The Impact of COVID-19 on the New Energy Vehicle Industry

Author: Wang Ci

Editor: Qiu Kaijun

On April 12, “Electric Vehicle Observer” conducted a survey on the impact of the COVID-19 pandemic on the new energy vehicle industry. The survey shows that 90% of the companies surveyed are experiencing various degrees of impact. 36.1% of the respondents said that the production or sales volume of their companies has decreased by more than one third.

Among the directly affected factors, nearly six out of ten respondents chose logistics stagnation, while nearly four out of ten respondents chose parts shortage, which is also related to logistics.

Decrease in Production and Delivery Delay

The survey covered OEMs, parts manufacturers, raw material factories, after-sales markets, and charging operation companies, and most of the respondents were in management positions, with sufficient knowledge of their companies’ situations.

The survey shows that the pandemic has had a wide-ranging impact, with only 10% of the respondents saying that their companies have not been affected.

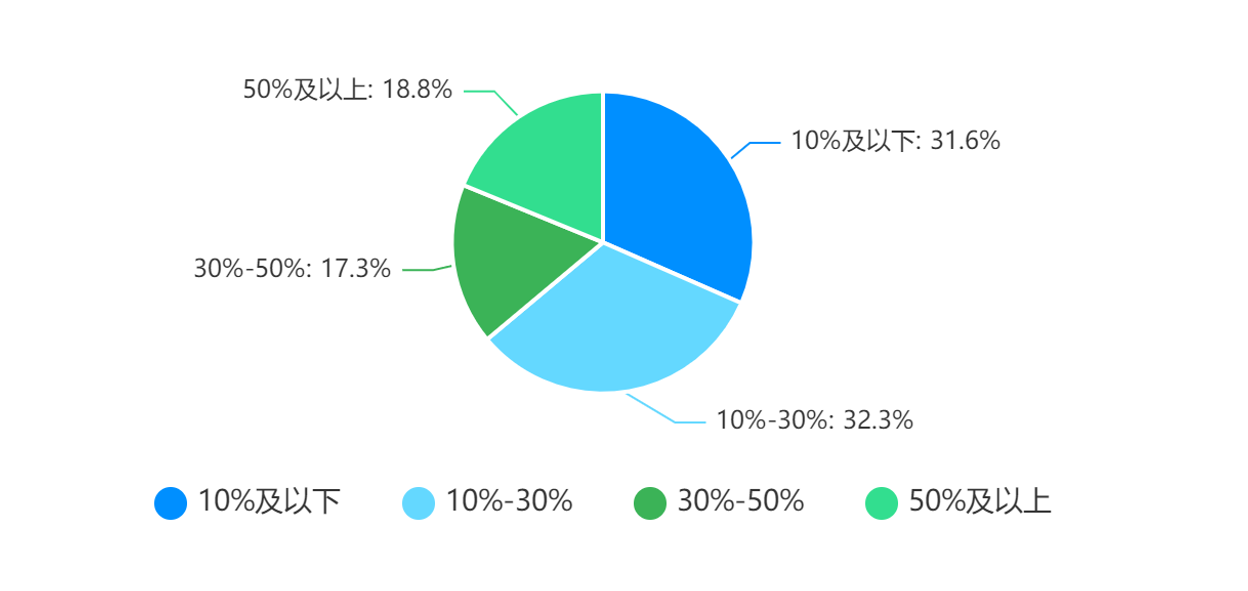

Among the affected respondents:

- 32.3% believe that their companies have been affected by 10%-30%, the largest proportion.

- The second largest group, 31.6% of the respondents, said that their companies’ production or sales volume has been affected by 10% or less.

- 18.8% have been affected by more than 50%.

- 17.3% of the respondents said that their companies’ production or sales volume has been affected by 30%-50%, mainly in parts manufacturing companies.

The degree of impact on production or sales volume is shown below:

The respondents who believed that the impact has exceeded 50% are mainly from trade and distribution companies and OEMs. Trade and distribution companies are unable to conduct business due to social stagnation or logistics issues, which has the greatest impact and is understandable.

A dealer in Tangshan interviewed by “Electric Vehicle Observer” was closed for business for 20 days at the end of March and early April. They only delivered 50 cars in March. The dealer said they would have delivered about 90 cars in March if they could’ve continued operating normally.

OEMs have also been greatly affected because of their characteristic of integrating parts on a large scale.

As William Li, founder of NIO, said, “If one part is missing, we can’t produce a car.” NIO’s vehicle production has already been suspended because of the disruption of the supply chain partners in Geelyn, Shanghai and Jiangsu.

Other related companies have also been affected, although to a lesser extent.

A raw material factory in Shanghai has reduced production by about 20% after three weeks of closed-loop production. However, due to logistics issues, goods could not be shipped out, and raw materials could not be delivered, which has greatly affected the overall situation.

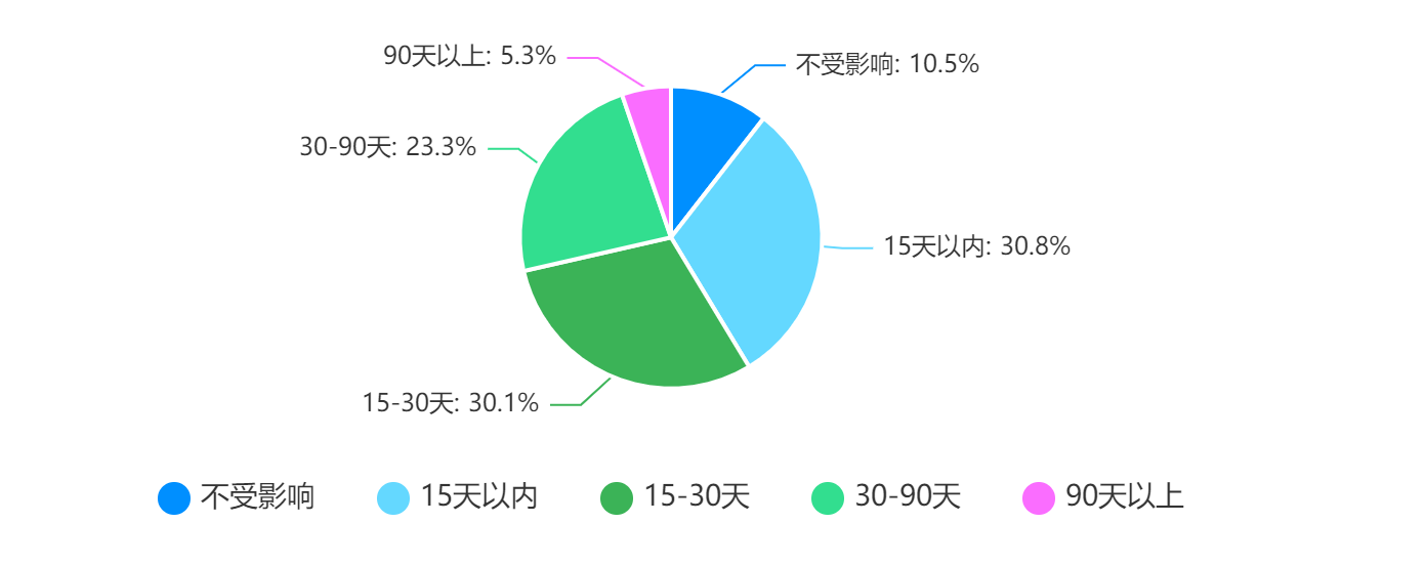

One direct manifestation of the impact on production and business operations is the delay in product delivery.Regarding the delay in product delivery, 60.9% of companies experience delays within 30 days, 23.3% experience delays of 30-90 days, and only a few 5.3% of companies experience delays of more than 90 days.

It is somewhat comforting that the majority of customers can understand the delay in product delivery, as reported by respondents.

Days of product delivery delay:

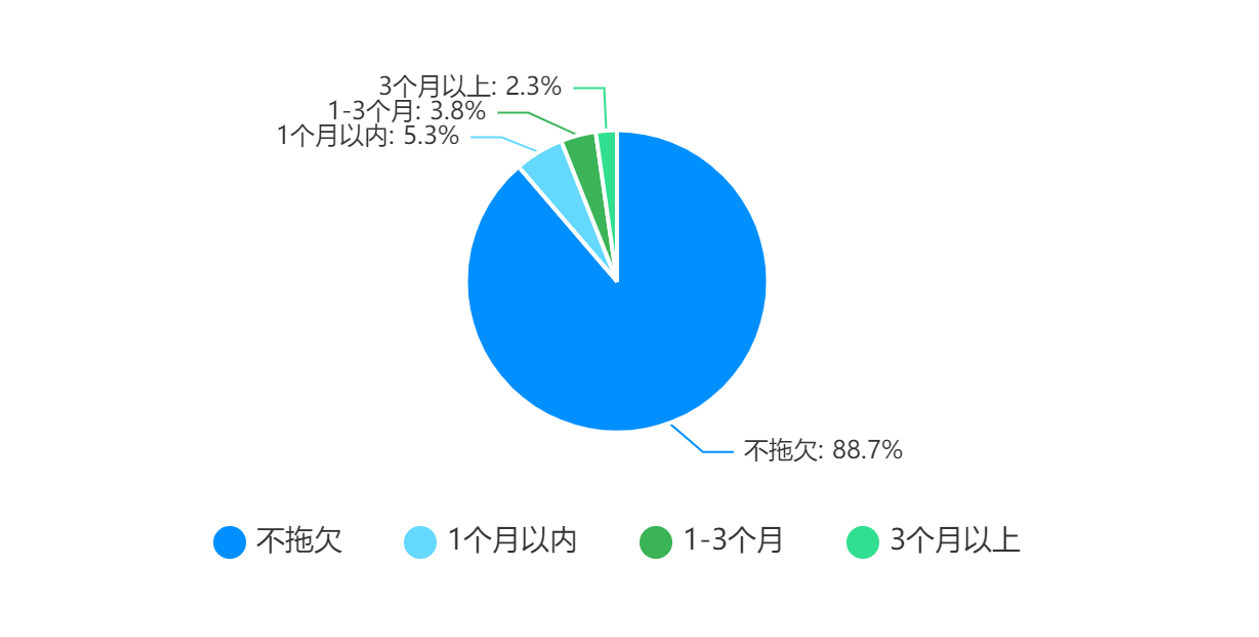

The impact of the epidemic on corporate salaries has not yet been reflected immediately.

The survey shows that a considerable number of companies are paying salaries normally without any arrears. Some employers even continue to give raises to their employees, which is commendable.

Companies with salary arrears:

Logistics is the most difficult

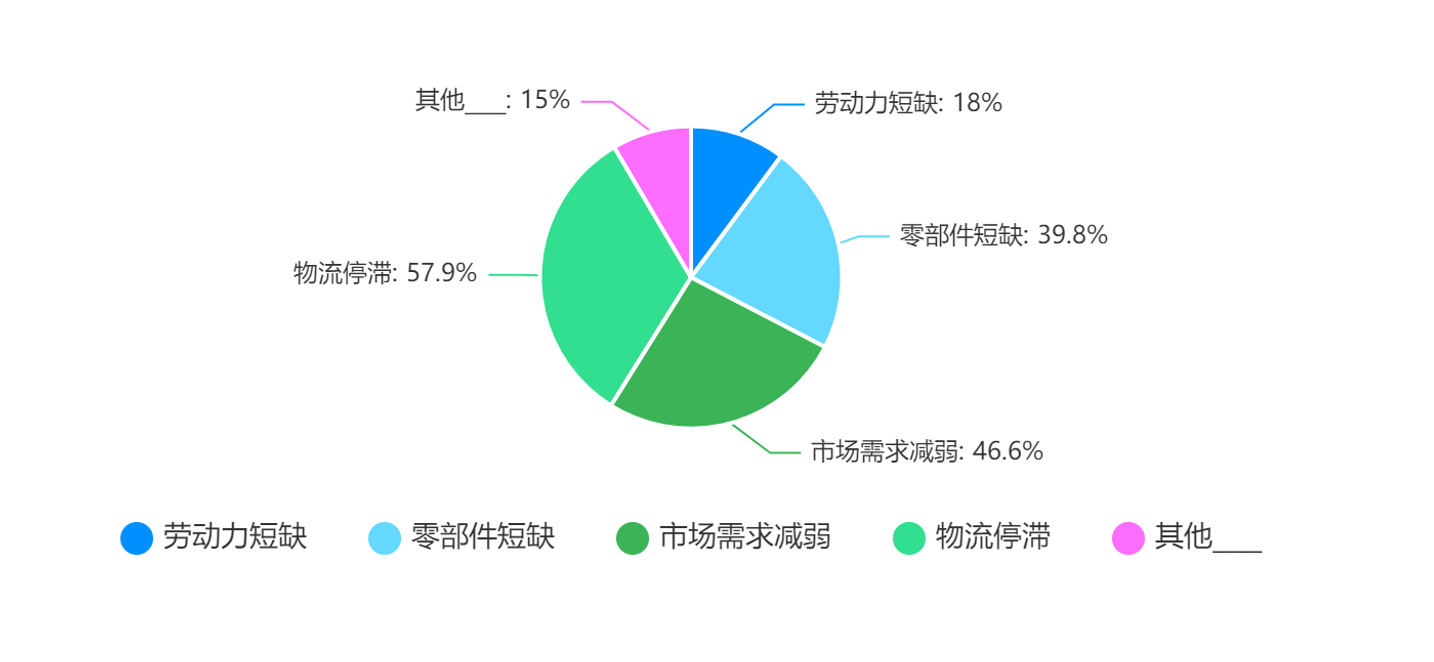

When asked about reasons for the impact of the epidemic on businesses, 57.9% of respondents chose logistics stagnation, 46.6% chose weakened market demand, and 39.8% chose component shortages, which are mostly affected by logistics.

It can be seen that logistics stagnation is the main reason.

Reasons for the impact on businesses (multiple choice):

In the survey questionnaire, respondents’ self-filled impressions during the epidemic period also reflect this:

“Logistics is the biggest problem, raw materials cannot enter, products cannot be sold.”

“The logistics problem is very serious! If this situation continues, it will inevitably affect the enthusiasm of foreign investment.”

“The company has a closed-loop production, but logistics is blocked, and goods cannot be shipped out, while materials cannot come in. The overall mood is greatly affected.”

“Consumer willingness has decreased, and the speed of goods circulation has slowed down. Living rhythm has changed, and ordinary people are becoming more and more difficult. We should cherish the present.”

…

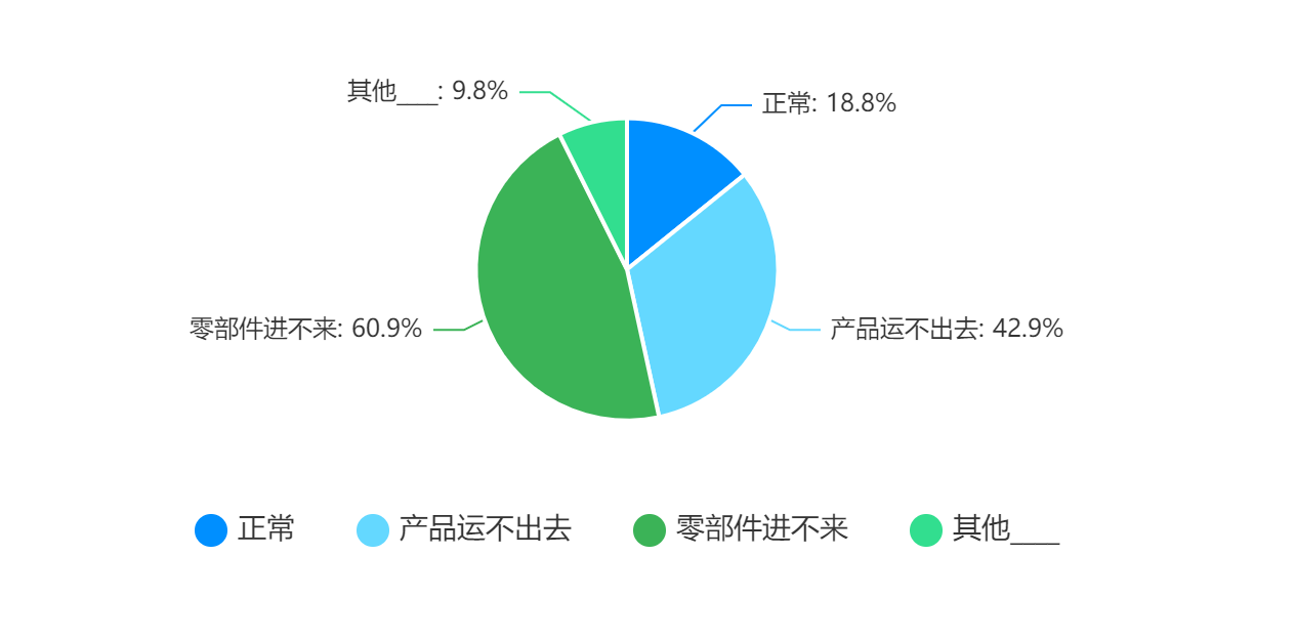

The inability to receive spare parts and the inability to ship products are major concerns for companies, with only 18.8% of respondents saying that logistics is normal. More than 60% of respondents said that spare parts cannot be delivered, and more than 40% said that products cannot be shipped.

Is logistics normal or not:

We interviewed several respondents as case studies.

The Zhejiang Geely logistics truck factory mainly assists in controlling spare parts that need to be purchased from Shenzhen. Due to the inability to transport goods from Shenzhen, delivery has been delayed by more than 15 days. Fortunately, since they have not used spare parts from Shanghai, they are not affected by the Shanghai lockdown.# Battery Positive Production in Shandong and the Effects of COVID-19 on the Electric Vehicle Industry

The biggest problem for battery positive manufacturers in Shandong is the supply of raw materials. Due to logistics stagnation caused by COVID-19, raw materials cannot be transported to the production site resulting in a buildup of inventory. Although the price of lithium carbonate has decreased, it cannot be locked in, and businesses are having difficulty selling their products.

The effects of COVID-19 on the industry are not limited to logistical stagnation, but also a decrease in market demand. Research shows that customers are less likely to purchase products now than they were before. For example, one electric vehicle dealership in Zhejiang sold over 100 cars in March, but only seven cars in April.

Similarly, the charging industry has been impacted significantly. Due to lockdown measures, many charging stations have closed and the frequency of travel has decreased, resulting in a decrease in demand for charging stations. Operations have been affected, causing some charging stations with low usage to close, and hurting the revenue of businesses such as a leading charging operation enterprise in Shanxi, which has had to delay the salary of its employees.

Several businesses mentioned the decrease in income of ride-hailing drivers, who have seen their daily income drop from 500-600 CNY to 200-300 CNY.

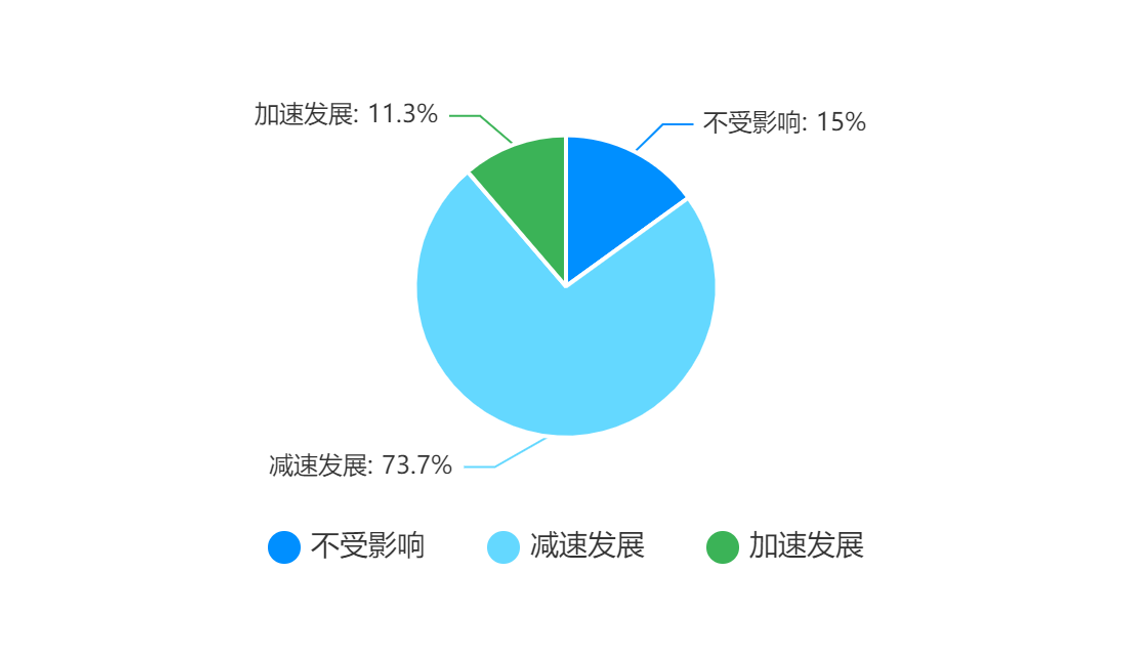

Although the COVID-19 pandemic has become the norm, its long-term effects on the electric vehicle industry are trouble to evaluate. A survey showed that 73.7% of respondents felt that the COVID-19 pandemic has resulted in a slowdown of the electric vehicle industry, while 15% felt no effect, and 11.3% felt there has been an acceleration of development.

The impact of the COVID-19 pandemic on the electric vehicle industry can be seen in the following chart:

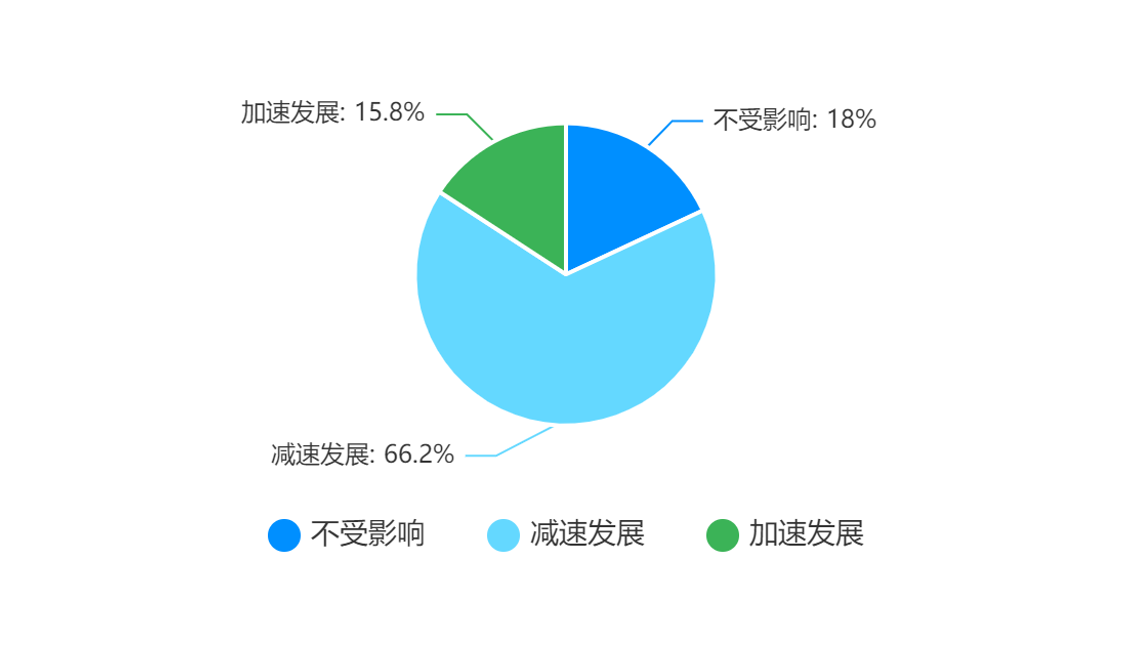

Looking towards the future, the outlook for the electric vehicle industry is relatively optimistic, with 66.2% of respondents believing that the COVID-19 pandemic will slow down the development of the industry, while 18% feel no effect, and 15.8% feel it will accelerate development.

The future impact of the COVID-19 pandemic on the electric vehicle industry can be seen in the following chart:

Although COVID-19 has had a significant impact on businesses, some companies have been able to adjust their business strategies to adapt. For instance, SAIC Volkswagen has adjusted production to meet customer orders in light of the pandemic’s progress and supplier conditions. Additionally, General Motors’ Chinese partner, SAIC GM, has demonstrated similar flexibility by implementing closed-loop production, wherein employees sleep at the factory, ensuring production of vehicles such as Chevy, Buick, and Cadillac models continue despite a decrease in production capacity.“`markdown

The main business of a battery service provider is to provide battery recombination and balance services to bus and operation companies. Due to the impact of the epidemic, they cannot travel, and their main business has come to a standstill while they stay at home. They have started to transform their business from selling services to selling products by making graded use of batteries. They also export small household energy storage devices with a capacity of 10 degrees to some developing countries with unstable power grids.

A battery recycling enterprise in Foshan, Guangdong, mainly collects first-hand sources of waste batteries. Customers usually want to dispose of their waste batteries quickly for safety reasons. In the past, the company’s procurement personnel would collect the waste batteries on-site, but due to the epidemic, they can no longer transport the goods. They have to find local collection points to temporarily store the batteries, and charge storage fees based on the storage time and weight. Although the procurement cost has slightly increased, the unified collection by the collection points has improved the efficiency of procurement personnel in recycling.

Currently, the new coronavirus epidemic is still spreading in various regions, and measures similar to Shanghai’s containment and control management are being adopted in other regions. Especially for the highways that shoulder logistics transportation tasks, the prevention and control measures are often strengthened by local governments. This will continue to have a negative impact on the new energy vehicle industry.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.