Translated Markdown Text with HTML Tags Preserved

Author: Xiao Dong

Editor: Chris

Stop Selling Fuel-Powered Cars

With a single announcement, BYD has stopped producing vehicles powered by fossil fuels. While many are still calling for a 2025, 2030, or even 2035 target to stop the use of fossil fuels, BYD has quietly reduced the proportion of fuel cars and completed a smooth transition to new energy vehicles. Surprisingly, stopping fuel car production has not caused much damage to the company.

In BYD’s announcement on April 18th, it expects a Q1 2022 net profit of 650-950 million yuan, a YoY increase of 174%-300%. Of course, this is for the entire group, but BYD also stated that “the group’s new energy vehicle sales reached a historic high, continuing to increase its market share and significantly improving profitability, and it has somewhat offset the pressure on profits brought about by the rising prices of upstream raw materials.”

More intuitively, BYD’s new energy vehicle sales in March were 103,229 units, a YoY increase of 334%. In the new energy vehicle manufacturer sales ranking published by the China Passenger Car Association, BYD steadily ranks first with a market share of 23.2%. As for BYD’s other important business, the mobile parts and assembly business, it is under pressure due to weak industry demand. Given the premise of the continuous increase in the domestic new energy vehicle market share, the two major businesses of BYD group have shown different states, which is not surprising.

As a “new” new energy vehicle manufacturer, BYD also has a nearly legendary experience, expanding from a mobile phone battery factory to a car factory, becoming one of the only two investment targets for Buffett in China, and being used as a state guest car for William and Kate’s China visit by the Bahamas, completely transforming into a new energy vehicle manufacturer, etc.

On the other hand, BYD has also experienced setbacks such as spontaneous combustion incidents, DM-i deceleration, its previous low-end brand image and poor user experience brought about by its distribution network. These have been reminding BYD that it can do better.

BYD seems like a huge ship sailing in the deep sea, firm and stable, yet always facing strong winds and heavy rain.

“Powering the World with Green Energy”

As a startup, BYD relied on cost advantages to stand out in the mobile phone battery field and stabilized its position. After listing in Hong Kong in 2002, BYD decisively expanded its business to the automotive sector while continuing to develop its mobile phone parts and assembly business. In BYD’s 2021 financial report, the combined income of these two businesses accounted for 92.04% of the total income, with automobiles and related products accounting for more than 50%.# From BYD’s Electric Vehicle Journey

Since BYD’s acquisition of Xi’an QinChuan Auto in 2003, Wang Chuanfu, who started with battery technology, announced the ultimate goal of BYD is the electric vehicle market. Like almost everyone else, BYD’s first step was to imitate. As a newcomer in the automotive industry, after the failure of the first model 316, BYD aimed at the most popular Toyota Corolla, and the F3 was born from then on.

BYD’s electrification has always been hidden in its heart. As early as the 2006 Beijing Auto Show, the F3e was unveiled, but due to the low level of infrastructure development in China at that time, it had to be abandoned. After that, the “dual-mode” electric car F3DM, born in 2008, made consumers more familiar with it. It can be driven by an internal combustion engine or run on pure electricity, with a pure electric range of 100 km. However, the price of 150,000 yuan did not make the F3DM a success. Instead, the F3, with its good quality and low price, became the best-selling model of the year in 2009 with sales of 285,913 units.

After that, BYD shifted its focus on electrification to the B-side. The first pure electric vehicle E6 was used as a taxi in Shenzhen in 2010, but by the end of 2011, only 300 vehicles had been put into operation. In addition, BYD was attracted to the field of electric buses, and in the past decade, its electric buses have been sold to more than 50 countries and regions and more than 300 cities worldwide. The cumulative global delivery of electric buses has exceeded 68,000 units, which is due to its cost and technological advantages.

In 2013, the tenth year of BYD’s car production, was also its first turning point. Because BYD has never been able to break through the Western technical barriers in the field of gasoline vehicles, and has always hit a ceiling, Wang Chuanfu decided to shift its core strategy to new energy vehicles. The BYD Qin was released, and the Wang Dynasty series was born. By 2015, the revenue of BYD’s new energy vehicles accounted for 48%, almost on par with gasoline vehicles. From 2016, the situation reversed, and the revenue of BYD’s new energy vehicles began to exceed that of gasoline vehicles until they were completely eliminated in 2022.

The era of relying on fossil fuels to advance electric vehicles has passed, and the era of “electric drive” has arrived. This time, BYD cannot sit still.In the fourth quarter of 2021, BYD’s market value exceeded RMB 900 billion, ranking seventh in the total market value of Shanghai and Shenzhen stock markets, second only to Guizhou Moutai and CATL in terms of trillion-dollar market capitalization companies, excluding banks. It is worth noting that until early 2020, BYD’s market value was only a little over RMB 100 billion. Its market value has increased six to seven times in less than two years.

Nowadays, most of BYD’s models are in short supply, and customers have to wait for several months from placing orders to delivery. Furthermore, there are reports that BYD has a backlog of 400,000 orders, while BYD’s total sales of new energy vehicles in 2019 were only 229,500.

So, what happened to BYD from 2020 to 2021?

Robust Backbone

In the first quarter of 2020, the blade battery was launched, which was not only the first product of Feiteng, a company established by BYD to split its battery business, but also a remarkable success. It can be said that this is a major counterattack by BYD after the disappointment of ternary lithium batteries. Compared with Ningde, which became the industry leader based on ternary lithium, BYD had some discontent.

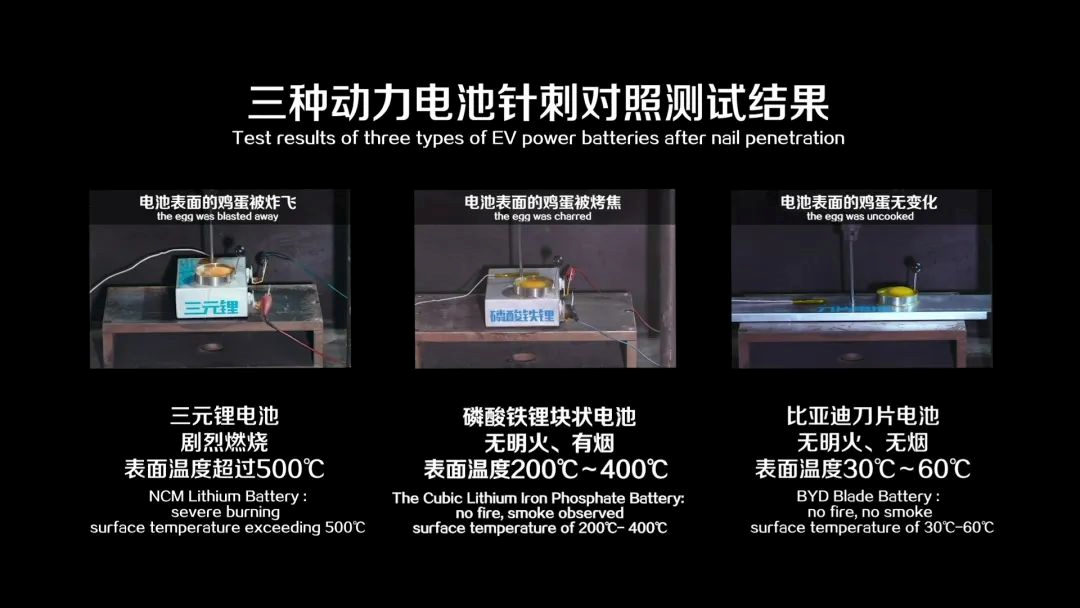

In the early days of the electric vehicle industry, self-ignition accidents frequently occurred, making safety the top priority. The biggest advantage of iron-phosphate batteries lies in safety. At the blade battery release conference, BYD used the theme of “safe world” and brought puncture experiments on stage. When facing steel needle puncture, the blade battery did not catch fire or smoke, and the surface temperature was only 30-60℃. The visual comparison of the puncture experiment also impressed consumers.

Wang Chuanfu also said that “the blade battery is expected to completely remove the word ‘self-ignition’ from the dictionary of new energy vehicles.”

In addition, the CTP structure and the similar long and thin shape of the single battery of the blade battery effectively improve the space utilization inside the battery pack, thereby improving the overall energy density of the battery pack and achieving longer cruising range. At the same time, compared with ternary lithium batteries, the cost of iron-phosphate batteries is lower.

The significance of the blade battery for iron-phosphate lies more in increasing energy density and achieving longer cruising range. However, the fundamental problems of iron-phosphate batteries still exist, such as poor charging and discharging performance in low-temperature environments, inaccurate SoC estimation leading to sudden power failure, and so on. In addition, in recent years, there have been incidents of self-ignition of vehicles equipped with blade batteries. Needle puncture experiments are equivalent to system-level safety, and it may not be appropriate.

If the blade battery makes consumers feel safe, scarcity becomes the bridge for BYD’s rapid growth.# January 11, 2021, BYD DM-i Super Hybrid Technology was released, and three new models equipped with DM-i technology, Qin Plus, Song Plus and Tang, were officially launched.

The popularity of DM-i models may have exceeded BYD’s expectations. When it was first launched, it was hard to get one, and some car owners said the waiting time was more than four months. Interestingly, if you search for complaints about BYD today, there are still many problems with not being able to pick up DM-i cars.

Short-term insufficient production capacity may be a “happy annoyance” for car companies, but in the long run, it may not be a good thing. Fortunately, BYD has expanded its production capacity very quickly. In 2020, BYD’s annual production capacity was 600,000 vehicles. The planned production capacity for 2022 is 3 million vehicles, and the actual production capacity can reach 2 million vehicles.

In short supply, DM-i naturally has unique attracting places for consumers.

The core advantages of DM-i models lie in excellent fuel consumption control and cost control. The hybrid market was once dominated by Japanese brands. Qin Plus DM-i has an electric deficit fuel consumption of 3.8 L/100 km (slightly higher in reality) and a price of 100,000-150,000 yuan, which undoubtedly gave a blow to the hybrid models of Japanese brands. A large number of personal users and online ride-hailing orders poured in. At the same time, the 100+ km pure electric endurance can also meet the commuting needs of most urban residents. At this price point, economy is the top priority.

In addition to DM-i, BYD has also proposed DM-p, where “p” stands for Powerful, which meets the needs of performance-oriented consumers. In March, the Han DM-p was officially launched, with a 0-100 km/h acceleration of 3.7 seconds and an electric deficit fuel consumption of 5.2 L/100 km, indicating that the DM hybrid system has found a balance point between cost, performance, and energy consumption through multiple generations of evolution.

BYD’s complete product matrix of EV and PHEV models has brought more sales to BYD. If you go to a new energy vehicle brand experience store at this stage, there are few car model options. Taking the XPeng P7 as an example, XPeng only has SUV models, and NIO did not have a sedan model before the release of the ET7. Other new energy vehicle brands are even more pathetic.For BYD, a complete product matrix allows consumers to actively choose rather than passively choose. Especially in the 100,000 to 200,000 yuan new energy vehicle market, there are few outstanding models available. “Sedans, SUVs,” “100,000 to 300,000 yuan,” two types of cars most frequently chosen by Chinese consumers and the price range with the highest vehicle market sales have all been fully covered by BYD.

Next, the continuous introduction of the Ocean series and the Warship series will make BYD’s product matrix even richer, and the scarcity has also become an important factor for BYD’s success.

In addition, BYD’s self-developed system and vertical integration capabilities bring cost advantages.

On the one hand, BYD’s self-developed system has reduced costs, for example, the blade battery that BYD has started to outsource, and the 20 GWh blade battery contract signed with Tesla. It is evident that BYD’s battery production capacity has reached a certain scale at this stage, and cost advantages are naturally highlighted under such large-scale production capacity. The negotiating power with upstream suppliers is also stronger. On the other hand, the supply side is more reliable and unrestricted. Nowadays, many automakers are also establishing their own battery supply chain. Guangzhou Automobile Group’s Jiuwan, Great Wall’s honeycomb, Volkswagen in Europe’s battery plant layout, and even Tesla.

Talking about the supply side, after the COVID-19 pandemic, the global automotive industry chain has been more or less impacted, and the most severe problem is chip shortage. Huawei Intelligent Automotive BU CEO Chengdong Yu once stated in an interview that a chip that used to cost 10 to 20 RMB has been hyped to 2,500 RMB. Major automakers have also been exposed for purchasing chips at high prices.

However, when BYD faced a chip shortage, its capacity was minimally affected, and its sales continued to increase. Part of the chips can even be outsourced. In BYD Semiconductor’s prospectus, brands such as XPeng, Voyah, Yutong, Xiaokang, and Changan have become BYD customers.

Under the self-developed system of BYD, IGBT and SiC power modules are also products that BYD has the ability to design and manufacture independently. This enables the expensive SiC to be installed in the electric drive system of the Han EV. It became one of the factors that allowed the Han EV to accelerate to 100 km/h in 3.9 seconds while reducing losses and improving the mileage. In the future, SiC power modules will be more popular in the 800V high voltage platform’s popularity.To talk about the vertical integration capability, we can trace it back to early BYD automobiles. From floor mats, interior parts, storage shelves, airbags, front and rear bumpers, and so on, BYD wanted to have control of all important components in the entire automobile production process. In the era of electrification, this is even more true for BYD.

Of course, BYD is not flawless.

Cannot be ignored

It seems like we cannot avoid the discussion about “intelligence”.

The emerging force of new carmakers is coming fiercely, with propaganda about intelligence sweeping the nation. Intelligent cockpits, intelligent driving, intelligent…, if the wheels can be intelligent, I believe everyone would not miss this propaganda opportunity. Intelligence is currently the most obvious difference between new car manufacturing and traditional fuel vehicles. Of course, this is indeed the necessary path for the automobile’s further evolution.

So, what about BYD’s intelligence?

In April 2018, BYD launched the DiLink 1.0 intelligent network system, which is compatible with both mobile phone and automobile ecosystems, and opened the era of network interconnection. By 2022, despite having undergone three major iterations, DiLink still looks like a car-borne pad and lacks high-quality human-machine interaction design, such as voice assistants, more flexible interface layouts, and reducing multi-level menu settings, etc. In addition, DiLink’s UI design and vehicle system fluency are relatively weak. In today’s highly competitive intelligent cockpit market, DiLink can only be said to have barely passed.

However, BYD is obviously falling behind in intelligent driving.

Arriving late is worse than arriving without success. As early as 2013, BYD collaborated with Beijing Institute of Technology to develop a line-controlled autonomous driving experimental vehicle, and later collaborated with the Institute for Infocomm Research of Singapore to jointly research and develop autonomous driving and intelligent transportation. In 2015, it also collaborated with Baidu for unmanned driving research, and so on. It can be said that BYD has always been paying attention to the direction of intelligent driving.

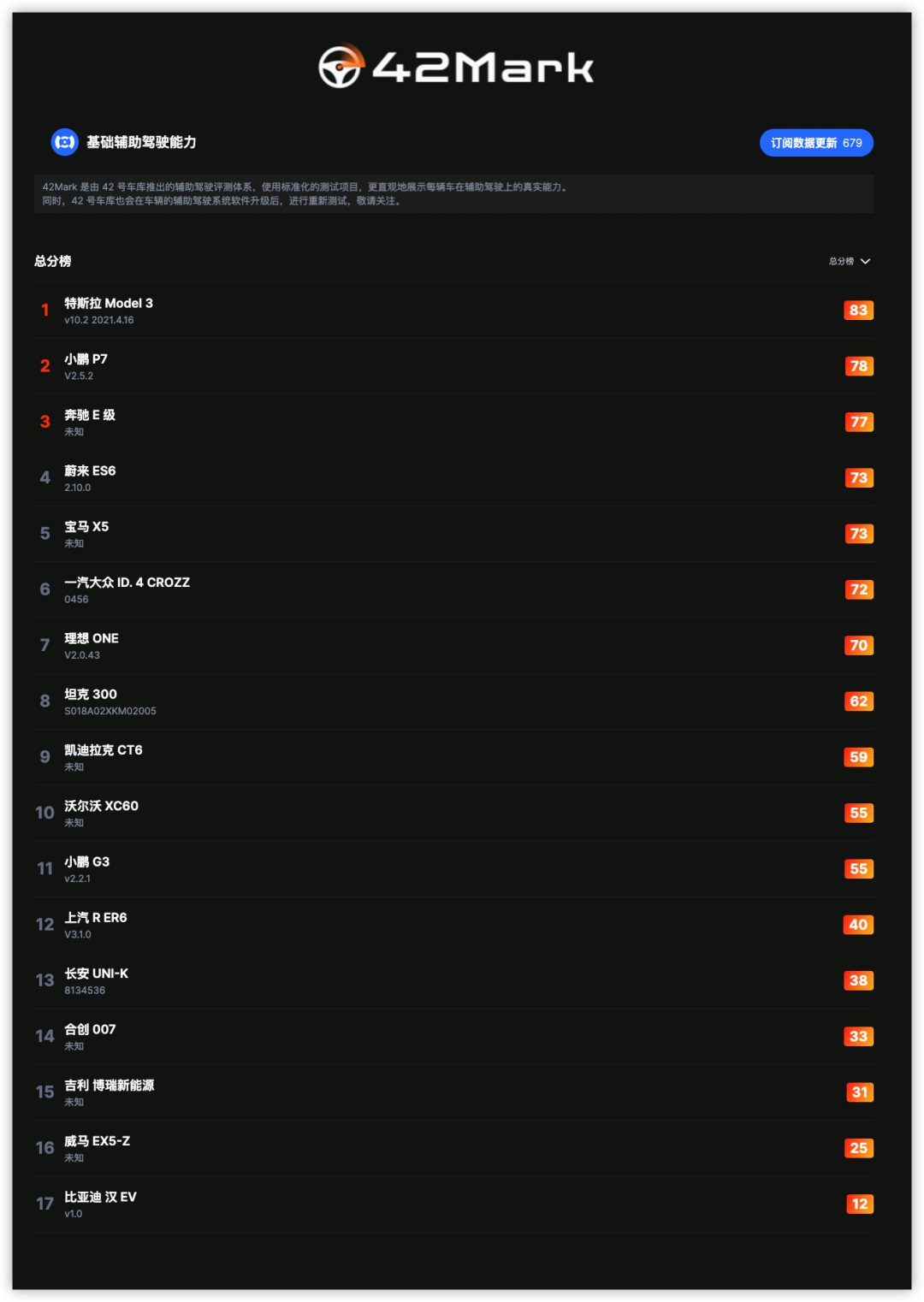

It was not until the launch of the BYD Han EV in 2020 that the DiPilot intelligent assisted driving system met with consumers. However, the early performance of DiPilot was not satisfactory. According to the ranking of 42 Mark’s basic assisted driving capability of the 42nd garage, the score of the BYD Han EV was only 12 points.

At last month’s Han Family Conference, DiPilot received an update that adds automatic light switching and avoiding large trucks functions. The hardware used is a combination of a front monocular camera + 5mm millimeter-wave radar + 4 surround-view cameras + 12 ultrasonic radar. It has two more millimeter-wave radars than it did previously. However, as the era of ubiquitous Lidar approaches in 2022, it falls behind somewhat as Byton’s flagship model.

At last month’s Han Family Conference, DiPilot received an update that adds automatic light switching and avoiding large trucks functions. The hardware used is a combination of a front monocular camera + 5mm millimeter-wave radar + 4 surround-view cameras + 12 ultrasonic radar. It has two more millimeter-wave radars than it did previously. However, as the era of ubiquitous Lidar approaches in 2022, it falls behind somewhat as Byton’s flagship model.

On the software side, more and more high-speed intelligent driving functions are being added, and leading players have already started city intelligent driving tests. Fortunately, at the 2021 Lenovo Innovation Technology Conference, Wang Chuanfu mentioned that “the great revolution in the automotive industry, electrification is the first half, and intelligence is the second half,” and BYD has also accelerated its intelligence process:

- BYD and Momenta established a joint venture – DiPilot Zhixing.

- BYD strategically invested in Lidar company Suzhou Juchuang.

- BYD cooperated with Baidu, which provided ANP intelligent driving systems for BYD.

- At the NVIDIA GTC conference, BYD announced that the new generation of models will adopt NVIDIA Orin chips.

- BYD and Huawei MDC launched a cooperative project.

- BYD and Horizon Robotics collaborated, and the first BYD model equipped with the Journey 5 chip will be launched in the first half of 2023.

BYD has launched cooperative models from algorithms, Lidar, chips, and platforms to accelerate its own intelligence process, flower in multiple places, and catch up head-on.

Some consumers may not care about intelligence and still define cars as pure transportation tools. So, let’s talk about BYD’s own problems.

First is user experience, BYD’s layout in charging networks is basically zero. Compared with car companies such as Tesla, NIO, and XPeng with a charging system, the user’s charging experience during the use of the car is weaker.

In addition, the direct sales model of new forces now far exceeds the buying experience of 4S stores, and various services are comprehensive. The distance between car companies and consumers is getting closer, and the idea of user co-creation is coming along with it, which also increases the user’s desire to purchase.

If there is no competition, the traditional 4S store model is understandable. However, in the era of the direct sales system, BYD still adopts the sales method of the former fuel system, and even generates some additional fees during the car purchasing process, undoubtedly bringing negative effects to the brand.# Brand Uplift

On April 22nd, BYD’s high-end brand Tang announced the official name of its first luxury MPV — the Tang D9.

Yes, Tang is back. Established as a joint venture between BYD and Daimler, the parent company of Mercedes-Benz, 12 years ago, Tang’s story has been witnessed by many. At the end of 2021, Tang and Daimler announced a plan for equity transfer, with BYD and Daimler holding 90% and 10% of stakes in Tang, respectively.

For the last 12 years, Tang has lost a lot of money. However, fortunately, it has left a brand behind. After all, with Daimler’s assistance, Tang’s story has become somewhat more attractive. This time, Tang has chosen to start anew and made many changes, particularly in brand marketing, by establishing a new direct sales channel, building an app, and frequently interacting with fans on Weibo, among other things.

With a price range of CNY 100,000 to CNY 300,000, BYD has already penetrated the mid-end market. Next, using Tang, it plans to break into the high-end market of CNY 300,000 to CNY 500,000, which is reasonable. However, BYD’s ambition goes far beyond this.

During the 2021 Guangzhou Auto Show, Du Guozhong, Vice President of the BYD Automobile Brand and Public Relations Division, stated in an interview with the media that “BYD is currently planning to launch a high-end brand with a completely independent brand, marketing team, and sales network, and the first model will be a high-end SUV with a price range of CNY 500,000 to CNY 900,000.“

A luxury brand that surpasses Tang is brewing. If the new brand is successful, BYD will cover a price range of CNY 100,000 to CNY 1 million. However, it is easier for a brand to move from high to low, but for a brand to move from low to high, product strength and brand recognition are equally important.

This sturdy and reliable giant ship is heading for distant waters, but it’s also afraid of encountering storms. Even if it won’t sink, it will still need to be patched up from time to time. After docking at the port, a new round of distant voyages will begin.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.