Author|Wang Yunpeng

No matter big or small, anyone who goes out will be subject to someone’s control.

With its small size, low price, and low post-use cost, micro EVs have become the preferred choice for daily commutes, errands, groceries, and picking up children in both first and fourth-tier cities.

In other words, after Laotoule left the market, micro EVs have successfully filled this gap and become a key part of China’s automotive market.

From the sales data, this is also evident. The data shows that from 2019 to 2021, China’s annual sales of new energy vehicles increased from 1.21 million to 3.52 million, with a market share of 13.4%. In the overall hot new energy market, micro EV sales have surged, accounting for 29.8% of sales by 2021.

Since the beginning of this year, micro EV sales have remained strong. The data shows that from January to March, micro EVs sold 264,000 units, accounting for 24.7% of the entire new energy vehicle market.

Although relying on the advantages of low prices, micro EVs still have inescapable shortcomings in passive and active safety, range, and charging due to cost constraints. “Due to the size of the vehicle and manufacturing costs, the space for deformation and energy absorption is insufficient when a collision occurs. At the same time, the price and performance of the vehicle’s seat belts and airbags differ from those of ordinary cars.” Liu Yuguang, Senior Technical Director of the Automobile Evaluation Management Center of the China Automotive Technology and Research Center, has stated.

Based on this, at the 2022 International Summit of Automotive Evaluation and C-NCAP Annual Meeting, the China Automotive Research Center (hereinafter referred to as “China Auto Center”) officially released the “Special Evaluation Regulations for Micro EVs” (hereinafter referred to as the “Regulations”). Under the framework of the C-NCAP and CCRT evaluation systems, the regulations are tailored to micro EVs based on safety and range considerations.

It is worth mentioning that the “Regulations” are scheduled to be implemented on July 1st of this year. From the current situation, although the release of the “Regulations” has not caused many waves, for micro EVs, this is likely the calm before the storm.

What content will the new “test paper” cover?

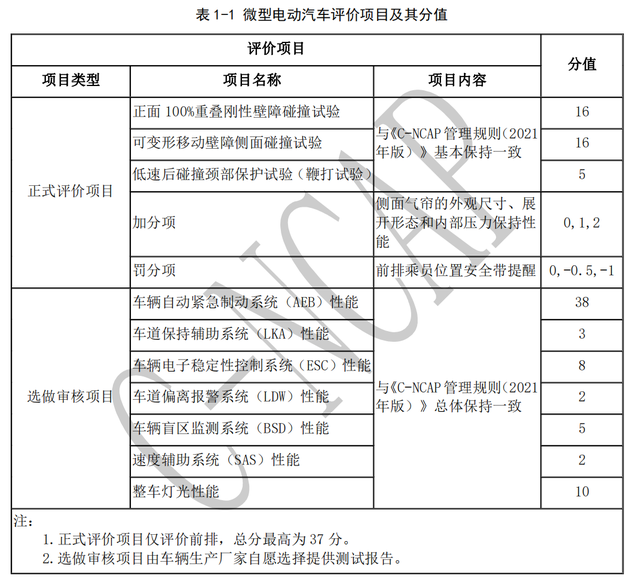

In terms of content, the “Regulations” mainly streamline and simplify the original C-NCAP and CCRT evaluation projects.

After simplification, the evaluation of the “Regulations” mainly includes three sections: crash safety, use safety, and range and charging, applicable to EVs with a length of less than 4 meters.

Combining with the division of car grades in the industry (the length of A-level cars is between 4.3-4.79m), the applicable models of the “Regulations” are A0/A00 level, which are mini electric vehicles. Specific to the model, the current popular ones such as Hong Guang MINIEV and Chery QQ Ice Cream all belong to the tested range of models.

So, how will the three aspects of collision safety, usage safety, and range/charging be evaluated?

For collision safety, the main evaluation is the protection effect of the vehicle body structure and restraint system (such as seats, seat belts, airbags/curtains, etc.) on the internal passengers during a collision accident. The evaluation content mainly includes three items: head-on collision, side collision, and whip test.

Among them, the standards of 100% overlap head-on collision and side collision are the same as those of normal passenger cars. Active safety items such as Automatic Emergency Braking System (AEB), Lane Keeping Assist (LKA), Vehicle Electronic Stability Control System (ESC), and Lane Departure Warning System (LDW) are “optional projects” that car companies decide on their own.

Overall, the evaluation of mini electric vehicles specified by the regulations is stricter than that of regular vehicle models, but the three items of head-on collision, side collision, and whip test can basically meet the safety demands of daily use.

For usage safety, the evaluation content mainly includes five items: charging safety, braking performance, electromagnetic disturbance immunity, submerging electrical safety, and human electromagnetic protection. In other words, it mainly evaluates the safety issues that consumers may encounter during daily vehicle use.

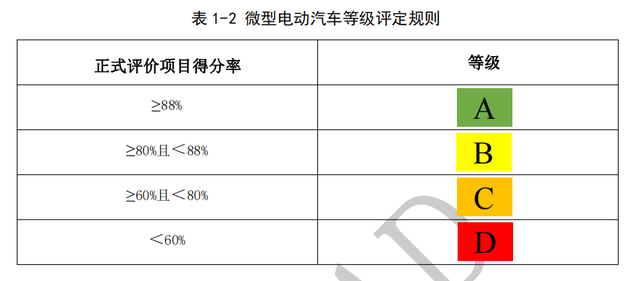

As for the range/charging sector, it mainly includes four items: ambient temperature endurance, low-temperature endurance, low-temperature charging, and charging compatibility. As for rating, the rating method for mini electric vehicles is consistent with other vehicle models, and is divided into ABCD grades based on the scoring rate.

In addition, from the purpose of the “Regulations,” it aims to guide manufacturers to improve the safety of vehicle body structure, add necessary safety configurations such as airbags, and solve user pain points, gradually guiding the performance of mini electric vehicles to be comparable to conventional-sized vehicles. “Through the evaluation, we can know whether a product is a ‘qualified product’ or an ‘excellent product’,” said Liu Yuguang.With the continuous expansion of the market share and ownership of micro electric vehicles, whether it is the three evaluation items subdivided or the “regulations” itself, it is very necessary and timely for the micro electric vehicle market.

Can the existing products pass the “test”?

Public data shows that by the end of 2021, there were more than 40 models of micro electric vehicles on the market. In terms of sales, the sales of micro electric vehicles last year increased by 205.2% year-on-year, exceeding the industry average level. The total sales volume was close to 900,000 vehicles, accounting for about 30% of the sales volume in the new energy passenger vehicle market.

The most intuitive manifestation of the popularity of micro electric vehicles is that last year, out of the top 15 new energy vehicle models in terms of sales, 9 of them were micro electric vehicles. Among them, Wuling Hongguang MINIEV, Chery QQ Ice Cream, and Changan Benben E-Star are among the top sellers.

Of course, compared with hardcore technology and product strength, the popularity of the above-mentioned models is more due to their direct hit on user pain points. Take Wuling Hongguang MINIEV as an example. The price of this car is controlled at around 40,000 yuan. It does not need to pay purchase tax, has no limit on the number of vehicles on the road, and is easy to park. It can also be charged with household 220V power supply. The price is cheap, which can be said to solve many pain points for users.

Because of this, Wuling Hongguang MINIEV quickly became popular shortly after its launch, and handed in a performance report of 426,000 vehicles in 2021.

Although the micro electric vehicle sub-market is hot, including models such as Wuling Hongguang MINIEV, Chery QQ Ice Cream, and Changan Benben E-Star are also favored by consumers. But with the release of the “regulations,” can they really pass the “test”?

The answer may be negative. Taking the active and passive safety of Wuling Hongguang MINIEV as an example. At the beginning of its launch, none of the cars in the series were equipped with ESP, EBA, and airbags. Even the 2021 Hongguang MINI Macaron version only equips a front airbag for the driver, and the ESP body stability system is still missing.

In terms of body motion safety, public information shows that the front anti-collision steel beam of Wuling Hongguang MINIEV is a single-layer stamping part with a thickness of 1.24 millimeters. The A pillar, B pillar, and C pillar use low-strength C-grade and D-grade steel. There is no anti-collision beam on the doors and tailgate. In addition, the energy-absorbing zone in the front row and the crumple zone in the rear row are very small. The safety of Wuling Hongguang MINIEV can be said to be worrying.

This was demonstrated on February 23, 2021, when the Hongguang MINI EV was involved in a serious traffic accident. The result was that the Hongguang MINI EV could not withstand the violent collision with the Audi A4L and could not effectively protect passengers.

In fact, not only the Hongguang MINI EV, but also other popular models such as the Chery QQ Ice Cream and the Changan Benben E-Star have relatively “simplistic” active and passive safety configurations in terms of safety airbags and ESP body stability systems.

In other words, after the implementation of the “regulations,” it is difficult for micro-electric cars currently on the market to pass the collision safety test alone. If the other two tests are added, it remains questionable what rating these models would receive.

“Regulations” may accelerate market reshuffle

Low prices are the key factor that enabled most micro-electric cars to quickly seize the market. At the same time, they may also become the first batch of products to be eliminated.

This can be seen from the once-popular Suzuki Alto, Fuler, and Xiali gasoline models, as well as the EV models such as Zhidou, Zotye Zhima, and Kandi. In other words, even without the “regulations,” the market for micro-electric cars would still undergo reshuffling.

In fact, this is the case. Due to factors such as product limitations, shortage of chips and electricity, rising prices of raw materials, subsidy reduction, and the reduction of carbon credits, the halo of micro-electric cars seems to be fading since the beginning of this year. Data shows that in the first three months of this year, the sales volume of micro-electric cars was 264,000 units, accounting for 24.7% of the entire new energy vehicle market, a decrease compared to 2021.

In addition, the change in policies will also cool down the micro-electric car market. For example, Shanghai has already begun to tighten the green license plate policy, and it is difficult to say that more cities will not introduce more policies that are unfavorable for the sales of micro-electric vehicles in the future. In terms of car companies, brands such as Ola and NETA have announced the suspension of some of their micro-electric car models since the beginning of this year.

Meanwhile, the current domestic electric car market has a “dumbbell-shaped” structure, with best-selling models mainly concentrated in the A00, B, and C-level markets. The A-level market lacks strong products, but this trend has begun to change since 2021. According to the predictions of Dongwu Securities Research Institute, the core theme of the new energy vehicle market this year is the A-level car market with a price range of 100,000 to 200,000 yuan, which may experience explosive growth, with sales reaching 1.7-1.9 million units. The rising sales of A-level electric vehicles will inevitably squeeze the market share of micro electric vehicles.

Meanwhile, the current domestic electric car market has a “dumbbell-shaped” structure, with best-selling models mainly concentrated in the A00, B, and C-level markets. The A-level market lacks strong products, but this trend has begun to change since 2021. According to the predictions of Dongwu Securities Research Institute, the core theme of the new energy vehicle market this year is the A-level car market with a price range of 100,000 to 200,000 yuan, which may experience explosive growth, with sales reaching 1.7-1.9 million units. The rising sales of A-level electric vehicles will inevitably squeeze the market share of micro electric vehicles.

It is worth mentioning that if we consider the “Regulation” to be implemented on July 1, the shuffle speed of the micro-electric vehicle market is likely to accelerate.

Specifically, the “Regulation” stipulates that the vehicle selection principle is determined by the management center based on market performance, and the evaluated models have no plans to stop production in the near future. This means that the currently popular micro electric vehicles are likely to face a “test” while on sale. This will inevitably force micro electric vehicle companies to make choices between maintaining low prices and improving performance.

However, if they choose the latter, the selling price of micro electric vehicles is likely to increase, and it remains to be seen whether consumers will still be willing to pay for it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.