Writing | Roomy

Editing | Zhou Changxian

A few days ago, General Motors and Honda joined forces. The representatives of these two automotive industry giants have taken a stand on electrification and are partnering to develop electric vehicles.

“GM has been in a hurry for a long time, and Honda has become particularly anxious this year”, many people say.

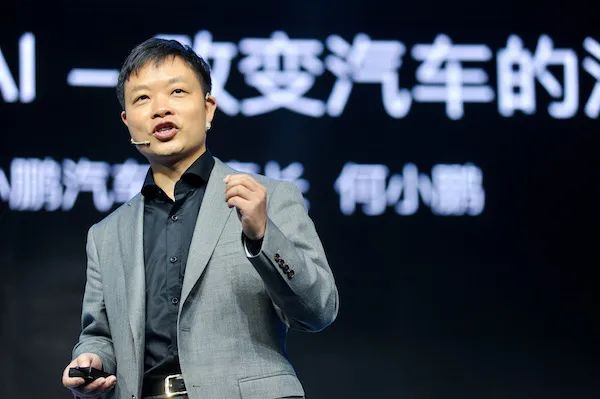

The reason for the urgency is not difficult to understand. As He XPeng said, “2024 is the last window period for this round of technology-driven car-making boom”. Everyone is trying their best to rush forward. After BYD suspended the production of fuel-powered cars, the sense of urgency in the electrification race has become even more obvious.

With little progress in electrification, GM and Honda don’t have much time to explore slowly. Mary Barra, the chief executive officer, knows that “2023-2025 are the key nodes of intelligent vehicles”. If they fail to grasp some product advantages by 2023, it will mean the advent of the “third crisis”.

Perhaps this will be the biggest crisis during her tenure, even more severe than Detroit’s bankruptcy in late 2009. For Mary Barra, there are two choices ahead–either be reborn in the transformation or cling to honor and perish.

But there is only one choice.

“We won’t give up our leadership to anyone.”

In a recent interview, He XPeng once again made it clear that more new intelligent car products will be launched in 2022, further intensifying the competition in the current industry and representing the growing vitality of this sector.

“New car-making forces like XPeng have already launched third or even fourth-generation products, and the entire process of automating vehicles has entered the intermediate stage,” which is what He XPeng calls the new car-making 2.0 phase. He also has an opinion on how to deal with traditional giants during this stage.

“Regardless of whether it is NIO and Li Bin, or IDEAL and Li Xiang, we all adhere to the same goal and remain in the same camp, continuously expanding the intelligent vehicle market share through our strength.”

From the urgent pace of the industry, we can also see that the turning point and scale effects the giants are waiting for have been delayed. But new entrants continue to emerge. In March, 1.579 million new energy passenger vehicles were sold, with a monthly penetration rate of 28.2%, reaching a historic high and achieving the 2025 target ahead of schedule.

Has the era of fuel-powered vehicles come to an end?If you’re asking about BYD, a car manufacturer which has stopped producing fuel cars, the answer is not difficult to guess. However, for a traditional automotive company like General Motors, they won’t admit this trend easily. Of course, the argument that the era of fuel-powered cars is over is not yet ripe.

Nevertheless, General Motors is already in crisis. Last year, Toyota overtook General Motors as the sales champion in the North American market. The dissatisfaction of investors towards Mary Barra added fuel to the flames. They believed that the huge investment in electrification transformation not only led to low sales, but also ended General Motors’ 90-year dominance in the US market.

There is a set of data that has made investors extremely angry. In the fourth quarter of last year, General Motors delivered only 26 electric vehicles in the US market, including 25 Chevrolet Bolt EVs and 1 pure electric Hummer, the worst performance since the launch of the first electric vehicle, Chevrolet Volt, in 2010.

In response, Elon Musk, who always enjoys stirring things up, made fun of it and said, “There is still room for improvement.” Tesla has become a huge obstacle for traditional car companies on the road to electrification, no matter whether these giants are willing to admit it or not.

Even so, Mary Barra still said in an interview, “General Motors is the leader in the electric vehicle market and will not give up its leadership to anyone”, setting a flag to catch up to Tesla’s electric vehicle sales in the US by 2025.

Mary Barra left no room for herself. “Sometimes, traditional automakers like General Motors are viewed from different angles even when we are innovating rapidly. However, it doesn’t matter. We will gradually prove this.”

Faced with a rapidly changing market, she is full of ambition and confidence.

“The Third Transformation Crisis”

In the past eight years, Mary Barra has gained the title of “Super Mary” for saving General Motors. Now, the electrification transformation is considered the “third crisis” for General Motors, and Mary Barra must once again demonstrate her courage.

Starting with her enrollment in General Motors College in 1980 at 18 years old, and as a trainee going to work in General Motors factory, Mary Barra has been with the company for more than 40 years, and observed General Motors’ 50% market share in the US market and the glorious moments, until it was overtaken by Toyota last year.

General Motors has experienced two major crises in its history, and Mary Barra has encountered both. One was the bankruptcy crisis in 2009. During the bankruptcy application, most of the executives either resigned or were fired, but she chose to stay. “I have to contribute to turning the situation around for General Motors.”

In the second crisis, the test for Mary Barra became even more severe. Just one month after she took office as CEO, the ignition switch failure caused an event that killed 13 people, triggering a safety crisis for General Motors.

Ellen Sloan, senior editor of Fortune magazine, wrote: “It took Barra 33 years of hard work to climb to the top of General Motors and become everyone’s idol. In less than a month, she went from a female pioneer who created automotive industry history to a target for everyone’s blame.”

Afterwards, she privately visited the families of the victims to apologize and promised compensation, launched the process of “speaking up for safety”, put forward the slogan “No more junk cars”, and recalled any vehicles with safety issues. “The Barra Legend” states that “Barra’s response to the recall of the ignition switch event was textbook crisis management”.

During the fossil fuel era, the “textbook” Mary Barra saved General Motors. Will she be able to steer GM in the right direction as it transitions to electrification? Many people began to worry that in this “third transformation crisis” in the name of electrification and intelligence, Barra’s situation will be like that of Mark Fields, who took over from Alan Mullaly and spent all the accumulated cash flow from the gasoline vehicle era without being able to lead the company out of trouble.

As an outsider of Wolfsburg, Diess’s transformation efforts are also facing resistance, and are constantly proving the difficulties of reforming traditional automobile companies. The complex contradictions formed by the broad and vigorous trend of electrification, the firmly entrenched interests of unions and investors, make this a predicament for General Motors.

In the eyes of former chairman and CEO Dan Akerson, Mary Barra is a reformer who is impatient with General Motors’ bureaucratic style. She once condensed the company’s 10-page dress code into one word – “appropriate attire”. Simplification is what Mary Barra does best.

During the electrification era, Mary Barra insisted on the “lean strategy” as always, not only selling brands such as Opel, Vauxhall, and Holden, but also decisively withdrawing from markets that were not profitable or did not have advantages.

“Making decisions is tough, but you have to do it. There must be a focus on the business.” She responded to the criticism from investors in this way. Foreign media praised her, “From the assembly line to the design studio, and then to the board, no one knows the pulse of GM better than her.” The US media reported that the transformation of General Motors will become a turning point for the North American automotive industry.

All the focus and expectations are on Mary Barra’s shoulders. Nowadays, General Motors’ sales of electric vehicles are not only falling behind Tesla, but also behind Ford.

All the focus and expectations are on Mary Barra’s shoulders. Nowadays, General Motors’ sales of electric vehicles are not only falling behind Tesla, but also behind Ford.

An inevitable oath

Musk’s mockery once again puts pressure on General Motors from Wall Street investors, demanding that Mary Barra take the lead in divesting the electric vehicle business as soon as possible to better respond to change.

This urgency is like the urgency to quickly withdraw from the long-term loss-making sedan business and focus on developing profitable businesses such as trucks and SUVs. “Profit” is like a double-edged sword, hanging over Mary Barra’s constantly investing money in the road of change.

The outside world does not know how much money General Motors has already spent on this transformation, but through planning, it can be clear that General Motors still needs to invest heavily. In 2021, General Motors decided to increase its investment in electric and autonomous driving fields from $27 billion over the next five years to $35 billion. This investment amount is more than five times the net profit of $6.4 billion in 2020.

Wall Street investors are worried because Mark Fields is a warning to the entire Detroit area.

Mark Fields, who has been constantly investing in smart travel and technology interconnection, has been criticized by investors as a “burning money expert”, using a lot of money to pull Ford from a hot state to a loss-making place.

High investments have brought Ford not only technological achievements beyond the label of “traditional car companies”, but also the pain of slowing down the launch of new cars, declining sales and profits in the traditional field… Huge discounts on profits and irritable investors forced the board of directors to “lay off” Mark Fields, who had worked for Ford for 29 years and had been the global CEO of Ford for only three years.

American writer Hoffman once said, “On the long list of Ford’s history, extraordinary success and unparalleled failures are alternately staged. After overcoming all difficulties and recovering, it often slides into collapse and returns to mediocrity and poorly managed old ways.” Ford’s old story makes people also worry about how long Mary Barra will have?

Traditional business is declining, and the new strategy has not yet yielded results. What will GM do next? Where is the future of Detroit going?

Detroit has publicly criticized Toyota for selling the Prius, complaining about how much money they lost, and complaining that the powerful Toyota was developing new cars without hesitation, investing more than 5% of its sales revenue in the development of related technologies. However, the louder the complaints, the more they indicate the backwardness and urgency of Detroit in transformation.

In the face of multiple pressures, Mary Barra remained firm, “The company is undergoing a painful but necessary transformation, and money must be invested in electric and self-driving cars.” However, General Motors has lost to Toyota on its home turf for two consecutive quarters.

In the face of multiple pressures, Mary Barra remained firm, “The company is undergoing a painful but necessary transformation, and money must be invested in electric and self-driving cars.” However, General Motors has lost to Toyota on its home turf for two consecutive quarters.

In the first quarter of this year, sales of all four of General Motors’ brands fell compared to the same period last year, and the sales data was not good. In addition, despite the US government repeatedly expressing the attitude that “the future of the automotive industry is electrification, and there is no turning back,” Americans’ enthusiasm for electric cars is still far lower than their passion for pickups, making General Motors’ reform crisis even more apparent.

In 2021, electric vehicle sales in the US market were only 6%, with Tesla accounting for 70% of electric vehicle sales and surpassing BMW and Mercedes-Benz, once again sitting at the top of the US luxury car rankings. However, Mary Barra still firmly declared that by 2025, General Motors will produce one million electric vehicles, surpassing Tesla’s electric vehicle sales in the US.

Of course, the US government’s expectations of General Motors also make this declaration a “must-do.”

General Motors and Honda Expand Together

Although all reformers take Tesla as their most direct opponent, General Motors also knows that “our competitors are everyone.”

Indeed, as Toyota’s Akio Toyoda said a few years ago, “Our opponents have extended from giants like Volkswagen and General Motors to technology companies like Apple and Google.”

The change in competitors has stimulated General Motors and also increased the complexity of Mary Barra’s reform. Traditional mainstream car companies that have been undergoing electrification trends for several years, including Volkswagen, General Motors, Geely, and Changan, have always believed one thing, “The scale advantages of traditional mainstream car companies will be fully reflected after the market turning point.”

But who holds the turning point, newcomers to the automobile industry or established giants? No one can give a clear answer, but new car makers have already taken the lead and accumulated market reputation.

In terms of determination and action, General Motors’ transformation efforts and investment in new technology have made people take notice, and Mary Barra’s determination fills every corner of General Motors’ headquarters building. However, what cannot be denied is that in the Chinese market, General Motors’ reform is still in a “huddled state,” and the speed of transformation is slow.

Until last year, General Motors officially launched a new electrification platform – Ultium, which incorporates 26 years of electrification research and development experience from General Motors, along with technology features such as “autonomous driving”, “BEV3 platform” and “Ultium battery”. No one knows what kind of answer this platform will ultimately bring to General Motors, but Mary Barra said during a speech that the Ultium pure electric platform provides scale and speed for General Motors’ future development.

Until last year, General Motors officially launched a new electrification platform – Ultium, which incorporates 26 years of electrification research and development experience from General Motors, along with technology features such as “autonomous driving”, “BEV3 platform” and “Ultium battery”. No one knows what kind of answer this platform will ultimately bring to General Motors, but Mary Barra said during a speech that the Ultium pure electric platform provides scale and speed for General Motors’ future development.

Recently, the first model of the platform, the Cadillac LYRIQ, was officially unveiled at the assembly plant in Spring Hill, Tennessee. “We have the technology, the talent, the ambition, and the confidence to deliver on this promise,” said Mary Barra, who believes that the inflection point of “pure electric, enjoyed globally” is here, and General Motors will lead this transformation.

It seems that no one except General Motors themselves believes that they will be the leader in this field. He XPeng once said that there will be five to ten major players in the future new energy vehicle industry, which is reminiscent of the prediction made ten years ago for domestic brands in the era of fuel vehicles. Everyone wants to be one of them, and those who are slow can only ally themselves.

In March of this year, Honda announced a plan to establish a new company this year in partnership with Sony to jointly develop pure electric vehicles. In April, Honda announced another partnership with General Motors to jointly develop low-priced electric vehicles. The two companies expect the selling price of the new model to be less than 30,000 US dollars and will be sold globally starting with the North American market after 2027.

The two companies also stated that they will deepen cooperation in the field of pure electric vehicle battery technology, including the development of new generation batteries such as solid-state batteries that both parties are currently promoting separately. Sharing technology, design, and manufacturing strategies can help both companies achieve technological innovation more quickly and accelerate their electrification transformation.

Honda acknowledged this. Honda President and CEO Toshihiro Mibe said in a statement: “Honda and General Motors will rapidly expand the sales of electric vehicles through successful technological cooperation.”

Mary Barra also believes that “cooperation between the two companies will supply pure electric vehicles to the world earlier than if they acted separately.”

However, the first model of the cooperation between the two parties will not be launched in the market until four years later. What will the market look like at that time?

Both Honda and General Motors know that the battlefield is in the Chinese market. In January of this year, Katsushi Inoue, president of Honda Automotive China, said, “If we cannot win the competition in China that is promoting electrification, we will be eliminated by the world. We must change in all areas, and the next five years will determine the outcome.”

But will investors give Mary Barra five years?On the one hand, the massive amount of money invested in the transition did not yield immediate results. On the other hand, sacrificing the company’s traditional car business and profits is not acceptable to investors. Finding a balanced solution between maintaining traditional car sales and investing in the future is a great test of Mary Bora’s wisdom and skills.

It’s really difficult to successfully navigate through the third crisis.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.