Wanbo Sent from the Passenger Temple

Reference of Intelligent Vehicles | WeChat Official Account AI4Auto

Friends, do you believe that you can sell your Tesla for a profit even after driving it for two years?

This is actually happening, with the phenomenon of “inverted pricing” of Tesla used cars appearing in both China and North America.

According to the information on the Tesla used car official website, the listed price of a Model Y from two years ago can even be 40,000 to 60,000 RMB higher than its original price.

While the conventional wisdom suggests that electric cars have a worse resale value compared to gas-powered cars, the reality is that many of them are selling at a premium.

In fact, not only Tesla but also new domestic smart EV start-ups have generally better resale value rates.

Why is this happening?

Used Teslas Are More Expensive Than New Ones?

Yes, that seems to be the case, and it’s a common phenomenon, especially for the Model Y.

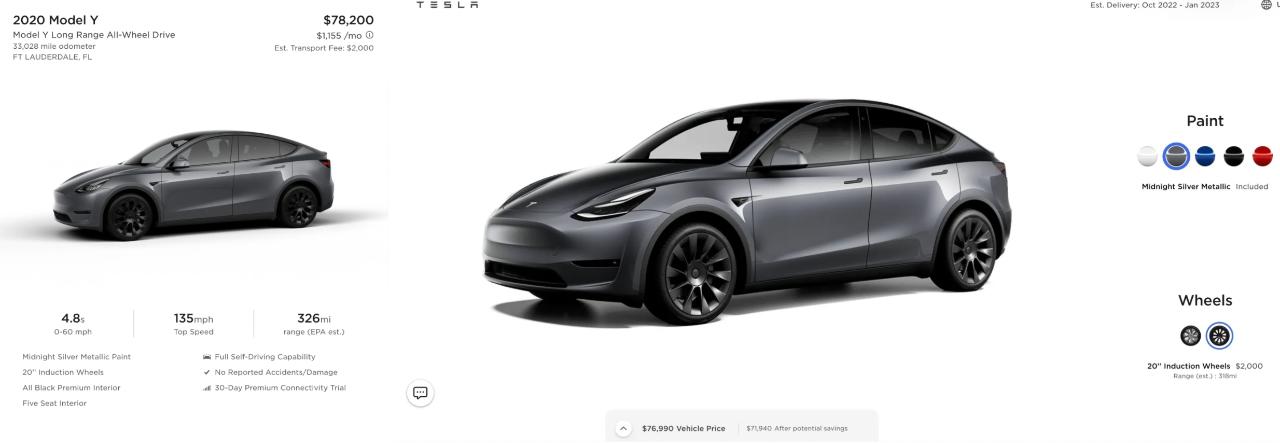

Take this 2020 Model Y as an example. With a total mileage of 33,028 miles (over 53,000 kilometers) and the FSD Autopilot system option, it is listed on the Tesla used car website for $78,200, which is even** $1,000 higher** than the price of a new vehicle of the same model and configuration.

And, believe it or not, this price is still higher by $6,000 to $10,000 than the original selling price in 2020.

In other words, if you bought a Model Y in 2020 and sold it after two years, you would not only avoid the usual depreciation, but also potentially earn up to 60,000 RMB.

With this rate of return, why bother buying stocks or funds when you can just buy a Model Y and enjoy your ride?

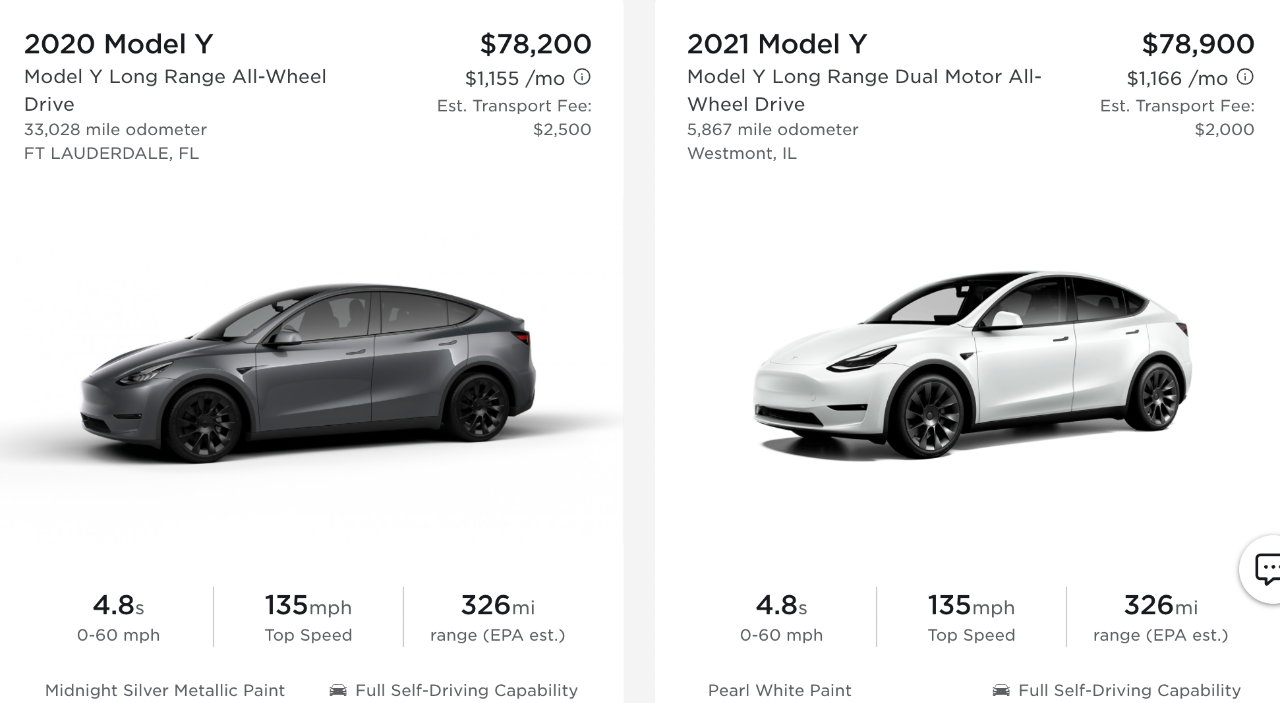

In addition to this car, there are several other used Model Ys listed on the website, all of which have higher prices than new vehicles with identical configurations.

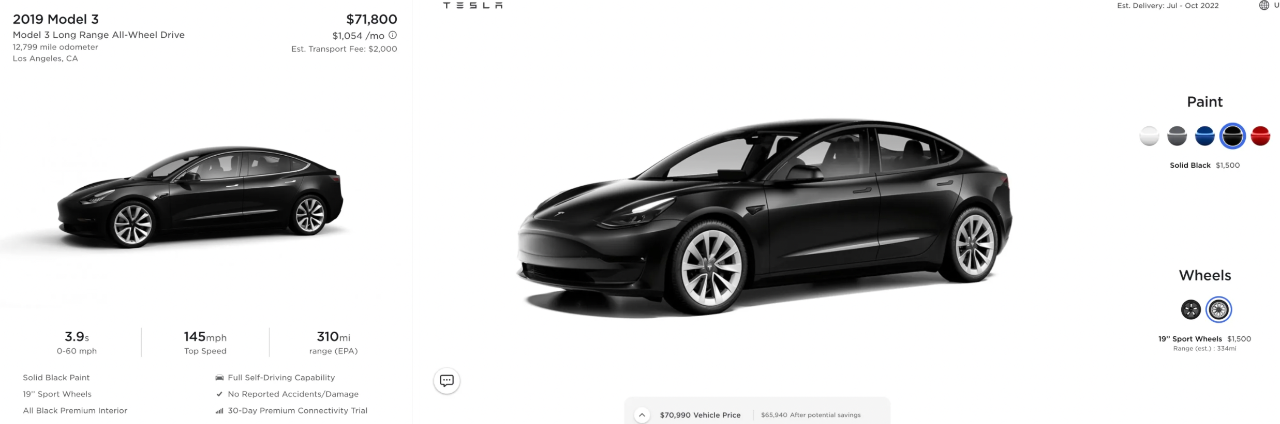

Another top-selling Tesla Model 3 does not have as much of a price difference as the Model Y, but still has a trend of being sold with a premium.

For example, this black 2019 Model 3 with the FSD Autopilot system option has a used car price of $80,300 on the official website, which is higher than the sticker price of a new vehicle with the same configuration.

For the higher-end Model S and Model X, although they don’t have excessive premiums, their resale value is also frighteningly high.

For the higher-end Model S and Model X, although they don’t have excessive premiums, their resale value is also frighteningly high.

Taking this 2019 Model S equipped with the FSD intelligent driving suite as an example, the official website’s used price is $91,900 (after subsidies).

For the same model, with the same color, wheel hub, and FSD option, the new car price is $111,740, which is $19,740 more expensive than the used car price.

Calculated over a period of three years, the average compound depreciation rate is less than 7%, which is a high level for electric cars and even for fuel-efficient cars with higher resale value.

In fact, Tesla’s resale value in the North American market has always been at a high level. Taking Model 3 as an example, according to CarEdge, an American car website, its three-year resale value is 76.33%, which is a very competitive level even in the fuel-efficient car market.

The above is the situation in the North American market. What about the Chinese market? Can used Teslas still be sold at new car prices?

Yes, although the phenomenon of premiums is not as exaggerated as in North America, it still exists.

As early as February this year, the media reported that a 2021 long-range version Model Y with a mileage of over 10,000 kilometers in the Chengdu area was listed on the official website for 413,600 yuan.

Looking at the quality assurance information of this car, it should have been purchased before the price hike of Model Y in May 2021, so according to this logic, this Model Y can still earn about 10,000 yuan after being driven for a year.

But this car is not seen on Tesla’s official used car website now, so it must have been sold already?

This is the situation of Tesla’s official used car trading website. What about third-party trading platforms? Taking a leading domestic second-hand car trading website as an example, the selling price of China-made 2021 used Tesla Model Y is generally around 350,000 yuan, and the highest selling price can reach 370,000 yuan.According to this calculation, the first-year residual value rate is about 90%, which is a relatively high level.

After some statistics, we found that not only Tesla, but also domestic manufacturers such as NIO, XPeng, and Li ONE, who are focused on intelligence, although not as exaggerated in price as Tesla, have generally high residual value rates.

What About XPeng Cars’ Residual Value Rate?

We take representative models of NIO, XPeng, and Li ONE as the measuring objects.

First, let’s take a look at NIO’s ES6, the main model in the second-hand car market.

We found on NIO’s official second-hand car trading platform that the residual value rate of ES6 with one year of service is basically maintained at around 74% if there is no major damage to the car condition.

For example, the price of the vehicle shown below at the time of purchase was 480,900 yuan, and the selling price on the website one year later was 357,800 yuan, with a residual value rate of 74.4%.

Moreover, we found that the residual value rate of NIO’s second-hand cars with battery rental models is higher than that of the purchase model, and the first-year residual value rate can reach about 80%.

Now let’s look at XPeng Motors. Take the XPeng P7 as an example. On the official second-hand car trading platform, this 2-year-old car with 26,000 kilometers of mileage had a selling price of 244,000 yuan, while the new car price two years ago was 314,700 yuan.

The two-year compound depreciation rate is 12%, and the first-year residual value rate is above 80%.

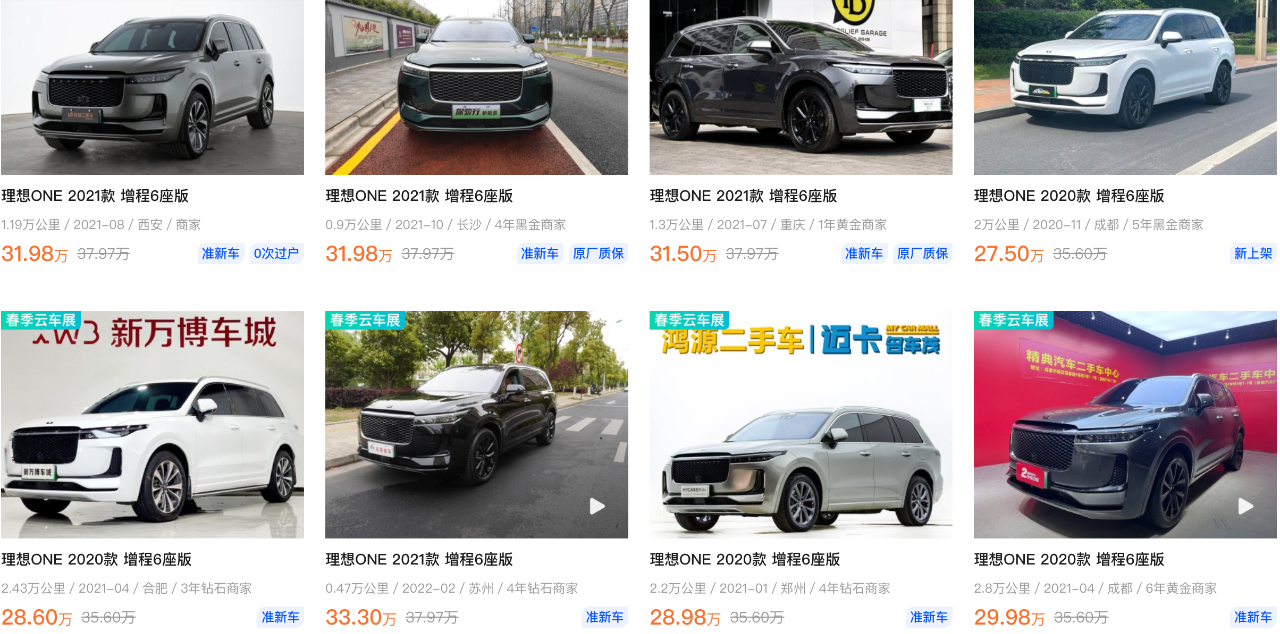

There is also Li ONE. How about the residual value of Li ONE, the only long-range electric vehicle among the three models?

We learned from Li ONE’s sales stores that the official second-hand car price of Li ONE 2021 model with less than 10,000 kilometers is basically around 300,000 yuan. The first-year residual value rate is basically above 80%, which is similar to that of third-party platforms.

Above are the basic conditions of the residual value rates of the second-hand cars of the three emerging intelligent vehicle manufacturers in China. Compared with the average level of new energy vehicles, they are also in the leading position.

However, this conclusion was derived under the circumstance of having official platforms for protection. What changes will occur if third-party platforms are involved?

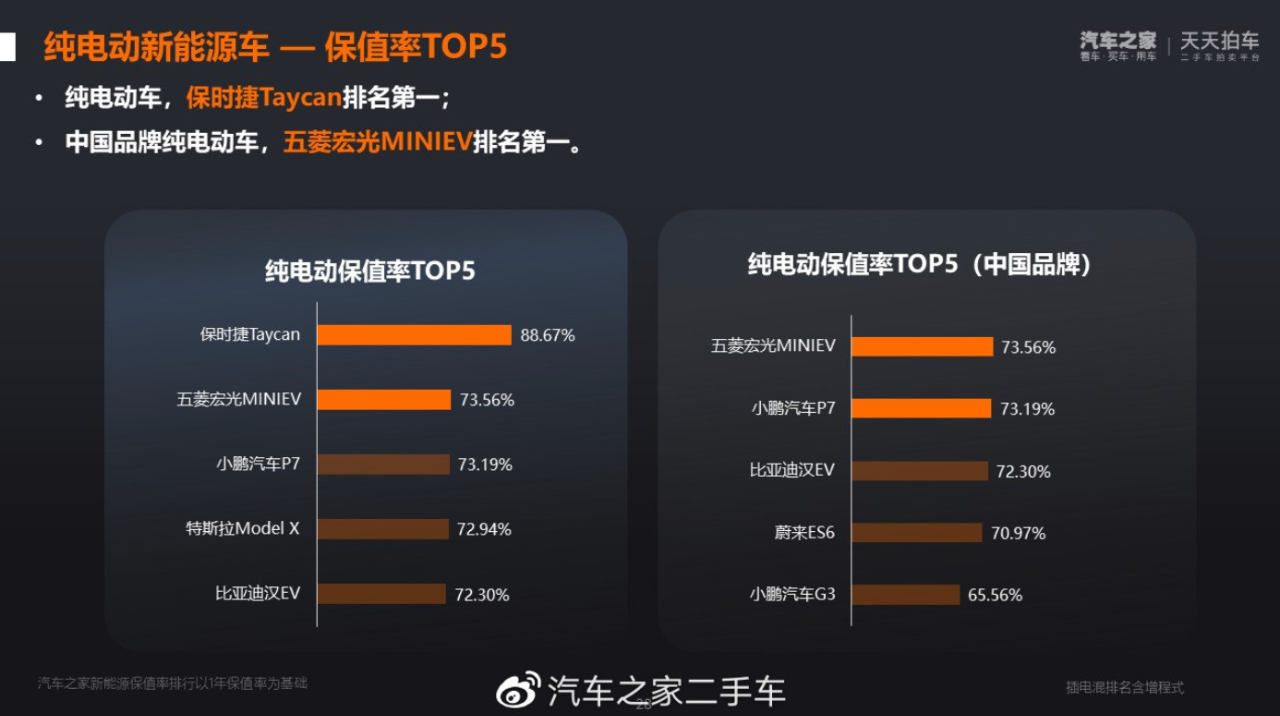

According to the “2021 China Car Resale Value Rankings” issued by the third-party platform “Autohome”, Tesla, NIO, and XPeng’s main models are all among the top 5 new energy models in terms of resale value.

In the domestic hybrid models, the Ideal ONE even ranked first in terms of resale value.

So, where does the high level of resale value of these car manufacturers come from?

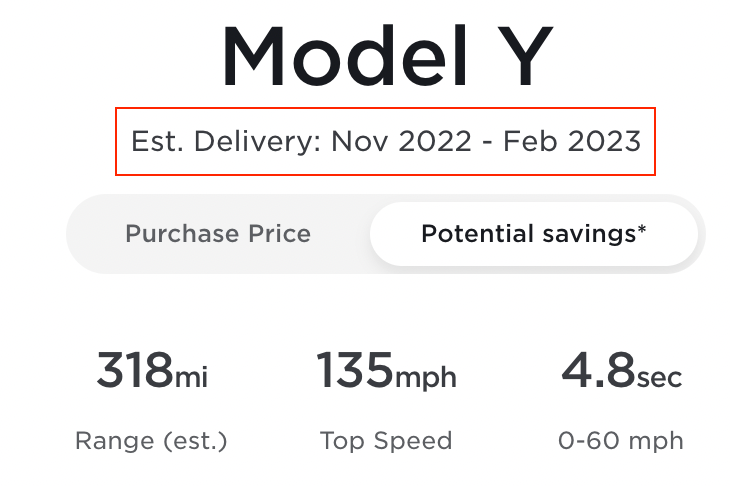

Firstly, the long delivery cycle is a major factor. Take Model Y and XPeng P7 as examples, the delivery cycle is generally over 3 months, with Model Y even lasting up to 6-9 months.

For these popular models, potential car owners who cannot wait will purchase nearly-new or even pre-owned cars at prices close to or even higher than the new car price, which is understandable.

The viral off-road vehicle, the Tank 300, is a typical representative of this phenomenon.

Secondly, the impact of power batteries is also significant. One of the controversies of new energy vehicles is their high depreciation rate, due to the high cost of power batteries in the car body, and the battery life is not like the engine of a fuel vehicle, which can run for several decades as long as it is well maintained.

However, as mentioned above, from the rule that NIO’s rental battery model has a higher resale value for pre-owned cars, when the battery is no longer bound to the vehicle, the resale value of electric vehicles will also be improved.

Finally, the positive impact of the level of intelligence on car resale value is also significant, especially for Tesla and the above-mentioned three domestic new forces represented by intelligent driving. With the label of intelligent driving, the improvement of the brand tone also makes the car models produced more competitive in the pre-owned car market.

In addition, it is also related to the fluctuations in the new car market.

Since February of this year, the instability of the new energy vehicle supply chain, as well as the continuous increase in the price of battery raw materials, have forced many new energy vehicle companies to raise prices in response.

With Tesla as an example, the new car prices were raised three times in one week in March of this year, and the main selling Model Y rear-wheel-drive version in China increased by more than 36,000 yuan within 7 days.

The increase in new car prices has a direct impact on the prices of the pre-owned car market.But in general, the overall residual value of new energy vehicles still has a considerable gap compared to fuel vehicles in the second-hand car market. How big is the gap? Take a look at this picture:

A depreciation of 20%-30%, which takes about 3 years for a fuel vehicle, but for pure electric vehicles, it can be achieved in just 1 year.

one more thing

Can you guess which model of domestic electric vehicles has the highest residual value?

It’s not Model Y, nor is it XPeng P7, this honor does not belong to any of the new forces of carmaking. Even the king of domestic electric vehicles, BYD, has to step aside.

The true champion: Wuling Hongguang MINI EV! A car that can be bought for 30,000 RMB, which is a great value for money.

The ending is surprising, but thinking about the logic behind it, it’s not difficult to understand. What more can be said for a car like Wuling Hongguang MINI EV, which costs just over 30,000 RMB? The price of a second-hand car can only go down so much.

What do you think?

— The End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.