allowing commercial testing and operation last month. On April 28th, Beijing’s Intelligent Network-Vehicle Pilot Zone issued the first “Notice of Demonstration Road Test for Unmanned Applications” to Baidu Apollo and Xiaoma Zhixing, allowing the two companies to provide autonomous driving travel services with only a safety officer in the front passenger seat, which expands the testing area from the previous 20 square kilometers to 60 square kilometers, including richer and more complex urban road scenarios.

From 20 square kilometers to 60 square kilometers, the testing range for unmanned driving has been expanding little by little, and the commercialization of Robotaxi is also advancing step by step, which is a difficult but unavoidable path.

At the same time, the capabilities of the vehicles and operations are also indispensable. This has led to the current situation where autonomous driving companies either obtain Robotaxis by jointly developing volume-produced cars with automakers or build their own testing vehicles.

Last year, Baidu Apollo and BAIC Motor cooperated to develop the Apollo Moon, reducing vehicle costs to one-third of the industry average. However, even with this reduction, costs are still around 480,000 RMB. Waymo, which chooses to develop all of its technology, vehicles, and operations on its own, incurs a cost of over one million RMB per test vehicle. It is no wonder that when foreign media experienced Waymo in Phoenix, they found that the price of one dollar per minute was 2.5 times higher than Uber in the same area, which limits the expansion of the fleet to some extent.

However, when it comes to vehicle development, Tesla can stand tall, as it can make three cars and sell one, which boosts the gross profit margin of its cars to over 30%. Tesla has extensive experience in low-cost vehicle building for fleets.## Is Robotaxi without LiDAR feasible?

LiDAR has recently been pushed to the forefront by several autonomous brand leaders, whether it’s top-mounted or front-mounted, one or more, becoming the battleground for several industry leaders and a selling point for new products. However, the consensus behind the controversy is that current autonomous driving cannot do without LiDAR.

A few years ago, when Waymo regarded having LiDAR as its moat, it could not have imagined that it would be ubiquitous on mass-produced cars in just a few years.

Therefore, when Musk said that Tesla wanted to make Robotaxi, my biggest question was: can a pure vision solution without LiDAR be enough for Robotaxi?

From academia to the current mass-produced car field, there seems to be no standard answer for the pure vision solution vs LiDAR solution. After all, both are still in the evolutionary stage. Musk’s advocated pure vision solution relies on AI algorithms, while other players who have integrated LiDAR and chosen a fusion route are equipped with sufficient “perception redundancy” and still cannot avoid occasional accidents, requiring smart algorithms.

For both, it may be more important to advance AI algorithm iterations through extensive testing in many scenarios at this stage. When the cost of LiDAR is lowered through mass production, Tesla may “turn back” on its decision?

Will Tesla’s Robotaxi be available in 2023?

“In the next 3 to 5 years, Robotaxi will not be truly commercially deployed.” Previously, the head of an autonomous driving start-up company in China described the prospects of Robotaxi this way.

Today, although policies, capital, and data have all been moving in a positive direction, commercialization of Robotaxi on a large scale remains difficult in the short term.

Therefore, when Musk said that the vehicle without brakes or steering wheel would “be unveiled in 2023 and mass-produced in 2024”, it was met with significant skepticism. After all, Cybertruck has been unveiled for more than two years, not to mention the Roadster unveiled in 2017. Will Robotaxi move that quickly?

For Tesla, the preview of Robotaxi is more like a “show of muscles” for FSD. Over the past period of time, FSD Beta has undergone frequent and intensive OTA updates, evolving at an almost “weekly” rate. The FSD Beta tester group has also rapidly expanded from thousands of people last year to over 100,000 people today.

From level 4 autonomous driving to production vehicles with advanced driving assistance functions, this has always been referred to as a “downgrade.” Therefore, after a period of rapid expansion and frequent improvements, Robotaxi is more like a “reassurance pill” that Musk gives to Tesla owners.

At the same time, it also serves as a “reassurance pill” for investors. Musk has always been very optimistic about the commercial prospects of FSD technology and software profits. At the beginning of the year’s financial report, Musk predicted that FSD would be fully promoted in 2022. However, at least in the Chinese market, this is still an unknown quantity. Under expected circumstances, adding some commercial imagination to FSD is reasonable.

So, you ask me if we can really see Tesla’s Robotaxi by 2023? Perhaps, at least, or maybe, we can see the demo car.

Finally

Not long ago, there was a video on a foreign social platform. Cruise’s autonomous driving test car was stopped by San Francisco police and then suddenly started and drove away before the police could react.

In this regard, experts have stated that while improving the specifications and standards of autonomous vehicles, efforts should also be made to train the police and other responsible persons on how to control autonomous vehicles.

You see, as technology advances, new problems that were previously unencountered have also arisen. On the road to commercializing Robotaxi, new challenges will be encountered.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.