Author: Zhu Yulong

I am working on the monthly battery report for Electric View. Here are some initial conclusions and discussions. Later I will write a more systematic and complete analysis article.

From what I see, as the application of lithium iron phosphate batteries becomes more popular, the competitiveness of ternary batteries is indeed weakening overall. From another perspective, some electric vehicle companies’ choices of cells have already begun to gradually differentiate. Let’s take a closer look at XPeng, Aiways, ora and Tesla.

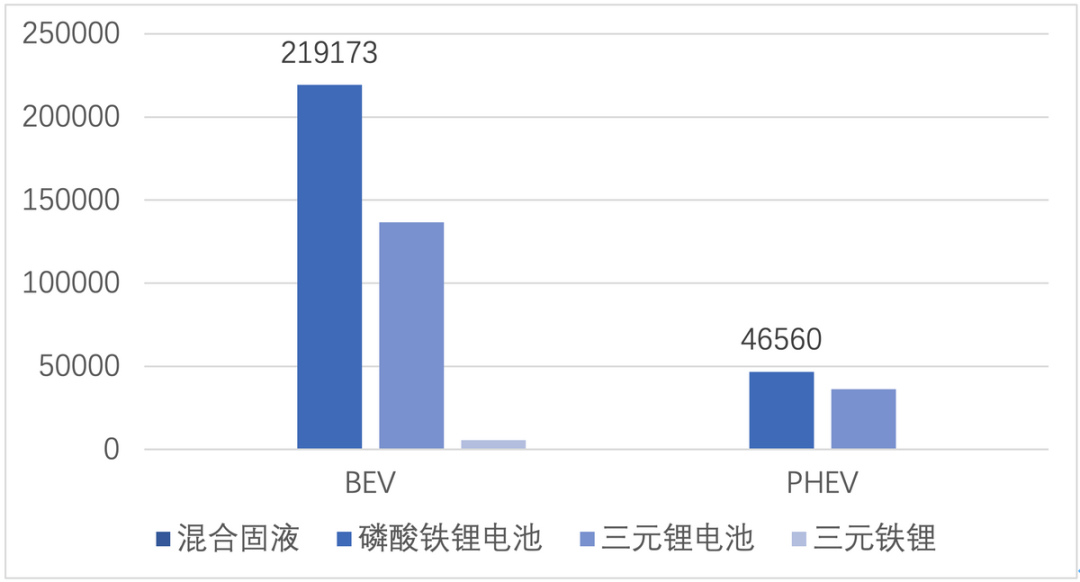

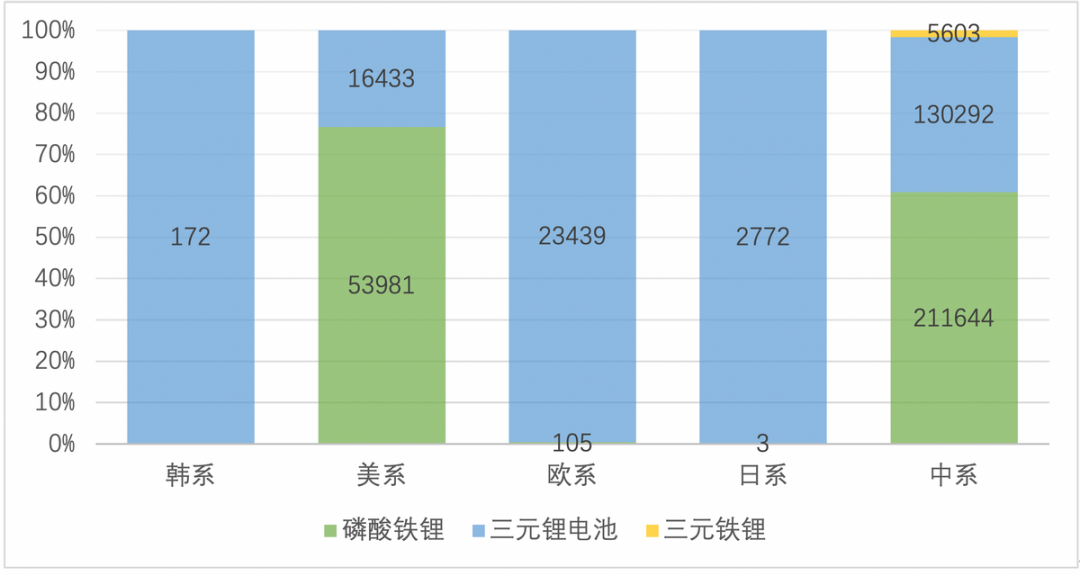

In terms of attributes, Chinese car companies and Tesla are waving the flag of lithium iron phosphate, while Japanese, Korean, and German car companies are not yet prepared. BYD and Tesla, on their own, have pushed the rate of popularity of lithium iron phosphate in China to a very high level.

The process of lithium iron phosphate conversion

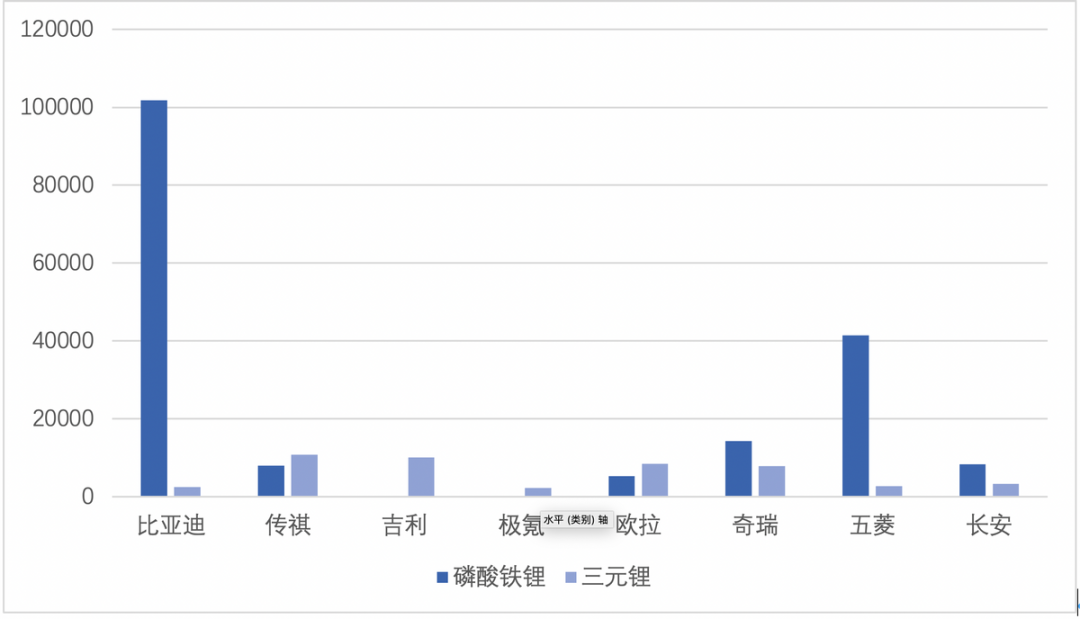

From the perspective of traditional car companies, BYD was the first to fully and thoroughly convert to lithium iron phosphate. With the subsequent iteration of the Han DM to DM-i model, there is basically no use of ternary batteries anymore. In the A00 sector, Wuling, Chery, and Changan have all taken big steps to use lithium iron phosphate batteries as a low-cost solution. However, Geely, a mainstay in the A-level car market, has not taken any action. We will analyze GAC and ora in the follow-up.

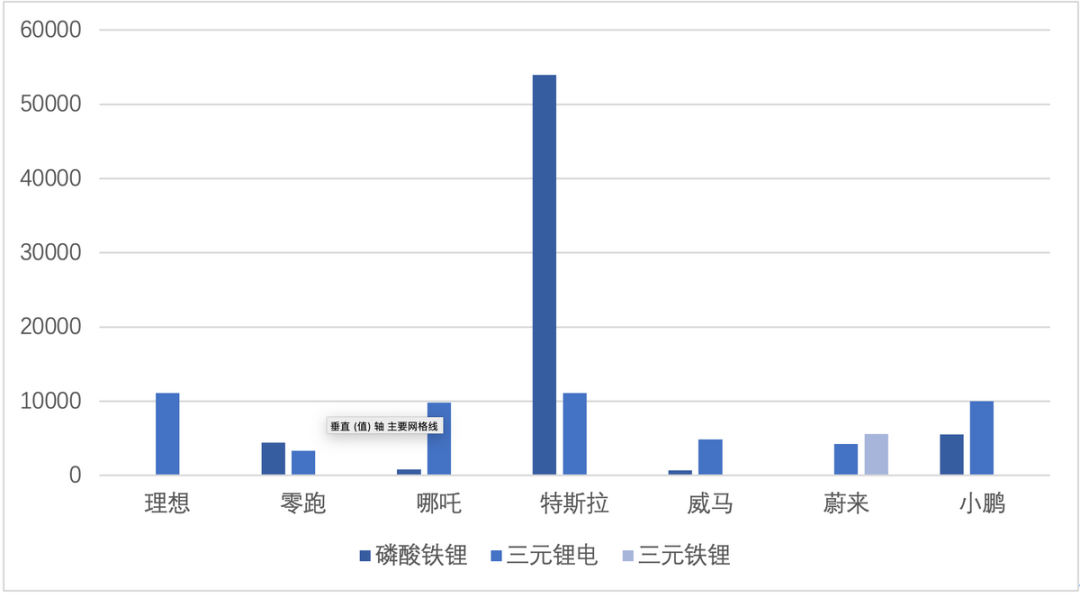

Amongst new forces, in addition to Tesla, Zer0Run, XPeng, and NIO are all rapidly promoting the conversion to lithium iron phosphate.

This is how I understand the difference in cost. Iron phosphate and ternary batteries had a price difference of about 0.1 RMB/Wh, but with an increase of over 30%, there is still an advantage to replace nickel-55 cells in high-voltage systems with iron phosphate from a cost perspective. As the price of cars spreads to the consumer market, the demand for lithium iron phosphate is still growing faster than that for ternary batteries. Moreover, from the perspective of new energy vehicle companies, the 400-500 km range of ternary batteries does not reflect their characteristics.

# Several Key Enterprises

# Several Key Enterprises

Tesla

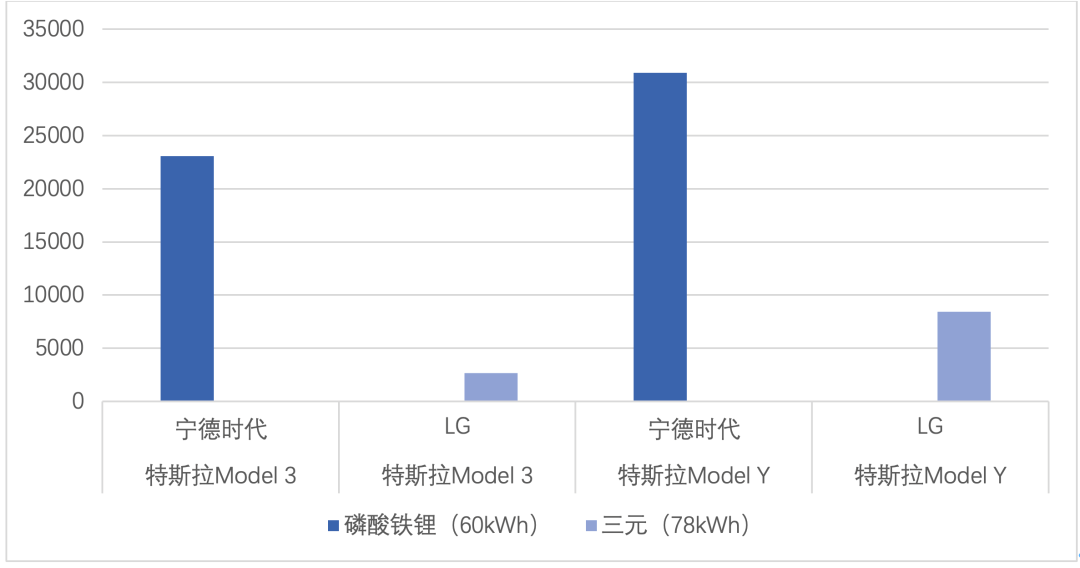

Tesla’s situation is relatively simple, with only 11,000 tri-metals accounting for 17%.

XPeng

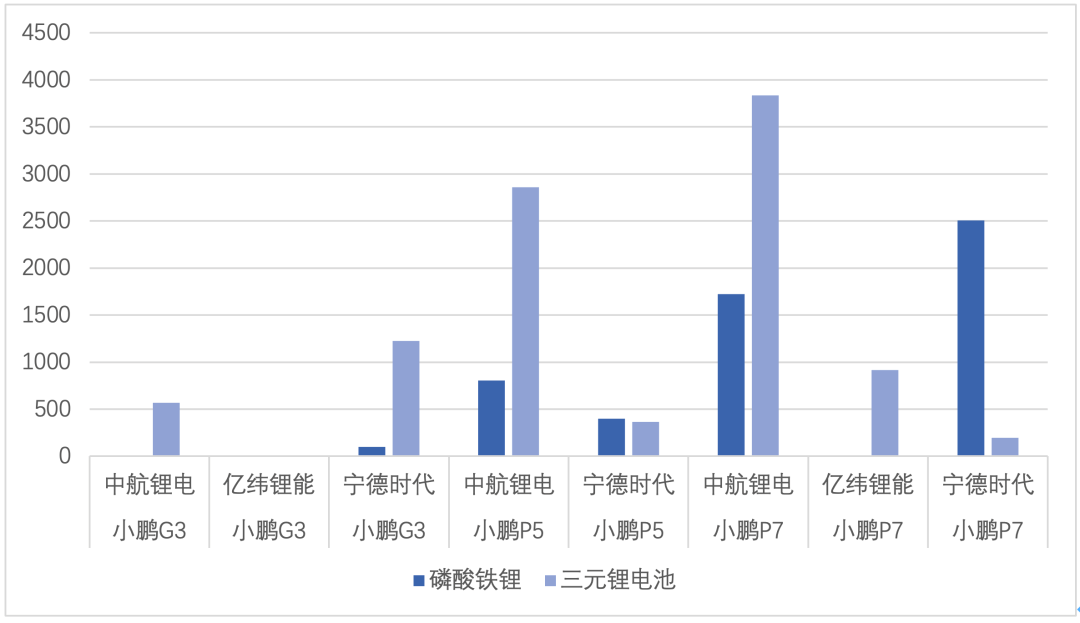

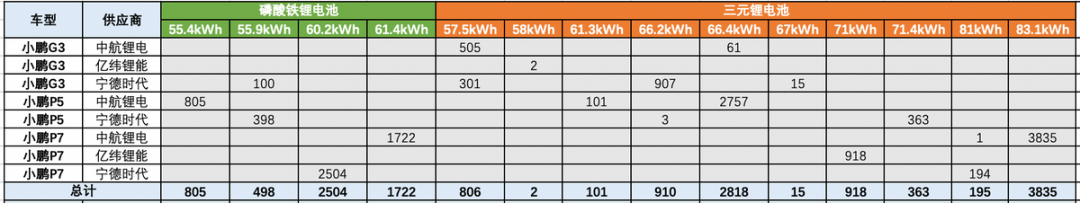

In XPeng’s case, there are still quite a few changes since switching to Ningde Times. This is also due to the fact that there are three types of vehicles, two types of chemical systems, and three suppliers, resulting in a relatively wide variety of electric quantities.

Take a look at this table. Comrade Anlong really needs to put in a lot of effort to manage so many products.

Conclusion: That’s all for now. Detailed analysis can be found in the Electric Vehicle Observer. We are still silent, and you can also take a quick look at the following items.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.