Author: Zhu Yulong

The development of electric vehicles has given many countries around the world the opportunity to seek leapfrog development in the period of global automotive industry transformation, such as VinFast from Vietnam. Petroleum-producing countries have also begun investing in the automotive industry, as seen in Lucid.

Thanks to its “oil daddy,” Lucid is still very ambitious:

On February 28, Lucid announced the construction of a new manufacturing facility in Saudi Arabia with an annual production capacity of 150,000 vehicles. Lucid is working with Saudi Arabia’s Ministry of Investment, the Saudi Industrial Development Fund (SIDF), and King Abdullah Economic City (KAEC) on the project. On April 27, the Saudi Arabian government announced plans to purchase at least 50,000-100,000 electric vehicles from Lucid Motors over the next 10 years, which represents a significant change by a petroleum-producing country that has traditionally relied on gasoline cars. This is somewhat similar to Norway, which was the first country to switch to electric vehicles based on its own considerations.

This is actually a very interesting change. While China has given many new players in the automotive industry opportunities to try through its industrial policies, during the automotive industry transformation period, countries are looking to simplify their supply chains and do their part in the face of large numbers of personnel redundancies in the automotive industry. In addition, the automotive industry is currently transitioning from deep globalization to regional supply, which may lead to a regional supply pattern.

Investment History and Production Process for Lucid

Lucid has had many experiences with Chinese capital in the past:

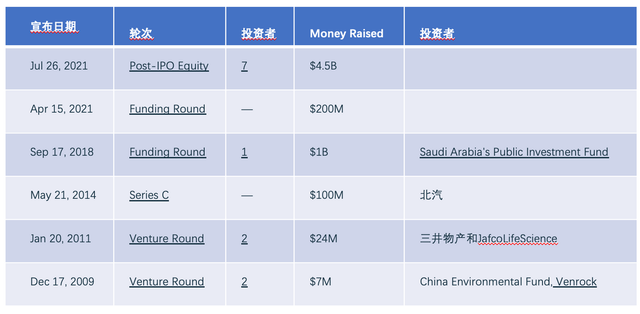

In 2009, Lucid raised $7 million in Series A financing, with investors including venture capital firm Venlock and China’s Qingyun Venture Capital. In 2011, Lucid completed a $24 million Series B financing round with Mitsui and JafcoLifeScience. In 2014, after a $100 million financing round, the story of North American automotive company BYD Auto and Jia Yueting unfolded, raising concerns about the sustainability of the company.

Then, the “oil daddy” entered the fray. The Public Investment Fund of Saudi Arabia invested $1 billion, and before the IPO, the sovereign fund held 1,015,252,523 shares, controlling Lucid until today.

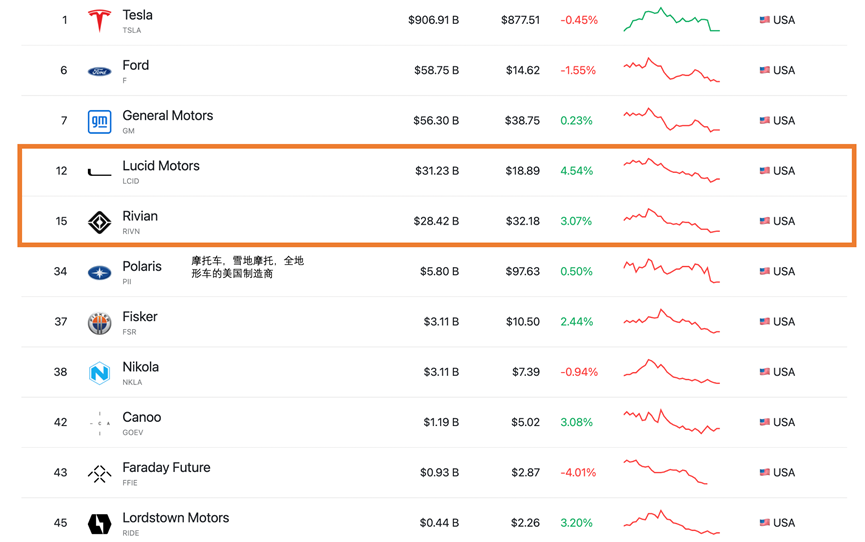

Compared with Rivian’s fluctuating stock price, Lucid’s stock price has remained relatively stable at a market value of $32 billion due to the sustained investment from Saudi Arabia and the substantial potential orders placed. From the perspective of the event, this is somewhat like an oil-rich kingdom playing football in Europe – investing in advanced manufacturing and technology through capital in the capital environment of the United States and then pulling back the critical parts of the industrial chain to Saudi Arabia to achieve local industrial development.

Compared with Rivian’s fluctuating stock price, Lucid’s stock price has remained relatively stable at a market value of $32 billion due to the sustained investment from Saudi Arabia and the substantial potential orders placed. From the perspective of the event, this is somewhat like an oil-rich kingdom playing football in Europe – investing in advanced manufacturing and technology through capital in the capital environment of the United States and then pulling back the critical parts of the industrial chain to Saudi Arabia to achieve local industrial development.

Currently, Lucid has 25,000 orders in the United States, and its factory is located in Casa Grande, Arizona, where it has been in small-scale production since September 2021 and started its first delivery at the end of October. The production plan for 2022 is mainly to deliver previous orders, and it is expected to produce 20,000 electric vehicles. The factory will gradually expand, with an investment of $700 million, and expand from a capacity of 34,000 vehicles to 53,000 vehicles in 2023, 90,000 vehicles in 2025, and more than 400,000 vehicles in 2028 in the third phase.

Lucid uses an 800V system, and the most important thing is to ensure the supply of SiC in the key supply chain.

In terms of the main drive,Lucid Motors continues to seek important cooperation with Wolfspeed after increasing its production volume. Wolfspeed and Lucid Motors have signed a multi-year agreement for Wolfspeed to produce and supply SiC devices. The Wolfspeed 1200V SiC XM3 half-bridge power module will be manufactured and supplied through the Wolfspeed Mohawk Valley Fab, located in New York State, which began production in April and is the world’s largest 200mm SiC manufacturing facility, increasing Wolfspeed’s power device production capacity. The Lucid Air inverter is equipped with a Wolfspeed XM3 SiC power module, which helps the Lucid motor (74kg, 500kW) achieve high efficiency and high power density.

(2) Lucid Motors chooses Rohm for on-board chargers and DCDC

Lucid uses Rohm’s silicon carbide semiconductor (SiC MOSFET) in the on-board charger for the Lucid Air. The central on-board charging unit, Wunderbox, integrates a DC-DC converter and bidirectional on-board charger, providing 19.2 KW of AC charging.

(3) Battery

Lucid uses 2170 batteries and has established supply relationships with Samsung SDI and LGES, with demand mainly in the United States. In the long term, it is expected that a lithium battery industry chain will be established in the Middle East, using funding from oil-rich countries and resources from Africa. Considering the hot climate in the Middle East, it seems reasonable to establish a dry battery industry in the future.

According to A2mac1’s disassembly, the first batch of Lucid vehicles, which use SDI cells, will deliver 118 kWh of long-range capacity.Summary: Similar to the way oil-producing countries play in the football market, their investments in electric and smart cars may become more practical and valuable for their industrial hedging. With the reduction of trade barriers, the concept of traditional automobile powers may choose to use capital as a link to create their own smart electric car enterprises through global division of labor, which is logically feasible.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.