Hydrogen Energy Is “Hot” Again in 2022.

On the one hand, due to the recent crazy rise in battery raw materials such as “demon lithium” and “demon nickel”, many people are no longer optimistic about the future of lithium batteries; on the other hand, the successful hosting of the Beijing Winter Olympics has greatly increased the exposure of hydrogen energy vehicles, including Toyota’s second-generation Mirai.

There have always been two completely opposite voices at home and abroad regarding hydrogen energy: one believes that hydrogen is absolutely environmentally friendly and the “ultimate energy”, and that current fossil fuels, lithium batteries, and others are just transitional, and hydrogen will dominate the world in the future; the other believes that hydrogen itself is expensive and dangerous, and will never have a future.

In order to avoid being misled by “binary” statements, let’s first take a look at the country’s plans and opinions. On March 23, the National Development and Reform Commission and the National Energy Administration jointly issued the “Medium- and Long-Term Development Plan for the Hydrogen Energy Industry (2021-2035)” (hereinafter referred to as the “Plan”), which clearly defines the three major “strategic positions” of hydrogen energy: hydrogen energy is an “important component” of the future national energy system; hydrogen energy is an “important carrier” for achieving green and low-carbon transformation in energy end-use; hydrogen energy industry is a “strategic emerging industry” and a “key development direction” for the future.

With the top-level design in place, in order to better understand the country’s plans and the future development direction of hydrogen energy, it is necessary to first understand the current situation of hydrogen energy development in China.

The current situation of China’s hydrogen energy: obvious hydrogen production advantages, but still in the early stages of development

First of all, contrary to many people’s impression, China is the world’s largest hydrogen producer, with an annual hydrogen production capacity of about 33 million tons, of which about 12 million tons meet the quality standards for industrial hydrogen.

However, from the perspective of hydrogen production sources, it is mainly “industrial by-product hydrogen” and “coal-derived hydrogen”, which are still “gray hydrogen” that is not very environmentally friendly. If carbon capture, utilization, and storage (CCUS) technology is combined during this process, up to 80% of carbon emissions can be reduced, making it a relatively environmentally friendly “blue hydrogen”. However, to achieve the ultimate zero-emission environmental protection goals, “green hydrogen” is still needed, and China happens to have some advantages in this regard.

Academician Chen Qingquan of the Chinese Academy of Engineering stated at the 2022 Electric Vehicle Hundred People’s Forum: “China has abundant renewable energy resources, such as solar, wind, and hydro power. The renewable energy resource endowment in China is equivalent to 2.7 times the total peak demand for energy.” Currently, China’s renewable energy installed capacity is the largest in the world and is still growing rapidly._20220413200535.png)

China’s western and central regions, where sunlight is abundant and sparsely populated, are very suitable for the development of photovoltaic power generation. At the same time, after more than a decade of policy support, China’s technology in photovoltaic power generation has also been leading globally. According to official data, in 2021, China’s newly installed photovoltaic power generation capacity reached 54.88 GW, and the amount of photovoltaic power generated reached 325.9 billion kWh, an increase of 25.1% year-on-year. In terms of exports, China’s photovoltaic products exported more than 28.4 billion US dollars, a year-on-year increase of 43.9%.

Under the dual effect of technological improvement and scale efficiency, the cost of photovoltaic power generation in China is rapidly decreasing. In June of last year, the first phase of the 200 MW photovoltaic base in Zhengdou, Ganzi County, Sichuan Province, was bid at an ultra-low price of 0.1476 yuan/kWh, which includes the cost of ecological maintenance.

In addition to photovoltaic power generation, China has significant advantages in renewable energy generation such as hydropower, nuclear power (with the most under-construction nuclear power plants), and wind energy. With the decrease in cost, in the future, using these energy sources to produce “green hydrogen” through “water electrolysis” will have significant importance in achieving the carbon peak in 2030 and carbon neutrality in 2060, while also reducing the degree of dependence on foreign energy.

Overall, whether it is “grey hydrogen” mainly derived from fossil energy and industrial byproducts at the current stage, or “green hydrogen” produced by renewable energy sources in the future, China has significant advantages.

However, the “Plan” also points out that China’s hydrogen energy industry is still in the early stage of development, and there are problems such as weak innovation capabilities and low technological equipment levels. The related core equipment still mainly relies on imports, some key technologies have short boards, and the development of hydrogen energy infrastructure, including hydrogen production facilities, hydrogen energy storage and transportation facilities, hydrogen refueling station layout, and hydrogen safety auxiliary facilities, etc. is lagging behind.

These problems reflect in reality that China’s utilization of hydrogen energy is mainly in the chemical industry sector as raw materials, and a considerable amount of hydrogen is wasted through “venting” each year.

So, besides the chemical industry sector, what are the other uses for so much hydrogen production? Let’s start with the automotive industry, which is relatively familiar and concerning to everyone.

Current Situation of Hydrogen Fuel Cell Vehicles: Difficult to Popularize for Passenger Cars, Reliant on Subsidies for Commercial VehiclesFirst of all, currently there are two factions of hydrogen energy vehicles – hydrogen internal combustion engine vehicles and hydrogen fuel cell vehicles. At present, Chinese automobile manufacturers Geely, Great Wall, and Hongqi have developed their own hydrogen internal combustion engines. This engine can burn hydrogen gas instead of oil, which means that it inherits the fuel system of conventional vehicles with low research and development difficulty. However, it is almost impossible to match the driving efficiency and driving experience of electric vehicles. Moreover, although it burns hydrogen gas, under high temperature and pressure conditions, it still produces serious air pollution called “NOx (nitrous oxide)” because there is still 70% nitrogen in the air. This deviates from the original intention of zero emission of hydrogen energy.

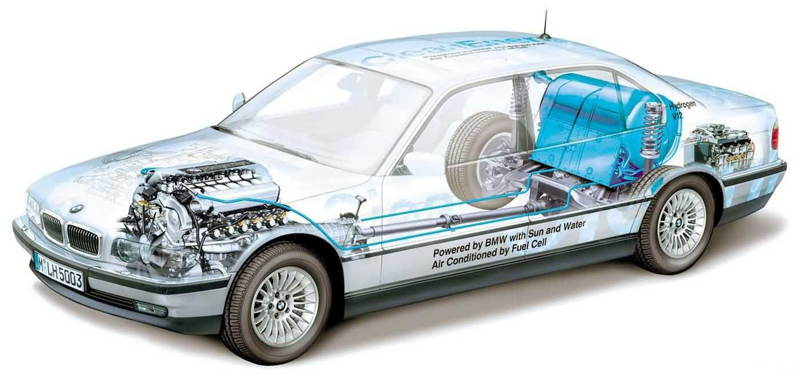

BMW started researching hydrogen internal combustion engines in the 1990s and produced 15 hydrogen-engine sedans, the BMW 750hL in 2000. It features a 5.4-liter V12 engine that can burn both oil and hydrogen gas. Although the technology is indeed advanced, its maximum power and peak torque were only 150 kW and 300 N·m, respectively when using hydrogen as fuel. Meanwhile, the huge hydrogen tank occupied most of the trunk, resulting in very poor practicality.

Therefore, BMW also gradually began to stop research and development of hydrogen internal combustion engines and began to focus on hydrogen fuel cell vehicles that can represent the future of automobiles. In fact, BMW started relevant research in the 1970s. The iX5 Hydrogen to be released this year is one of their notable hydrogen fuel cell vehicles, with a maximum power of 275 kW and a range of over 500 km at low temperatures.

In addition, Mazda has also announced the development of hydrogen rotary engines, but it has remained on PPT and patents. Overall, the future of hydrogen energy vehicles mainly lies in hydrogen fuel cell vehicles.

Currently, only Toyota, Hyundai, and BMW are mass producing hydrogen fuel cell passenger cars. In 2021, Honda and Nissan announced the discontinuation of their hydrogen fuel cell cars and turning to electric vehicles instead. On April 12, Honda revealed a very “radical” electrification plan: investing approximately 5 trillion yen over the next 10 years in electrification and software, launching 30 pure electric cars in the global market by 2030, with a planned annual production volume of over 2 million vehicles, and opening a full solid-state battery production line in 2024.

Currently, only Toyota, Hyundai, and BMW are mass producing hydrogen fuel cell passenger cars. In 2021, Honda and Nissan announced the discontinuation of their hydrogen fuel cell cars and turning to electric vehicles instead. On April 12, Honda revealed a very “radical” electrification plan: investing approximately 5 trillion yen over the next 10 years in electrification and software, launching 30 pure electric cars in the global market by 2030, with a planned annual production volume of over 2 million vehicles, and opening a full solid-state battery production line in 2024.

In 2021, the global sales of hydrogen fuel cell passenger cars (FCEVs) were only 16,000 units, of which the global sales of Hyundai NEXO and Toyota Mirai were 9,620 and 5,918 units, respectively. Other manufacturers and models can be ignored. In contrast, the sales of electric vehicles worldwide reached 6.5 million units in 2021, a year-on-year increase of 109%, accounting for 9% of all passenger cars. The share of hydrogen fuel cell cars is negligible compared to that of electric vehicles.

It’s worth noting that Toyota and Hyundai have already made great efforts to promote their hydrogen fuel cell products. For example, the Hyundai NEXO Limited model, which has a suggested retail price of $62,385 in the United States, has an official discount of $20,000, plus a $8,000 federal tax offset and a $4,500 California clean vehicle rebate. The final cost is only $29,885 with a six-year interest-free loan. Nonetheless, few Americans buy it (most of the NEXO sales are concentrated in South Korea).

The reason why no one buys it is simple: poor experience.

The first reason for the poor experience is the lack of hydrogen refueling stations. According to data from the end of 2020, there were only 49 hydrogen refueling stations in the United States and a total of 553 worldwide. This is much worse than the range anxiety of “electric daddy” and the car can only be driven around where there are refueling stations.

The issue of which comes first, the chicken or the egg, applies to hydrogen filling stations and hydrogen fuel cell vehicles. Without vehicles to refuel, there is no incentive to build hydrogen filling stations. Without filling stations, there is no interest in purchasing hydrogen fuel cell vehicles. Even with significant government subsidies, most hydrogen filling stations operate at a loss due to their high construction costs. In China, the cost of building a hydrogen filling station is approximately 10-15 million yuan, three times higher than that of a traditional petrol station. Moreover, hydrogen filling stations have extremely destructive power in the event of an explosion, leading residents in surrounding areas to vigorously protest against them. Similar incidents have already occurred in Norway and South Korea.

The issue of which comes first, the chicken or the egg, applies to hydrogen filling stations and hydrogen fuel cell vehicles. Without vehicles to refuel, there is no incentive to build hydrogen filling stations. Without filling stations, there is no interest in purchasing hydrogen fuel cell vehicles. Even with significant government subsidies, most hydrogen filling stations operate at a loss due to their high construction costs. In China, the cost of building a hydrogen filling station is approximately 10-15 million yuan, three times higher than that of a traditional petrol station. Moreover, hydrogen filling stations have extremely destructive power in the event of an explosion, leading residents in surrounding areas to vigorously protest against them. Similar incidents have already occurred in Norway and South Korea.

In addition, the large hydrogen storage tanks take up precious space inside cars. The second-generation Toyota Mirai, which shares the same platform as the Lexus LS, has much less rear seat and cargo space due to its large hydrogen storage tanks. Furthermore, while the Toyota Mirai uses electric propulsion, the power output of fuel cells is currently limited. This results in poor acceleration performance, taking approximately 9 seconds for the Toyota Mirai to accelerate, compared to 3-4 seconds for most electric cars.

Therefore, many experts believe that hydrogen fuel cells have greater potential in commercial vehicles, especially heavy trucks. Hydrogen is the smallest molecule, making it abundant with a high energy density of up to 142 MJ/kg, three times that of gasoline and 200 times that of lithium batteries. Hydrogen can also be refuelled at a much faster speed than that of battery charging. This is particularly important for heavy truck drivers who strive for efficiency since carrying a 4-5 ton battery pack and waiting for several hours for each charge is intolerable. Finally, the fixed routes of heavy trucks allow for more efficient layout of hydrogen filling stations, further enhancing the commercial potential of hydrogen fuel cells in the industry.

图片注释:

- The second-generation Toyota Mirai uses three hydrogen storage tanks with a driving range of up to 850 kilometers but significantly occupies space inside the car.

- SAIC Maxus V80 hydrogen fuel cell vehicle refuelling at a hydrogen filling station.The cost of hydrogen fuel heavy trucks is still high as the fuel cell stack system accounts for 65% of the vehicle cost, and many critical components are imported. It is understood that the current factory price of a hydrogen fuel cell heavy truck with power over 110 kW and a load capacity of over 31 tons is around 1.3-1.5 million yuan. If it is purchased in 2020 according to a 1:1 subsidy standard, it can enjoy a subsidy of 546,000 yuan, and the final price can be comparable to the selling price of traditional diesel trucks, around 300,000-400,000 yuan. However, with the decline of national and local subsidies, it is difficult to attract customers to purchase a hydrogen fuel cell truck if the speed of cost reduction is not fast enough. For example, in 2018, the price of a SAIC Maxus V80 hydrogen fuel cell version was about 1.3 million yuan, and it only reached a terminal price of about 300,000 yuan after receiving a 1 million yuan subsidy, while its gasoline version only costs over 100,000 yuan.

At the same time, hydrogen fuel heavy trucks are also facing the impact of the “battery swapping” model. Currently, domestic giants such as Geely and Ningde have already begun to layout, while Tesla’s Semi is expected to be released next year. It is said that after equipped with 4680 batteries, its driving range can reach close to 1,000 kilometers, and it can travel about 650 kilometers after a 30-minute charge. If these parameters can be realized, hydrogen fuel cell heavy trucks may temporarily have no advantage.

Currently, the development of hydrogen fuel cells in passenger cars has been far behind that of electric vehicles, and in the commercial vehicle field, it is still heavily dependent on subsidies (fortunately, due to the high threshold, there is not much concern about “fraudulent subsidies”). For a considerable period of time, hydrogen energy vehicles have always been just a supporting role. The “Planning” proposes that by 2025, the number of China’s hydrogen energy vehicles should reach 50,000, which is less than the monthly output of Tesla’s Shanghai factory, and most of them will be hydrogen fuel cell commercial vehicles.

Lithium-ion Battery Vehicles or Hydrogen Fuel Cell Cars, Japan’s Opinion Doesn’t Count

Going back to 2010, at that time, electric vehicles were generally not favored, but with more than 300 billion yuan in national subsidies and policy dividends such as green license plates, the latest data from the China Passenger Car Association (CPCA) shows that in March, the penetration rate of new energy vehicles has reached 28.2%, and the replacement of fuel vehicles is no longer a joke.Assuming that hydrogen fuel cells receive the same level of support from China, the United States, and Europe during the same period, and with the joint efforts of policy, capital, and talent, their cost will significantly decrease. Data shows that from 2010 to 2020, the average price of lithium-ion battery packs worldwide decreased from $1,100/kWh to $137/kWh, a decrease of 89\%. If hydrogen fuel cells can achieve a similar cost reduction path, they will not only be shown off at the Winter Olympics.

However, at present, China, the United States, and Europe have tacitly chosen the lithium battery route and only regard hydrogen fuel cells as a backup plan. The potential of hydrogen fuel cell cars is only potential as Japan has accumulated high barriers in the hydrogen energy field. Currently, in the layout of global hydrogen energy and technology, only Toyota has about 6,000 core-related patents, accounting for about half of the world’s patents, which appears to be a “monopoly” attitude. Choosing to focus on the development of hydrogen fuel cells is tantamount to working for Japan.

The combined automotive markets of China, the United States, and Europe account for about 65\% of the global market, while the Japanese market is only about 5\%. Meanwhile, the combined GDP of China, the United States, and Europe is ten times that of Japan. Even if Japan wants to promote hydrogen energy vehicles, its local market and funds cannot support the continuous rapid iteration and upgrade of technology and products.

The underestimated hydrogen energy storage: a perfect match for photovoltaic and wind power

Although it was mentioned above that China currently relies mainly on “coal power” for electricity generation and hydrogen production, in the future, hydropower, photovoltaics, wind power, and nuclear power will become more and more significant. The “World Energy Industry 2050 Net Zero Emissions Roadmap” released by the International Energy Agency (IEA) points out that by 2050, nearly 90\% of global electricity will come from renewable energy, with wind and solar photovoltaic power accounting for nearly 70\%.

However, these renewable energies have a significant characteristic — instability. For example, photovoltaic power generation is entirely dependent on sunlight and varies greatly with different seasons and times, which is very “unsatisfactory.” Most of the time, the power grid is unable to accommodate this type of electricity. If the electricity generated by a photovoltaic system is connected directly to your appliance, it will either frequently break down or burn out.So a lot of electricity is wasted every year in China, with more than 100 billion kilowatt-hours abandoned in the 2018 in the field of photovoltaic, wind and hydroelectricity. Therefore, energy storage has become a crucial element. According to the Guidelines for Accelerating the Development of New Types of Energy Storage issued by the National Development and Reform Commission and the National Energy Administration, the installation capacity of new types of energy storage in China must reach over 30 GW by 2025, ten times that of 2020. It is forecasted that by 2030, in most parts of China, the photovoltaic-battery combination can achieve cost parity, and the market space for energy storage can reach more than RMB 1.2 trillion.

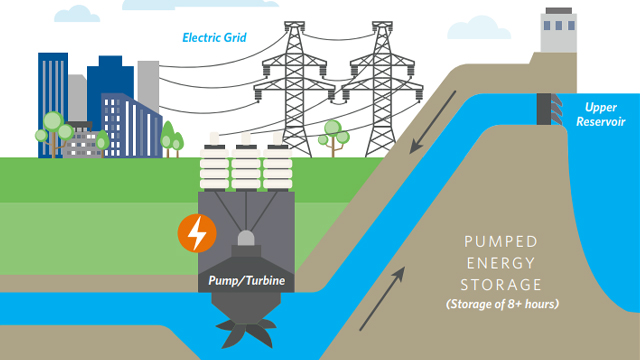

There are currently two main modes of energy storage. The first is “pumped storage”, which is a cost-effective method. However, it does not work well in places where there is no water. For example, in many barren and water-scarce regions the wind and photovoltaic power generation will have a significant share in the future. The other mode is “electrochemical”, which is mainly done through large battery storage, but is too costly and unsuitable for long-term storage.

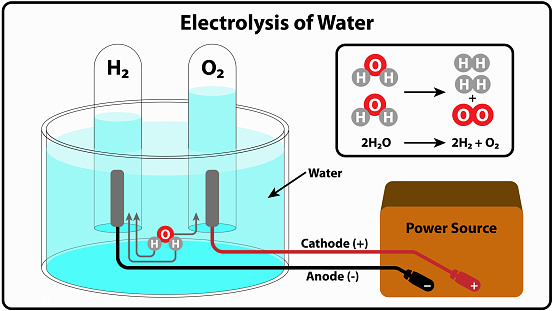

Compared to other methods, hydrogen storage is a relatively ideal solution. The basic principle is to use electricity generated from wind, photovoltaic or hydroelectric power to electrolyze water and store the hydrogen produced. This hydrogen can be transformed back into power through combustion or fuel cells to meet the electricity demand from the power grid. Alternatively, it can also be used for chemical purposes or transportation.

For example, In a photovoltaic power generation area in western China, there could be too much electricity generated in the summer and too little in the winter. In such cases, it may be necessary to store the power generated for six months, and hydrogen, with its high energy density, is a good option. Additionally, the stored hydrogen can be transported via pipelines or long tank trailers to high-demand areas.

Academicians at the Chinese Academy of Sciences, such as Ouyang Mingao, claim that, based on the scale of energy storage and economics, the cost of stationary hydrogen storage is one order of magnitude lower than that of battery storage. Hydrogen energy has thus proven to be the best way to enable the long-term storage of a large amount of renewable energy. However, the efficiency of the “electric-hydrogen-electricity” method is not highly efficient at present, only 30-50%. Additionally, the cost of producing hydrogen via water electrolysis is currently high, while high-efficient and low-cost water electrolysis technology is a promising breakthrough direction in the future.In general, with the rapid development of renewable energy in the future, hydrogen energy storage has enormous potential, even more than hydrogen fuel cell vehicles.

Conclusion

Currently, there is still a lot of controversy and disagreement on the future of hydrogen energy in and outside of the industry. As the top-level design of the country is released, hydrogen energy plays an important part in the future national energy system and will play an increasingly important role. According to the forecast of the China Hydrogen and Fuel Cell Industry Alliance, hydrogen will account for 10% and 20% of China’s energy system by 2050/2060.

Regarding the application of hydrogen, currently, the chance of large-scale popularization of hydrogen energy passenger vehicles is very slim. In the commercial vehicle sector, it will compete head-on with electric vehicles, while the potential of hydrogen energy storage is clearly underestimated, and it may play a more important role than hydrogen fuel cell vehicles in the future. In addition, in the fields of building supporting energy supply, energy distribution, hydrogen-powered airplanes, hydrogen-powered ships, and other domains, hydrogen energy has significant potential. In short, next time you talk about hydrogen energy, don’t just talk about cars.

Finally, feel free to download the Garage App to learn about the latest news on new energy. If you want more real-time communication, you can click here to join our community.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.