Highlights of the Financial Report

Financial Data:

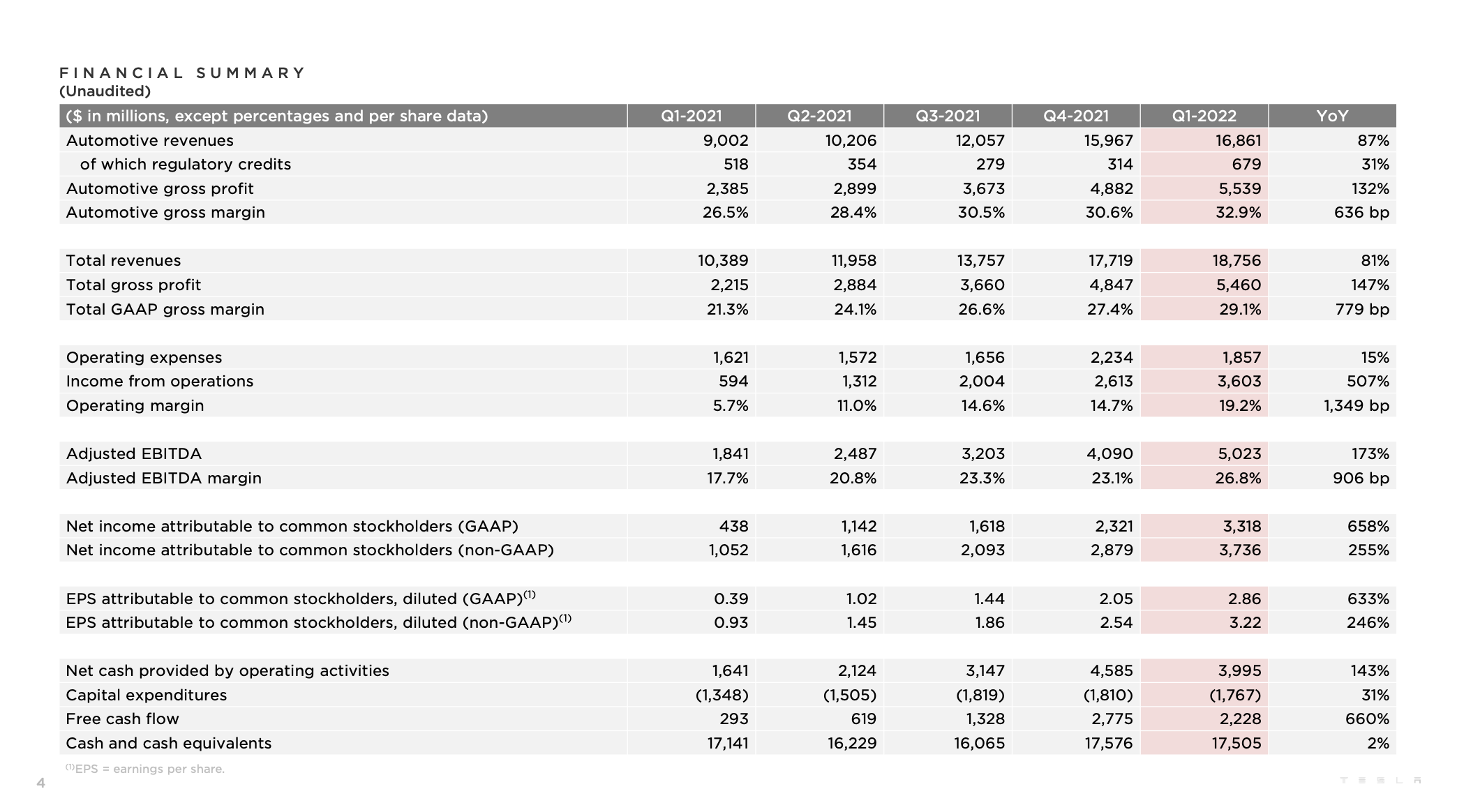

- In Q1 2022, the total revenue was $18.756 billion, a QoQ increase of 5.85%, and a YoY increase of 81%. The revenue for the automotive segment was $16.861 billion (including $679 million from the sale of carbon emission credits), a QoQ increase of 5.6% and a YoY increase of 87% (with carbon emission credit revenue seeing a YoY increase of 31%).

- The automotive segment’s gross profit was $5.539 billion, a QoQ increase of 13.5%, and a YoY increase of 132%.

- The total gross profit was $5.460 billion, with an overall gross margin of 29.1% and a per-vehicle gross margin of 32.9%.

- Cash and cash equivalents reached $17.505 billion.

- GAAP net profit was $3.32 billion.

- Operating cash flow minus capital expenditure (free cash flow) was $2.228 billion.

- GAAP-based operating revenue was $3.6 billion, with an operating profit margin of 19.2%.

Financial Summary:

Q1 total revenue amounted to $18.8 billion, an increase of 81% QoY, due to increased delivery volume, higher per-vehicle sales prices, and growth in other business areas. Operating revenue increased to $3.6 billion, and the operating profit margin reached 19.2%. Thanks to $2.2 billion in free cash flow, total debt fell below $100 million.

Delivery Data:

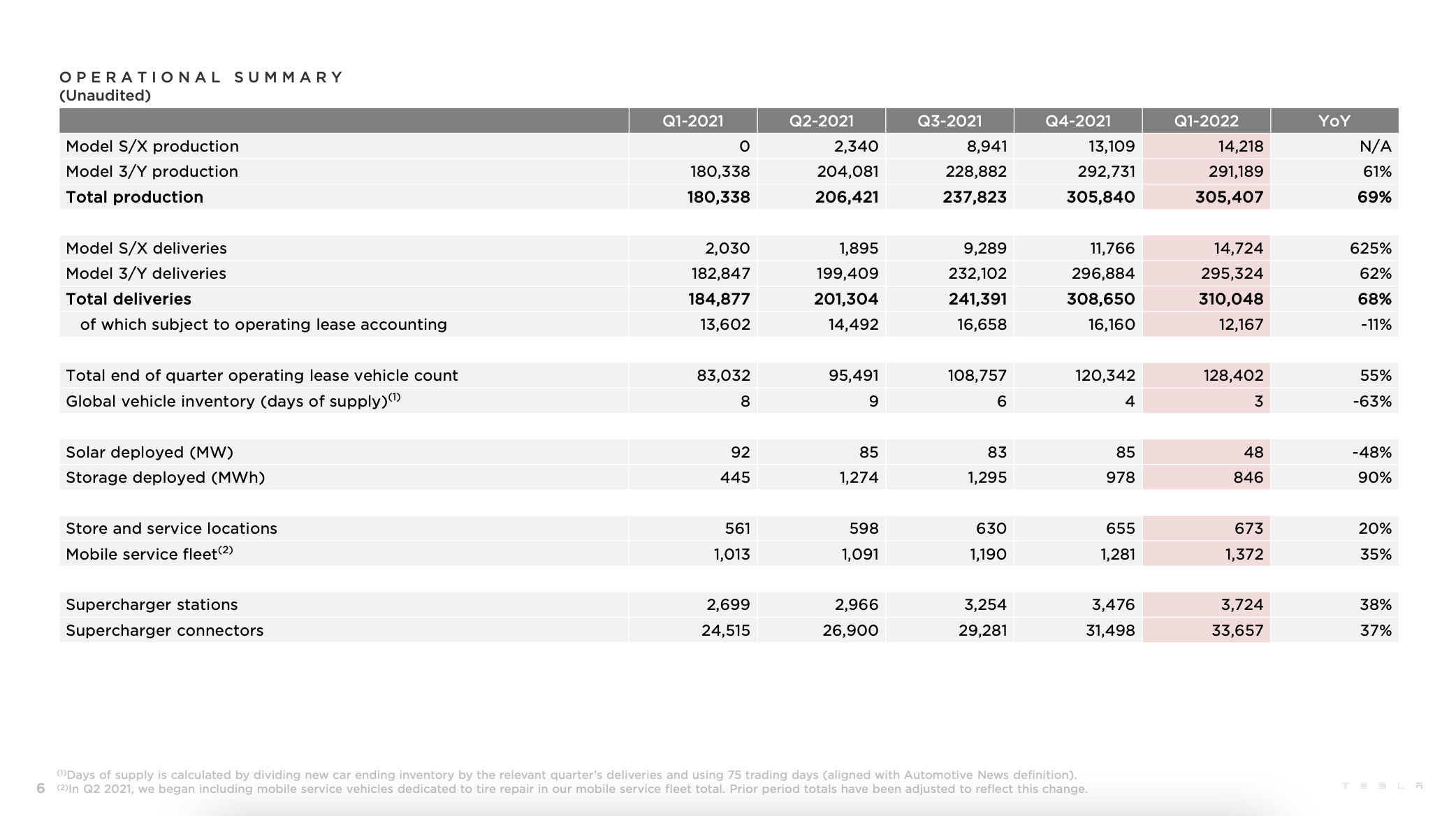

- In Q1 2022, the total production volume was 305,407 units, including 14,218 Model S/X vehicles and 291,189 Model 3/Y vehicles, similar to Q4.

- The total delivery volume was 310,048 units, including 14,724 Model S/X vehicles and 295,324 Model 3/Y vehicles.

- The average global market inventory cycle was three days, down from four days in the previous quarter, a 63% YoY decrease.

Factory and Capacity:

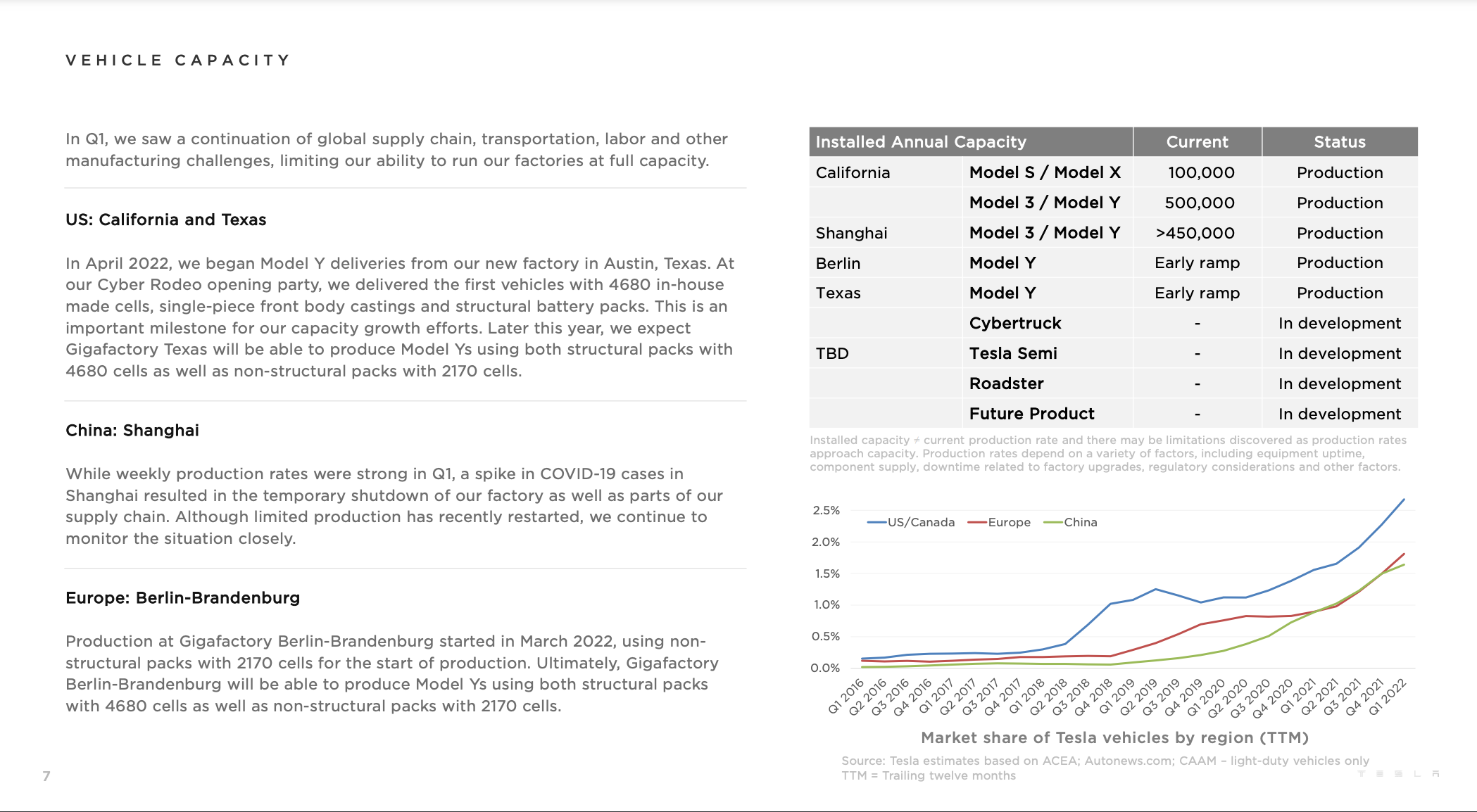

Tesla stated that Q1 was adversely affected by persistent global supply chain disruptions, logistical challenges, and various other manufacturing side challenges, impeding the company’s planned vehicle production capacity and factory full-rate operation.

-

California/Texas, USA:In April 2022, the Texas GigaFactory began production and delivery of Model Y equipped with 4680 batteries.

-

Shanghai, China:

The Shanghai GigaFactory was briefly shut down due to the pandemic, and suppliers were also affected, but production has now resumed. -

Berlin, Germany:

The Berlin GigaFactory began production in March.

Energy Business:

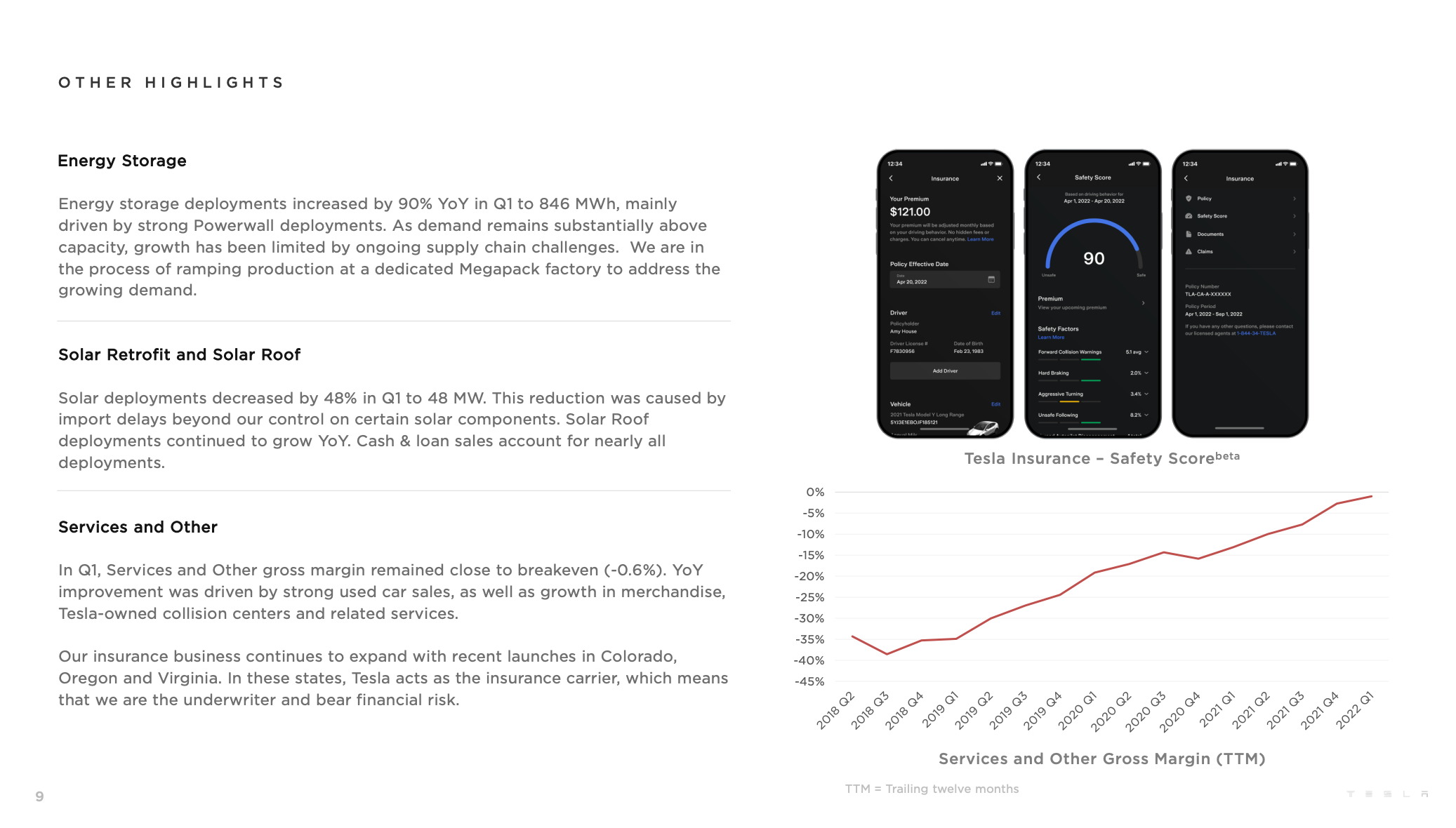

- The increase in Powerwall deployment had a major impact, with energy storage deployment in Q1 growing 90% year-on-year to 846 MWh. Solar energy deployment fell 48% year-on-year to only 48 MW, mainly due to import restrictions on components.

Others:

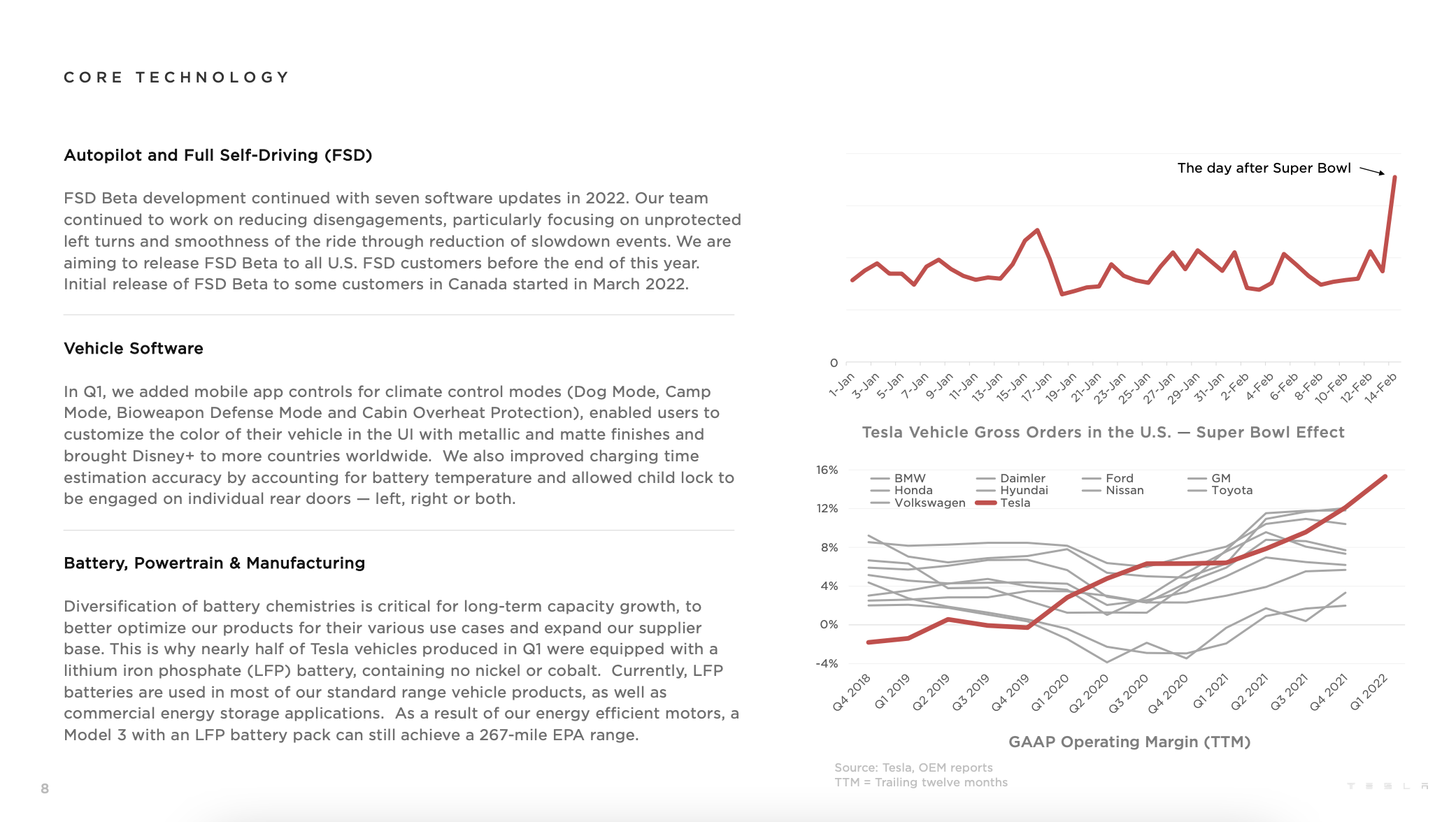

- Tesla FSD Beta will be rolled out to all FSD subscribers in the United States later this year, with the first batch of rollouts in Canada beginning in March.

QA Highlights

- The production volume of the Shanghai factory reached a new high in Q1 2022, and production in Q2 is expected to be higher than in Q1, despite the impact of the pandemic.

- Tesla is confident in achieving a 50% production volume growth this year, reaching 1.5 million vehicles.

- Last year’s production volume of 100 vehicles was only a start, with the ultimate goal of producing 20 million vehicles per year.

- Mass production of Cybertruck is expected to be achieved in 2022.

- It will take a few more years for the 4680 battery to be applied to Model 3.

- 800V has no significant advantages in small cars and comes at a higher cost. Tesla is considering using 800V voltage for Cybertruck and Semi.

- The importance of Optimus will gradually become apparent in the next few years, which will be more valuable than the automotive business or FSD.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.