Article by Zheng Wen

Edited by Zhou Changxian

Since mid-March, car companies such as Tesla, XPeng, Geometry, Zeropoint, WM Motor, Great Wall Euler, and GAC have successively announced price increases for their new energy vehicle models, with unprecedented price hikes and implementation speeds.

During this period, Tesla, who is known for being always unpredictable, has actually increased its prices three times, with the cumulative price increase of 14,000 to 30,000 yuan for all domestically produced models. XPeng Motors raised the prices of its models for sale by 10,100 to 32,600 yuan, matching Tesla’s increase. Byd’s price increase was effective just ten minutes after announcement, and Dynasty and Ocean Majesty’s models were generally adjusted by 3,000 to 6,000 yuan, while the DMi series increased by 3,000 yuan and the EV model increased by 6,000 yuan.

In fact, the pressure to raise prices for new energy vehicles has long existed, with the most important pressure coming from power batteries, which account for 10% to 40% of the costs.

As the old saying goes, there is no such thing as a peaceful and comfortable life for many years, as someone is always taking on the heavy burden for you. Last year, power battery companies took on most of the pressure from rising raw material costs, but this year they are no longer able to bear the burden alone. Under duress, they had to pass it on to the end-users.

Because under the impact of multiple factors, the shortage and rising prices of raw materials for power batteries not only did not curb, but escalated further. Even the leading battery companies with large scale and strong bargaining power, using long-term lock-in pricing strategies and raw material locking capabilities, were unable to keep up with the pace of rising raw materials prices.

It is staggering that from 2022 onwards, the prices of nickel/cobalt/lithium/copper/aluminium, lithium hydroxide, lithium carbonate, hexafluorophosphoric acid lithium, PVDF, VC, and other materials have all been rising. Even some of the auxiliary materials for lithium batteries have increased several times more than in 2021, showing a “jumping increase” pattern.

Take lithium carbonate as an example, the average price for battery-grade lithium carbonate began to jump after reaching 300,000 yuan/tonne on New Year’s Day in 2022. It surged to 400,000 yuan/tonne in mid-February and broke through the 500,000 yuan/tonne mark in early March, an increase of nearly 70% from the beginning of the year. Although there has been some policy control, the price has only slightly fallen from its peak, with a price of 470,000 yuan/tonne in April.

This new energy blue ocean carries too many visions and imaginative spaces for the automotive industry. According to BNEF’s prediction, by 2025, global sales of new energy vehicles will reach 11 million, with a penetration rate of 11%, while conventional fuel vehicles will enter a turning point and begin to decline. By 2030, global sales of new energy vehicles will continue to rise to 20 million, the penetration rate will reach 28%, and by 2040, it will increase to 60 million. In the long run, the market space for new energy is expected to grow to 10 trillion yuan.“`

According to another set of data from Bloomberg, the global new energy industry is expected to demand more than 1.5TWh and 3TWh of batteries by 2025 and 2030, respectively.

But it’s not easy to switch the momentum of a huge industry. In the early years, relying on the B-side market such as leasing and ride-hailing, the new energy vehicle supply chain was gradually improved. Now, with the demand gradually released from the private market, the industry chain has once again set off a huge wave.

At present, power battery companies are working hard on three top priorities: building a safe, stable, and benign supply chain system; seeking more technological paths to achieve cost reduction goals; and cultivating more high-quality suppliers.

“First principles” exist everywhere

As Musk’s presence in the auto industry grows stronger, his way of thinking also leads him further.

Most of the time, we are thinking by analogy, which is actually to imitate others’ methods and make some improvements. But Musk believes that first principles thinking is very important, especially when you need to create an unprecedented field.

First principles is a principle in quantum mechanics, and Musk seizes upon the core idea of “deducing things based on their essence”. The opposite of this core idea is “empiricism” and “looking at the world from the perspective of giants”.

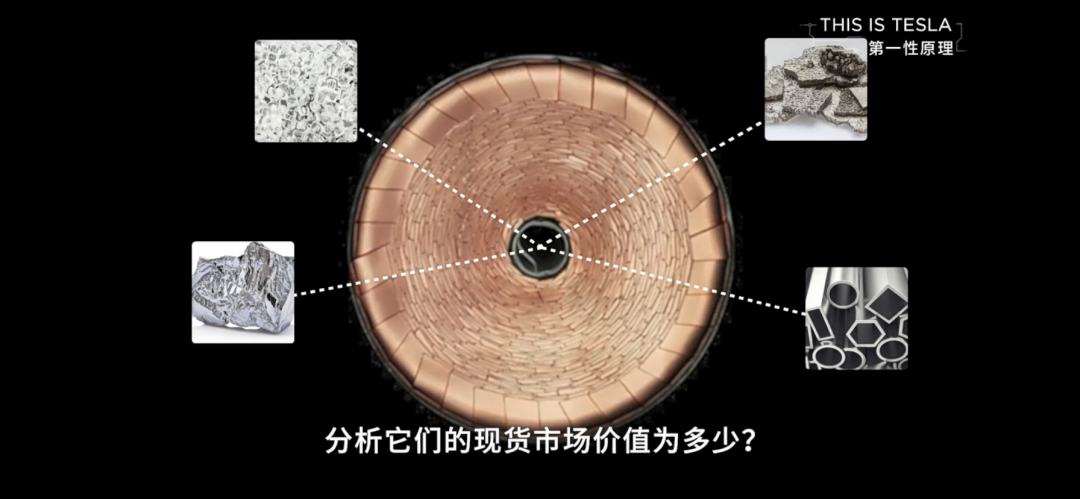

For example, the cost of battery packs is very expensive, and some people say it’s about $600 per kilowatt-hour, and it will remain high in the future because it has always been like this. But Musk does not think so. He uses first principles to think, exploring what raw materials make up the battery, breaking it down into various raw materials, and analyzing how much they are worth on the spot market. Finally, he concludes that the cost is $80 per kilowatt-hour.

In fact, in this newly constructing world, people who have no experience to follow are consciously or unconsciously applying “first principles”, but Musk has deeply described it.

Perhaps Musk did not expect that the price of raw materials would become more and more out of control. Therefore, building a safe, stable, and benign supply chain system has become the top priority for the development of the industry.

In fact, companies on the industrial chain are all working hard on this. Since raw material prices are unstable, can they improve the problem of limited and uneven distribution of mineral resources by going upstream and optimizing mineral resource supply, and do a good job of recycling downstream? Can they seek alternative raw materials in the periodic table of elements? Can they change the product form to increase energy density?

“`More and more opportunities and possibilities are waiting for people to deduce and verify.

Moving Upstream

On March 30th, Bee Health Energy and BASF YPC announced their strategic investment in Hunan Yongsheng Lithium Industry Co., Ltd., each holding 10% of its equity. This move is precisely to ensure the supply of lithium salts and strengthen the advantage in raw material costs.

Yang Feng, chairman of Yongsheng Lithium Industry, said: “The cooperation with Bee Health Energy will greatly promote the expansion of Yongsheng Lithium Industry’s lithium salt production capacity and actively respond to the current strong downstream demand, rising prices, and production expansion pressure.”

At the Electric Vehicle 100-Person Meeting in late March 2022, we also saw many efforts in the industry chain upstream to try to change the current situation of “lithium travels all over the world, and nothing else can move.”

Zhao Weijun, executive director and China regional president of Farasis Energy, pointed out that a key factor in the development of the next-generation power battery industry is the deep synergy of the industrial chain.

He believes that the matching and integration of key materials such as lithium ore, lithium brine, nickel ore, cobalt ore, precursors, positive electrodes, and negative electrodes from the battery industry and upstream, especially material suppliers, are vital.

However, Li Zhen, chairman of CATL, believes that the shortage of power battery supplies is a phased phenomenon. “By 2025, the demand for lithium iron phosphate, ternary materials, and negative electrode materials will be 2 million tons, 1.3 million tons, and 1.6 million tons, respectively, and the current plan of the top ten production enterprises will respectively reach 5.460 million tons, 2.67 million tons, and 3.17 million tons.”

He pointed out that Jiangxi Yichun Lithium Mica Project in China is growing rapidly, and Yichun is expected to develop 500,000 tons of lithium resources by 2025. In addition, lithium brine extraction technology in Qinghai is advancing, and lithium mines in Sichuan are being mined.

At the same time, the advancement of recycling technology will greatly reduce resource dependence. Li Zhen expects that by 2040, the total demand for raw materials for battery manufacturing can be acquired from recycled batteries.

Iron-Phosphate Lithium, Ternary Lithium, and What Else?

From a technical path perspective, since Nissan introduced the LMO system electric vehicle in 2010, the technical iteration from lithium manganate (LMO) to lithium iron phosphate (LFP), and then to the middle-to-low nickel (NCM3 series, 5 series) and high-nickel (NCM8 series) ternary materials has been completed.

Currently, lithium batteries used in electric vehicles on the market are divided into iron-lithium and ternary according to the positive electrode materials, and high-performance ternary materials have higher energy density, while economical iron-lithium materials have lower cost. Positive electrode materials account for as much as 30% to 40% of the cost of lithium batteries, so reducing the cost of positive electrode materials is the key to reducing the cost of batteries.The main raw materials of lithium iron phosphate are lithium carbonate and iron phosphate, mainly lithium carbonate, despite the price increase caused by the hot situation of lithium iron phosphate this year, the cost advantage of lithium iron phosphate is still strong under the conditions of sufficient production capacity and supply-demand balance.

From the perspective of energy density, lithium iron phosphate is gradually catching up, and through a series of improvements, the energy density of lithium iron phosphate batteries can now exceed 200Wh/kg, and the volume-to-system efficiency of battery cells has increased from 40% to 60%. The latest released energy density of lithium iron phosphate batteries can reach 210Wh/kg, and the single-cell energy density has reached the level of tri-element NCM5.

Data shows that from 2018 to the first quarter of 2020 is the off-season of lithium iron phosphate batteries, and the installed capacity in the power market has dropped to 33%. Since the second quarter of 2020, lithium iron phosphate batteries have begun to rise, and the proportion has reached 56% in January and February of this year.

The story of improving lithium iron phosphate is not over yet. Can the phosphate positive electrode material be mixed with other elements to improve the energy density of the battery by increasing the voltage while maintaining the battery discharge time? Yes.

Verification found that adding manganese elements has this effect, and the increased energy density can reach about 20%. Currently, LiFe0.5Mn0.5Po4 of manganese iron 1:1 is more concerned about.

However, it also has problems of low electronic conductivity and slow lithium ion diffusion rate, and modification technology is needed to improve the material’s electrochemical properties in the synthesis process. Currently, many companies mainly use surface coating and nanometallization measures, so the technical barriers are relatively high.

China Securities’ research report pointed out that with the improvement of the penetration rate of new manganese-based positive electrode materials, from 2021 to 2035, the amount of manganese used in lithium batteries will increase by more than 10 times, and the industrialization process will gradually accelerate.

In a ternary lithium battery, nickel, cobalt, and manganese (ternary materials) are transition metal elements, forming a solid solution, and atoms can be mixed in any proportion. Among them, nickel is the active element of the battery and is the key to improving the energy density of the battery; manganese exhibits electrochemical inertness and mainly plays a stabilizing structure role; cobalt can stabilize the layered structure of the material and reduce cation mixing, which is beneficial to the battery cycle performance, but it is expensive and polluting.

Generally speaking, for new energy vehicles with a range of more than 600 kilometers, high-nickel technology is a better choice, and for new energy vehicles with a range of more than 800 kilometers, high nickel is almost the only choice.So, we can see that the issue of “cobalt-free batteries” is also in the plans of the power battery companies. Companies like BYD, Panasonic, and Tesla are all working to reduce the cobalt content, but it still needs time for technology development to be reduced to zero.

Exploration of the positive electrode material is still ongoing. The solutions mentioned earlier involve adding additional elements to lithium batteries, but can lithium be replaced altogether? The answer is still yes.

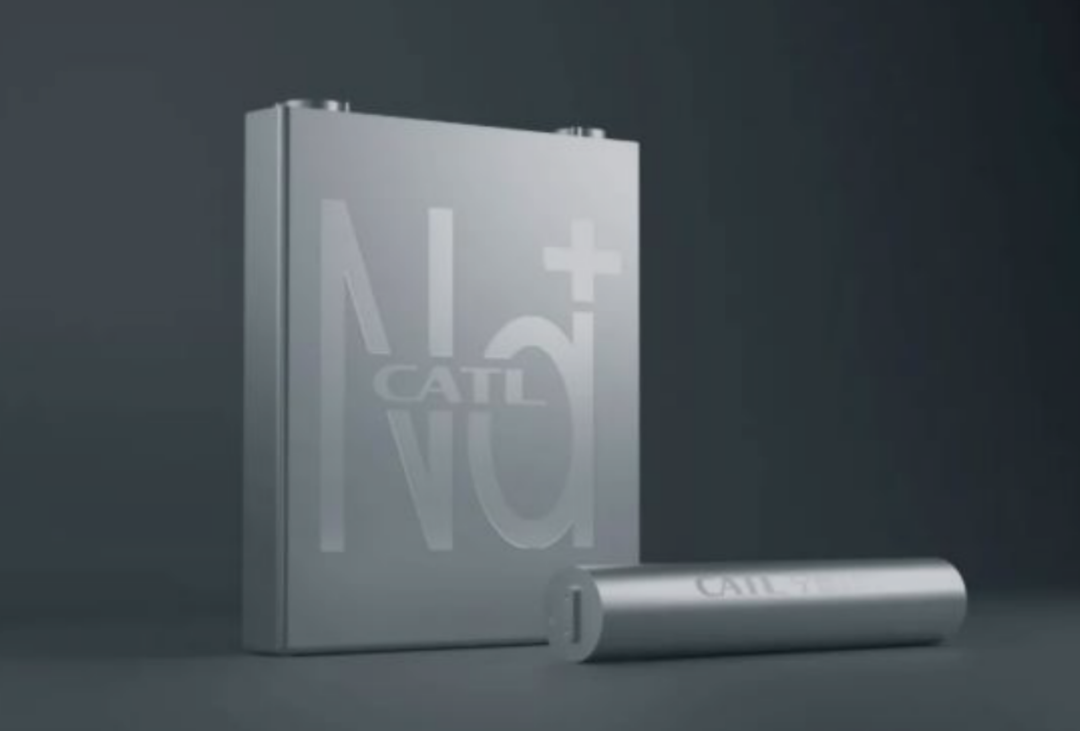

On February 17th of this year, CATL [short for Contemporary Amperex Technology Co. Limited] replied to investor inquiries on the investor relations platform, explicitly stating that the company has already begun laying out the industrialization of Na-ion batteries, and by 2023 it will form a basic industry chain.

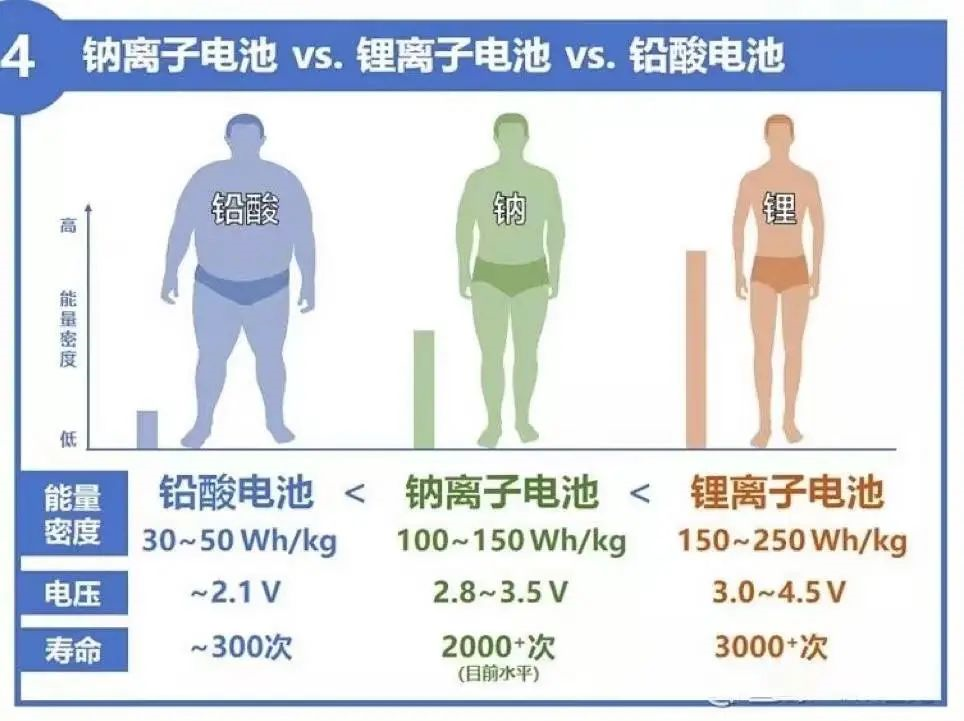

CATL’s first generation Na-ion battery cell has an energy density of up to 160Wh/kg, which is slightly lower than the current iron lithium cell of 160-200Wh/kg, but its battery performance far exceeds peers. The company expects that the second generation’s energy density target will be 200Wh/kg, which will be comparable to iron lithium batteries with a system integration efficiency of up to 80%.

Na-ion batteries work similarly to Li-ion batteries, but differ in the positive and negative electrode materials and electrolyte. There are two types of positive electrode materials, Prussian white and layered oxide; the negative electrode material needs to be developed with a unique porous structure suitable for allowing Na-ions to store and shuttle through quickly, while the electrolyte needs to be developed in an electrolyte system that is compatible with the positive and negative electrode materials.

Although the energy density of Na-ion batteries is lower than that of Li-ion batteries, they have a significant advantage in fast charging, taking only about 10 minutes. Sodium compounds have higher thermal stability than lithium, so they also perform well in high and low temperature conditions.

The key is that the cost of Na-ion batteries has decreased significantly. According to research data released by Ping An Securities, the cost of Na-ion battery materials has dropped by as much as 30% to 40% compared to Li-ion batteries.

Furthermore, sodium resources are richly distributed and widely available, with 420 times the lithium reserves, and their price is low. Existing material and battery production processes and equipment for Li-ion batteries can be extended to the production of Na-ion batteries.

In the future, Na-ion batteries can not only serve as an important supplement to Li-ion batteries but can also gradually replace lead-acid batteries, which seriously pollute the environment. Yuexing Chu, from Guotai Junan Securities, estimates that the potential demand for Na-ion batteries in domestic application scenarios in 2025 will be 123 GWh, with a corresponding market space of approximately RMB 53.7 billion (US$8.4 billion) at the price of lithium iron phosphate batteries.

Except for sodium, elements such as magnesium and calcium have also been included in the research of battery materials. The diversified development of the power battery materials has even expanded from the positive electrode to the negative electrode. For example, silicon is added to the negative electrode of ternary lithium batteries.

Except for sodium, elements such as magnesium and calcium have also been included in the research of battery materials. The diversified development of the power battery materials has even expanded from the positive electrode to the negative electrode. For example, silicon is added to the negative electrode of ternary lithium batteries.

At present, the mainstream graphite negative electrode can achieve a specific capacity of 355-360mAh/g, while the theoretical specific capacity of silicon materials can reach 4200mAh/g, which is more than 10 times that of graphite. However, it is limited by its high expansion rate (silicon expansion rate is 300%, graphite is 12%), and is generally added to the graphite negative electrode in the form of a doping ratio of about 5%.

Flattening and rounding the battery

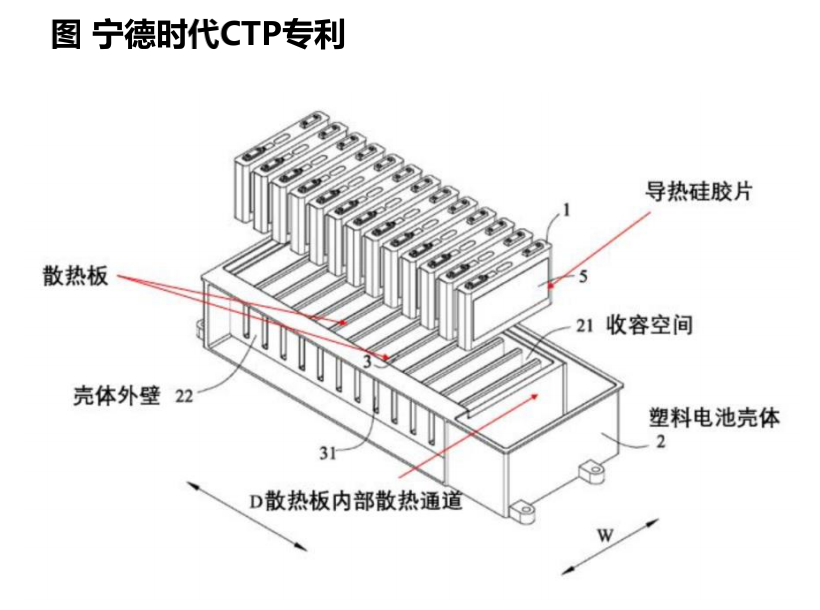

As we mentioned earlier, in the past two years, the energy density of lithium iron phosphate has been breakthrough due to the innovative encapsulation technology of Ningde era and BYD’s CTP and blade batteries, which brings a significant improvement in the efficiency from the battery cell to the PACK, and then allows lithium iron phosphate with low energy density to achieve better group energy density.

The CTP battery of Ningde era is similar to BYD’s blade battery, but the difference is that Ningde era uses the concept of “large module”, still retains some modules, and increases the number or volume of battery cells to improve integration efficiency by reducing the use of modules.

Its phase results announced is the third generation CTP (Cell to Pack) technology, internally known as “Kirin Battery”. Under the same chemical system and the same battery pack size, the capacity of Kirin Battery pack can be increased by 13% compared with the 4680 system.

Since the second half of 2020, the high cost-effective “square iron phosphate” battery combined with CTP/blade technology has been shining in the electric vehicle market with a range of 600 kilometers or less. In 2021, the domestic “iron phosphate + square” accounts for nearly 90%.

On another track, cylindrical batteries have also come into the public eye in the past two years. In September 2020, at Tesla’s Battery Day, the next-generation power battery will use cylindrical cells with a diameter of 46mm and a height of 80mm.

Interestingly, on the night before Battery Day, Fan Wenguang, vice president of BAK Power Battery in Shenzhen, accurately guessed the topics of cylindrical cells, full pole ears, silicon negative electrodes, and so on in a media interview.

At the Electric Vehicle 100-People Congress 2022, he predicted that the large cylindrical cell is the optimal solution for mid-to-high-end electric vehicles in the next five to ten years. By 2025, the market share of large cylindrical cells will exceed 30%, or about 480GWh, exceeding the total global demand in 2021.Currently, enterprises including Panasonic, CATL and BYD are all backing the 4680 large cylindrical battery.

In terms of form, power batteries are divided into three categories: rectangular, cylindrical, and soft pack. Specifically, each has its own advantages and disadvantages:

Currently, rectangular batteries are the mainstream power battery worldwide. Its advantages are that the single-cell capacity is large, the shape can be customized according to customer needs, it is more flexible in application, lightweight, has a simple structure, and is relatively easy to expand and manage the system.

However, due to customized sizing, the models and production processes of rectangular batteries on the market are relatively inconsistent, with lower levels of production automation and greater individual differences in cell performance. Thus, when used in groups, there may be problems such as the short lifespan of battery packs compared to individual cells.

Cylindrical battery cells are currently the safest among the several mainstream forms, and their high safety limits enable them to support chemical systems with higher energy densities. Moreover, the small volume of cylindrical cells is conducive to thermal management, allowing for flexible utilization of abnormal spaces, and the highly standardized form is conducive to platformization and iteration.

For example, the high nickel ternary lithium battery combined with a silicon negative electrode has high energy density and is suitable for fast charging, but poor thermal stability and prone to silicon expansion. These issues can be solved by using cylindrical packaging forms.

In terms of the level of difficulty in industrialization, cylindrical battery development has the longest history, high standardization, and has achieved a relatively unified standard within the industry. Additionally, the production automation level of cylindrical cells is higher than the other types of batteries, which ensures the high efficiency of cylindrical battery production.

The only downside is that the production cost of cylindrical cells is higher than that of rectangular cells.

Soft pack batteries use a stacked manufacturing method, so they have a small size, high energy density, excellent heat dissipation performance, and are about 40% lighter than steel-shell lithium batteries and 20% lighter than aluminum-shell batteries in the case of the same capacity. However, the shell strength of soft pack batteries is not as good as that of aluminum shells or steel shells, and their dependence on group assembly technology is strong, making them more difficult to produce and the most expensive.

After weighing the pros and cons, many power battery companies and host manufacturers have begun to vote with their feet. Mr. Fan Wenguang said, “Currently, many large new energy vehicle companies have decided to use economically efficient rectangular/blade LFP batteries and three-element+silicon large cylindrical batteries for middle and high-end models over the next 5-10 years.”

Looking ahead, there will be more changes in the form of power batteries. Although liquid battery technology is mature at present, its energy density is about to reach the upper limit of 350 Wh/kg, and many companies have begun to reserve next-generation battery technology, known as solid-state batteries. Simply put, it is to turn the liquid electrolyte into a solid “electrolyte.”

In terms of performance comparison, solid-state batteries will be superior to existing liquid batteries in ion conductivity, energy density, high voltage and high temperature resistance, and cycle life.

Currently, solid-state batteries are in the research and pilot plant stage worldwide, with Japan in the first tier and China and the US in the second tier, with a technology gap of about 1-2 years.

In addition, WL semi-solid and SES semi-solid batteries have made new attempts, with the core logic being manufacturability and the aim to reuse some mature production processes for current liquid lithium batteries. It is reported that the WL New Energy semi-solid-state battery will be used in the NIO ET7.

Supporting “New Ningwang”?

In just ten years, from BMW in Europe to leading domestic car companies, and then to new forces in the industry, a large and diverse customer base has turned CATL into a legendary enterprise.

In 2012, CATL successfully seized the opportunity to cooperate with Huachen BMW, laying the foundation for its later takeoff. The BMW project not only enabled CATL to grow rapidly but also attracted the attention of other European automakers, who offered olive branches one after another.

Compared with driving cooperation by focalize on point in the European market, CATL’s way of attacking cities and capturing territories directly in China is more direct. It has cast a wide net to win a group of mainstream traditional passenger and commercial vehicle companies, as well as new forces in car-making, Yutong, SAIC, Changan, Geely, GAC, Dongfeng, BAIC, Chery, NIO, WM… The list goes on and on. A commercial empire has emerged.

In 2017, CATL reached the top of the global rankings with an installed capacity of 11.84 GWh, and since then, no one else has been left behind.

On April 4, 2018, shareholders witnessed the miracle of CATL’s IPO. From the disclosure of the prospectus to the successful IPO approval, it took CATL only 24 days, setting a new record for IPO approval. Since then, the stock code 300750 has become one of the best quality stocks.At some point, CATL, the global champion and money-making machine, received a more resonant label – “Ning King.” Meanwhile, its market share continues to climb.

According to the latest data from the Korean market research firm, SNE Research, in 2021, CATL ranked first in global power battery installations, with 36.5GWh more installations than LG Energy Solution, which ranked second. Its market share increased from 24.6% in the previous year to 32.6%. Domestic installation capacity reached 80.51GWh, accounting for 90% of the company’s total business.

Looking at another set of domestic data, the latest data from the China Automotive Power Battery Industry Innovation Alliance shows that in March, the total installed capacity of China’s top 10 power battery manufacturers was 20.44GWh, accounting for 95.5%, of which CATL ranked first with an installed capacity of 10.81GWh, accounting for 50.5% of domestic market share.

To maintain its leading position, CATL is widening its moat. In addition to its continually expanding production capacity, it is exploring sodium-ion batteries, cobalt-free batteries, anode-free financial batteries, lithium-metal batteries, solid-state batteries, rare earth-free batteries, lithium-air batteries, CTP, CTC, and A/B pathways in the technology field.

According to statistics, from 2018 to 2021, the company has accumulated more than 5000 patents, of which the most are at the module and pack levels, close to 25%. Additionally, it has had extensive layout upstream in cathode, anode, electrolyte, diaphragm, equipment, and structural components, with a total of nearly 1605 patents, accounting for 32%.

However, despite its remarkable development speed and bright future, the obvious fact is that CATL cannot swallow the enormous growth space.

From another perspective, monopoly in any industry, whether in global or domestic markets, is harmful to the industry’s healthy development during rapid growth. Conversely, it may not be beneficial to the healthy operation of the enterprise.

At present, the shortage of upstream power battery supply has caused delays in new car deliveries, which is no longer a rare occurrence. Volkswagen, Audi, and Mercedes-Benz have all been forced to delay or even halt the production of some models due to a battery shortage.

In fact, more and more automakers are seeking “secondary supply” or even “tertiary supply” to reduce risks and ensure more stable supply chains, which is largely an opportunity for second-tier battery manufacturers.On the evening of February 24th, Xinyangda announced that the company’s board of directors has approved a capital increase proposal, agreeing to 19 enterprises’ capital increase by a total of 2.43 billion yuan RMB for its subsidiary Xinyangda Electric Vehicle Battery Co., Ltd. Among them, Ideal, NIO, and XPeng’s affiliated companies participated with investments of 400 million yuan, 250 million yuan, and 400 million yuan respectively. In addition, there are other traditional automakers affiliated companies involved. This action undoubtedly provides room for imagination for future cooperation.

On March 16th, Farasis Energy announced a strategic partnership with Mercedes-Benz in the United States. Farasis Energy will provide high-quality, high-safety, and zero-carbon power battery products for Mercedes-Benz’s new generation of luxury pure electric SUV EQS and EQE models. It is reported that Farasis Energy’s new battery factory in the United States will achieve mass production by 2025.

On March 18th, EVE Energy was selected as a supplier for Bosch to provide lithium-ion power batteries for auxiliary applications in electric vehicles for the global market.

It is reported that Fudi Battery under BYD has signed designated cooperation agreements with NIO and Xiaomi Motors.

The rise of second-tier players in the industry will inevitably ease some of the anxiety at the industry level, and whether it is a small part or a large part depends on whether they can seize the opportunity.

Final Remarks

Today, a group of excellent electric vehicle companies has emerged in the Chinese market, which is a unique phenomenon globally. With their rise, power battery companies such as CATL, BYD, Guoxuan High-Tech, and FENC also emerged and were once sought after by the capital market.

Achievements can only belong to the past, and challenges are always ahead. In the unprecedented upheaval, whether it is those who change the direction of the tide or those who dance with the times, they are still on the road of innovative change.

From the perspective of the market, the systematic anxiety of the power battery industry in the short term is difficult to resolve quickly. Even from an optimistic perspective, it is unlikely that the resource supply of the industry chain can achieve balance by around 2025, and there may even be cyclic oversupply of production capacity as predicted by some. The premise is that you can survive healthily until the dawn comes.

In this process, first-tier power battery manufacturers with strong capital will inevitably deepen and broaden their technology roadmaps, continue to invest heavily in upstream resources, and continue to horizontally and vertically integrate customer resources to conquer new territories. Facing the constantly appearing time windows, second-tier players with strong capabilities also have the opportunity to take advantage of the situation and obtain their own piece of the increasingly larger pie.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.