Author: Kenvin

At the just-ended Bai Ren Hui (100 People Meeting), Gu Huinan, General Manager of GAC Aion, stated that the company’s self-developed battery trial production line will be completed by the end of the year, and small-scale production will be realized. This news quickly sparked controversy within the industry, with some believing that car companies should make batteries, while others are against it.

The “Electric Momentum” reporter believes that self-developed battery technology is not wrong for car companies with strength, but the key is whether to invest heavily in mass production and bear the risk of failure. Also, compared with the already mature liquid lithium batteries, researching the next-generation solid-state batteries may be a better approach.

In recent years, GAC Aion has taken many actions in the field of three-electric technology, but many are just gimmicks and have been criticized by the industry. Perhaps some of the technology has a high technical content, such as achieving 1,000 kilometers of endurance, but the problem is that the high cost makes it impossible for large-scale production. So what is the significance of this kind of research and development? Is there a problem of wasting a limited R&D budget?

Therefore, the three-electric research and development strategy of GAC Aion is still open to debate. In fact, for the current GAC Aion, it is more urgent to focus on the market, solidify the brand, and boost the influence in the smart field rather than blindly pursue unfamiliar and challenging three-electric technology.

Judging from the performance of GAC Aion, although it has achieved a certain breakthrough in sales by launching the lower-end AION Y after being independent for more than a year, it has also been criticized for sacrificing prices to gain quantity. In particular, the high-end market still hasn’t seen any improvement, while the rental-car properties have become deeply ingrained, which means that Aion’s initially high-end positioning has basically failed.

Under the leadership of Gu Huinan, from GAC New Energy to GAC Aion, the company’s organizational mechanisms may have made progress and breakthroughs, but actual operations are far from excellent, especially the failure to excel in brand promotion. This also became a big regret for the transformation of GAC. As the pioneer of GAC’s transformation, Gu Huinan’s ambition ultimately exceeded the capability.

Failure in High-end Market

For China’s automobile industry, new energy not only provides an opportunity for competitive diversion but also offers a shortcut to the high-end market through changes in technology, products, the market, and users. This is the fundamental reason why NIO and Li Auto have established their market positions in the high-end segment. They have firmly grasped the opportunity given by the times.

Do the traditional brands not know about this opportunity? Obviously, they do, including Dongfeng’s LanTu, SAIC’s ZhiJi, Geely’s Zeekr… Everyone knows that achieving high-end through new energy is the future direction. As for the AION product line established in 2018 and the subsequent independent Aion brand, their initial positioning is also high-end, aiming to improve the brand image.In the overall strategic layout, Guangzhou Automobile Group (GAC) did not lag behind the times, and even showed a certain forward-looking ability. However, Guangzhou Automobile New Energy (GAC Aion) has failed miserably in executing their plans.

At the Guangzhou Auto Show in 2018, GAC Aion launched the AION series, formerly known as Aion, and introduced the “world-class intelligent car” – AION S. In April 2019, the GAC Aion S, positioned as a “leader in mid-to-high-end intelligent sedans,” was officially launched.

However, Aion S was packaged as the Chinese Tesla, under the buzzwords of overtaking, surpassing fuel-powered cars, and overturning new energy. GAC Aion, not fully understanding the new energy market, has been spending lavishly on meaningless packaging.

Despite entering as a disruptor, Aion S did not actually cause any disruption, as it was mainly sold to B-side markets such as ride-hailing, even becoming a “king of ride-hailing” within the industry after its launch.

Gu Huinan, the chairman of GAC Aion, did not deny this embarrassing history, stating at a forum that “Aion’s performance in the B-side market has indeed been very good and has played a very good role in its own development.” In his opinion, Aion’s core focus is on development and quantity, so it is reasonable to invest in the B-side market.

This reveals that Gu Huinan has lacked sufficient strategic focus and has not lived up to GAC’s transformation expectations.

At the organizational level, GAC Aion assumes the responsibility for GAC’s transformation, especially brand breakthroughs, which is the place where the GAC Trumpchi brand has been struggling for many years in the fuel-powered car market. To achieve this goal, GAC has not only given Aion independence but also invested their core R&D resources into it, hoping to activate Aion’s combat effectiveness.

Since the primary focus for GAC Aion is brand breakthroughs, sales naturally come second. Otherwise, how is it any different from Wuling MINI EV and Chery QQ Ice Cream Edition?

The ride-hailing market is like a drug, once you are addicted, it is difficult to withdraw. This will have a profound impact on the brand’s development. After being labeled as a ride-hailing car, the Aion brand’s high-end road has been effectively shut down.

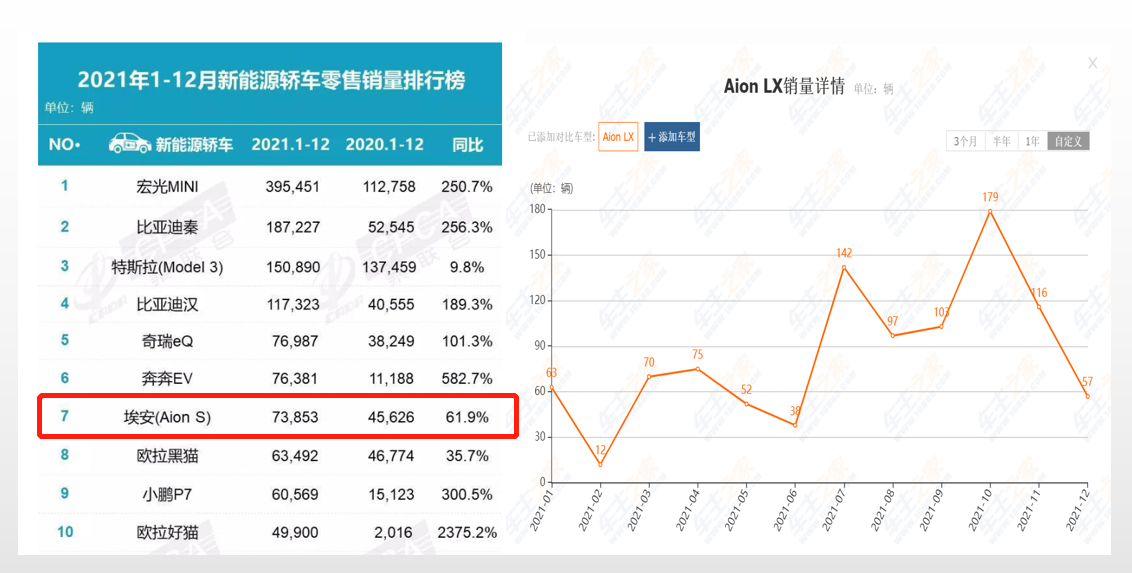

As of 2021, GAC Aion’s total retail sales reached 123,660 units, with AION LX series selling only 1004 units, accounting for only 0.8% of their sales, with barely any presence. AION LX’s monthly sales are less than 100 units, a far cry from high-end pure electric new forces such as NIO, as well as new up-and-comers like JiKe 001 and the Voyah FREE.

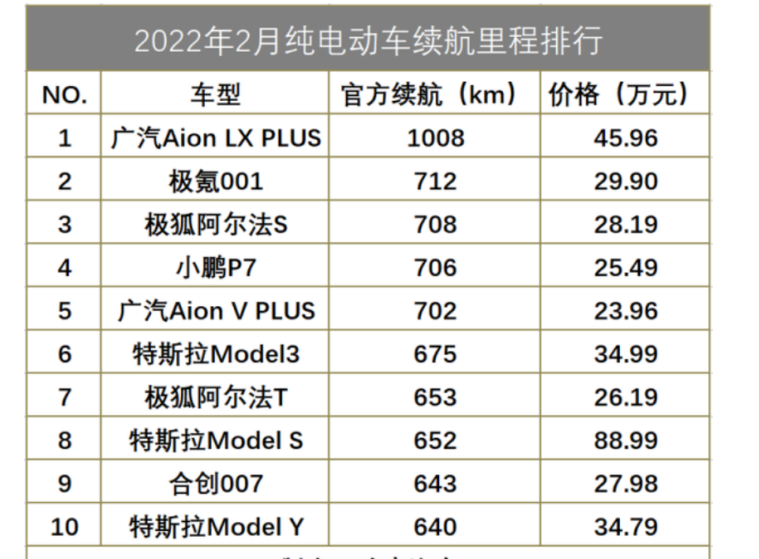

On January 5th, the long-awaited GAC Aion LX Plus was officially launched at a subsidized price range of RMB 286,600 to RMB 459,600. The biggest highlight of the new car is the application of GAC Aion’s globally pioneering silicon sponge negative pole battery technology, which can achieve a maximum range of 1008 kilometers, ranking first in the world.

The launch of AION LX Plus shows that although GAC Aion’s high-end road has already come to an end, it still seeks breakthroughs. Such a dilemma is enough to make people ponder why GAC, which has leading-edge technology globally, cannot break through the high-end market, and lose to new forces such as NIO, as well as emerging powers such as Zeekr and Voyah.

From the perspective of brand management, GAC Aion lacks sufficient strategic determination, and is more involved in short-term interests. Instead of winning the present, it loses the opportunity to define the future, making the strategic layout fall short.

This kind of management thinking has also pushed GAC Aion into another abyss – self-developed batteries. On March 10th, GAC Aion’s self-developed power battery trial production line was laid and built, and it is expected to start small-scale production at the end of the year. This move marks the formal landing of the GAC Group’s self-developed battery trial production line construction project.

GAC Aion stated that its self-developed batteries, including silicon sponge negative pole batteries, will be independently produced on this trial production line in the future, realizing battery self-sufficiency, reducing the dependence on battery suppliers, and greatly reducing the cost of batteries, hoping to achieve “battery freedom” eventually.

At the Hundred People’s Meeting last year, Gu Huinan stated that “whether or not the automaker produces batteries, researching batteries is an inevitable trend. Vehicle companies researching batteries is not essentially to replace battery factories to produce batteries. If automakers do not research batteries, there will definitely be obstacles to the connection between them and battery factories.”

There has always been controversy in the industry about car companies’ self-developed batteries.Supporters generally believe that batteries are the core technology of new energy vehicles, and their cost is high, so car companies must develop batteries themselves. Opponents believe that batteries involve electrochemistry, which is a weakness for car companies, and battery technology requires a large investment and has a high risk. Now it is too late for car companies to develop batteries themselves and the benefits may not outweigh the costs.

Currently, opponents hold the mainstream view. The main ways that domestic new energy vehicle companies obtain batteries are as follows:

-

Directly purchasing from battery suppliers. The advantage is that there is no need to bear the risk and cost of the battery finished product, but the disadvantage is that the battery procurement cost fluctuates greatly and it is impossible to control the pressure brought by the cost. Tesla, a number of new car companies (such as WM Motor), and most traditional car companies adopt this approach.

-

Car companies establish battery factories through joint ventures with battery suppliers. The factories are generally located near the car companies to reduce the cost of battery transportation. For example, Guangzhou Auto Group, Geely, and SAIC have established joint ventures to produce batteries with CATL (Contemporary Amperex Technology Co. Limited).

-

Developing and manufacturing batteries themselves. For example, BYD started from battery research and development and has now set up a separate battery production company to supply batteries to other car companies such as Ford and Li Auto. Few domestic car companies have both self-developed batteries and production lines, except for BYD and Great Wall’s sub-brand Hengchi.

-

Car companies invest by acquiring stakes in battery manufacturers. In order to gain a greater voice in the battery field, battery manufacturers and car companies have also launched joint ventures and other models to guarantee production capacity.

In the latest round of financing, Xinwangda, a battery manufacturer, agreed to increase its capital by 2.33 billion yuan from 23 companies, including well-known car companies such as WM Motor, SAIC and Dongfeng Group, and multiple investment parties. Volkswagen Group also directly acquired a majority stake in domestic battery manufacturer Guoxuan High-tech making Guoxuan High-tech become the designated production enterprise for Volkswagen’s battery production.

It can be seen that in addition to BYD, only Great Wall’s sub-brand Hengchi, which is beginning to support the development of battery technology research and development, is self-developing, while other brands basically collaborate with battery factories in various ways. Therefore, after the explosion of the new energy vehicle market, the only car company that has truly self-developed batteries is Guangzhou AEV.

We can understand Guangzhou AEV’s demand for self-developed batteries, but the question is whether the direction is correct, whether the timing is right, and whether their understanding of batteries is accurate. From the continuous spontaneous combustion of AION S, it may not be the case.

If these questions cannot be answered, the development and production of batteries by Guangzhou AEV should be questioned.In addition to the controversy surrounding self-developed batteries, some more practical solutions have emerged. Car companies such as Toyota, Nissan, Honda and BMW have announced the self-development of the next generation of solid-state batteries. Currently, as lithium-ion batteries tend to mature, it is difficult for car companies to compete with the finished products of battery suppliers by hiring dozens or hundreds of people for self-development. Therefore, it is undoubtedly more realistic to focus on the next generation of solid-state batteries.

As for GAC Group, it is more feasible to invest in or hold a battery manufacturer instead of developing and producing batteries from scratch, or to focus research and development on the next generation of solid-state batteries. In addition, is it appropriate to entrust the heavy responsibility of battery self-development to the new brand GAC Aion? Why not establish a battery brand separately, like Great Wall Motors’ Honeycomb?

As for GAC Aion, its top priority is to manage the brand, produce excellent products, cultivate the market, and not to focus the limited resources on the risky horizontal expansion of self-developed batteries.

Moreover, GAC Aion is also actively introducing strategic investment. Currently, the investment value of a new energy vehicle brand is not measured by how wide its horizontal business is, but by the potential of its core brand value, that is, why the market needs GAC Aion and whether it is irreplaceable. This involves brand positioning issues, which is precisely the biggest shortcoming of GAC Aion at the moment.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.