Author | Wang Lingfang

Editor | Qiu Kaijun

Entering into 2022, as the vane of the new energy sector, CATL (Contemporary Amperex Technology), is currently stuck in a downward spiral, with its market value recently falling below one trillion yuan, in stark contrast to its stock price trajectory in 2022.

However, CATL did perform well in 2021, with an annual operating income exceeding 130 billion yuan, sales revenue doubling, and a comprehensive gross profit margin of 26.28%.

Nevertheless, CATL does face the growing pains of its expansion. With nearly one-third of the global market and almost half of the Chinese market share, what else can CATL do?

According to their 2021 annual report, CATL is still actively seeking new growth opportunities:

- CATL aims high by expanding into the upstream battery material business, with a growth of over 300%.

- CATL expands horizontally by significantly entering into the energy storage battery business, similar to the power battery, with revenue growth of 600%.

- CATL goes deeper by consolidating its position through further technological research and development (R&D), binding with auto manufacturers, perfecting its supply chain, and so on.

- CATL also crosses boundaries and enters other fields such as battery swapping, autonomous driving, and chassis R&D to explore its second growth curve and to seek new territory.

Core Data Remains Robust

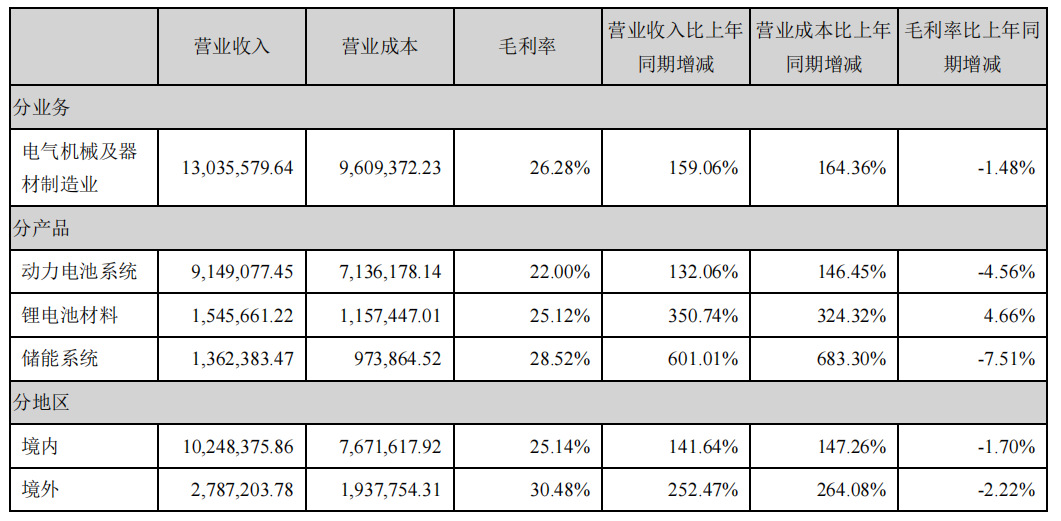

CATL mainly has three major product categories: power battery, lithium battery materials, and energy storage systems, with revenue ratios of 70.19%, 11.85% and 10.45%, respectively.

Revenue-wise, CATL has surpassed the ¥100 billion mark, and its comprehensive gross profit margin remained high at 26.28%. The gross profit margin of power battery systems reached 22%, while that of lithium battery materials and energy storage systems were higher, reaching 25.12% and 28.52%, respectively.

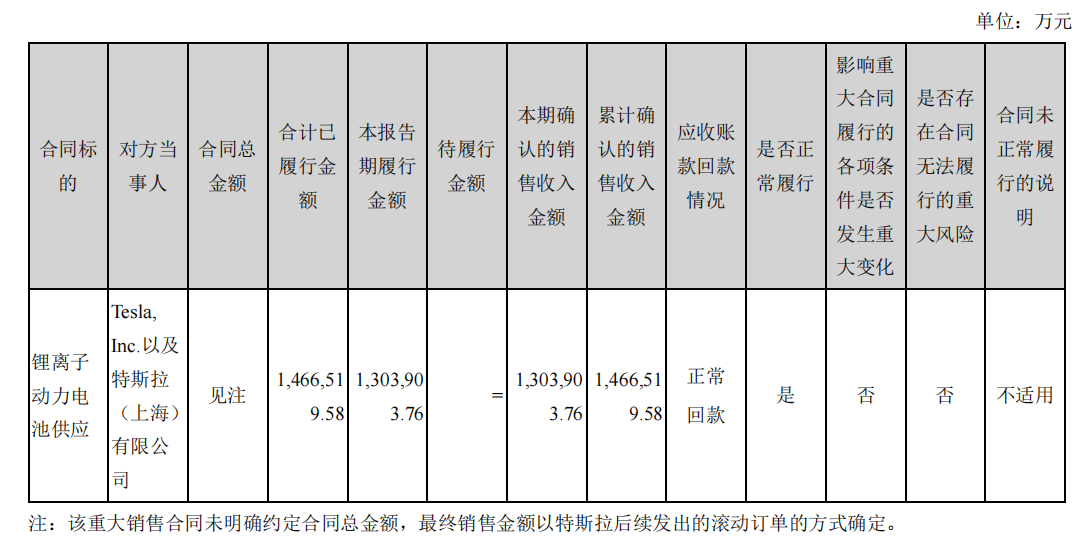

In terms of customers, CATL’s advantage is outstanding. In 2021, CATL’s largest customer was Tesla, with a share of 10%, exceeding RMB 13 billion. This was the first time such a major sale contract was disclosed.

According to the framework agreement signed by both parties in 2021, their cooperation will continue until 2025, and orders for the next three years will be secured.

## NINGDE TIMES: Leading the Global Automotive Industry

## NINGDE TIMES: Leading the Global Automotive Industry

In terms of other clients, Ningde Times covers all major global customers, including Tesla, Hyundai, Ford, Daimler, Great Wall Motors, Ideal, and NIO. Ningde City has also entered the downstream automotive sector through investments and shareholdings, such as investing in and holding shares in car brands such as Avatar, JiKe, and NETA, further consolidating the relationship between both parties.

Ningde Times’ industry position remains solid. According to SNE Research, the company ranked first globally in terms of power battery usage for five consecutive years from 2017 to 2021. In 2021, Ningde Times’ market share of power battery usage was 32.6%. According to data from the China Automotive Power Battery Industry Innovation Alliance, Ningde Times ranked first in terms of installation in China in 2021, accounting for 52.1% of the installed car batteries.

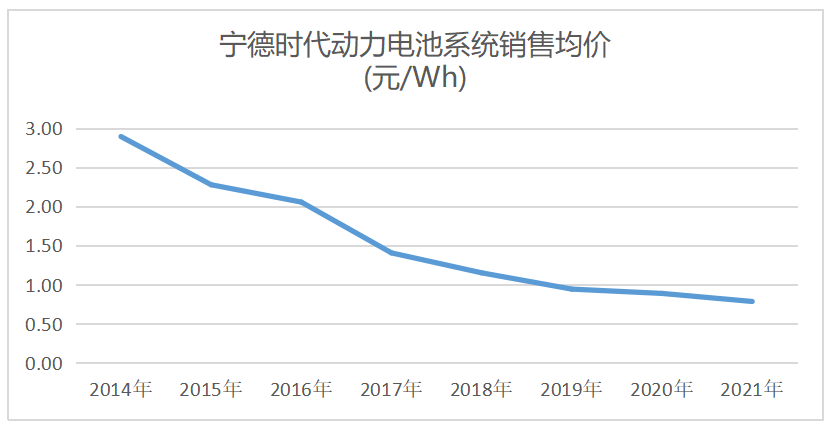

Moreover, it is worth noting that the decrease in battery sales prices is slowing down. Since 2019, the decline in the sales price of Ningde Times’ power battery system has begun to slow down. However, in 2021, there is still a relatively significant decrease, and at the same time, the production capacity of Ningde Times has greatly increased.

Therefore, it can be inferred that the cost reduction of raw materials has reached the critical point, and scale cost reduction will become the main direction in the future.

Energy storage is a horizontal business parallel to power batteries. In 2021, Ningde Times’ revenue from energy storage business reached 13.6 billion yuan, a year-on-year growth of an astonishing 601%. At the same time, the gross profit margin of energy storage systems has decreased significantly.

In terms of operating income, Ningde Times’ energy storage business entered a explosive growth phase in 2021.

In terms of clients, Ningde Times has signed strategic cooperation agreements with State Grid Corporation of China, China Energy Engineering Group, China Huadian, China Three Gorges Group, Sungrow Power Supply, Ates, Eaton, and other enterprises.

In terms of the domestic market, Ningde Times is participating in exploring various commercial models for energy storage across the country, helping Shandong’s GWh-level shared energy storage project to land.

In terms of overseas markets, Ningde Times’ products are exported to 35 countries and regions worldwide, covering various fields such as new energy generation, peak regulation and frequency regulation independent power station, and green mining.

In recent years, Ningde Times’ progress in energy storage products has been remarkable, achieving high growth annually, and this year it has entered the threshold of tens of billions of yuan in revenue.

Sticking to Innovation

As a company that holds more than half of the Chinese market share and nearly one-third of the global market share, it is becoming increasingly difficult for Ningde Times to continue making breakthroughs in market share.For the future development, CATL focuses more on maintaining market share and creating a second growth curve.

To maintain market share, CATL needs to develop in-depth – tapping potential, further improving technology and R&D, keeping pace with industry development in terms of capacity, and addressing potential supply chain security risks.

(1)Introducing innovative products

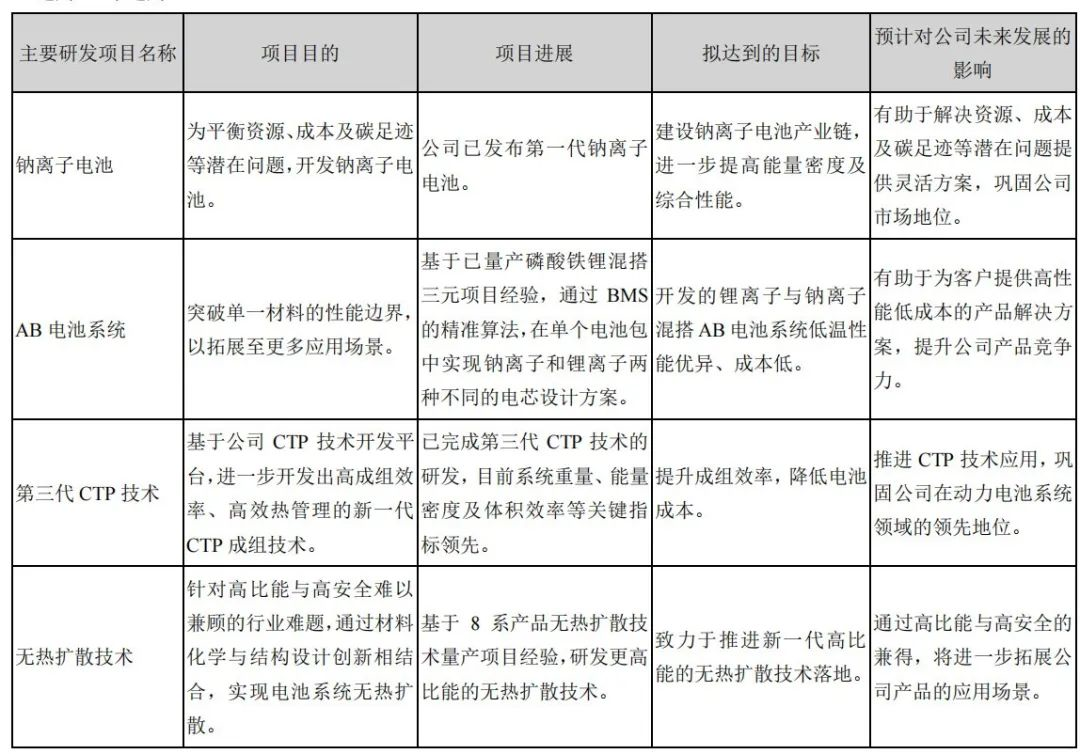

In terms of technology reserves, in 2021, CATL took the lead in introducing sodium-ion batteries, explored and promoted the CTC and A/B cell mixing configuration, and continued to promote the industrialization of new technologies.

Specific project progress is shown in the table below:

In terms of energy storage technology, CATL has overcome the technical challenges of 12,000 super-long cycle life and high safety energy storage dedicated batteries, mastered system integration technologies such as unified control of large-scale energy storage power stations and battery energy management.

In 2021, CATL’s outdoor liquid-cooled EnerOne product, which was promoted in the early stage, has been mass-produced. Based on long-life cell technology and liquid-cooled CTP battery box technology, CATL has launched the outdoor prefabricated cabin system EnerC, which has obvious advantages in safety, energy density of floor space projection, charge and discharge efficiency, and long-term reliability, and first realized project promotion and landing overseas.

In addition, CATL has also realized technology transfer. CATL has signed a cross-technology license agreement with ATL and a CTP technology license and cooperation agreement with Modern Mobility, realizing technology output and corresponding economic value through business cooperation and license authorization.

(2) Intensifying industry-university-research cooperation to grasp the industry’s cutting-edge trends

CATL attaches greater importance to cooperation with research institutions and has established deep cooperation relationships with well-known domestic and foreign enterprises, universities, and research institutes. For example, CATL has established the Future Energy Research Institute with Shanghai Jiao Tong University and co-founded the Xiamen Times New Energy Research Institute with Xiamen University.

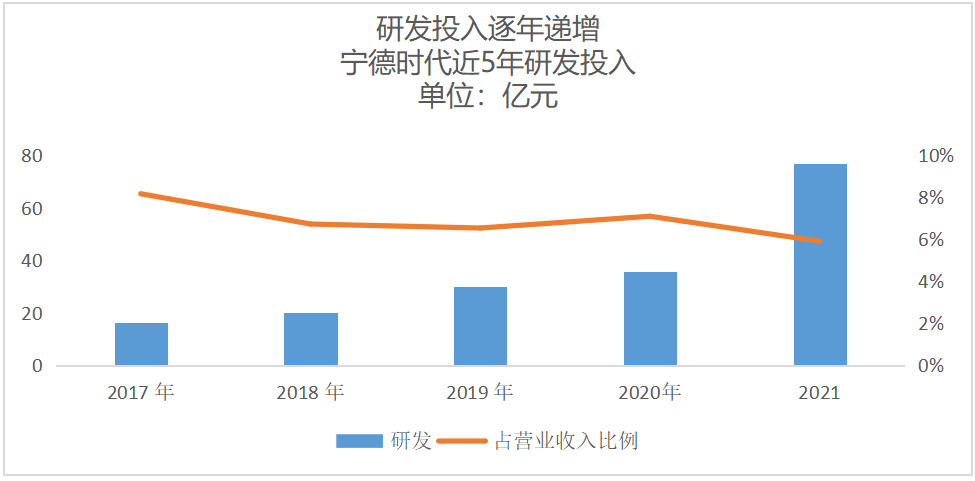

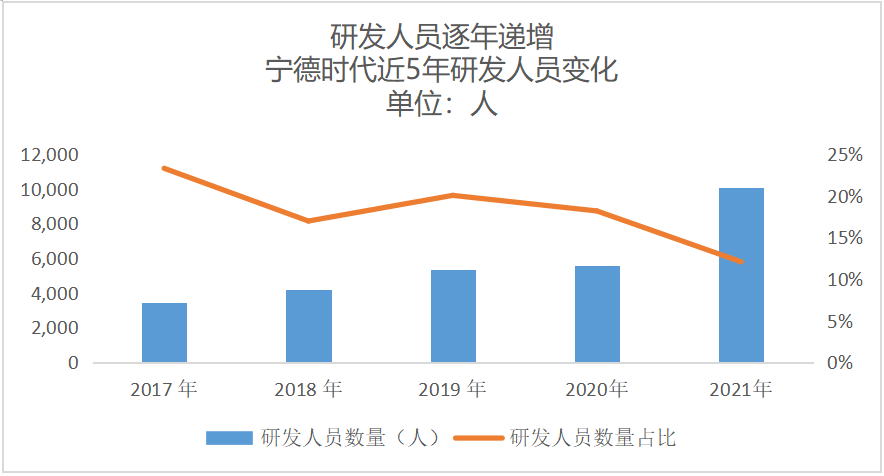

In terms of R&D capabilities, in 2021, CATL invested 7.691 billion yuan in research and development, accounting for 5.9% of revenue. Although the proportion of investment has decreased compared to previous years, the absolute amount has increased significantly, with a year-on-year growth of 115.5%.

The number of R&D personnel continues to grow. As of December 31, 2021, CATL had 10,079 R&D technical personnel, including 170 with a doctoral degree and 2,086 with a master’s degree. The overall scale and strength of the R&D team is leading the industry.

As of December 31, 2021, CATL has a total of 3,772 domestic patents and 673 foreign patents, and is in the process of applying for a total of 5,777 domestic and foreign patents. CATL’s innovative team for the development and application of new lithium batteries has undertaken the national key R&D project “Development and Application of 100 MWh-scale New Lithium Battery Energy Storage Technology”.

Thanks to high investment in R&D, CATL has established a powerful technological reserve and intellectual property defense system.

(3) Actively constructing production capacity to respond to high industry growth

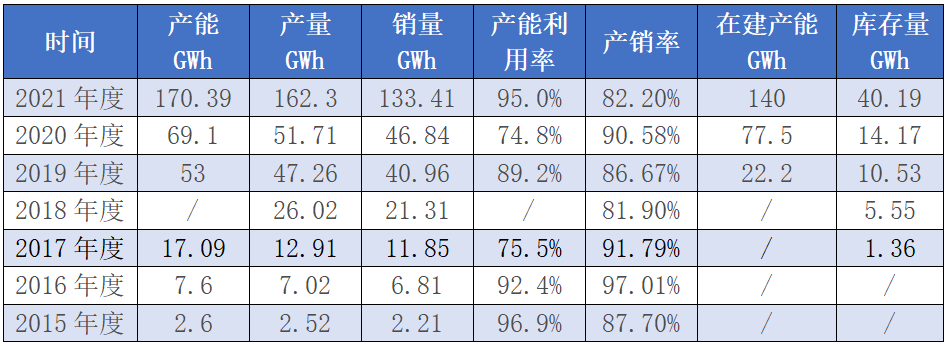

Due to the rapid construction of production capacity in the early stage, CATL’s production capacity doubled in 2021, reaching 170 GWh, and its production and sales volumes also reached new highs of 162.3 GWh and 133.41 GWh, respectively.

From the data, CATL’s production capacity utilization rate reached 95%, basically reaching full capacity. Even so, CATL’s under-construction production capacity was still as high as 140 GWh in 2021.

Of course, with the increase in production capacity, inventory levels have also increased significantly.

Production and sales of CATL power batteries in previous years

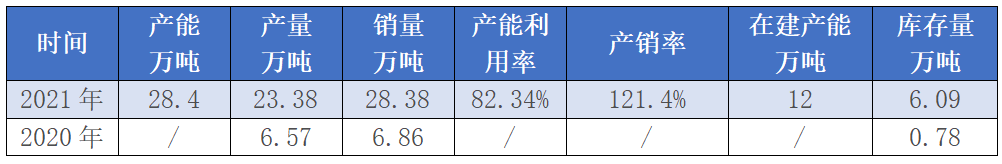

In addition to the production capacity layout at the power battery system level, CATL is also accelerating the promotion of lithium battery materials, and disclosed production capacity, production volume, and other related information for the first time.

In 2021, CATL’s positive electrode material production capacity reached 284,000 tons, with a production volume of 233,800 tons, and construction of production capacity reached 120,000 tons.

Production and sales of CATL positive electrode materials

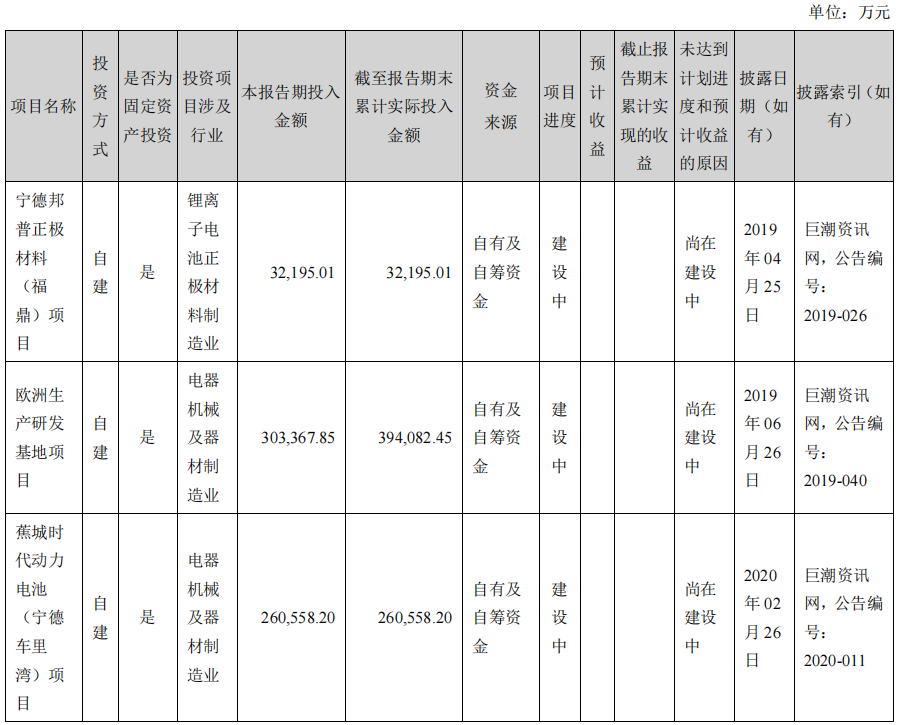

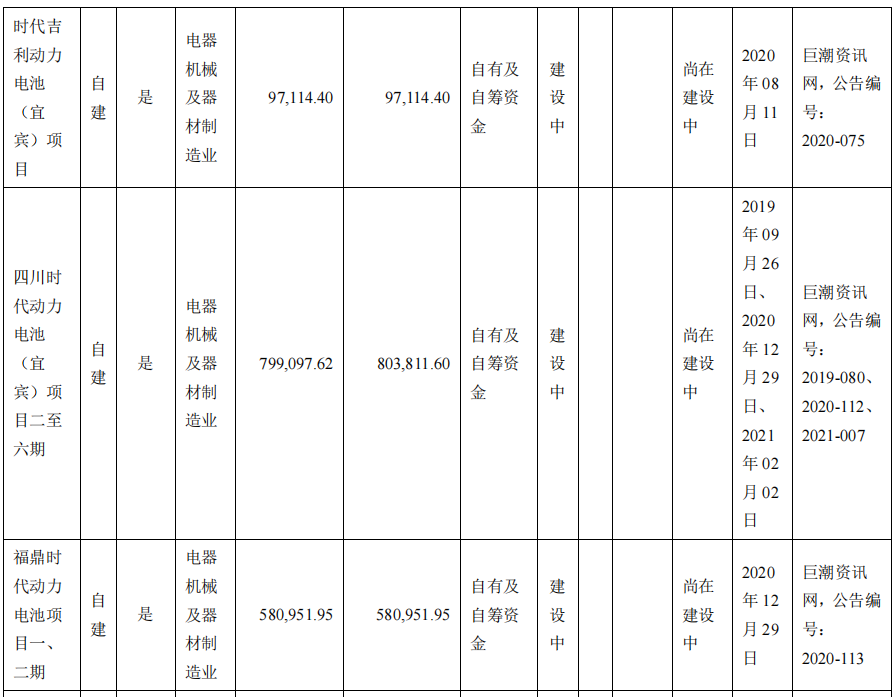

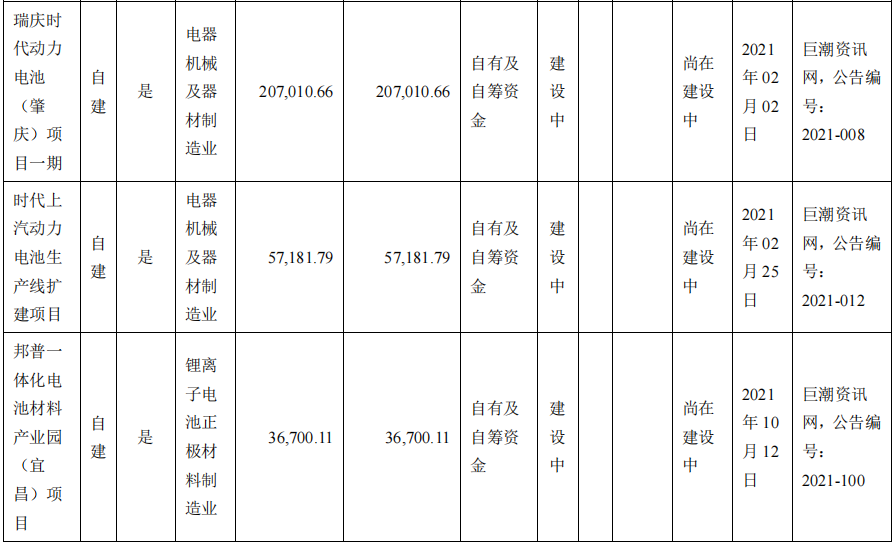

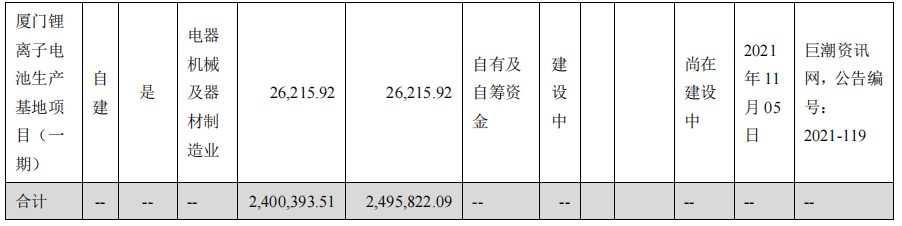

In the annual report, CATL disclosed 10 self-built projects, including the European R&D and production base. From the perspective of capital investment, the progress has reached 76.9%, and is close to completion with an expected completion date this year.

CATL’s self-built production base capacity planning has exceeded 650GWh. In addition, CATL has established joint ventures with FAW, Geely, GAC, SAIC, and Dongfeng respectively, and the capacity planning of joint venture batteries has exceeded 140GWh.

In terms of manufacturing, CATL is committed to achieving three goals through extreme manufacturing innovation: first, to reduce the safety failure rate of battery cells from ppm (parts per million) level to ppb (parts per billion) level; second, to guarantee the reliability of battery products throughout their entire life cycle; and third, to significantly improve production efficiency and build a “TWh”-level capacity for large-scale, high-quality deliveries.

Through increased capacity and extreme manufacturing capabilities, CATL has widened the gap with second-tier companies.

(4) Increase investment in supply security

In terms of supply security, in 2021, CATL’s lithium-ion battery materials sales business achieved a significant increase and has now become the second largest business segment, with revenue reaching RMB 15.46 billion, an increase of 350.74% year-on-year.

It is clearly not enough to only engage in the production and sales of upstream battery materials. It is also necessary to solve the supply problem of raw materials – minerals.

CATL has arranged for these two areas. First, it has arranged for upstream mineral resources. In 2021, CATL’s Indonesian nickel-iron production project was put into operation, increasing the production capacity of lithium-ion materials.

Second, it has arranged for battery material recycling. CATL’s nickel-cobalt-manganese recovery rate has exceeded 99%. In 2021, CATL and BASF of Germany cooperated to expand the European market and promote the rapid development of recycling business by building a Bangpu integrated battery material industrial park in Yichang, Hubei Province.

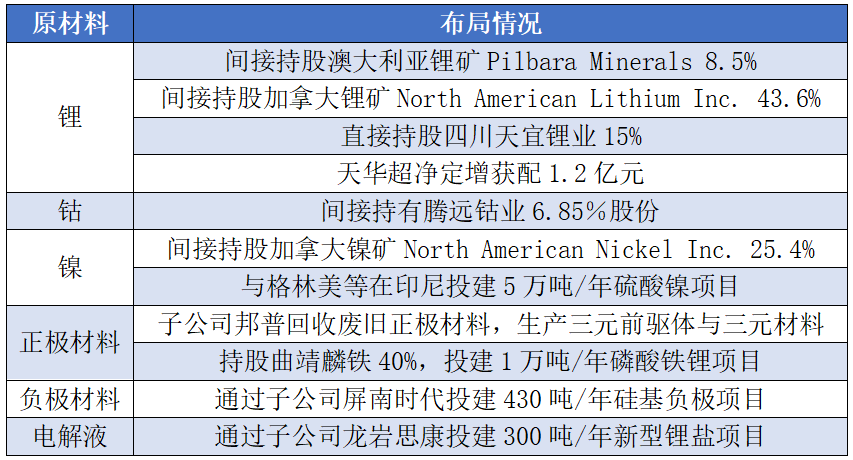

CATL’s layout of some raw materials:

If investment in technology, research and development, production capacity, and supply is an expansion and deepening of the existing moat, then exploring new markets is an attempt to tap into incremental markets.

(5) Diversified investment, opening up the second growth curve

As the industry leader, CATL also has the trouble of growth. Its high market share and strong dominance cause fear in the host factory, and the rise of second-tier battery enterprises also threatens CATL’s market share.

Of course, CATL is not sitting idly by. On the one hand, it further binds supply by investing in downstream car companies. On the other hand, it develops diversified businesses to further enhance its competitiveness.Ningde Times is currently focusing on cultivating application ecosystems beyond the vehicle assembly sector, including electric motorcycle battery swapping (Xiaoha Swap), smart travel (Enjoyor), automotive chips (Horizon Robotics), intelligent battery swapping stations (Blue Valley Intelligence), third-party charging SaaS service platforms (YunKuaiChong), autonomous driving trucks (TuSimple), insurance, consumer finance, and battery rental (NIO BaaS service, self-built battery swapping stations) and other fields.

There are three directions worth mentioning. First, Ningde Times has recently entered the battery swapping business. If joint ventures with NIO are a minor attempt at battery swapping, then operating one’s own operations is a major investment.

From the perspective of overall planning and layout, Ningde Times’ investment in battery swapping is not small. One is to create brand effects for consumers and, in turn, to more deeply bind with car companies. Second, through the construction of battery swapping stations, it empowers its own energy storage business.

Secondly, Ningde Times has also been involved in the intelligentization of specific fields, such as the layout of electric-powered intelligent unmanned mining technology, and heavy-duty unmanned driving technology.

For example, Ningde Times first cooperated with PROS in establishing an asset operating and management joint venture; subsequently, it led the investment in the automatic driving star start-up TuSimple invested by PROS. This is the layout in the unmanned driving field.

Third, Ningde Times is also involved in the fields of insurance and consumer finance. In 2021, Ningde Times invested 900 million yuan, holding a 30% stake, becoming the second-largest shareholder of Sino-French Life.

On the same day, Qingshan Holding Group Co., Ltd. and Guizhou Guixing Automobile Sales and Service Co., Ltd. also became shareholders of Sino-French Life, with their registered capital increasing from RMB 200 million to RMB 3 billion, an increase of 1,400%.

Currently, Sino-French Life has been renamed Xiaokang Life Insurance Co., Ltd.

Interestingly, Xiaokang Life, as a comprehensive insurance service provider, whose business scope includes life insurance, health insurance, accident insurance, etc., is not an upstream or downstream company in the industrial chain.

Moreover, Ningde Times previously invested 640 million yuan to participate in Chongqing Ant Consumer Finance Co., Ltd.

Currently, it is unknown whether entering these fields is simply a financial investment or has deeper implications.From the long-term planning of Ningde Times Chairman Zeng Yuqun, there are three objectives: firstly, to make the power battery the core, with the goal of replacing mobile fossil energy; secondly, to combine with the storage and power generation field, especially new types of solar cells, with the goal of replacing fixed fossil energy; thirdly, to carry out intelligent and electrification cooperation in specific fields.

In the current economic environment and international situation, the market value of Ningde Times has also been heavily hit. Fortunately, with previous accumulation, Ningde Times has reserved sufficient funds and technology. Anyway, in the uncertain overall economic situation, building high walls and storing food is always the most correct choice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.