After Tesla’s earnings report came out, I read it thoroughly, and there are only two words to describe it: “explosive profits.”

In Q1 2022, Tesla sold 310,000 cars, accounting for $18.8 billion. Net profit increased by 658% YoY, reaching a record-breaking $3.32 billion! The gross profit margin per car reached 32.9%! The global market average inventory cycle is only 3 days!

How did Tesla make so much profit?

In Q1 2022, Tesla delivered more than 310,000 new cars, a slight increase compared to 300,000 in Q4 2021. But the profit skyrocketed from $2.32 billion to $3.32 billion!

Typically, with a slight increase in sales, the profit does not shoot up. I was very curious about how they achieved such high profits.

On the earnings conference call, Ma Yilong said that in addition to the increase in delivery volume, the reason for the explosive increase in profit was due to multiple price increases.

It is true that prices have gone up. In just one week in March of this year, Tesla China raised prices on its products three times. The price increase for the Model Y rear-wheel drive version was as high as RMB 15,000.

After several price increases, Tesla’s gross profit margin per car continued to rise from just over 30.6% in Q4 2021 to 32.9% in Q1 2022, a very impressive number. This means that Tesla earns a minimum of $9,200 per car sold.

On the earnings call, Musk defended Tesla’s pricing strategy: “Our vehicle ordering cycle is very long, and orders for many models are already scheduled for next year. Therefore, the pricing we have given now has actually taken into account the possible increase in supply chain and logistics costs that may occur in the next 6 to 12 months.”

This leads to another question: why can Tesla’s gross profit margin continue to soar even with rising battery costs, chip prices, and declining subsidies, which have caused virtually all pure electric vehicle models, even extended-range electric vehicles, to increase in price? Tesla has always followed the cost pricing principle, and the soaring raw material prices are making it more challenging, so how can their profit margin continue to be so high?

- First, Tesla is delivering high gross profit margin models: from the sales ratio, it can be seen that sales of the Model S/X, which have higher selling prices and higher gross profit margins, have increased further. At the same time, the new Berlin and Texas factories are producing primarily higher gross profit margin Model Ys.- The second one is the deferred revenue brought by FSD. As FSD capability gradually improves, more and more users are willing to pay extra for FSD software. In the latest interview, Elon revealed that FSD Beta has already been pushed to 100,000 customers.

Ma Yilong also earned a fortune

2022Q1 was not only a lucrative season for Tesla, but also for Ma Yilong himself.

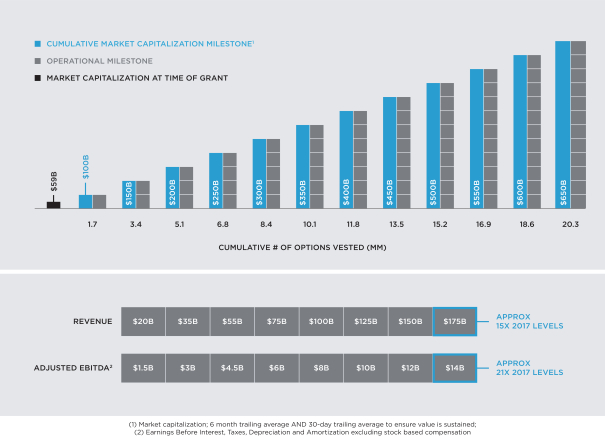

We know that Ma Yilong does not receive a salary from Tesla, and relies entirely on the incentive plan arranged by the Tesla board. Tesla has had a very good financial performance and production capacity since last year, and the Q1 2022 financial report is still impressive.

This enabled Ma Yilong to unlock his generous incentive options. Ma Yilong can purchase 25.32 million shares of Tesla’s stock at a price of $70.01 per share, which are worth $24.7 billion (Wednesday’s closing price for Tesla’s stock was $977). However, Ma Yilong needs to hold the shares for 5 years according to the requirements. Therefore, acquiring Twitter is not a difficult task for him.

Will Q2 also be a “money-making” season?

The second highlight is the 3-day inventory cycle, which means that it only takes less than a week from car production to delivery, making every Tesla the freshest one. It is as good as the medical supplies during the Shanghai anti-epidemic campaign. The car was produced on April 19, and was delivered to me on April 21.

However, the problem brought by the short inventory cycle is that once the factory shuts down, the delivery will also be suspended.

We know that the Shanghai factory is the backbone of Tesla. Before the epidemic prevention and control started in March, 66,000 cars were produced in the Shanghai factory. Due to the continuous outbreak of the epidemic, the Shanghai factory of Tesla also shut down on March 28.

The good news is that Tesla announced that it started to resume work and production on April 19.

But considering that Shanghai has not completely lifted its epidemic prevention and control measures, it is not optimistic for Tesla to quickly restore its production capacity to the level of March. Tesla’s Chief Financial Officer, Zach Kirkhorn, said that “Production is ramping back up slowly and Tesla is working hard to restore full production as soon as possible.”

According to our normal logic, Ma Yilong, although he can rely on last quarter’s high profits and incentive bonuses to feel “safe” (rich), still needs to think seriously about the impact of the epidemic on the Shanghai factory’s sales, and Q2’s sales may not be optimistic.At this moment, on the earnings call, a stubborn voice came from the other end of the line – it was Elon Musk. He insisted that Tesla’s Q2 deliveries would remain essentially flat compared to Q1, and that the company would complete its goal of delivering a total of 1.5 million vehicles this year!

This stubbornness of Musk’s is due to the opening of new factories one after another. One is the German Berlin factory that was delayed for 8 months, and the other is the giant new factory in Texas, USA.

On March 22nd, Musk put on a formal suit and danced gracefully in front of the camera at the Berlin factory. However, the factory, which has a planned annual capacity of 500,000 vehicles, may produce only 54,000 vehicles this year, even if factors such as water shortages and labor shortages are excluded, at most can make up for a month’s output of the Shanghai factory.

On April 8th, the Texas factory, which has a planned annual capacity of 1 million vehicles, opened. It is clear that Musk has high expectations for the Texas factory. However, the factory is currently in the state of debugging and increasing production, and how much it can contribute next quarter and how much it can produce this year is still unknown.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.