Author: Su Qin

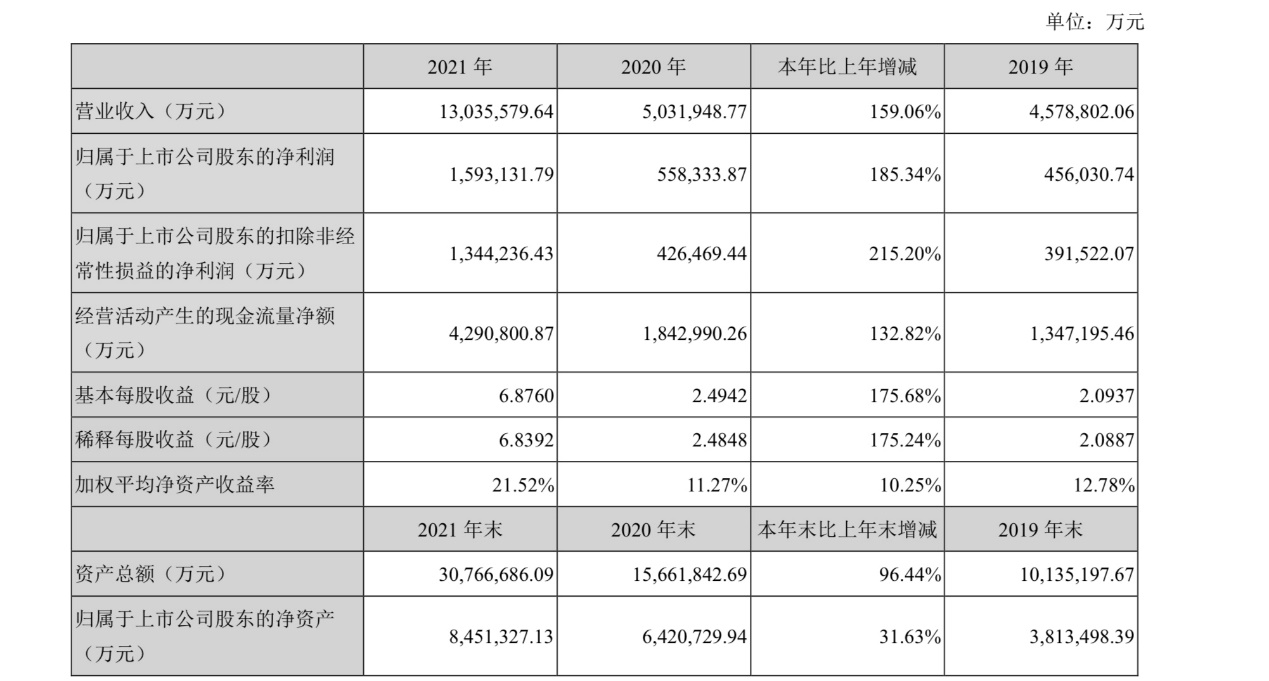

On the evening of April 21st, the 2021 financial report released by CATL (Contemporary Amperex Technology Co. Limited) showed that the company’s operating income was approximately CNY 130.356 billion, a year-on-year increase of 159.06%, and the net profit attributable to shareholders of listed companies was approximately CNY 15.931 billion, a year-on-year increase of 185.34%.

This is the first time that CATL’s operating income has exceeded CNY 100 billion, and the net profit has exceeded the total of the past three years from 2018 to 2020.

Three Major Revenue Projects Contributed Significantly

As a global leader in innovative new energy technologies, CATL focuses on the research and development, production, and sales of power batteries, energy storage batteries, and battery recycling products.

According to SNE Research, CATL has ranked first in global power battery usage from 2017 to 2021 for five consecutive years. According to ICC Xinyi Information, CATL’s global market share of energy storage batteries production was the highest in 2021.

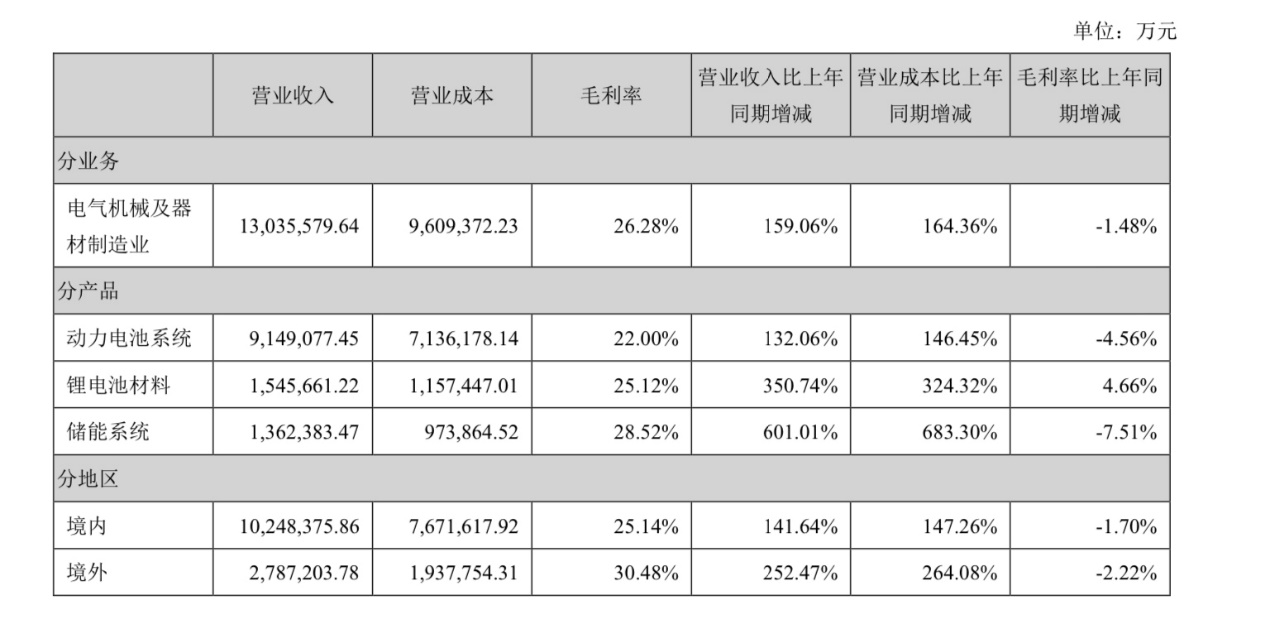

During the reporting period, the sales of power battery systems were the company’s main source of revenue, contributing about CNY 91.491 billion, a year-on-year increase of 132.06%, accounting for 70.19% of total revenue.

This is closely related to the continuous growth in the global new energy market. According to SNE Research, the global usage of power batteries for new energy vehicles reached 296.8 GWh in 2021, an increase of 102.3% year-on-year, showing a rapid growth trend.

During the reporting period, energy storage systems contributed CNY 13.624 billion to CATL’s operating income, a year-on-year increase of 601.01%, accounting for approximately 10.45% of total revenue.

CATL’s main energy storage application field is the front-of-meter market, including power generation and power transmission and distribution. The company has signed strategic cooperation agreements with State Grid, China Energy Construction, China Huadian, EATON, and other enterprises.

In addition, during the reporting period, CATL achieved revenue from lithium battery material sales of CNY 15.457 billion, a year-on-year increase of 350.74%. The report shows that the company’s nickel-iron production project in Indonesia has been put into operation, adding lithium battery material production capacity.

Gross Margin Declines While R&D Investment Continues to Increase

However, it is worth noting that of the three businesses, the only one with an increasing gross margin was lithium battery materials, which increased by 4.66% to 25.12% year-on-year. The gross margins of power battery systems and energy storage systems decreased by 4.56 percentage points and 7.51 percentage points, respectively.The financial report shows that Ningde Times is currently facing risks including: the continued impact of the COVID-19 pandemic on the production and operation of the new energy industry chain; the rapid development of the lithium-ion battery market and the expansion of production capacity by power battery companies, leading to increasingly fierce competition in the market; and rising prices of raw materials needed for production and operation, creating significant cost pressure.

In response, Ningde Times stated that it will continue to increase investment in research and development of products and technological processes, establish an innovative system that covers the entire industry chain, and maintain its leading position in the industry with advanced technology.

Ningde Times has 10,079 research and development technical personnel, including 170 with doctoral degrees and 2,086 with master’s degrees. The company and its subsidiaries have a total of 3,772 domestic patents and 673 foreign patents, and are applying for a total of 5,777 domestic and foreign patents.

The financial report shows that Ningde Times invested approximately RMB 7.69 billion in research and development in 2021, compared to approximately RMB 3.57 billion in 2020.

Tesla Becomes the Largest Customer

The financial report shows that Ningde Times regards “building customer ecology and coordinating industry development” as an important core competitiveness.

In terms of power batteries, Ningde Times has the widest customer base, and has close cooperation with global customers such as Tesla, Hyundai, Ford, Daimler, Great Wall Motors, Ideal, and NIO.

The total sales of Ningde Times’ top five customers reached approximately RMB 40.826 billion, accounting for 31.32% of the total sales.

Among them, Tesla has become Ningde Times’ largest customer. In 2021, the fulfillment amount of the procurement contract between Ningde Times and Tesla was RMB 13.039 billion. The two parties signed a supply framework agreement in June 2021, and Ningde Times will supply products to Tesla from 2022 to 2025.

It is worth mentioning that Ningde Times’ overseas business is growing rapidly. In 2021, Ningde Times’ overseas revenue reached RMB 27.872 billion, a year-on-year increase of 252.47%. The overseas gross profit margin was higher than that of the domestic market, reaching 30.48%.

As of December 31, 2021, Ningde Times’ total assets were approximately RMB 307.667 billion, an increase of 96.44% from the end of 2020.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.