Article by: Leng Zelin

Edited by: Wang Pan

At the 2017 NIO Day, Li Xiang, as the 82nd NIO car owner and founding investor, drove the NIO ES8 and took the stage at the press conference, spending nearly ten minutes elaborating on the numerous advantages of the ES8.

However, at the launch event for IDEAL ONE one year later, Li Bin sat with Qin Lihong in the audience silently observing Li Xiang.

Another top player, Xpeng Motors, also frequently engages in such interactions. Whether it’s Li Bin showing up at Xpeng’s auto show booth, or Li Xiang calling out to He XPeng and Li Bin as brothers-in-arms through the internet.

Of course, being in the same industry also means inevitable friction. Compared to Xpeng, NIO and IDEAL have more similar models and pricing, resulting in a higher degree of overlap in their customer base, which has led to the most frequent friction between NIO and IDEAL in recent years.

At the 2018 IDEAL launch event, an embarrassing scene occurred when Li Xiang mentioned the issue of electric car resale value: “In a few years, used electric cars with a range of two to three hundred kilometers will be like chicken ribs – useless.” Completely ignoring Li Bin and Qin Lihong in the audience, as at that time the NEDC range of NIO ES8 was only 355km.

Since then, from the “38th Car Reviewer” incident, NIO executive Shen Fei’s pessimism towards extended range, to Li Xiang’s criticism of pure electric vehicles, and various intentional and unintentional behaviors of hiding the other company’s models in rankings, both parties have had to put aside their “friendship” for the sake of their company’s interests.

Recently, IDEAL was embroiled in the “ascending Buddha hill” incident. Not only did Lan Tu release a picture saying “let’s ascend Buddha hill together,” but NIO also took a jab at their former ally, publishing an article on their official account saying, “Isn’t it just climbing a hill?”

NIO and IDEAL are like bordering great powers: they occasionally have disputes and push and shove each other, but as long as they don’t touch each other’s core interests, they often turn small things into nothing and maintain a good relationship on the surface.

However, the relationship between these three companies may be placed squarely in the public eye this year.

As we stated in a previous article, this year is particularly important for most new players. They need to seize as much market share as possible before subsidy policies end, traditional automakers transform, and the internet enters the market, laying a solid foundation for further marketization.

For NIO, this year is especially critical. The aftermath of the funding crisis in 2019 has affected its development and product planning for the past two years, resulting in the delay of NIO ET7 and software updates. Therefore, this year should be a year for NIO to catch up with sales after making up for lost time.Apart from this, we also see that the middle and low-end markets where the core power lies have gradually begun to increase, while the middle and high-end markets are becoming increasingly crowded. From traditional car companies to new forces and to Internet technology companies, they have all planted seeds in this market. The time of a hundred flowers blooming is not far away.

The roads of NIO and Xiaoli walked together, but their hearts are gradually moving apart.

The War of Car Models

Before 2022, NIO and Xiaoli had a feeling of “sympathy with each other” in terms of pricing and model selection.

XPeng is mostly priced between 150,000 and 250,000 yuan, NIO is between 350,000 and 550,000 yuan, and XPeng’s ideal price range is between 328,000 and 338,000 yuan. They each dominate in the fields of sedans, SUVs, pure electric, and extended range. However, this balance will be completely broken this year.

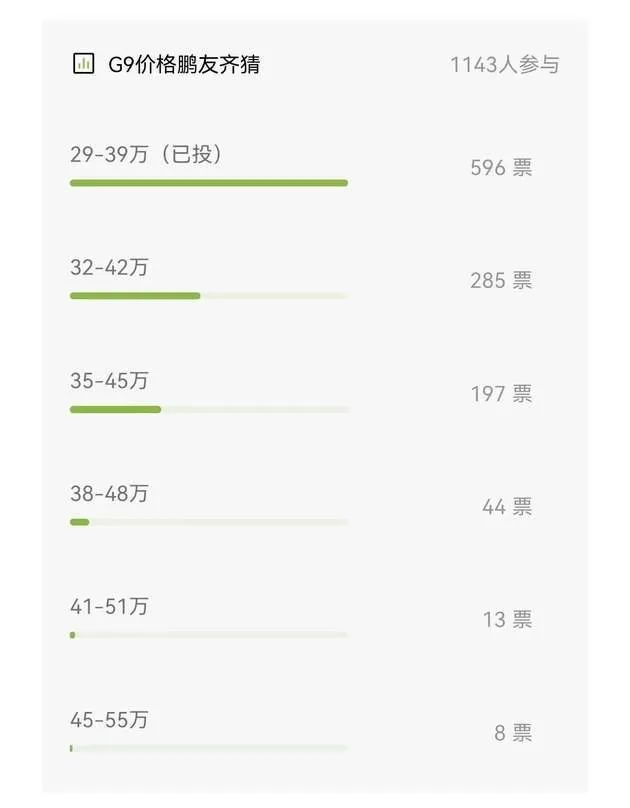

XPeng will release its first medium to large SUV in June. Although the price has not yet been revealed, in its official activities, most car owners chose a price range of 290,000 to 390,000 yuan. This price range highly overlaps with NIO’s current best-selling models ES6 and EC6.

EC6 and ES6 models accounted for approximately 77% of NIO’s vehicles delivered in the fourth quarter, which is truly NIO’s main models.

In addition to XPeng, Ideal Auto has also started to launch an “attack” against NIO, pushing up into its brand’s price range.

Since last month, Ideal has planned a series of L9 pre-heating activities. Although the press conference originally scheduled for April 16th was postponed due to an irresistible reason, a lot of information has still been released in the continuous “spoiler” activities.

The price range for Ideal L9 is tentatively set at 450,000 to 500,000 yuan according to different configurations, which is different from the previous single-price mode, indicating that Ideal has given up the strategy of forcing sales and chose to learn from NIO by giving users more choices.

Similarly, as a six-seater SUV priced between 450,000 and 500,000 yuan, the pricing and model of Ideal L9 overlaps with NIO’s ES8. In today’s market where cars are becoming more and more like phones, the idea of buying new instead of old is most people’s preference. The falling behind of NIO’s sales last year has also proved that the market competitiveness of these three models is gradually weakening with the launch of more new cars.

In fact, although the new energy trend has been blowing for several years, new energy medium to large SUVs priced between 400,000 and 500,000 yuan are still almost blank in the market, except for the Audi Q5 e-tron launched in February this year, and the higher-priced GAC New Energy HiPhi X. It can be said that in the past, the ES8 was fighting against “air”, and the performance of the ES8 may be affected after the introduction of L9.

After all, who can refuse a car that can connect to the Switch?

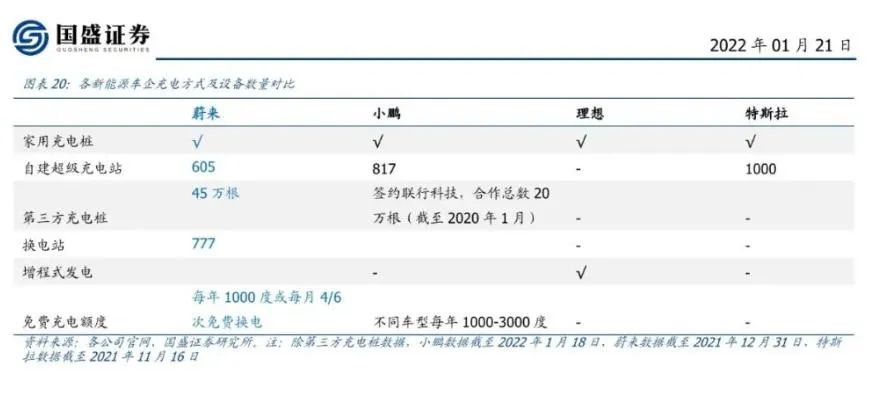

Apart from its products, NIO’s services have always been seen as one of its competitive advantages. Its battery swap mode has been recognized by many users. The second-generation battery swap station launched last year reduced the replenishment time to 3 minutes and even surpassed refueling in terms of user experience.

However, this advantage is gradually diminishing, and XPeng and Ideal’s new cars have also given their own solutions.

Ideal L9 still uses the range extender, but has made improvements in terms of range compared to Ideal ONE. The battery pack has been expanded from 40.5 kWh to 44.5 kWh, and the fuel tank has been increased from 55L to 65L, achieving a comprehensive range of 1315 kilometers. As for the formerly criticized range extender, it now uses a 1.5T four-cylinder engine to dispel users’ concerns.

At the same time, Ideal’s 800V high-voltage pure electric platform whale and shark will also be launched before 2025. It is not difficult to see that Ideal has chosen to take a two-pronged approach with range extender and fast charging, which is consistent with Li Xiang’s previous strategy: “Pure electric models will not be introduced until fast charging technology matures.”

XPeng G9’s answer is the 800V high-voltage SIC platform and 480kW high-power charging station. Official data shows that 5 minutes of charging can give a range of 200 kilometers.

In comparison, perhaps due to the conflict between battery swapping and fast charging, NIO is not particularly keen on high-voltage fast charging, and has not yet released much information in this area.

Although the models of various companies are moving towards integration, they have given different answers in terms of details such as range and replenishment. Currently, NIO still has an advantage in resolving battery renewal and attenuation issues with its battery swap mode. At the same time, according to data from Guosheng Securities, NIO’s layout in the replenishment system is far ahead of the other two companies.

Of course, NIO will not turn a blind eye to Ideal and XPeng’s “stationary output”.

Li Bin himself has repeatedly revealed his appreciation for the NT2.0 platform. The three new models sold by NIO this year are all based on the second-generation platform. Among them, the ET5 adopts the BaaS solution and starts selling at a price of 258,000 yuan, which will directly compete with XPeng’s current main model P7.

New energy vehicles priced at 200,000 yuan have lower entry barriers and a broader audience. XPeng P7, Tesla Model 3, and BYD Han have all gained considerable traction in this price range.

According to the latest WeChat index from 42 Garage, three out of the top five new energy vehicles are in this range. ET5 will likely also play this role in NIO’s product planning.

On the other hand, NIO’s brand aimed at the mass market has entered a crucial stage of product development, and Li Bin will soon lead his team from Hefei to Changzhou and Zhaoqing.

Who will win the competition, is it the upward-reaching XPeng and Ideal, or the downward-punching NIO?

The war for talent

If the competition for car models is not yet apparent, the competition for talent has completely torn apart the surface relationship between NIO and XPeng.

In March of this year, Huang Xin, the former chief of XPeng’s autonomous driving product, joined NIO as a vice president and directly reported to Li Bin. It is reported that Huang Xin promoted the implementation of XPeng’s NGP and memory parking projects during his tenure.

Personnel circulation is not rare, but the high-level “internal circulation” within the three NIO companies started by Huang Xin is a new phenomenon. This also shows that traditional car companies and the Internet can no longer provide the talent required for new car manufacturing, especially in autonomous driving and algorithms.

In fact, since 2020, talent in new car manufacturing has begun to return, and many NIO executives have chosen to leave new car manufacturing and return to traditional car companies.

For example, Zhu Jiang, the former vice president of NIO responsible for user development, went to Ford China after leaving in 2020. Zhao Yuhui, the former NIO user vice president, also joined Great Wall Motors in the same period and served as the general manager of the user center of Great Wall Sales Company. Zheng Xiancong, the former executive vice president of NIO, “retired” from NIO in 2019, but joined Foxconn as the chief executive officer of the electric vehicle platform at the beginning of last year.

This is also related to the sense of crisis among traditional car companies. Some companies have begun to prevent further talent loss by increasing salaries and conducting equity incentives.

An engineer who comes from traditional car companies once told a Photon Planet reporter that he switched to Voyah in early 2021, immediately followed by many former colleagues who started to switch jobs. In order to prevent further talent loss, the former company launched a new round of salary increases, with a general salary increase of 20%-30%.

Not only salary increases, but independent brands of some traditional car companies have also offered equity incentives to their employees.

In March of this year, Guangqi E-An announced in its mixed-ownership reform that it would implement equity incentives for 679 employees of Guangqi E-An and 115 technology personnel of Guangqi Research Institute through non-public agreement of capital increase, with a total investment of 1.781 billion yuan.

This not only stimulates the entrepreneurial vitality of employees, avoids falling behind in the face of the impact of new forces, but also binds talent and enterprises together.On the other hand, in the organization and cultural traditions, traditional automakers are gradually catching up with the trend of new car manufacturing. In 2020, Great Wall Motors proposed the “decentralization” initiative in its organizational restructuring, while Dongfeng Motor Corporation internally required that its employees be addressed as “teachers”. All of these initiatives aim to eliminate hierarchical barriers and accelerate internal information flow within the company.

In addition, the entry of internet technology companies has also accelerated the phenomenon of “talent return”. If there are doubts about whether traditional car companies can eliminate long-standing problems through reform, the entry of internet companies has given talents more choices.

Zhu Jiang, who had just completed his first year at Ford China, once again jumped to Jidu as Vice President and Head of User Development and Operations. Guo Yandong, Chief Scientist of XPeng Motors, as well as visual experts Tao Xunqiang and Feng Tianpeng, joined OPPO last year.

In addition to job-hopping, many executives choose to start their own businesses after polishing their skills in new car manufacturing.

An entrepreneur in the automotive wiring harness industry told “Photon Planet” that the automotive industry supply chain is lengthy, and many stages are still controlled by foreign companies. In his view, the emergence of new energy vehicles not only subverts consumers’ perception, but also provides an opportunity for domestic supply chains.

For example, with wiring harnesses, many models from traditional luxury brands often have problems with wiring during the debugging period just after production. Aging of wiring harnesses can also cause some functions to malfunction over time.

Especially for new energy vehicle models that emphasize intelligence, the use of wiring harnesses is much higher than traditional models, and there is a higher demand for high-voltage and high-speed wiring harnesses. When new requirements arise and traditional foreign suppliers fail to keep up, it becomes an opportunity for domestic supply chains to compete for market share.

Similarly, Zhang Jianyong, former Assistant Vice President of Autonomous Driving at NIO, will also invest in a chip start-up project. Huang Chendong, former Senior Vice President in charge of NIO’s electric power engineering team, founded Qianchen Automobile after leaving.

Huang Xin’s joining of NIO is only the beginning of the talent war in NIO. In the future, it will become increasingly difficult for new car manufacturers to dig suitable talents from traditional car companies and internet industries, and talent “internal circulation” may become the norm for new car manufacturers.

Conclusion

It is not difficult to see that in the current trend of traditional automakers and internet car companies laying out their markets, new car manufacturers also feel a sense of crisis. New car manufacturing is no longer simply competing with fuel-powered cars.

The competition between new car manufacturers, between new car manufacturers and traditional car enterprises, and between new car manufacturers and internet companies will become increasingly fierce.

During XPeng Motors’ dual listing in Hong Kong last year, He XPeng told Photon Planet, “Today, every company is preparing for war, and industry competition has entered the Warring States period from the Spring and Autumn period.”

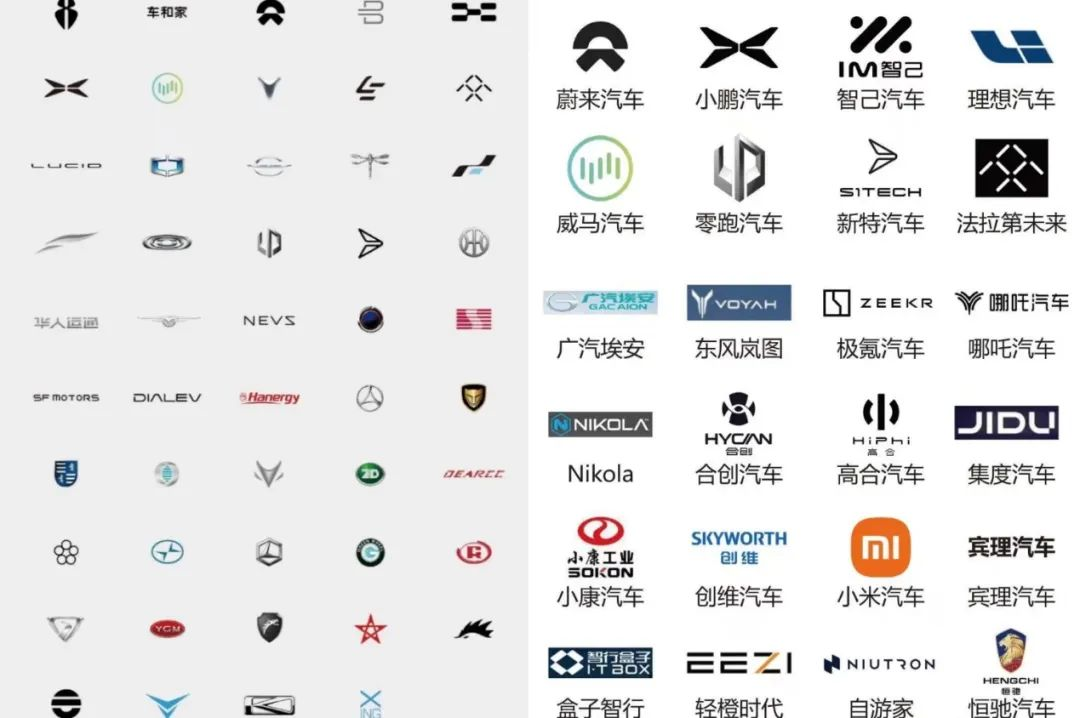

A few years ago, there were a lot of car companies who made cars with PPT. A picture with dozens of car logos became popular on the internet. However, after experiencing the new energy vehicle “winter” from 2019 to 2020, one by one the logos were crossed out.

A few years ago, there were a lot of car companies who made cars with PPT. A picture with dozens of car logos became popular on the internet. However, after experiencing the new energy vehicle “winter” from 2019 to 2020, one by one the logos were crossed out.

But as some car companies were going bankrupt, new logos have emerged on paper, as if just exchanging old symbols for new ones.

Perhaps the charge for a full-scale war has already been sounded, so is the new round of reshuffling still far away?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.