Written by Zheng Wen

Edited by Zhou Changxian

In late April, Leapmotor announced at an online conference that it had become the first domestic automaker to mass-produce CTC technology, with its fourth model, C01, being the first mass-produced model to adopt CTC battery technology.

Since then, Leapmotor has officially entered the era of CTC technology after going through the 1.0 era of power battery technology standardization modules of the VDA and the 2.0 era of CTP large module.

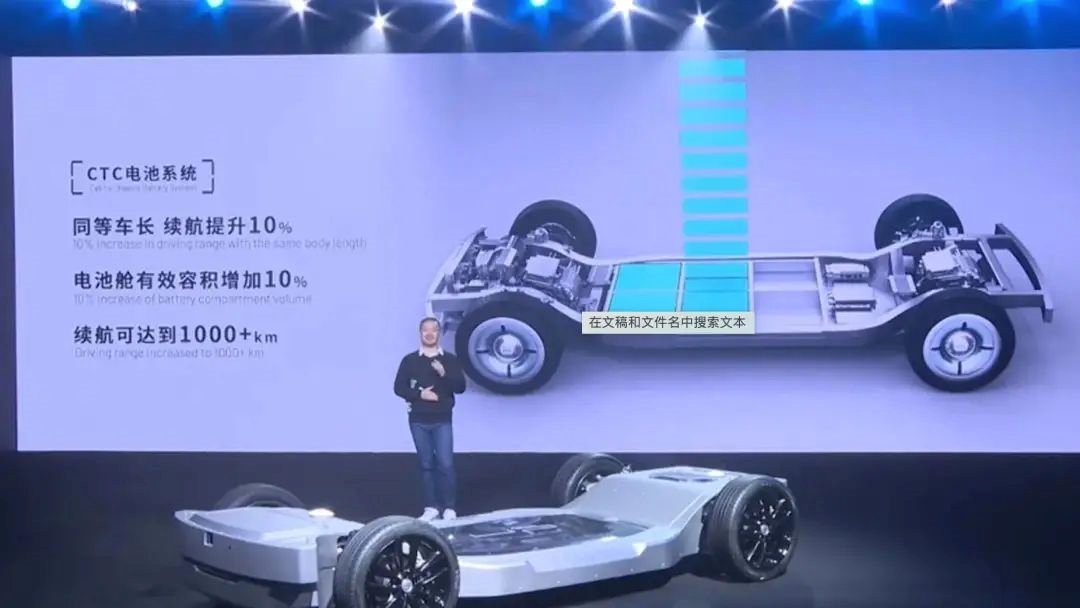

With the CTC solution, the battery layout space of Leapmotor C01 has increased by 14.5%, the vertical space of the vehicle has increased by 10mm, the comprehensive operating range has increased by 10%, the lightweight coefficient of the vehicle body has been improved by 20%, the number of parts has been reduced by 20% after simplifying the total assembly process, and the cost of structural parts has been reduced by 15%.

Chen IMa, Leapmotor’s director of vehicle body development, said, “By using the longitudinal and horizontal beams of the vehicle body to form a complete sealed structure, the battery tray skeleton structure and the vehicle body skeleton structure are integrated into one.”

Song Yineng, the general manager of Leapmotor’s battery product line, said, “It truly achieves a high degree of integration between the battery and the vehicle body, making the battery from the perspective of the vehicle and the vehicle from the perspective of the battery.”

So what is CTC battery technology?

CTC is a further expansion of the integrated power battery system, which directly integrates the battery into the chassis frame. Its goal is not only to rearrange the battery but also to incorporate it into the three-electric system and optimize power distribution and reduce energy consumption through intelligent powertrain controllers. CTC can minimize battery pack weight and space.

The innovation of the power battery system is mainly reflected in two aspects: battery materials and system structure. Battery materials have revolutionary innovations in the performance of the battery system, but as the pace of material innovation slows down, structural innovation has become the current key.

Initially, the industry hoped to achieve cost reduction through cell standardization and scale, but later found that the requirements of different automakers and different models under the same brand were different, and the desire to achieve uniform cell size was only a pipe dream.

Therefore, the goal of standardization has shifted to modules, and the feasibility has greatly increased, while the space utilization rate of the module is relatively low, and further CTP solutions have been continuously introduced to the market.

When Tesla launched the Model 3 in April 2016, it announced a new battery pack consisting of four large modules based on the 2170 cylindrical cell. Compared to its traditional solution, the number of modules was reduced to four, the number of parts was reduced by 10%, and the group cost was reduced from $185/kWh to $170/kWh.Its CTP technology’s landing application is three years ahead of the industry. In 2019, CATL launched the CTP high-integration power battery development platform. Compared with traditional battery packs, its volume utilization rate is increased by 15%-20%, its number of parts is reduced by 40%, and its production efficiency is increased by 50%.

BYD’s blade battery is also popular in the market. The shape of this type of battery cell is flatter and narrower, and is stacked like a blade inserted into a battery pack, which is also CTP technology. Compared with traditional batteries, the heat generated by the blade battery can be diffused in a timely manner because of its large heat dissipation area. Its volume utilization rate is increased by 50%.

Of course, many battery manufacturers have also launched their own CTP solutions, such as Guoxuan High-Tech and Honeycomb Energy.

At Battery Day in September 2020, in addition to introducing 4680 battery cells, Tesla also released a new CTC (Cell to Chassis) whole-package packaging technology, which cancels the Pack design and directly installs battery cells or modules on the vehicle body. The battery is not only an energy device, but also a structural device itself. CTC technology is officially moving towards the historical stage.

Musk once stated that by using CTC technology in combination with integrated die-casting technology, 370 parts can be saved, the weight of the vehicle can be reduced by 10%, and the battery cost per kilowatt-hour can be reduced by 7%.

Following Tesla, Volvo announced on February 8 this year that it will invest SEK 10 billion (approximately RMB 6.95 billion) to upgrade its Torslanda factory in Sweden, where a key component is the use of a giant die-casting machine with a locking force of 8,000 tons to produce the rear plate of automobiles. In addition, Volvo and Northvolt confirmed cooperation in battery cell production, and the newly built battery assembly plant will introduce the CTC process for battery packaging.

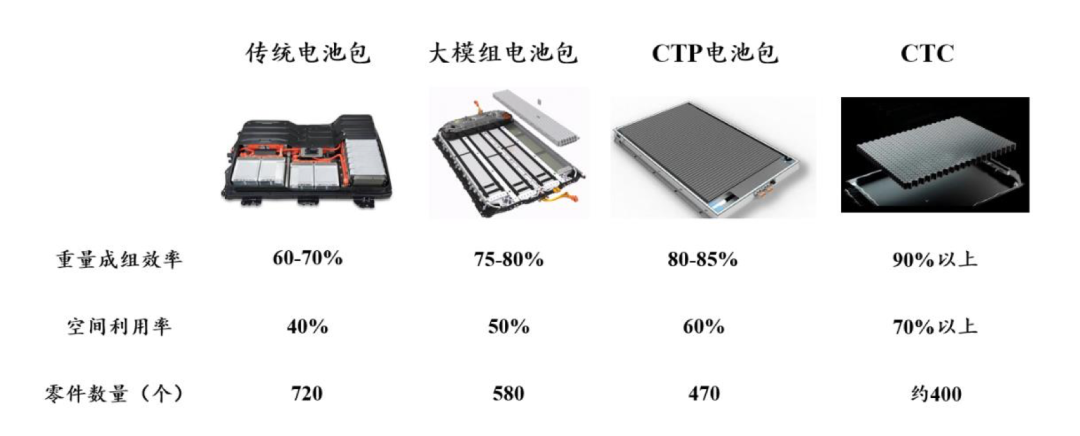

According to Guohai Securities, CTC will enable the assembly efficiency to reach over 90%, space utilization rate to exceed 70%, and the number of components to further decrease to about 400.

Based on the CTC schematic diagram released by Zerun from its press conference, combined with its own patent, its solution did not directly integrate the battery cell into the vehicle body structure, but kept the module, which is relatively easier to achieve.The integration solution of Leap Motor is to remove the cover on the battery pack, while the other parts remain basically unchanged. The most significant adjustment in this solution is the removal of the cover, which increases the requirements for thermal management. Strictly speaking, Leap Motor follows the MTC (Module to Chassis) route. Similar to LG’s previously announced CTC technology solution, Leap Motor retains the module.

However, even with Tesla’s long preparation, Leap Motor still managed to seize the leading edge of mass production.

This article will attempt to analyze three core issues in conjunction with the industry’s thinking at the node where Leap Motor announces mass production of CTC technology: will CTC technology bring the dominance of power battery back to the OEMs? Which is better between CTC technology and battery swapping? What is the relationship between CTC and skateboard chassis?

The dominance of power battery will return to OEMs?

In the development of power battery for a long time, the technical boundary between OEMs and battery suppliers has become increasingly clear, and automakers have gradually become differentiated.

With the development of power battery packs, OEMs have increasingly gained control.

In the more highly integrated CTP phase, the differentiation of OEMs has begun. Since different automakers’ models have not formed standardization at the battery pack level, CTP needs to be customized for different models.

At this time, weak technical OEMs will hand over the development of battery packs to the battery suppliers, directly transferring the development capability to the battery manufacturers. Strong technical OEMs will take this opportunity to build their technical capabilities in the field of batteries.

From CTP to CTC, OEMs’ dominance will further increase.

CTP to CTC is not just a simple structural simplification. CTP did not break through to the PACK and the technology did not extend downstream; battery companies can still independently complete development. The emergence of CTC involves the car chassis. The chassis is an important component that embodies the value of traditional vehicle manufacturers and accumulates the core advantages of long-term development.

Dominant automakers will take control of chassis development through self-developed CTC to firmly grasp the initiative. After all, CTC is not simply a collection of battery cells, but a fusion of the power domain of three electric systems.

If in the CTC technology stage, the core battlefield of the past dominated by OEMs is taken over by battery companies, it means that the core value of the entire vehicle manufacturer will be weakened, and both the dominance and profit space will be significantly reduced. Powerful battery manufacturers will take advantage of this opportunity to extend their capabilities to the chassis development field.

Therefore, the emergence of CTC technology not only reduces costs but also significantly increases the opportunity for OEMs to increase their dominance.The final result is that car companies with weak technical capabilities directly purchase battery packs, while those with relatively stronger technical capabilities will purchase battery modules, based on which they will lead the development of battery packs. Some car companies with even stronger technical capabilities purchase battery cells and consider the possibility of layout of battery cells in the vehicle structure in a more fundamental way.

Among these three levels of car companies, the third level of car companies obviously has completely taken the initiative in terms of battery technology.

Tesla Goes Left, NIO Goes Right, and CATL is Everywhere

Which is better between CTC and the “Battery Swap” model that takes another extreme?

From a commercial perspective, both solutions consider the feasibility of profit models. For example, under NIO’s multiple years of operation, an energy system that can be charged, swapped, and upgraded has gradually been established, and the entire energy circulation closed loop has been gradually completed. The Battery Swap mode has become the most efficient way in the energy replenishment system and is also an important part of the energy replenishment system.

In addition, the Battery Swap mode is not only about rapid energy replenishment, but also about the concept of “vehicle-electric separation”. The consumption cycle of cars is relatively long, while the development of battery technology is still quickly evolving. Vehicle-electric separation can adapt to the rapid development of battery technology, and theoretically, users can continuously obtain batteries with constantly improving technology and high health levels.

At the same time, the enterprise side manages the charging and discharging of batteries in a centralized way, which facilitates the establishment of an ecological gradient utilization mode of batteries. The heavy assets of energy storage can also maximize benefits. On the consumer side, consumers do not have to worry about the impact of batteries on the residual value of their vehicles.

Many people naturally compare it to the development path from removable batteries to integrated batteries in the mobile phone industry in the past. However, there are still some differences between the mobile phone industry and the automotive industry. Removable battery phones are inconvenient for phone quality control and the security of batteries. On the other hand, on automotive products, individuals have no ability to replace batteries.

The starting point of CTC technology is to maximize the reduction of production costs. Elon Musk has explicitly stated that in order to accelerate the transition to sustainable energy, it is necessary to produce more affordable electric vehicles, energy storage, and build more battery factories with less investment. Before the qualitative leap of battery raw materials, this goal undoubtedly requires a rethinking of the production and design mode of batteries.

Whether to go left or right, neither is an easy road. Can the battery specifications of the Battery Swap model adapt to the development of battery materials and performance? Is the establishment of heavy asset Battery Swap sites sustainable and can the industry development speed keep up?

CTC technology is obviously a high-threshold in terms of product definition and technical implementation, and the safety, heat dissipation, and other problems brought about by high integration will bring new challenges, which means it will test multiple capabilities in various fields. Consumers may also face the problem of high maintenance costs when using it.The power battery system has the “barrel effect”. The performance, reliability, and safety of the battery system depend on the least stable battery cell. This requires higher requirements for the integration level and thermal management design level of the car manufacturer’s battery system while ensuring cell consistency. In addition, under the CTC technical characteristics, the lack of protection for module and PACK structure can easily lead to thermal runaway of individual cells, causing the entire system to lose control.

On the other hand, the CTC technology also means that vehicle body design loses flexibility. For traditional car companies with large volume and numerous models, the platform for quickly developing new models is extremely important, and CTC technology is not friendly to them.

Sometimes there may not be a clear right or wrong in the business world. As long as a profitable model can be explored with a strategic path, there will be followers, and the paths chosen by both parties are based on their corporate values. Regarding this, CATL stated that only children make choices and adults do not.

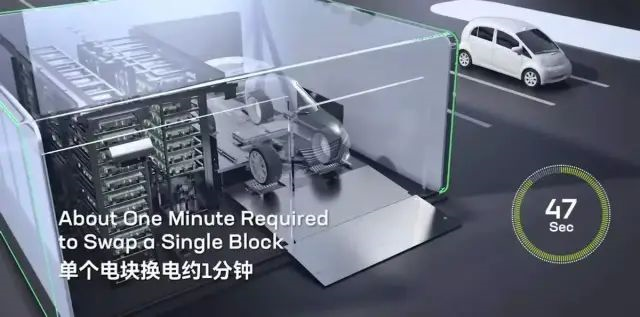

On January 18 this year, CATL officially released its new battery swap brand EVOGO and the overall battery swap solution. The battery specially developed for shared battery swap is called “Chocolate Battery Swap Block”. A single battery block can provide a range of about 200 kilometers and can be adapted to pure electric platforms that have been launched and will be launched in the next 3 years worldwide.

CATL has also laid out the CTC technology in advance and established a technology subsidiary in Shanghai for forward-looking technology research and development. The launch of the battery swap brand means that CATL will form a dual-wheel drive with CTC technology from now on.

CATL plans to achieve integrated CTC by 2025 and intelligent CTC by 2030. According to CATL Chairman Zeng Yuqun, CATL’s integrated CTC technology will not only re-layout batteries, but also incorporate power components such as motors, electronic controls, DC/DC, and OBC. Intelligent CTC technology will further optimize power allocation and reduce energy consumption through intelligent power domain controllers.

The “skateboard-style chassis” racetrack opened up

CTC guides the direction of battery-chassis integration, and a new racetrack has been opened up by developing skateboard-style chassis and exploring the integration of the chassis with the CTC solution, creating a competitive barrier.The sliding skateboard chassis platform promoted by Rivian, a new force in the American electric car industry, embeds four motors, an all-wheel drive system, and three battery packs into the chassis to decouple the upper and lower body and push for standardization.

Another start-up company, Canoo, also adopts sliding skateboard-style electric chassis, with a module structure that has not yet achieved complete cowl-to-cowl (CTC). It retains the longitudinal and transverse beam structure in PACK.

There are also domestic companies joining this race.

In December 2020, Konnypu, in Suzhou, held a press conference announcing a CTC-integrated electric chassis. The advantages of integration in this 2.8-meter wheelbase chassis are already apparent, with a 15% weight reduction and 20% cost reduction. This is a version 1.0 product plan, with versions 2.0 and 3.0 gradually realizing networked and intelligent integration.

Yorin, a startup, promotes the UP Super Chassis, making CTC battery systems an important component of the chassis.

In the future, more companies may join this race…

An obvious market space is for OEMs that emphasize self-driving and technology-driven travel services, with lightweight assets operated or developed by third parties who focus on chassis development. These companies provide core value through efficient technology travel service solutions.

Not only the start-ups revolving around the chassis participate in the competition to get a share of the pie; battery companies that gradually build chassis development competitiveness by acquisition or holding, might become powerful competitors.

At the end of the press conference, the Chairman of Leapmotor, Zhu Jiangming recalled the initial idea of integrated power battery in 2016. After six long years of difficult research and development, Leapmotor has achieved mass production of CTC technology, but Leapmotor does not intend to create any barriers with it. New technology should not be a barrier.

“As a single person can travel faster, a group can travel farther,” Zhu Jiangming announced, “Leapmotor will open and share CTC technology for free.”

If Ford’s assembly line changed the production process from a manual workshop to a fast, efficient, and cost-effective one, Toyota’s lean production catered to the demands of a diversified market, further increasing production efficiency, and Volkswagen’s platform development pushed the parts universality to a new high.

Can CTC technology bring about a new round of production manufacturing revolution in the electric vehicle industry?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.