Author: Kaijun Qiu

Editor: Kaijun Qiu

The outbreak has dealt a heavy blow to China’s new energy vehicle industry, but different regions and companies have been affected differently.

According to the terminal insurance data, new energy vehicle companies in the Shanghai area, represented by Tesla, NIO, and SAIC, have been seriously affected, while companies in the Pearl River Delta area, such as BYD, GAC Motor, and XPeng Motors, have been less affected.

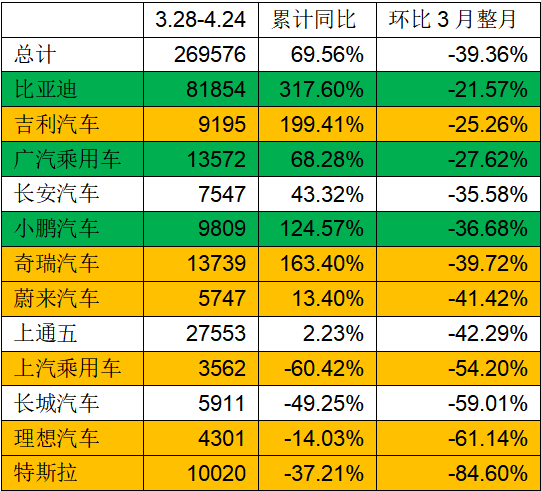

In the four weeks from March 28th to April 24th, compared to March, the cumulative number of terminal insurance policies for new energy passenger vehicles was only about 270,000 vehicles, a decrease of nearly 40% from the 444,500 vehicles in March.

However, some areas and companies resumed work and production in the last week of April, and after deducting the sales volume from March 28th to 31st, it is difficult to determine the terminal sales volume in April. Optimistically, the month-on-month decline will be smaller, approaching 30%. Compared to last year, the sales volume of new energy passenger vehicles can still maintain a growth rate of about 70%.

Specifically, companies in the Pearl River Delta, BYD, GAC, and XPeng were slightly less affected, with a decline in sales volume ranging from 22% to 37%. Companies in the Yangtze River Delta were harder hit, especially Tesla and SAIC in Shanghai, with declines of more than 80% and 50%, respectively. However, Tesla may allocate more production capacity for exports in April, the first month of the second quarter, so the actual decline in output is not that great. NIO, Ideal, and Chery, which are closely related to Shanghai, all saw declines of more than 40%, while Geely performed slightly better.

New energy companies in the Yangtze River Delta have been hit hard since the end of March, when Shanghai began to implement strict control measures, which serve as a prototype for the present situation.

Affected by the epidemic prevention policies in Shanghai, Tesla’s Shanghai factory suspended production activities on March 28th. On April 19th, Tesla’s Shanghai Lingang super factory, which had been closed for nearly three weeks, resumed work, and 8,000 employees arrived early. However, the production director of Tesla’s Shanghai factory also stated that the production capacity of Tesla will be restored to full production levels within the next three or four days, but the current inventory of complete vehicles and parts is expected to meet only about one week of production capacity.

NIO’s factory is located in Hefei, but it has also been greatly affected.

On April 9th, NIO founder, chairman, and CEO Bin Li also stated in the NIO app that affected by the epidemic, NIO had already experienced a parts shortage in mid-March and relied on inventory support until last week. The recent outbreaks in Shanghai, Jiangsu, and other places have caused more partners to be unable to supply, and production can only be temporarily suspended. Li Bin said: “If a vehicle is missing a part, we cannot produce it. This situation is not unique to us, and many manufacturers have also suspended production.”The NIO factory has also resumed production recently. On April 26th, NIO announced that the 200,000th mass-produced car was produced at the JAC-NIO Advanced Manufacturing Center in Hefei.

In comparison, the impact on companies in the Pearl River Delta region is somewhat smaller. Although Shenzhen has also experienced comprehensive social control measures and Guangzhou has sporadically experienced outbreaks, the control measures have not lasted long, and the peripheral logistics are still relatively smooth.

Specifically, BYD, known for its self-sufficiency, has the smallest impact, and with the efforts made in the last week, sales figures in April may maintain March’s performance.

GAC Passenger Vehicle’s performance is still good, while XPENG is relatively affected.

On April 14th, He XPeng, the Chairman of XPENG, posted on his WeChat Moments, “If Shanghai and the surrounding supply chain companies fail to find a way to resume production and work, all car manufacturers in China may have to stop production in May.” This also shows that the impact of the epidemic is not small.

To reiterate, the above figures are based on a comparison between March’s terminal insurance numbers from March 28th to April 24th. The specific terminal sales in April still need some time to be clarified, but the trend is clear. We hope that the epidemic will ease in May and that the new energy vehicle sector will regain its momentum.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.