The strategy of new energy vehicles is showing its effectiveness.

By CH_Chen

In 2009, China’s automobile sales surpassed the United States for the first time, becoming the world’s leading automobile manufacturing and sales country. This milestone marked China’s true emergence as an “automotive giant.”

Since then, the topic of “when will China transform from an ‘automotive giant’ to an ‘automotive powerhouse’?” has been repeatedly mentioned.

Over the past decade, China’s automobile industry has never stopped its forward momentum. We have transitioned from copying and imitating in the initial stage to self-research and development, from learning others’ standards to establishing our own research and development and production system architecture, and from rough car sales to refined services, striving to narrow the gap with world-class automotive companies.

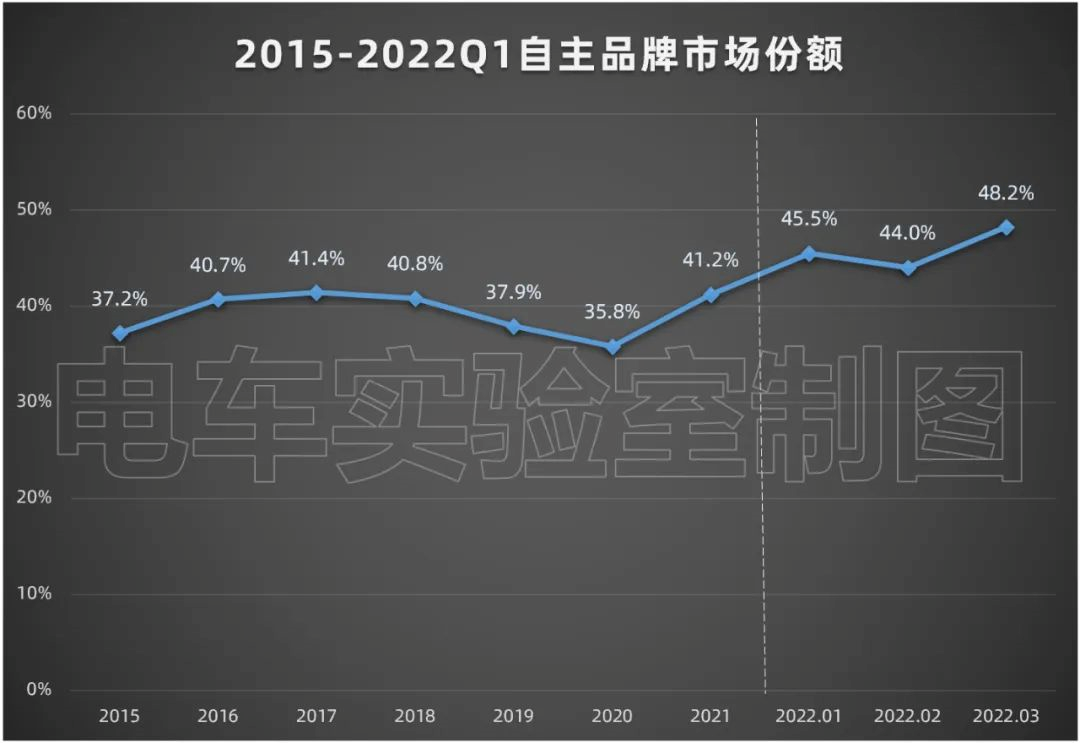

However, market competition is fierce. Since 2018, as the prices of joint venture brands have fallen and the trend of consumption upgrading has strengthened, the mid-to-low-price market dominated by domestic brands has been severely impacted, and market share has plummeted, hitting its lowest point in 2020, with only 35.8% of the market share remaining.

The reason behind this can be attributed to the technology gap between domestic brands’ core technologies such as engines and transmissions and those of world-class automotive companies, which has consistently remained insurmountable, despite our efforts to catch up over the past decade.

However, things took a turn in 2021.

Last year, the market share of domestic brand automobiles increased significantly, reaching 41.2%, returning to historical highs. In the same year, China’s retail sales of new energy vehicles reached 2.989 million, a year-on-year increase of 169.1%.

In the new energy vehicle market, domestic brands “won the lottery”

Entering 2022, the market share of domestic brands maintains its strong growth, especially in March. Despite the overall decline of 10.5% in the passenger vehicle market, the retail sales of domestic brands reached 750,000 units, an increase of 17% year-on-year and 37% month-on-month. The domestic retail market share of domestic brands in March increased by 11.5 percentage points year-on-year, reaching 48.2%.

Entering 2022, the market share of domestic brands maintains its strong growth, especially in March. Despite the overall decline of 10.5% in the passenger vehicle market, the retail sales of domestic brands reached 750,000 units, an increase of 17% year-on-year and 37% month-on-month. The domestic retail market share of domestic brands in March increased by 11.5 percentage points year-on-year, reaching 48.2%.

According to the data released by China Passenger Car Association, the domestic market share of domestic brands reached 48% in the first three months of this year, an increase of 9.7 percentage points over the same period in 2021. On the other hand, the domestic retail sales of new energy passenger vehicles for January to March reached 1,070,000 units, with a year-on-year increase of 146.6%.

What connects these two pieces of data is the market penetration rate of new energy vehicles.

In March of this year, the domestic retail penetration rate of new energy vehicles reached 28.2%, an increase of 17.6 percentage points over the penetration rate of 10.6% in March 2021. Among them, the penetration rate of new energy vehicles in domestic brands reached 46%, while that of luxury brands reached 32%, and that of mainstream joint venture brands was only 4.3%.

In other words, in March, for every 100 new vehicles sold in China, 28 were new energy vehicles, and for every 100 new vehicles sold by domestic brands, 46 were new energy vehicles.

The growth of sales in the new energy vehicle market is mainly contributed by domestic brands, and the growth of domestic brands’ market share is also due to the popularity of new energy vehicles.

The most typical example is BYD, which just announced its plan to stop production of fuel vehicles.

BYD, whose sales of new energy vehicles account for over 90%, has been dominant this year. In March, BYD sold over 100,000 units, with an overall sales volume of 104,338 units and a year-on-year increase of 160.9%. The overall sales and sales of new energy vehicles both created new records, enabling the company to rise to the third place in the ranking of manufacturers.

In the first three months of this year, BYD’s cumulative sales reached 287,363 units, a year-on-year increase of 182.8%, ranking fifth among manufacturers. Among them, the sales volume of new energy vehicles was 282,686, with a year-on-year increase of 421.5% and a 26.4% share in the new energy vehicle market, far ahead of other car companies.

According to the new energy vehicle manufacturer sales ranking released by China Association of Automobile Manufacturers from January to March, only two foreign-funded/joint venture manufacturers, Tesla China and SAIC Volkswagen, ranked in the top 15, and the other 13 seats were occupied by domestic brands. There is no doubt that domestic brands are the biggest beneficiaries of the development of the new energy vehicle market, and they have truly “won big” in the competition in this emerging automobile market.

“Changing Lanes to Overtake” is Not a Joke

Data does not lie. No matter how many people ridicule the new energy strategy on the Internet, the improvement of China’s automobile competitiveness through the new energy strategy is very obvious. In March, for the first time, both sedan and SUV sales rankings in China were taken by new energy vehicles. In the weak sedan market for domestic brands, the sales volume of Wuling Hongguang MINI EV exceeded that of Nissan Sylphy by 11,000 units, which is unimaginable in the field of fuel vehicles.

The significance of new energy vehicles for domestic brands and even the entire premium car market is even more evident in the high-end car market with starting prices above 300,000 RMB. From the data released by China Association of Automobile Manufacturers, we can see that only Hongqi H9, a Chinese brand, is on the list in the high-end sedan market with a lack of new energy products, and the entire segment market is shrinking significantly. Luxury mid-size cars have been severely impacted by new energy sedans represented by Tesla Model 3 with lower starting prices, and there are few pure electric sedans with starting prices over 300,000 RMB.

On the other hand, in the high-end SUV rankings above 300,000 RMB, Ideal ONE ranked fourth in March, and NIO ES6 and EC6 also made it to the list, plus the eye-catching performance of Tesla Model Y. There are already four new energy vehicles in the top 10, and the growth rate of new energy vehicles far exceeds that of fuel vehicles.It can be foreseen that by the end of this year, NIO’s two sedan models, the ET7 and ET5, will appear on the high-end sedan sales charts. Furthermore, the NIO ET5 is expected to make a push for the top three on the chart next year. In the high-end SUV sales chart, the number of new energy vehicles appearing on the list is likely to reach 6-7, with the upcoming high-end new energy SUVs such as Li Xiang L9, XPeng G9, and NIO ES7 clearly more competitive than the fuel SUVs at the bottom of the current chart.

Developing new energy vehicles not only improves the sales of domestic automotive brands but also allows them to sell at higher prices. Three years ago, 200,000 RMB was already considered the price ceiling for domestic automotive brands. However, now, XPeng with an average price of 200,000 RMB, Li Xiang with an average price exceeding 300,000 RMB, and NIO with an average price exceeding 400,000 RMB have each secured a stable leading position in their respective niche markets.

The competition in the new energy vehicle market is essentially a “lane-changing race.” Our gap with the world’s leading level in motors, batteries, electric control, and intelligentization is far less than the gap in engines and transmissions. With the advantages of our early-mover status, industrial scale, and institutional advantages, “overtaking in lane change” is not a joke.

How far away are we from becoming an “automotive powerhouse”?

“Going global” is an essential step towards becoming an “automotive powerhouse.” If you pay attention to foreign automotive websites, you will find that there is much more news about Chinese cars now, with the vast majority of it being related to new energy vehicles. On the other hand, new energy vehicles from Chinese automakers such as Hongqi, BYD, NIO, and XPeng have already started entering the European market and even plan to enter the local markets in Germany and the United States, challenging the traditional automakers in the world’s two major automotive powerhouses.

This time, compared to the collective overseas expansion of domestic automotive brands many years ago, we not only have more public attention, access to more advanced automotive markets, but also stronger products and more confidence.

Although we still need time to accumulate and precipitate in automotive culture, we are really not far from becoming an “automotive powerhouse” if we seize the trend of the world’s automotive electrification and intelligentization.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.