Two years ago, under the guidance of the Ministry of Industry and Information Technology, the China Society of Automotive Engineers led the compilation of the “Roadmap of Energy-saving and New Energy Vehicles Technology 2.0”. At that time, perhaps no one would have expected that the target of 20% new energy penetration rate in 2025 would be exceeded by 155% in March 2022.

Data from March showed that passenger car sales fell by 15.1% to 1.434 million units, while the new energy passenger car market grew 1.4 times to 444,500 units, and the penetration rate reached 31.0%.

However, a closer observation reveals the “Matthew Effect” between different types of car companies is very pronounced. The new energy penetration rate of domestic brands (including SAIC-GM-Wuling) is as high as 52.7%, while the new energy penetration rate of joint ventures (excluding Tesla) is only 4.9%. The new energy penetration rate of domestic brands is over 10 times that of joint venture brands.

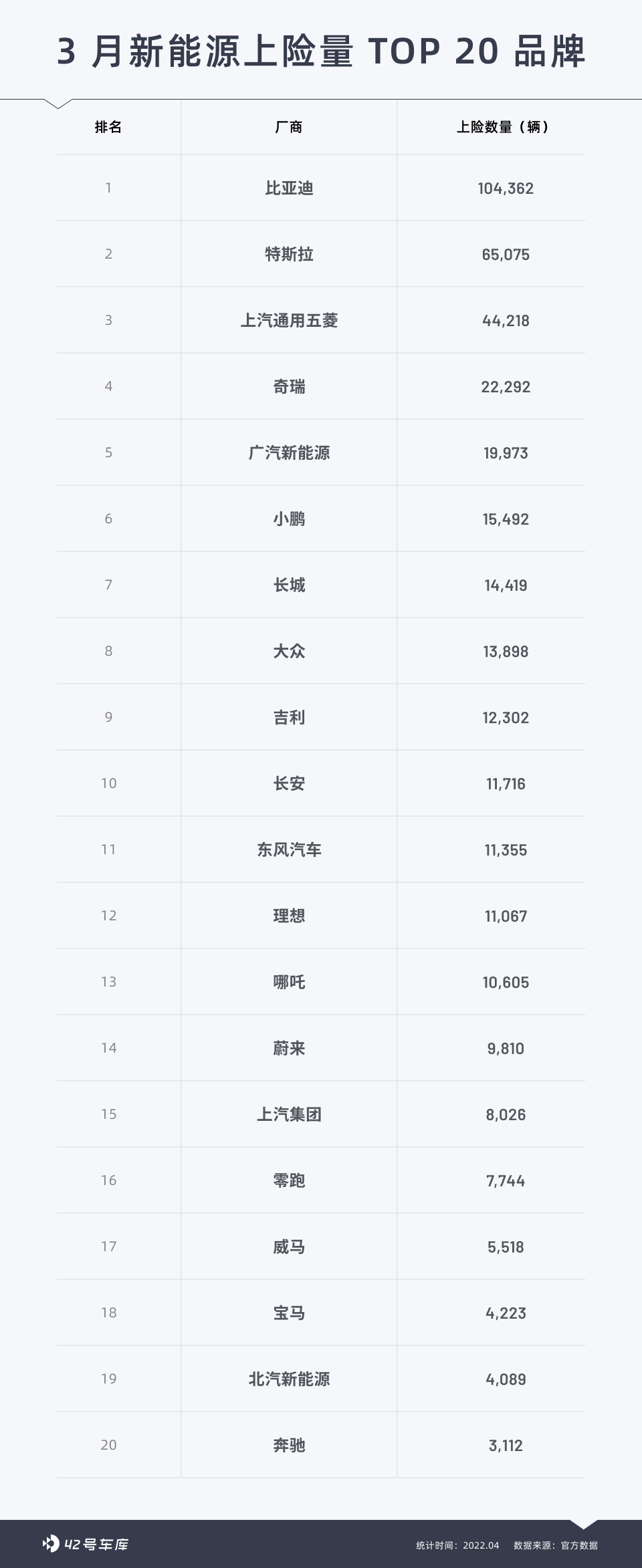

Looking specifically at the TOP 20 list of new energy brands in March, except for Volkswagen brands ranking 8th, only BMW and Mercedes-Benz rank 18th and 20th, respectively.

BYD + Tesla: The “Two Superpowers Plus Two Titans” Situation has Emerged

At present, in the domestic new energy market, the “Two Superpowers Plus Two Titans” situation has basically formed. The “Two Superpowers” naturally refer to BYD and Tesla. Among them, BYD not only achieved sales of over 100,000 units, but also announced the discontinuation of fossil fuel cars. Currently, it is said to have accumulated more than 400,000 orders, and it is not a problem to complete the target of 1.2 million units this year. There is even hope to challenge the target of 1.5 million units.

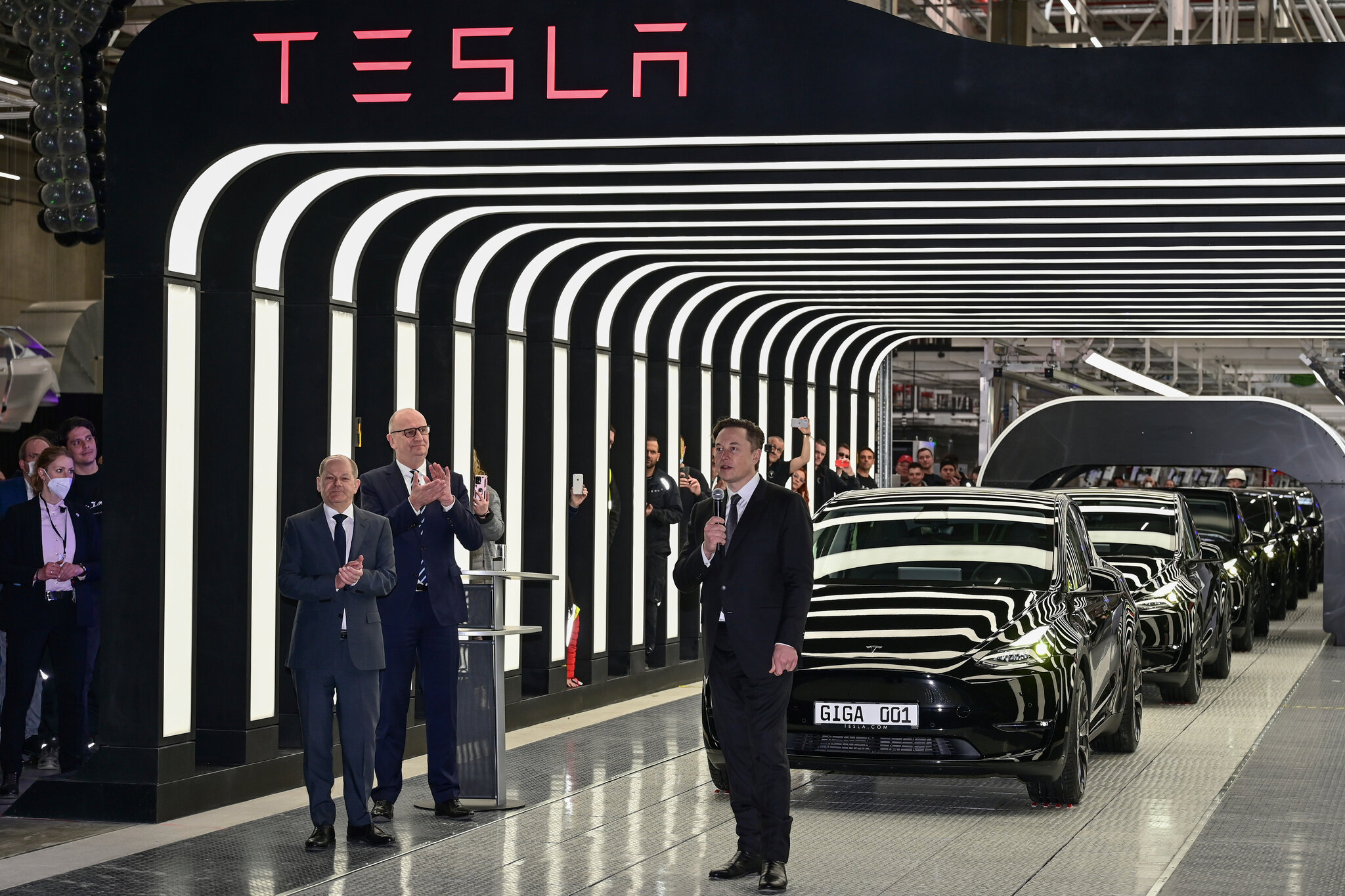

Although Tesla did not release new cars this year, it has been getting good news all along. The Berlin factory opened in March, and two weeks later the headquarters factory in Texas began operating. In the first quarter, it delivered 310,000 new cars worldwide, a year-on-year increase of 68%. The target for this year is to complete 1.5 million new vehicles worldwide.

At the same time, the only factor determining the sales volume of the “Two Superpowers” is their own production capacity.In addition to the two major automakers, the new forces are the representatives of strength, demonstrating what is meant by “a spark can start a prairie fire” through their actual performance. Among the top 20 brands, new energy brands occupy six seats, with a total of 49,631 vehicles sold, accounting for 11.1% of the total new energy vehicle sales.

Specifically, in terms of “Wei Xiaoli,” XPeng has taken the lead with 15,492 vehicles sold. Li Auto is in second place with 11,067 vehicles sold, while NIO is in third place with 9,810 vehicles sold. Additionally, NIO’s NIO ET7 and LINGPAI’s T03 have also performed well, with 10,605 and 7,744 vehicles sold, respectively. The new force team is still constantly expanding.

Among traditional domestic brands, GAC New Energy is the most outstanding, with nearly 20,000 vehicles sold, giving Feng Xingya, the general manager of GAC Group, the confidence to change the name of “Wei Xiaoli” to “Ai Xiaowei.”

As for joint venture brands, many have chosen to “flatten out.” Of these, Volkswagen has been making the most effort. Currently, “North and South Volkswagen” have five ID. models, among which the sales of the ID.4 and ID.6 models hover around 5,000 and 3,000 vehicles, respectively. Although the sales results are not impressive, they are already the leaders among joint venture brands, reflecting the difficulties they face during transformation in the domestic market.

Pure electric dominates, DM-i and range extenders drive PHEV growth

In March’s sales of 444,000 new energy vehicles, pure electric vehicles occupied the absolute mainstream, with 362,000 vehicles sold, accounting for 85% of the market share. The sales of PHEV (including those with range extenders) reached 82,000 vehicles, although the share is not as high as pure electric, it has increased by 1.5 times compared to the previous year.During the early development of new energy vehicles in China, PHEV and pure electric models were in a neck-and-neck competition, with PHEVs even selling better due to the generous subsidies during the initial stage. Car manufacturers only needed to make minimal changes to their existing P2 hybrid architecture to sell their vehicles. Currently, Europe is in a similar stage of development.

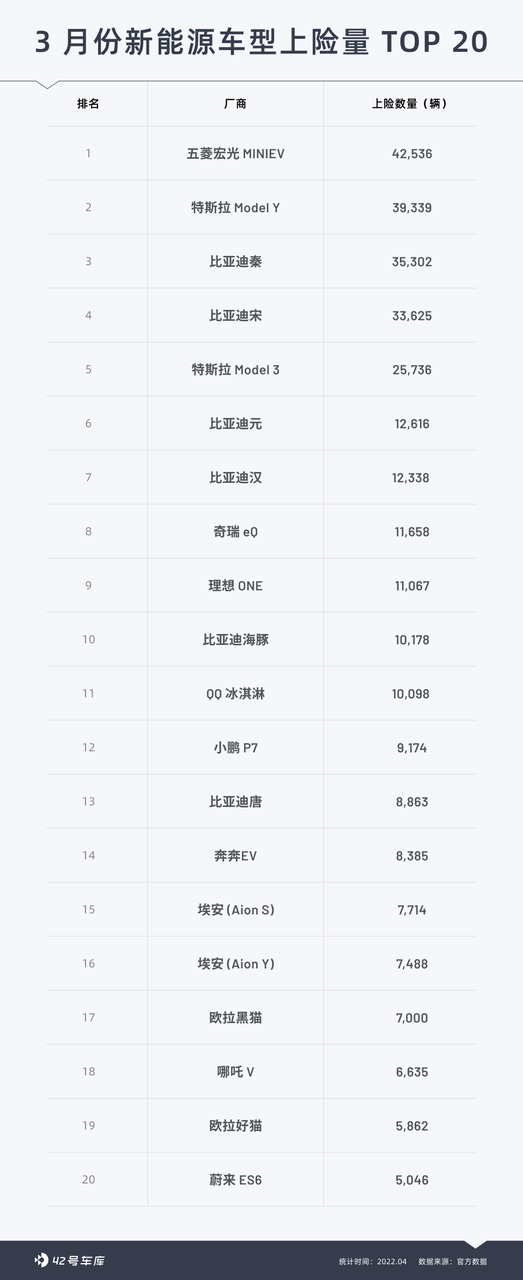

However, as technology advances and subsidies decline, people have become increasingly dissatisfied with PHEVs that consume electricity and then gasoline, are expensive, and have sudden drops in performance. As a result, the share of PHEVs in the new energy vehicle market has been rapidly declining, until the launch of the Ideal ONE and the BYD DM-i.

Of the top ten models on the list, the BYD DM-i occupies four seats and has become an absolute leader in the PHEV field. However, its competitors are also catching up quickly. The Chery Kunpeng e+, Geely’s Thunderbolt hybrid, and Great Wall’s Lemon DHT are all eyeing a piece of the hybrid powertrain market.

Furthermore, although Ideal Motors only has one car, the sales of over 11,000 units have made a huge contribution to the PHEV and range-extended vehicle market. Another range-extended vehicle, the Wanjie M5, had an online volume of nearly 3,000 units, ranking sixth. Although the range-extended technology is not advanced and has a low upper limit, its structure is relatively simple, and has a higher lower limit, making it a good choice for “new players”.

In addition, Mercedes-Benz E-Class PHEV, BMW 5 Series PHEV, and Changan UNI-K PHEV, all P2 hybrid models, have sales of over 1,000 units. Currently, for cities with license plate restrictions, choosing these three models depends on the policy benefits of “green plates” and “exemption from purchase tax”, but they will gradually be marginalized in the future.

HEV Strong Hybrids: Black Horses That May Compete with Plug-In Hybrids

Although HEV Strong Hybrids are not part of the new energy vehicle category, their excellent fuel-saving performance has made them popular even during a time when gasoline prices were at 9 CNY/liter. Data shows that in March, sales of HEV Strong Hybrid models reached 67,000 units, a year-on-year increase of 50%.Currently, the main players in the hybrid market are “Ryota”: Toyota sold 45,000 vehicles and Honda sold 16,000, occupying nearly 90% of the market. This is mainly due to “Ryota” being ahead in layout and long-term promotion, making Toyota THS and Honda i-MMD hybrids well-known.

However, domestic brands are also catching up. Many models under the Great Wall WEY brand, such as Machado and Latte, have launched DHT models. In addition, the Geely Thunderbolt hybrid has also been launched. Both of these brands are not inferior to “Ryota” in hybrid technology, and even surpass it. For example, the Great Wall Lemon DHT has one more gear than Honda i-MMD, and the Geely Thunderbolt hybrid has two more gears than Toyota THS.

According to the plan, the policy of new energy subsidies and tax exemption will end by the end of the year. If there is no special policy to extend it, the cost of PHEVs may increase by 20,000 to 30,000 yuan next year. HEV without large batteries will gain a wave of development due to cost advantages.

COVID-19 and price increases lead to a pessimistic outlook for new energy vehicle sales in the second quarter

Since the second half of last year, the price of battery-grade lithium carbonate has been fluctuating greatly, from around 50,000 yuan/ton at the beginning of the year to 500,000 yuan/ton at the beginning of this year. Other raw materials such as cobalt, copper foil, and aluminum foil have also increased to varying degrees. Therefore, more than 20 car companies and 50 models have raised prices since the end of last year. Some models, such as the Leapmotor C11, have seen price increases of up to 30,000 yuan.

In March, new energy vehicle sales increased by 80.9% month-on-month. According to Cui Dongshu, the Secretary-General of the China Passenger Car Association, the new energy vehicle manufacturers delivered orders from the end of last year to January and February of this year in March, so the price increase did not significantly affect the actual delivery volume in the first quarter. He predicts that the impact of price increases on sales will truly be reflected in May.

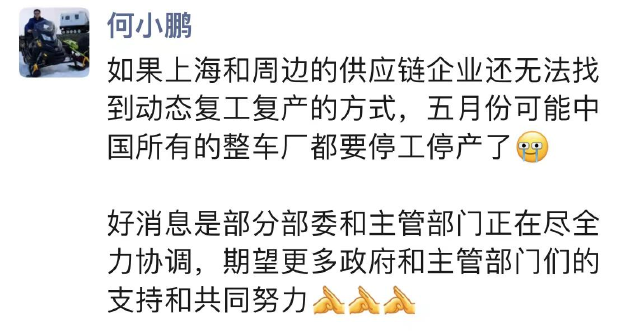

In addition, He XPeng and Yu Chengdong recently stated on their social media accounts that the current epidemic has had a significant impact on the automotive supply chain in Shanghai and surrounding areas. If work cannot resume, all automakers may face production stoppages in May.

The good news is that the Ministry of Industry and Information Technology has recently dispatched a working group to Shanghai to give priority guarantee to the resumption of work and production of 666 key enterprises in the fields of automobile manufacturing, equipment manufacturing, integrated circuits, etc. The production and sales volume of automobiles in the second quarter should not fall too sharply.

The good news is that the Ministry of Industry and Information Technology has recently dispatched a working group to Shanghai to give priority guarantee to the resumption of work and production of 666 key enterprises in the fields of automobile manufacturing, equipment manufacturing, integrated circuits, etc. The production and sales volume of automobiles in the second quarter should not fall too sharply.

Finally, starting from next year, new energy subsidies will be completely phased out, and there is a high probability that the dividend of exempting from purchase tax will also end. It is expected that the growth rate of new energy will also begin to slow down by then.

Finally, you are welcome to download the Garage App to learn about the latest new energy information. If you want to get more timely communication, you can click here to join our community.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.