Author: Zheng Senhong

“There’s no need to put another box in the box.”

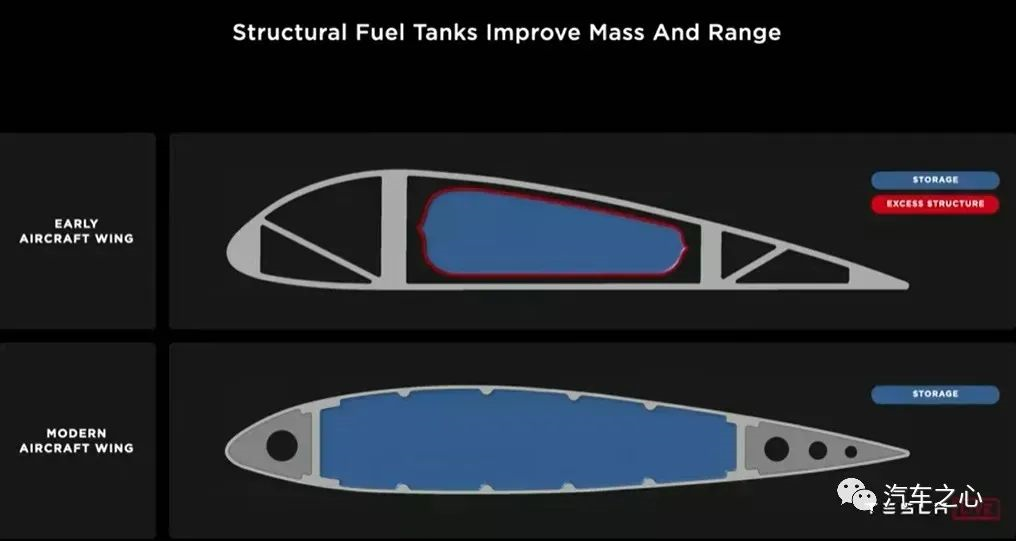

This was Tesla CEO Musk’s first public explanation of CTC technology at the 2020 Tesla Battery Day, where he used the story of filling fuel into wings of the aircraft to describe CTC technology.

Two years later, Tesla plans to assemble CTC battery packs with 4680 cells at its Texas Gigafactory by the end of this year.

“CTC will enable the cost of new energy vehicles to directly compete with fuel vehicles, with more spacious seating and better chassis performance.”

This is the affirmation of CTC technology by Ningde Times Chairman Zeng Yuqun at the China Automotive Blue Book Forum. He also stated that Ningde Times is accelerating the mass production process of CTC technology and is expected to apply it in mass production by 2024.

It can be seen that one is a leading new energy vehicle company in global sales, and the other is a leading power battery pack assembler globally. Their next common goal is the “CTC battery chassis integration technology.”

In addition to Tesla and Ningde Times, many players from different fields including Leap Motor, BYD, Volkswagen, Volvo, Ford, LG, and Yudo Technology are conducting research and development and application layout of CTC technology.

But in this list, Leap Motor became the first domestic automaker to taste the crab.

Key data: range increased by 10%, space increased by 10mm, rigidity increased by 25%

The so-called CTC (Cell to Chassis) means that the battery cells are directly installed on the body chassis, eliminating the intermediate module group and forming an integrated battery and chassis.

In addition to Musk’s story of filling fuel into wings of the aircraft, a traditional flashlight is also a vivid example.

In fact, a traditional flashlight is a metal shell that can hold standard batteries, like a metal shell that serves both as a battery container and a flashlight structure (CTC structure).

On the other hand, if the batteries need to be filled into a battery case and then stuffed into a flashlight, it is a CTP structure.

Inspired by the structure of mobile phone batteries, in 2016, Leap Motor CEO Zhu Jiangming proposed whether electric vehicles could also use this technology, since mobile phone batteries could be transformed from a separate structure to an integrated technology, which made the body lighter and thinner.

After years of research and development focused on “developing batteries from the perspective of cars and cars from the perspective of batteries,” from the initial standard modularization of the 1.0 era to the CTP large modularization technology of the 2.0 era, and then to the CTC technology of the 3.0 era, it took just seven years for the EV maker LI to reach this point.

After years of research and development focused on “developing batteries from the perspective of cars and cars from the perspective of batteries,” from the initial standard modularization of the 1.0 era to the CTP large modularization technology of the 2.0 era, and then to the CTC technology of the 3.0 era, it took just seven years for the EV maker LI to reach this point.

Regarding the LI CTC technology, the general manager of the LI Technology battery product line, Song Yining, provides an introduction from hardware and software perspectives.

First, let’s consider the hardware level.

Song Yining emphasized that the biggest challenge of CTC technology is that it requires both integration and a degree of modularity, which is a contradiction.

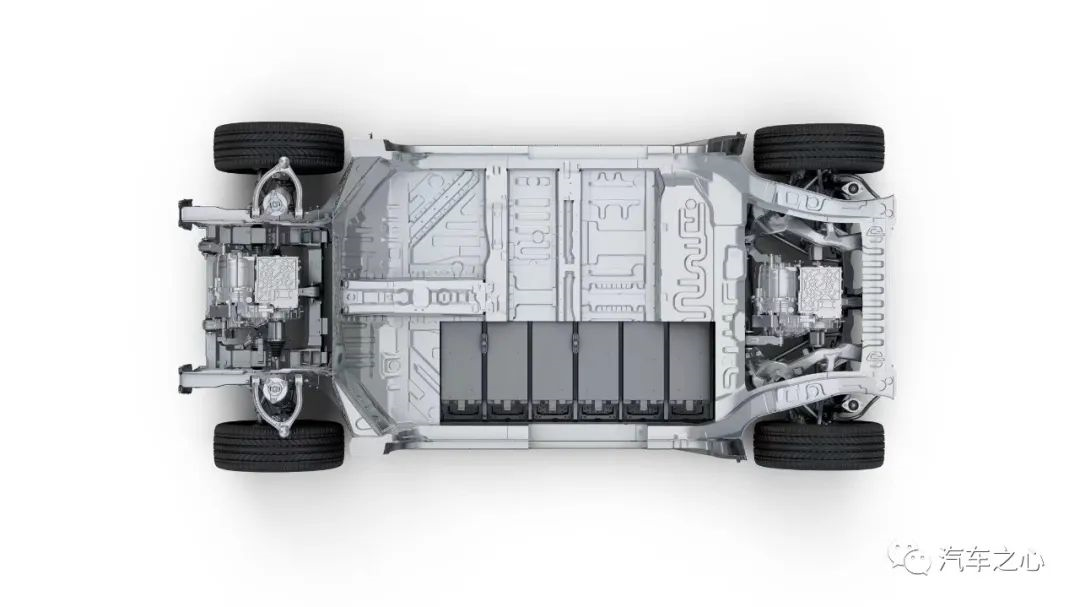

To solve this problem, LI Automotive uses the CTC dual-skeleton ring beam structure to integrate battery skeleton structure with the vehicle body chassis, which is both the vehicle body chassis and the battery architecture.

At the same time, in order to ensure the sealing between the body and the battery cells, LI utilizes longitudinal and transverse beams to form a complete sealed structure. This solves the hardware barrier of CTC technology to the vehicle body.

The breakthrough at the hardware level not only achieves perfect integration of battery cells and chassis but also significantly reduces the number and weight of parts in the entire vehicle, making the chassis thinner, lowering the vehicle height and reducing wind resistance.

Elon Musk said that after adopting CTC technology, 370 parts can be saved, vehicle weight can be reduced by 10%, and the battery cost per kilowatt-hour can be reduced by 7%.

Moreover, applying the LI CTC technology can reduce the number of vehicle parts by 20%, reduce the structural component cost by 15%, and increase the vehicle’s overall stiffness by 25%.

At the same time, due to the removal of module groups, the entire battery structure can be significantly simplified, thereby releasing more utilization space. In the case of expanding the battery pack capacity and reducing the mass of the battery group, this can improve the energy density of the battery and reduce costs.

After adopting CTC technology, the mileage of electric vehicles is expected to exceed 800 kilometers (500 miles), and Zeng Yuqun believes that CTC technology can alleviate the range anxiety of pure electric vehicles in the current stage.

Song Yining pointed out that using the LI CTC technology can increase the battery arrangement space by 14.5%.

For consumers, this brings two visibly noticeable changes:

- Firstly, the cabin increases 10 mm of vertical (head) space;

- Secondly, the comprehensive cruising range increased by 10%.

Of course, after the adoption of CTC scheme, the rigidity, thermal control management, and safety requirements of the battery pack as a structural component are all higher.After testing in various scenarios, the CTC technology of LINGPAI has exceeded the national standards in safety tests such as body torsion stiffness, high altitude dropping, heating control loss, and compression.

Next is the software aspect.

LINGPAI adopts AI BMS big data intelligent battery management system to perform real-time online detection of the BMS on the car side, including six functions: data monitoring, safety warning, usage statistics, car-network interaction, long-life battery, and economic management.

In other words, based on environmental perception and deep data analysis and learning, LINGPAI uses intelligent AI battery algorithms to monitor the safety and efficiency of batteries for the long term and continuously updates the software throughout the lifecycle through OTA, making the batteries safer and longer-lasting.

It can be seen that the hardware of LINGPAI’s CTC technology meets users’ needs for more space, longer battery life, and better performance, while the software aspect enhances battery main safety.

At the same time, LINGPAI’s CTC, which combines hardware and software, is also known as the “sustainably evolving energy matrix”:

-

High adaptation: highly matched with the whole vehicle, adaptable to cross-platform and various levels and types of vehicles

-

Strong expansion: compatible with the 800V high-voltage platform, and supports 400kW super-fast charging.

At the end of the press conference, Zhu Jiangming announced that “LINGPAI will share CTC technology for free.”

As the first domestically producible CTC battery chassis integration technology, Zhu Jiangming did not show an overly excited mood. Instead, facing the various questioning voices from the self-researching road over the years, he proved his choice.

Battery pack dominance: automakers have the final say

In the past, the development of power battery packs involved a tug-of-war between battery manufacturers and automakers regarding the dominance of the PACK.

In the 1.0 era, standardized modules were basically in the form of an entire package, and automakers were extremely passive, needing to consider vehicle body size, driving range, etc. based on the size of a battery pack composed of many battery modules, with the dominance fully on the battery manufacturer’s side.

In the 2.0 era, the number of group modules relatively decreased, reducing the space occupied by the battery pack and allowing automakers to have more sufficient design options.

In the 3.0 era, however, CTC technology means that the dominance is entirely on the automaker’s side, and the battery manufacturer only plays the role of providing battery cells as raw materials.After continuous optimization, auto companies have gradually gained the dominant position of the PACK technology. The dividend of the PACK technology has gradually disappeared and the dominance of battery manufacturers in battery packs is diminishing.

From the perspective of the leading CTC technology of LI, its technical R&D involves more chassis hardware and structural design, in which auto companies undoubtedly have a greater advantage.

Even though the technology barriers for chassis development have fallen sharply compared with internal combustion engine vehicles, the technologies related to hardware and structure are more of an area in which auto companies excel.

Therefore, for auto companies, the mass production of CTC technology only requires discussions with battery manufacturers on the optimal integration of battery cells and car body structures. Compared with the era of modularization in the past, this is more conducive to producing more ideal vehicle models.

The Secretary-General of the China Passenger Car Association, Cui Dongshu, believes that CTC technology is a relatively strong integration technology that makes it possible to effectively improve the energy density of batteries, make vehicle design more lightweight, form more independent and personalized designs for the whole vehicle and match vehicle design with battery design more effectively.

But this does not mean that auto companies can recklessly take this step. The so-called CTC technology requires the following industry-agreed prerequisites:

-

Auto companies need to take the lead in the production of from battery cells to electric vehicles, and configure them in accordance with a certain number, such as a minimum unit layout of 50,000 units of capacity with a single capacity of approximately 80kwh (40GWh).

-

Certain designs should be focused on popular products, and experiments should be conducted on the platform with different power levels, vehicle body structures, and different segmented markets.

-

Sufficient stability is required, from the material system of the battery cell to the size, which cannot be easily changed.

The above three prerequisites ultimately boil down to quantity and scale.

The CTC technology means that the entire cylindrical battery cell needs to be carried out on a bottom support component, and after all the components are manufactured, they are directly integrated with the car body. To solve the problems of structural fixation and sealing, the lower floor of the car body will be used as the upper cover seal, making the entire battery pack an unwieldy component. Therefore, the stability of orders is crucial for auto companies.

As the first domestic company to taste the benefits of this technology, LI has pinned its hopes on its first mass-produced CTC technology vehicle, LI C01.

LI C01 is positioned as a mid-to-large sedan, equipped with a 90-degree power battery pack and achieves a 0-100 km/h acceleration time of 3 seconds, with a comprehensive range of more than 700 km.

From the current market situation, the product lineup of pure electric sedans is relatively thin, and there are only a few pure electric sedans available, such as Tesla Model 3, XPeng P7, and BYD Han.The demand for midsize and large cars among consumers is increasing year by year as the popularity of pure electric cars rises. Analysts in the auto industry claim that while consumers previously focused on the use of pure electric products at home, an increasing number of consumers are now seeking comfort and performance.

Comfort and performance have always been the strengths of C-class sedans (midsize and large sedans) in the gasoline car market and will also be so in the pure electric car market.

Compared to Tesla Model 3, XPeng P7, and BYD Han, the three biggest competitors currently, the Zero Run C01 using CTC technology has superior performance in terms of battery life and power, and its comfort is equally outstanding. Additionally, the Zero Run C01 is the only model with a body length exceeding 5 meters, naturally providing an advantage in driving and riding space compared to its competitors.

With its triple advantages of long battery life, high performance, and comfort, the Zero Run C01 undoubtedly has the ability to become a standard-bearer in the pure electric midsize and large sedan market.

For Zero Run, the arrival of the Zero Run C01 not only enriches its product lineup but also aims to surpass Tesla Model 3, XPeng P7, and BYD Han, the leading players in the pure electric midsize and large sedan market, and thus enhance brand influence.

Autonomous R&D to mitigate the unknown

Exceeding Tesla is the goal that Zhu Jiangming set for himself in his automotive career.

In the official promotional material of Zero Run, it is stated that Zero Run is a new energy vehicle enterprise that truly possesses intelligent automotive R&D, production, sales, and service integrated full-industry-chain cycle besides Tesla.

As a result, following the logic of Yu Chengdong that “no one remembers second place,” Zhu Jiangming’s ambitious promise to exceed Tesla may be discernible to some extent.

As an engineering man with nearly 30 years of research and development and manufacturing experience, Zhu Jiangming values R&D and likes technology, and he believes that independent R&D of core technology is of significant importance for the long-term development of a company. From the beginning, Zero Run has firmly chosen “autonomous R&D” and has consistently adhered to independent research and development in core technologies such as chips, three-electric systems, and vehicle networking solutions.

In Zhu Jiangming’s view, the three core new components of intelligent electric vehicles are the smart cabin, smart driving, and smart power, which are the true complete body of intelligent cars.

Years later, Zero Run has used autonomous R&D to create the so-called complete body of intelligent cars, becoming one of the companies with the most self-developed and manufactured core electronic components, following Tesla and BYD.In the IPO filing submitted to the Hong Kong Stock Exchange, Neovasc displayed its full range of technological modules, including the Leap Power intelligent power system, the Leap Pilot intelligent driving system, and the Leap OS intelligent cockpit system.

According to Zhu Jiangming, Neovasc’s self-developed core lies in its electronic components, including electric drives, BMS, perception, calculation, control, and other equipment, while there is no plan to develop standardized products such as battery cells.

Self-developed electronic components have already enabled Neovasc to be more differentiated, have faster production and iteration speeds, and have stronger capability to respond to supply chain fluctuations.

As for the original intention of “self-developed in all areas”, co-founder, board member, and president Wu Baojun said that Neovasc wants to hold core competencies in its own hands, but it is currently uncertain what the core competencies of future new energy vehicles or smart electric vehicles will be.

“So, we make everything ourselves to ensure a better chance of holding core competencies. Our advantages are intelligent driving chips, intelligent manufacturing; all electrical software is self-written. All of this is based on having uncertain future core competencies, and refining our competitiveness in the development process”.

Since 2015, you can question Zhu Jiangming’s status as an outsider in the auto industry, you can question whether Neovasc’s first product S01 is a “standalone” model, and you can even marvel at Neovasc’s courage to lose fifty billion yuan in order to sell 50,000 cars.

But for his persistence in self-development, you can fully trust Zhu Jiangming, this technology enthusiast.

As a senior technical person, Zhu Jiangming has always been seen by the outside world as someone who is not good at speech.

While all other competitors have already begun to talk about “changing the world with me”, he will only repeatedly talk about “self-development”.

Today, with the rapid advancement of Neovasc’s 2.0 self-production era, we believe that there will one day be a solo performance for Neovasc automobiles, from “industrial commute vehicles” to “technological aesthetics”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.