Author: Zhu Yulong

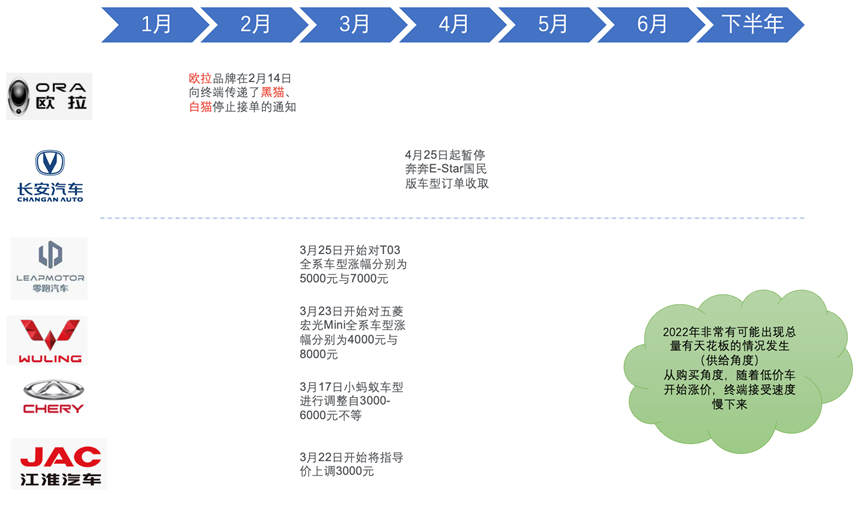

On April 24, Changan New Energy issued a “Notice on Suspending the Acceptance of Orders for the Benben E-Star National Edition“, announcing the suspension of accepting orders for the Benben E-Star National Edition from April 25. There are a total of 7 models of the Benben E-Star, including 5 national editions with a price range of 29,800-53,800 yuan; in addition, there are the Rewarding Edition and the Clearing Edition (with a price range of 74,800-69,800 yuan).

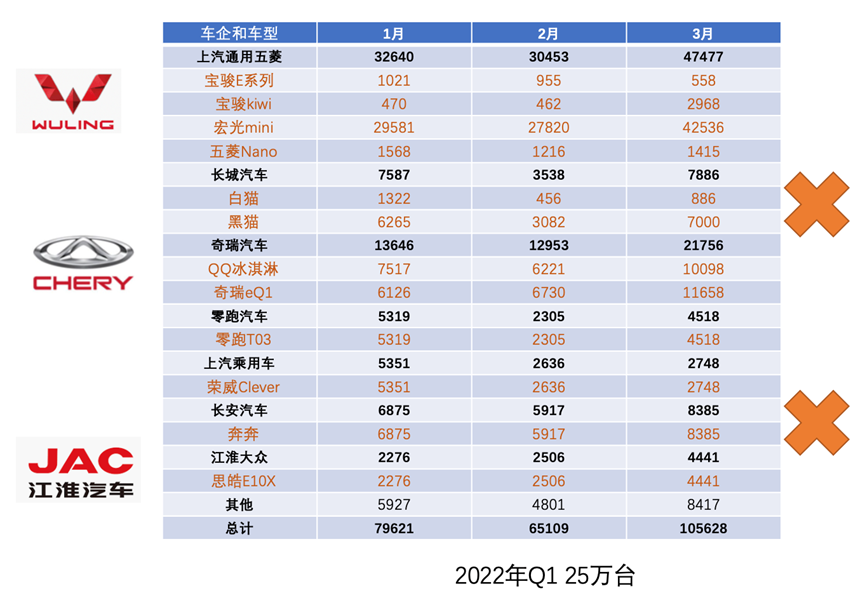

Overall, a total of 250,000 A00 pure electric vehicles were sold in the retail market in Q1 2022. As different car companies are all raising prices, we can make a simple evaluation of the price-sensitive A00 market.

Note: The reopening of the A00 pure electric market is mainly due to the strong pricing power of Wuling’s Mini EV, followed by the boost from Ola’s Black Cat and White Cat, and also with the push of Chery, which led to sales of 825,000 units in the A00 series last year.

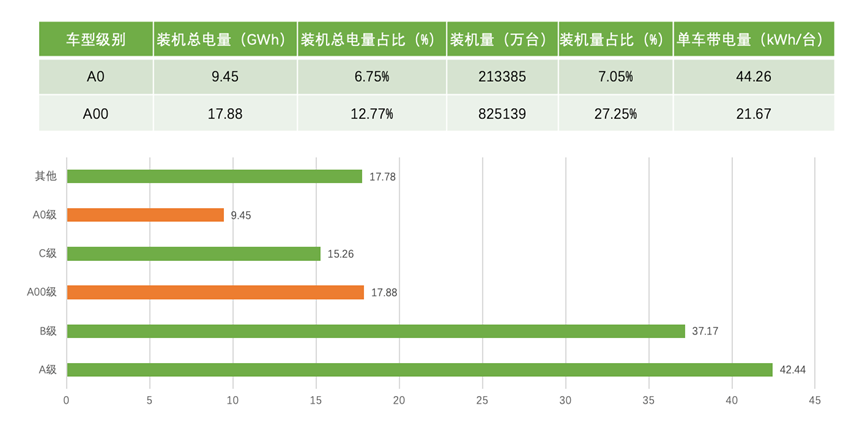

A0 and A00 levels are interconnected, and the entire 80,000-100,000 yuan pure electric vehicle market is a segmented market centered on the dual credit policy. In 2021, the installation volume of A00 and A0 were 825,000 and 213,300 respectively, totaling 1,038,000, accounting for 34.2% of the entire market in 2021.

The average energy density of A00 is 21.67 kWh, and that of A0 is 44.26 kWh, corresponding to demand of 17.88 GWh and 9.45 GWh respectively. From the market perspective, the battery demand for A-level cars in 2021 was 42.44 GWh, 37.17 GWh for B-level, and 15.26 GWh for C-level.

Compared to these markets, the A00 and A0 level markets have the following characteristics:

1. The A00 market is driven by car companies.

From a logical perspective, we can see that SAIC Group, Great Wall Motors, Chery Automobile, Changan Automobile and Jianghuai Group, these companies are selling small cars in order to offset fuel consumption and obtain certain new energy credits, forming a huge difference compared to some car companies whose demands are not obvious. It can be said that the total quantity is pushed along the cost line.As the entire shape of the 2022 dual credit policy has changed, especially with the increase in battery costs surpassing expectations, this logic requires detailed accounting.

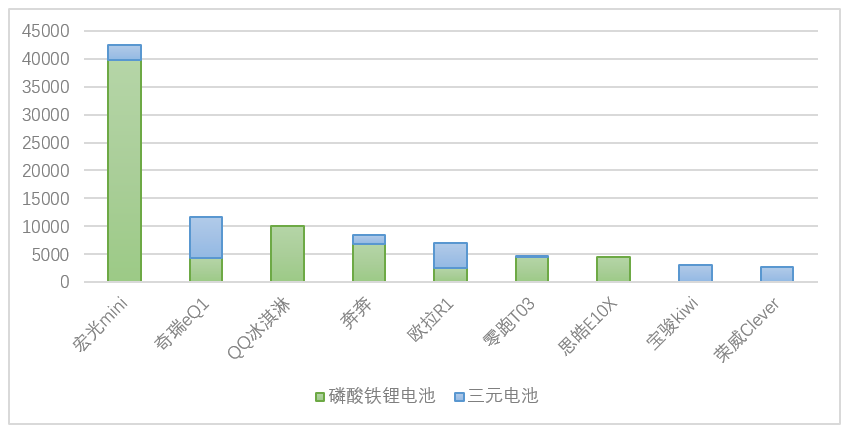

(2) The LFP popularity rate is relatively high, and the driving force for cost reduction is minimal.

As shown in Figure 4 below, major automakers in 2021 have tried their best to use low-cost Lithium Iron Phosphate (LFP) batteries, even the cheapest products on the market, and some even with prices below 0.5 yuan/Wh. With skyrocketing battery raw material prices, even if it rises to 0.7 yuan/Wh, it is still priced around cost, making it difficult for cost absorption.

(3) Is there a premium for A00-level models?

This is the core issue: A00-level models, from the perspective of sales areas, mainly revolve around cities below the third tier. With the price increase, including the manufacturer itself, the market’s enthusiasm decreases. We can see the sales table of models in Figure 5:

- Ola

This brand itself wants to move from low-priced cars towards a personalized electric vehicle brand for women, from black cats and white cats to cherry cats, lightning cats, and so on. Previously, the low-priced cars were considered a negative asset for the brand.

- Changan

Changan intermittently requires dual credits. With the preparation of high-end brands and a large number of plug-in products, low-priced cars have gradually become negative assets for the brand. After all, the scale of traditional cars is large, and selling electric cars at around 30,000 yuan has not been successful.

- Wuling, Chery, JAC, and Leapmotor

My understanding is: With the acquisition by Luxshare Precision, the positioning of new energy vehicles in Chery is also shifting upwards; Leapmotor initially aimed to sell high-performance cost-effective models, and negative gross margins have been criticized a lot. With the enrichment of product matrix in 2022, the T03 of A00 is slowly retreating into the background-this process is the same logic as NETA switching from A0 to A-B levels.

Therefore, from the perspective of 2022, the 250,000 units in the first quarter may be a swan song; with the adjustment of battery and policy prices, this segment market will enter a calm period at both supply and demand ends.

If we split the data on electric cars in March 2022 by unit price, there are four categories:

If we split the data on electric cars in March 2022 by unit price, there are four categories:

-

Low priced: <100,000 RMB. This market includes almost all A00 and some A0 cars.

-

Economical: 100,000-200,000 RMB.

-

Medium: 200,000-300,000 RMB.

-

High-priced: >300,000 RMB.

Statistics for three indicators (sales volume, sales price, and output value) are all based on the sales data of the top 10 car models for each category.

From the sales volume perspective, the percentages of low-priced (36%), economical (25%), medium (20%), and high-priced (20%) categories are associated with 11%, 20%, 30%, and 38% of their respective output values.

It is evident that the sales volume of low-priced vehicles (>100,000 RMB) is about twice as much as that of high-priced ones. However, the average price of high-priced vehicles is 330,000 RMB, which is six times that of low-priced vehicles. Consequently, in terms of their output values, high-priced vehicles are about three times that of low-priced vehicles. Therefore, all automakers have realized that the 200K+ market is a battlefield, and models with monthly sales of tens of thousands must target this market.

Conclusion: In 2022, there is no room for continuing to produce vehicles with a good price-performance ratio. Except for the batteries, the prices of most materials and components are increasing, and relying solely on volume sales won’t work. This year’s growth mainly relies on PHEV and medium- to high-end vehicles priced at 250,000 RMB or more.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.