Author: Feng Jingang

On April 18th, EVOGO, a subsidiary of Contemporary Amperex Technology (CATL), launched its first battery swapping station in Xiamen. EVOGO, similar to NIO's affiliated battery swapping brand NIO Power, is a battery swapping brand released by CATL's subsidiary Times EV Service in January this year.

With the strong entry of CATL, the wind of the battery swapping market has once again risen, which is more intense than ever before.

## In fact, battery swapping has a history of over 100 years.

Nowadays, when many people talk about electric vehicle battery swapping, they will mention Better Place in Israel and regard it as the pioneer of battery swapping. However, this statement is not correct. In fact, the history of battery swapping dates back to 126 years ago.

In 1881, French electrical engineer and inventor Gustave Trouvé integrated a small electric motor, lead-acid battery, and frame to create the world's first electric car.

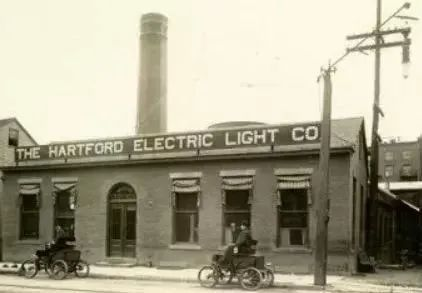

In 1896, the Hartford Electric Light Company (HELCO), located in Hartford, Connecticut, USA, proposed the battery swapping model of "car-electricity separation" to solve the problem of slow charging of electric vehicles.

In 1917, Milburn Wagon, a car company in Chicago, also provided battery swapping services to car owners, allowing them to purchase cars without batteries.

This brings us to an insight: will car companies providing only the whole car except for the battery be a future development trend?

At that time, as cities became larger and highways longer, the drawback of short range of electric vehicles was further amplified due to high prices and other factors, causing people to be more dissatisfied with electric vehicles.

In 1912, the revolutionary Ford Model T was launched. Due to the assembly line production mode, the selling price of Model T was only $650, compared with the selling price of electric vehicles of the same type at $1750.

The improved experience of using gasoline-powered cars and the reduced cost directly killed off electric cars, as well as indirectly killed off battery swapping.

Subsequently, although electric vehicles have never been forgotten by car companies, they have only been promoted as research projects, including BMW's 1602 Elektro-Antrieb in the 1970s, and General Motors' EV1 in the 1990s.

Thanks to the increasing demand for environmentally friendly cars in the world and the historical breakthrough of lithium battery technology in the 1990s, electric cars have been reborn in the 21st century while gasoline cars are gradually being abandoned.

Along with the rebirth of electric cars, battery swapping has also been called out. This time, China is on par with the world, and even takes the lead.

In 2000, Aotong took the lead in exploring the battery-swapping mode for electric cars. In 2003, Better Place from Israel joined the battlefield, but due to poor management, Better Place declared bankruptcy in 2013.

Although Aotong tried to implement battery swapping earlier, their reputation is much lower than that of Better Place.

And then there’s NIO. At the first NIO Day in 2017, NIO released its first mass-produced vehicle, the ES8, which was equipped with battery swapping technology.

While Aotong and NIO are thriving in the field of battery swapping, most other companies are indifferent to this technology.

Especially Tesla, after the failure of battery swapping, began to strongly oppose it. But is Tesla right?

Until the Two Sessions in 2020, battery swapping stations were classified as an important part of China’s new infrastructure and were first written into the “Government Work Report”.

Since then, battery swapping has become a must-do rather than a right-or-wrong question.

In the past two years, battery swapping has been a lively topic in the industry. In 2020, the number of registered battery swapping companies reached as high as 17,000, a year-on-year increase of 348.7%; in 2021, there were over 45,000 new companies, a year-on-year increase of 147%.

As of 2021, there were more than 81,000 battery swapping-related companies in China, including heavyweight players like Sinopec.

On January 18, 2021, CATL established Tianneng EV Service and launched the EVOGO battery swapping service, officially entering the battery swapping market. CATL was the only player that entered the battery swapping market as a battery manufacturer.

Some organizations predict that by 2025, battery swapping vehicles will account for 30% of the market, with a demand for about 28,000 battery swapping stations and a market size of about 300 billion yuan for the whole industry chain.

In the development process of the century-old electric vehicle industry, charging and battery swapping are not mutually exclusive, but coexist.

The storage characteristics of batteries determine that both charging and battery swapping are necessary, and flexible configuration is dependent on their respective usage scenarios.

What are the advantages of battery swapping?

Battery swapping, which was discovered a century ago and then revived, has its unique value.First, safety. Currently, the largest fire incidents for electric cars occur before and after charging, accounting for about 40%. However, there have been few cases of spontaneous combustion with NIO and ORA’s battery swapping, and even when batteries become uncontrollably hot, early intervention prevents serious consequences.

Second, high efficiency. Charging is a chemical reaction, while swapping is a mechanical action, which generally takes only a few minutes, providing a fueling experience similar to that of refueling at gas stations. For B-side markets such as taxis, battery swapping provides an excellent user experience, as the poor charging experience and low efficiency are rather unsatisfactory.

Yang Ye, the co-founder and senior vice president of ORA Energy, revealed that taxi and ride-hailing customers need to swap batteries 1-2 times a day, saving each swap 1-2 hours and an extra 2,000 yuan ($308) per month.

Third, reducing the cost of purchasing a car. Currently, the battery accounts for the highest cost in electric vehicles, but by using battery swapping, the cost of purchasing the car can be directly reduced, and electric cars can challenge gasoline cars with more confidence, eventually achieving parity.

Fourth, no need to worry about battery degradation. Batteries are chemicals with a certain degree of wear and tear, and most battery warranties last only 8 years. Once the warranty period passes, users are responsible for high maintenance or replacement costs. However, with swapping, there is no need to worry about this issue.

Fifth, battery swapping facilitates the centralized management of batteries. This is why the government has begun promoting battery swapping. When electric vehicles are scaled up, effective management of the battery is necessary, including integrating the power battery into the entire energy network for management and recycling upstream battery materials, among others.

Sixth, battery swapping is a key part of the new four modernizations of automobiles. Under the leadership of the new four modernizations, electric cars will only become more intelligent and environmentally friendly. For example, the growing popularity of RoboTaxi. As the central hub for energy conversion in electric cars, battery swapping stations will play a critical role.

Shigeki Miwa, CEO of SB Energy, stated that commercial battery swapping operations are critical for promoting the networking, automation, sharing, and electrification of the automotive industry from the perspective of sustainable development, and making contributions to the future development prospects of the electric vehicle market.

Regardless of whether it is from the user’s perspective or from the macro strategic management of the country, battery swapping is an important part of the electric vehicle industry.

Of course, we must also admit that there are still many problems to be solved with battery swapping such as different battery specifications across different brands and fewer battery swapping models, among others. However, all these issues will gradually be resolved as more industry giants join the market.

Who is more suitable for battery swapping?From what was seen a century ago, the exchange of batteries was done by third-party companies such as HELCO, while car manufacturers only provided the entire vehicle except for the battery. In 1917, MilburnWagon also began to provide this service.

Entering the 21st century, in addition to third-party battery swap service providers such as Auton, Better Place, there are also vehicle manufacturers such as NIO, and battery manufacturers who have just announced their entry into the battery swap market— CATL.

Currently, third-party battery swap operations have more data and stories, although they have gained a lot of support, the overall progress is not easy.

Between 1910 and 1924, HELCO’s battery swap service provided more than 9.66 million kilometers of total driving range.

Assuming that at that time, the driving range of a car was 100 kilometers (a conservative assumption, the actual driving range may not be so long), then HELCO’s cumulative battery swaps reached 96,600 times.

By comparison, as of the end of last year, Auton’s cumulative battery swaps reached 20 million times.

As for the meteoric Better Place, although it has disappeared, its mismanagement is considered to be the root cause of its failure.

One insider once evaluated Better Place’s founder and CEO Shai Agassi, “He stubbornly believed that people would change to electric cars because of their huge enthusiasm for the environment. He was like being in love with his own vision and was not good at management.”

It is reported that Better Place only really started selling and commercializing the concept in Israel and Denmark. However, in order to promote it, Better Place also invested in a series of demonstration projects in Yokohama and Tokyo, the San Francisco Bay Area in the United States, and Dutch airports, including charging and battery swap networks and sponsored electric taxis.

Better Place’s shareholders believe that these globally spread demonstration projects, besides looking lively and prosperous, cannot bring substantial benefits.

As for Auton, although it currently has the highest number of cumulative battery swaps, its lead is not large, and the number of cumulative battery swap stations has been surpassed by NIO, the later investor. Auton has been staggering for more than 20 years and its corporate growth is uncertain.

The reason why third-party battery swap operations are difficult to scale and strengthen has a core element, and that is that it is difficult to gain the trust of car manufacturers.

Situli Xin, senior manager of the Hong Kong Productivity Council’s Automotive Parts Research and Development Centre, said when analyzing Better Place, “The battery needs to be separated from the car, and the battery is the most expensive part of an electric car. Handing over such an important part to a third party has a great impact on the car’s price, and automakers do not want to share such a large responsibility with others.”From promoting battery swapping to the collapse of Better Place in 2013, for six years, the only vehicle model from Better Place was the Renault Fluence ZE, and no other automakers were willing to join the battery swapping camp of Better Place.

The original equipment manufacturers have their own ideas. As for making the battery swapping, the advantage is that they can control the battery and ensure the service, but the disadvantage is that the cost is too high, even causing business pressure.

According to reports, NIO’s cost of building a battery swapping station is about 2 million yuan, and NIO has now built 900 swapping stations. In this way, NIO’s construction cost of swapping stations has reached as high as 1.8 billion yuan.

In 2019, if it were not for the rescue of Xuezhusongtan in Hefei, NIO might have already vanished. Fortunately, NIO finally made it through.

As of April this year, NIO’s cumulative number of battery swaps has reached 8 million times, and NIO’s battery swapping stations have reached 900, ranking first in the world. The number of stations in China will reach 1,300 this year.

Battery swapping has become an important support point for NIO’s foothold in the high-end new energy market, as well as its confidence in challenging the traditional high-end electric vehicle brands of BMW, Benz, and Audi.

However, does the success of NIO’s battery swapping mean that other car companies can also do battery swapping?

I think that the reason why NIO was able to overcome the difficulties of battery swapping is inseparable from its high-end brand positioning. Only high-value-added services can support the huge infrastructure and cost of battery swapping, which is somewhat unique.

As for other non-luxury brands, their core competence lies in product definition, facing users, competing with other brands, rather than building stations and providing services.

Finally, it is unprecedented for a battery maker like CATL to do battery swapping, but it is perhaps the most reasonable arrangement.

The core of battery swapping is the battery, and the biggest cost is also the battery. So who has the battery? Of course, it is the battery maker. From this logical chain, it is natural for the battery maker to do battery swapping, and it is responsible for battery property, safety, and loss.

As the world’s number one power battery maker for five consecutive years, with over half of the market share in China, it is understandable for CATL to take on the heavy responsibility of battery swapping.

For original equipment manufacturers, whether it is charging or swapping batteries, the batteries are all from CATL, there is not much difference.

If a battery swapping solution from CATL is adopted, the product strength of the original equipment manufacturers will not only be improved rapidly, but they will also surpass other charging models, and even be able to directly compete with traditional gasoline vehicles.

In addition, original equipment manufacturers who give up on batteries can invest more in product definition, marketing, and software development, moving their enterprise form closer to technology companies like Apple and Xiaomi, and be in an advantageous position in facing the future.As a result of their innate cognition, OEMs find it difficult to relinquish control of the battery. Now, OEMs find themselves in a contradictory position-unable to manage the battery, yet hesitant to relinquish control of it-due to concerns regarding the high cost of battery replacement.

Change takes time.

Ningde era is a leading battery company that was established in Fuding, Fujian Province in 2011, after ATL. Within just six years, in 2017, Ningde era triumphed globally, becoming the world’s primary brand of power batteries.

It is not an exaggeration to describe Ningde era as one of the greatest new energy brands of the last decade. Every move made by this giant is watched closely by the industry.

Ningde era has been laying the groundwork for battery swapping for years. Why did they choose to enter the battery swapping market at this time? Chen Weifeng, the head of Time Electric Vehicle Services, seems to have hinted at the answer.

During the EVOGO conference, Chen Weifeng stated that the global new energy vehicle market has entered a new stage of explosive growth this year, with a sharp increase in demand for power batteries and a significant increase in raw material prices. Compared with that, the cost reduction brought about by economies of scale and technological improvements is nominal.

Indeed, since last year, when “Dian Dong Shi” (Electric Shock) began reporting on the price increases of new energy vehicles, many electric vehicle manufacturers have experienced several rounds of price increases, with the highest increase reaching over 30,000 yuan.

This price increase may provide short-term support for automakers to win orders, but in the long run, it further undermines the competitiveness of new energy vehicles compared to petrol-powered vehicles.

In addition, with no consensus reached on subsidy declines and purchase tax, the cost of buying an electric vehicle is expected to increase by at least 10,000 to 20,000 yuan next year compared to this year.

With subsidies declining while raw material costs continue to rise, power batteries and new energy car companies face multiple pressures, sounding the alarm for the sustainable development of the new energy vehicle industry.

Based on the current situation in the industry, employing battery swapping can exclude the cost of batteries from the entire vehicle. It is undoubtedly a great solution for the industry to move forward.

As Ningde era enters the battery swapping arena, it undoubtedly strengthens the battery swapping camp. With Ningde era’s appeal to the new energy and battery markets, the new energy vehicle market has already sounded the battery swapping call.

On January 18, Ningde era released EVOGO “Little Green Circle Family” Member No. 001, FAW-Bestune NAT Combination Battery Swap Edition. Ningde era also stated that more brand swapping models will be released.

On April 27, Ningde era’s battery swapping brand scored another win when Ai Chi Auto, a new force in vehicle manufacturing, announced its participation in the EVOGO battery swapping array.

Ningde era said that it will release more brand and models that will join EVOGO.

Guess who’s next?

#

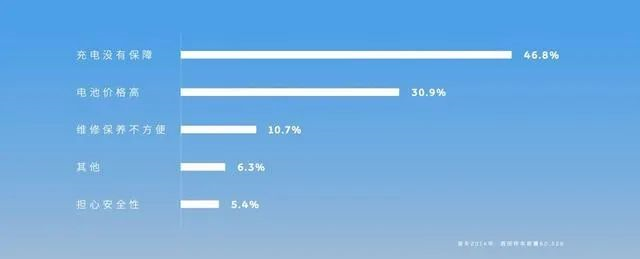

Battery swapping is undoubtedly a trend, but the pace of development depends on whether it can meet the real needs of consumers. So, what are the real needs of consumers?

Under some articles about new energy products in “Electric Power”, there are always arguments like “I’ll buy it if the car has a range of over 1,000 kilometers”. However, if we look at the current car models with over 1,000 kilometers of range, such as the GAC Aion LX, only 406 units were insured from January to March this year, which can be described as dismal.

The direct reason why the GAC Aion LX is not selling well is that its price is too high, ranging from 2.866 to 4.996 million yuan after subsidies, which makes consumers hesitate to buy it.

On the contrary, the best-selling pure electric car models on the market, such as the Tesla Model 3 with a range of 556 kilometers and the Wuling Hongguang MINI EV with a range of 120 kilometers, sell over ten thousand units per month.

In the view of Chen Weifeng, most private car owners only use 10-20% of the battery capacity in daily use scenarios, but they choose to buy cars with larger battery capacity to relieve range anxiety and meet occasional long-distance travel needs. Consumers pay a lot of sunk costs for the battery capacity that they rarely use.

Based on such demand considerations, Times Electric Group has launched the “combination battery swapping solution”, which consists of three major products: “swappable battery blocks, fast swapping stations, and an app”.

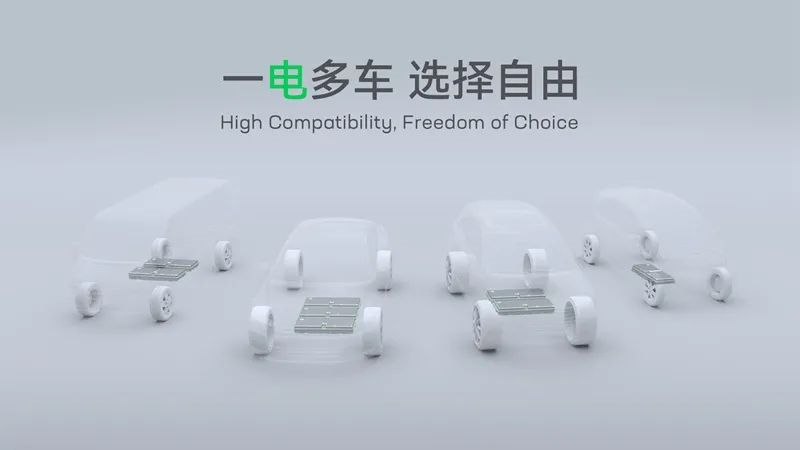

As for the swappable battery blocks, they are developed by CATL specifically for “shared battery swapping” and have three major advantages:

Firstly, small and high-energy: using CATL’s latest CTP technology, the weight energy density is over 160Wh/kg and the volume energy density is over 325Wh/L. One battery block has a capacity of 26.5kWh, which can provide a range of about 200 kilometers and is compatible with most pure electric model platforms.

The adaptability of a battery swapping platform and its ability to be compatible with more car models is an important indicator. The adaptability of CATL’s battery swapping blocks is not limited to a specific brand, but most pure electric platforms. This means that car companies focusing on pure electric platforms can directly access CATL’s battery swapping platform without too much modification cost.

Secondly, free combinations: users can choose one, two, or three battery blocks to flexibly match different range (200 kilometers, 400 kilometers, 600 kilometers) needs.

In urban and town commuting scenes, one or two batteries can be used, with a range of 200/400 kilometers, which is sufficient for daily commuting. You can either change the battery when it runs out or charge it at home. For long-distance travel, two or three batteries can be used, with a range of 400/600 kilometers. Plan ahead for the route of battery swapping stations, or use the charging method even if there is no battery swapping station available.

In urban and town commuting scenes, one or two batteries can be used, with a range of 200/400 kilometers, which is sufficient for daily commuting. You can either change the battery when it runs out or charge it at home. For long-distance travel, two or three batteries can be used, with a range of 400/600 kilometers. Plan ahead for the route of battery swapping stations, or use the charging method even if there is no battery swapping station available.

Because the battery swapping block looks like chocolate, it is also called the “chocolate battery”.

Third, minimalist design: Wireless BMS technology is used for the first time, and the battery swapping block only has a high-voltage positive and negative interface on the outside, which greatly improves the reliability of plug-in components.

Regarding the fast swapping station, its characteristics are small footprint, fast circulation, large capacity, and all-weather. A standard station only requires three parking spaces and it takes about 1 minute to swap a single battery. The station can store 48 battery swapping blocks (up to 48 cars can be swapped at the same time, and at least 16 cars can be swapped at the same time).

CATL stated that it will ensure that users always have fully charged battery swapping blocks that can be replaced without long waits for battery charging. In addition, different versions of battery swapping stations can be adapted to different regional climate environments.

Regarding the APP, it provides interconnections and services for people, cars, stations, and battery swapping blocks, enabling users to understand vehicle conditions, search for battery swapping stations, etc. I downloaded the APP to learn more, but it seems that a vehicle nameplate number is required to log in, so is this software specially designed for users?

In terms of cooperation mode, CATL has launched the Urban Partner Program. CATL’s subsidiary, CATL Electric Service, cooperates with partners in a comprehensive win-win cooperation in technology, resources, services, etc., to jointly promote the construction of battery swapping networks and the promotion of “Green Cycle” electric vehicles.

As a newcomer in the battery swapping field, CATL’s battery swapping solution is quite comprehensive, with the universality of pure electric platforms, the combination of three battery blocks, and even some surprises.

#

CATL stated that in the future, EVOGO will choose to launch battery swapping services in ten cities, the first being Xiamen.

On April 18th, EVOGO battery swapping services were officially launched in Xiamen, making Xiamen the first “Green Cycle City”.

In Xiamen, CATL has launched 4 fast swapping stations, distributed in Siming District, Huli District, and Haicang District. It is expected that 30 fast swapping stations will be completed by the end of the year. By then, there will be one fast swapping station within a service radius of 3 kilometers on Xiamen Island.

This time, CATL also announced the monthly rental price of the chocolate battery swapping block, with a minimum discount price of 399 yuan per block, and the unit price is between the NIO 75-degree and 100-degree battery packs, but it can be rented separately. In this way, the monthly rent can be much lower, suitable for commuting users.It should be noted that the rental prices for chocolate exchangeable battery blocks can be dynamically adjusted according to users’ different usage conditions, which differs from the fixed prices of NIO’s exchangeable battery blocks.

It is worth noting that the above prices are only for renting the batteries and do not include the cost of exchanging them (where the electricity fees are paid according to the difference in electricity capacity between the old and new batteries). This cost is similar to our usual fast charging prices and is dynamically adjusted based on factors such as station location and time period.

Compared with NIO’s exchangeable battery plan, CATL’s plan is generally more flexible and affordable in terms of both its scheme and price. Moreover, compared with NIO’s closed-loop operation, CATL’s exchangeable battery mode is more open, which means that it can reach more people and have a larger scale.

Through this battery exchange program, CATL has been able to establish a connection with C-end users, and is no longer just a power battery supplier, but also a 2C-end brand.

Of course, what distinguishes CATL from other 2C enterprises is that it only sells battery exchange services, not whole cars, so strictly speaking, they are not competitors.

With this layer of benefit segregation, it means that CATL’s promotion of battery exchange will not face significant obstacles, and its expansion speed may exceed everyone’s expectations.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.