Author | Roomy

Editor | Zhou Changxian

How can the establishment of Changan Deep Blue brand coexist with Avatar?

On April 13th, when Deep Blue brand was announced, many people raised this question. Even though Changan Group has already set a product boundary in its product planning, such a topic is everywhere in the era of fuel vehicles. The intensive product line layout and multi-brand operation is a problem that almost all car companies have not been able to solve satisfactorily. Therefore, in the era of electric vehicles, the question that arises when Changan established Deep Blue brand together is how to divide it from Avatar, so as not to cause market squeeze.

According to Changan’s product planning, this worry intensifies. Changan will launch 36 new products successively in 2022, including 9 new products, 10 facelifts, and 8 new energy vehicle products. Among them, 8 new energy products, including the first Deep Blue brand model C385 and micro EV LUMIN, and Avatar 11, will be launched in the second half of the year.

From the given product positioning, there is no overlap. “LUMIN focuses on the micro EV market to achieve industry breakthroughs; C385 and subsequent products will focus on mainstream users to achieve scale breakthroughs; Avatar E11 and subsequent products mainly focus on high-end customers to achieve brand upgrades.”

However, it is not easy to make the market clearly divided and achieve expected strategies. Especially in today’s increasingly homogenized trinity and intelligence, the ultimate test still lies in the brand’s ability to grasp the segmented market.

Do you remember the question raised by He XPeng on the day Avatar was released? “I have not understood why a brand wants to make a bunch of brands in the same direction. If you think that the new brand is easier to succeed, why can’t the old one?”

At this time, old words are mentioned again.

“Parallel Runner” and “Leader”

The establishment of Changan Deep Blue brand has been traceable for a long time.

In August last year, at the Changan Automotive Technology Day, Avatar E11 and Changan New Energy C385 were both unveiled, and the focus was on Avatar brand and the first model E11. At that time, C385 was just a code name.

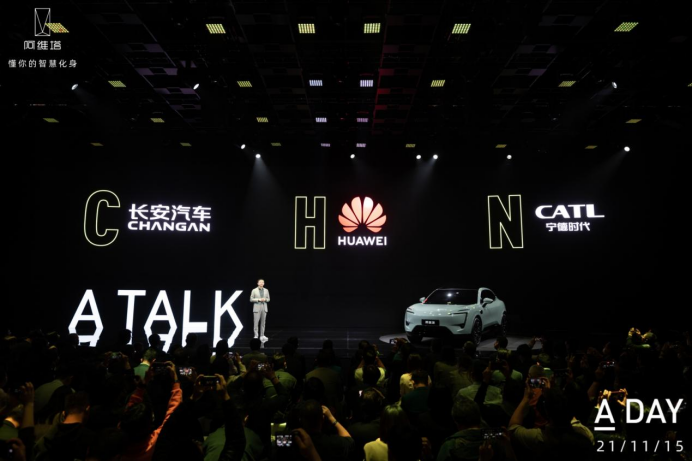

Looking at the current new energy strategy of domestic manufacturers, most of them basically adopt the low-end and high-end polarization to avoid Tesla. The number of models that choose to confront Tesla head-on is few. Therefore, after Avatar was listed as Changan’s high-end brand, the industry began to have one more expectation.The joint venture of Changan, Huawei, and CATL to build the Avita did not ignite the market. Some people say that “Apart from high-end luxury, there is hardly any technology or warm and caring tone that the brand claims.” The capital market chose to vote with their feet, and Changan Automobile’s stock price has fallen for three consecutive days.

Thus, the presence of C385 became even weaker. It wasn’t until November last year that Changan New Energy applied for the “Qiyuan Automobile” trademark that a new speculation arose: “Could C385 be the first car under the new logo?”

In January of this year, Changan New Energy registered the “Qiyuan Automobile User Service” public account as an account entity. Speculation about the Changan New Energy brand began to increase. On March 14th, the account was renamed “Changan Deep Blue,” and the new brand name officially surfaced.

Questions also followed. Can Deep Blue brand make up for Avita’s poor start? After all, in the field of intelligent cars, there is no lack of stories, nor is there a shortage of storytellers.

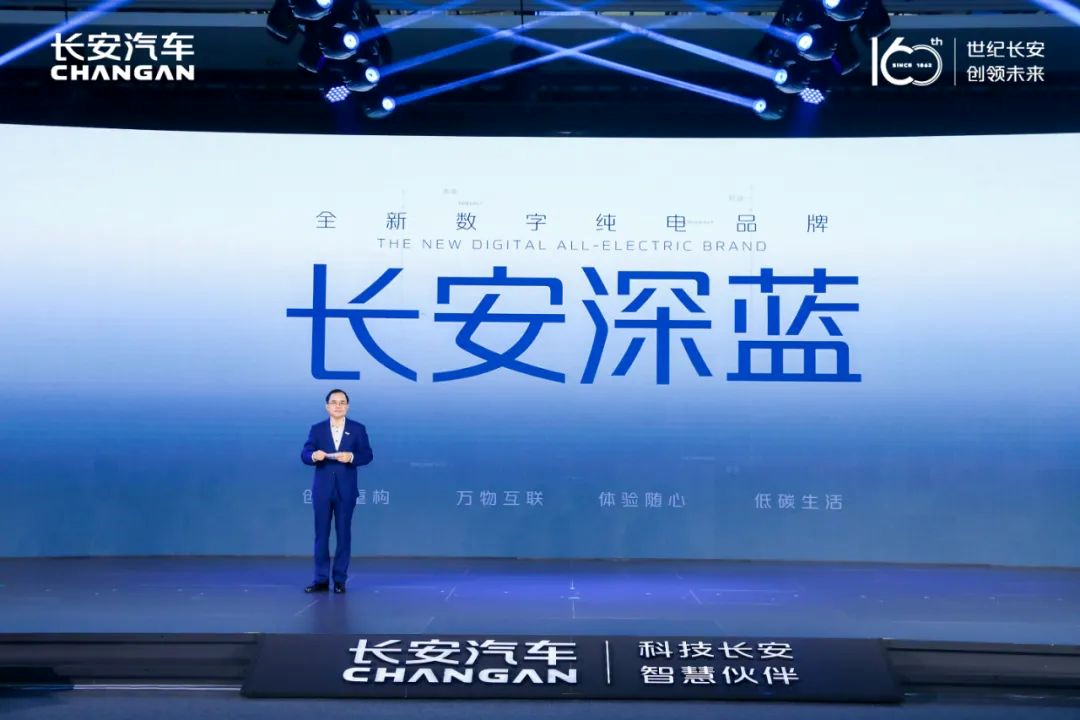

On April 13th, at the Changan Automobile Global Partner Conference, Changan Group Chairman Zhu Huarong once again became the storyteller. He said that the establishment of the Deep Blue brand is a natural next step and an accumulation of hard work.

“In the transformation of electrification and intelligentization, as well as the exploration of emerging business models, Chinese car brands are no longer bystanders or simple followers but have become runners and even leaders.”

Zhu Huarong’s statement shows a certain level of confidence. This confidence comes not only from Changan’s long-term layout in the field of new energy but also from the rise of new forces such as WEY, which has revived this market.

In 2001, Changan entered the field of new energy, going through three stages of technical research, industrialization promotion, and market operation successively, mastering more than 400 key technologies and applying for more than 800 core patents.

Technically, Changan has complete forward development capabilities for new energy “big three-electricity,” with MPA architecture, EPA architecture, CHN platform, and will build the SDA smart electric vehicle architecture in the future. However, many brands share a common thread: a technology-led approach that may not be completely reflected in their branding or market share.

Currently, Changan Automobile has four series of complete vehicle products, including A00-level small car Benben EV, and Yidong EV460. The new energy vehicle’s sales volume exceeded 100,000 units for the first time in 2021. “Not hot or cold, and not outpacing the market,” is how the industry evaluates Changan New Energy’s layout.## Long road to reach the scale threshold of 100,000 vehicles for NIO and XPeng in about 7 years

It took about 7 years for NIO and XPeng to reach the scale threshold of 100,000 vehicles. During these 7 years, they had to overcome birth, death, perseverance, and finally exhibit their sharpness to cross the threshold. The road that outsiders have explored has also given traditional car companies some ideas for transformation.

朱华荣 once said in an interview, “I think traditional car companies have learned some advantages of the new forces in car making fairly well.” In just 7 years, outsiders have become the pioneers of the intelligent era, while traditional car companies have become the ones declaring war.

Creating a new brand that meets the needs of the market

Changan has high expectations for the Deep Blue brand. Currently, under Changan Automobile’s Avita, Deep Blue, UNI, Oshan, and micro-car series, each has its own new energy business. However, although laying a foundation for the Changan new energy brand, completing economies of scale, the focus is still on the Deep Blue brand.

Compared with Avita, which targets the high-end market and shoulders the upward brand task, the Deep Blue brand, facing the “mainstream market”, has to undertake more “volume-oriented” tasks. Especially in Changan’s overall sales plan, it is clear that Deep Blue’s sales are crucial.

Whether it is Changan’s 4 million vehicles in 2025, where Salon Zhixing was entrusted with a heavy responsibility, or Geely’s goal to reach 3.65 million vehicles four years later, where Zeekr is seen as Geely’s future, they are all like Changan’s transformation battle of 4 million vehicles. The Deep Blue brand is irreplaceable.

朱华荣 revealed the sales target at the meeting, expecting Changan Automobile’s total sales to reach 4 million vehicles by 2025. Among them, 3 million are Changan brand, new energy vehicle sales reach 1.05 million, accounting for 35%. By the year 2030, Changan Automobile’s sales target is 5.5 million vehicles. Among them, 4.5 million are Changan brand, new energy vehicle sales reach 2.7 million, accounting for 60%.

If we look at the sales targets alone, Changan’s ambitions, as one of the three independent powerhouses, are not as great as Geely and Great Wall, but they are still “confident” enough.

To achieve these goals, Changan has made a rich product layout. “By 2025, Changan Automobile will introduce 21 products targeting the mainstream passenger car market, including 5 Deep Blue brands, and will launch the C385EV and C673EV of the Deep Blue brand in 2022,” said Zhu Huarong.# Changan plans to promote the UNI brand operation, achieve electrification of all products, and launch two new energy products: UNI-K PHEV and UNI-V PHEV, while the Oushang brand will launch Z6 PHEV. In the small car market, four new products will be launched.

From the perspective of Changan’s layout, it can be said that it is comprehensive and meticulous, and it has also given the Deep Blue brand the good things it holds in its hand. The C385EV and C673EV models launched this year are based on the important EPA platform of Changan. “The EPA architecture is a platform architecture for the mainstream electric vehicle market.”

In order to fully carry out the transformation, Changan plans to invest 80 billion yuan in key areas such as new energy, intelligence, and technological innovation in the next three years. At the same time, it will improve the competitiveness of the supply chain cost, build new partnership relationships, and accelerate the construction of core capabilities in the transformation field.

Everything seems to be ready, and the east wind has already blown. The Deep Blue brand that carries the scale effect of the transformation can grasp the opportunity? In fact, there is no definite answer.

Because the market is sensitive and changeable, it is difficult to capture users in the era of intelligence. This has become a major issue for traditional car companies to change their thinking and operate new brands. Whether it is Volkswagen or Geely Great Wall, there are no obvious successes.

It can also be seen from Avatar that the story that can be told is not so vivid. Avatar’s road will not be blooming all the way just because Huawei and Ningde Times are supporting it. As for whether a new brand that the market needs can be created, Deep Blue, which has just been established, has not taken the first step completely.

There is still a long way to go.

Deep Blue needs a new story

In fact, I no longer want to ask whether “the market needs a new brand” or not. Because from the development in recent years, it is meaningless to ask. No one wants to miss this opportunity. The investment in new energy will only increase.

The arrival of Deep Blue can be understood and predicted.

At the end of 2021, many people used almost the same sentence when summarizing: After 2021, new carmakers began to show their sharpness, and the entire auto industry quickly came to a transitional node. The anxiety and restlessness of the past few years have been thrown to the traditional giants.

In the past, traditional car companies liked to draw a watershed for the development of the industry. Starting in 2021, the object of frequent questioning of “when is the watershed” has become Li Bin, He XPeng, Li Xiang, and others.”5-10 mainstream new energy companies will emerge”, “the next two years will be like the Warring States period”, these predictions from the founders of these new forces are similar to those made by companies like Geely, GAC, and Changan in the era of fuel vehicles. Even so, new brands continue to be founded.

In 2021, there are constant actions by major auto groups like JiKe, IM, and Ativa, but the restlessness that covers each new brand is becoming more and more obvious. Weak fuel vehicle brands are continuously eliminated from the market. 9 brands disappeared in the competition last year, and there are currently a total of 86 fuel vehicle brands, of which 34 brands have a monthly sales volume of less than a thousand.

The trend of the shrinking fuel vehicle market is clear. “80% of Chinese fuel vehicle brands will be shut down in the next 3-5 years,” reiterates Zhu Huarong. He believes that within the next five years, 80% of Chinese fuel vehicle brands will enter the stage of closure, cessation of production, merger, or transformation.

I agree with the statement made in 2021, “the anxiety of traditional car companies is becoming increasingly apparent.” On investment websites, traditional auto companies frequently face the soul-searching question, “How likely is it that we will be eliminated by the new energy vehicle wave?”

Whether it is Lei Jun, Evergrande’s “crazy buying spree” approach, or Zhou Hongyi’s investment in NETA, various “outsiders” who are aggressively entering the market have repeatedly torn open the boundaries of the auto industry, making traditional car companies feel increasingly pressured. They have to take the risk of offending their existing suppliers and open up their traditional industrial chains to find new blood.

From Stuttgart to Detroit, from Wolfsburg to Nagoya, counterattacks rise and fall. as the “critical point” of change approaches, Changan must also find various ways to fight back.

“Why should I establish a joint venture with Li Bin? Jokingly speaking, Li Bin says he wants to overthrow us, and I want to see how he will do it. This led to the birth of Ativa. To be truthful, if it wasn’t for that round of cooperation, Ativa would not have been born,” says Zhu Huarong.

He believes that many traditional auto companies are now collaborating with internet companies, and everyone is beginning to penetrate each other. New forces are learning from traditional auto companies, and traditional auto companies are also learning from them.

In the process of integration, Changan has further cooperated with Huawei and Ningde Times. This has also led to a lot of overlap in the product information that has been published for Deep Blue models with the Ativa brand. After Changan completes the electrification of its entire product line, the Deep Blue brand’s positioning will be between the UNI and Ativa brands.

At that time, although they were two different brands, they came from the same platform and used the same technology, only with different prices. What is the development potential of Deep Blue?

At that time, although they were two different brands, they came from the same platform and used the same technology, only with different prices. What is the development potential of Deep Blue?

Moreover, the internal competition has already reached a considerable level.

Zhu Huarong explained the four core values of the Deep Blue brand using four phrases: “innovative reconstruction, interconnection of all things, customizable experience, and low-carbon living”. To be honest, these four values are not particularly innovative and are similar to the terms used by various car companies in their layout of new energy.

Of course, the 90-minute press conference was only an official announcement or declaration of Deep Blue brand. Next, we will have to see what kind of answer their first product, the C385EV, can provide.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.