Author|Nie Yiyao

Since March, Omikron has successively broken out in Geelyn and Shanghai, and multiple scattered outbreaks throughout the country. It has already shown serious destructive power in the domestic automobile market.

On April 11, data released by China Association of Automobile Manufacturers (CAAM) showed that the national retail sales of narrow-class passenger cars in March 2022 were 1.579 million units, a year-on-year decrease of 10.5%, and a decrease of 185,000 units from the same period last year.

This is a sacrifice that the domestic automobile market has to make in order to fight the epidemic.

It is worth mentioning that Geelyn and Shanghai, where the epidemic was the most serious in March, are the homes of the two major automobile groups, FAW and SAIC, and there are also many component suppliers in the surrounding areas. The outbreak of the epidemic has seriously dragged down the production of local automakers and component suppliers, which is reflected in the terminal sales of the entire car market, which is not too optimistic.

However, compared with the overall sales volume in March, the collapse of the car market under the epidemic is even more cruel. The joint venture camp was hit hardest by the epidemic, and many brands are already complaining about it. In terms of independent brands, the independent new energy brand represented by BYD has achieved remarkable sales.

Joint venture brands are already complaining about it

Not surprisingly, FAW and SAIC joint venture brands suffered the most severe impact in this epidemic, and their terminal sales volume also declined the most significantly.

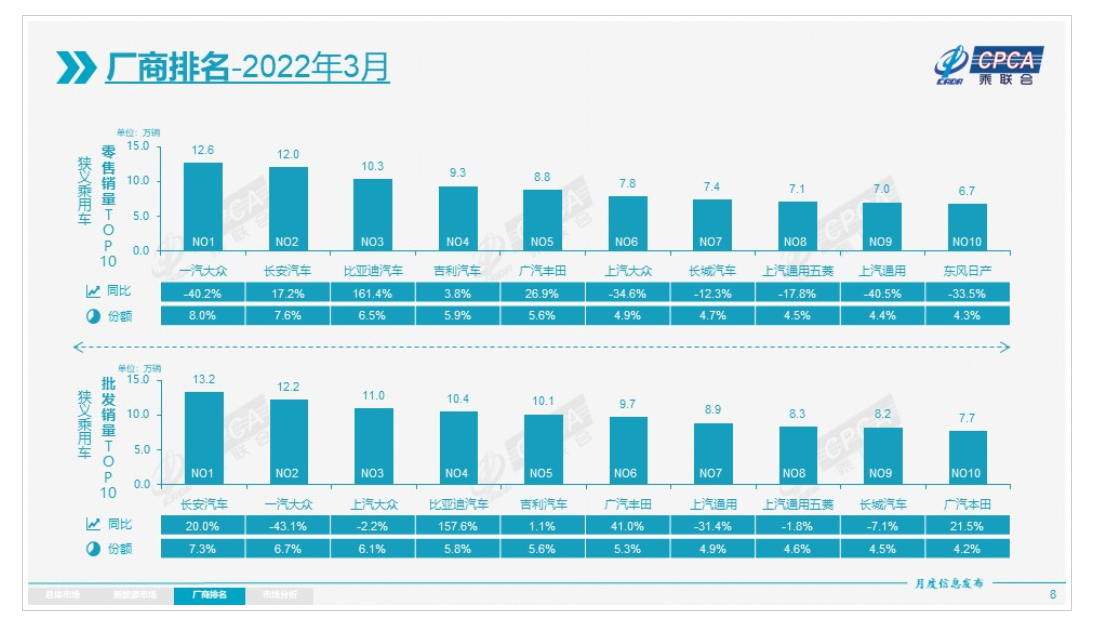

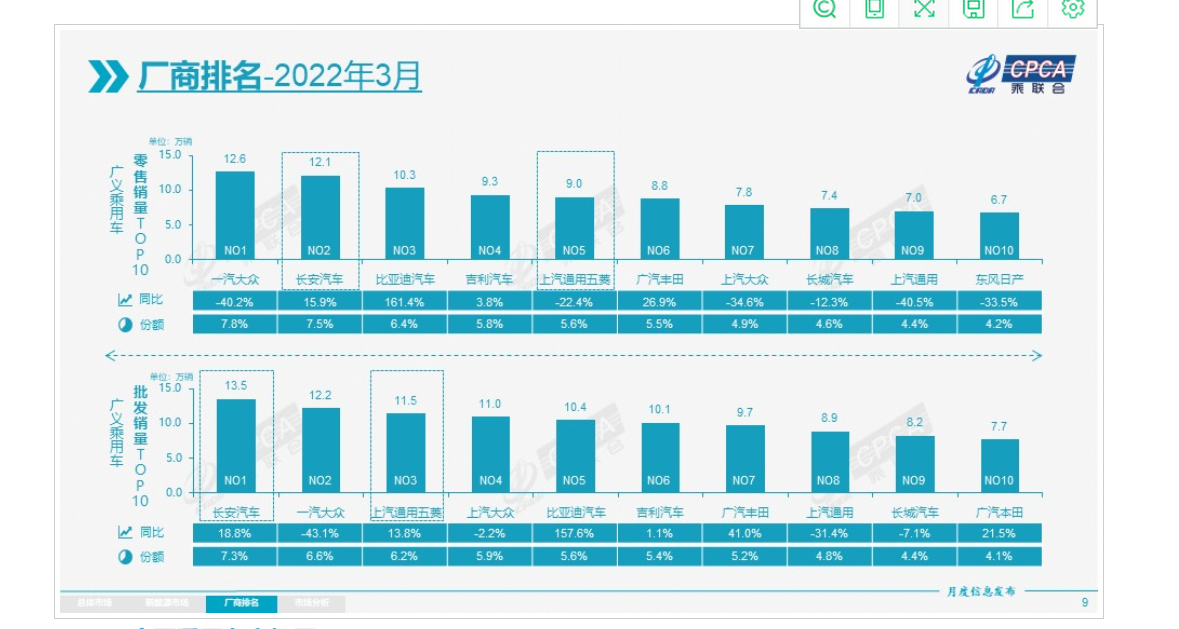

FAW-Volkswagen’s retail sales in March were 126,000 units, a year-on-year decline of 40.2%. Although FAW-Volkswagen maintained its sales championship in March, it only won the second-ranked Changan Automobile with a slight advantage of 0.6 thousand units.

FAW-Toyota, another joint venture brand of the FAW, did not appear in the CAAM’s announced March sales data, and FAW-Toyota has not yet announced its retail sales volume for March.

However, Toyota Motor announced on April 8 that its new car sales in China in March were 167,300 units, a year-on-year increase of 0.4%.

According to CAAM data, Guangqi Toyota’s wholesale sales in March were 97,000 units. Based on this, it can be inferred that FAW-Toyota’s wholesale sales in March will not be higher than 70,300 units. This is at least a 16% decrease compared with FAW-Toyota’s 84,000 units in March 2021.

The direct factor for the decline in March sales of FAW-Volkswagen and FAW-Toyota was the epidemic. It was learned that as early as March 13, FAW Group had urgently issued a factory shutdown plan to cooperate with epidemic prevention and control, planning to stop production until March 16.

The direct factor for the decline in March sales of FAW-Volkswagen and FAW-Toyota was the epidemic. It was learned that as early as March 13, FAW Group had urgently issued a factory shutdown plan to cooperate with epidemic prevention and control, planning to stop production until March 16.

In fact, FAW-Volkswagen and FAW-Toyota factories located in Changchun have not resumed production so far. FAW-Toyota’s factory in Tianjin also sometimes stops production, and FAW-Volkswagen only has normal production in Chengdu and Foshan factories.

The counterparts of FAW group’s joint venture brands that were similarly affected by the epidemic are SAIC joint venture brands.

SAIC Volkswagen’s March retail sales were 78,000 units, a year-on-year decrease of 34.6%. SAIC-GM’s March retail sales were 70,000 units, a year-on-year decrease of 40.5%.

However, FAW group’s joint venture brands and SAIC’s joint venture brands were affected by the epidemic for slightly different reasons.

In terms of time, the outbreak in Geelyn was earlier than that in Shanghai, and FAW-Volkswagen and FAW-Toyota were more affected by production reduction in sales in March.

SAIC Volkswagen and SAIC-GM began to stop 「partial production」 in late March. The sales decline of SAIC Volkswagen and SAIC-GM in March was less affected by production reduction.

This can be confirmed by the wholesale sales volume. In March 2022, FAW-Volkswagen’s wholesale sales were 122,000 units, lower than its retail sales. FAW-Toyota’s data is not available yet. During the same period, SAIC Volkswagen and SAIC-GM’s wholesale sales were much higher than retail sales, reaching 110,000 units and 89,000 units respectively.

What was the reason that seriously affected the March retail sales of SAIC’s joint venture brands?

The analysis given by the China Passenger Car Association is: Affected by the epidemic, the purchasing demand for entry-level traditional fuel cars is rapidly decreasing. The main reason is that this group of car buyers has suffered significant losses in work income during the epidemic, which has suppressed their purchasing demand, rather than shifting it to new energy models.

Therefore, the sales of entry-level traditional fuel cars in China have declined significantly, with A-level fuel car sales in March declining by 29%.

This can explain why the retail sales of SAIC Volkswagen and SAIC-GM in March have declined so severely.

In other words, the epidemic affected the sales performance of their hot-selling models, the A-level cars Lavida and Excelle, further dragging down their sales performance in March.

Of course, this is only one of the most intuitive factors.The impact of the epidemic has also heavily affected the sales of A-level fuel vehicles, including Dongfeng Nissan. Data shows that in March, Dongfeng Nissan’s retail sales were 67,000 vehicles, down 33.5% YoY.

The data currently available shows that the A-level vehicle model, the Nissan Sylphy, sold 30,240 vehicles in March, down 31.6% YoY from 44,209 vehicles the previous year.

It appears that A-level fuel vehicles with the greatest demand nationwide have been hit the hardest by the epidemic, resulting in the greatest impact on the sales of popular car models.

However, there are still shining examples among the joint venture brands in the midst of the disaster. Guangzhou Toyota is a standout, bucking the trend of declining sales amid the epidemic. In March, Guangzhou Toyota’s retail sales were 88,000 vehicles, up 26.9% YoY. This is mainly due to the Camry selling 22,518 vehicles in March, accounting for around 1/4 of the entire Guangzhou Toyota sales. Without being troubled by the epidemic and having such a strong performance from their B-level car sales, Guangzhou Toyota is currently the most successful.

Independent New Energy Vehicles Soar

Alongside the epidemic is a new wave of rising prices for raw materials for new energy vehicles, which has led to a price surge. On the other side, however, is skyrocketing terminal sales.

In March, domestic retail sales of new energy passenger vehicles reached 445,000 vehicles, up 137.6% YoY and 63.1% MoM, with a retail penetration rate of 28.2%. Pure electric vehicles (BEV) continue to dominate sales, accounting for 81% of sales, while plug-in hybrid vehicles (PHEV) accounted for only 19%.

Compared to the sluggishness of fuel vehicles, the strength of new energy vehicles is even more prominent. In particular, BYD had retail sales of 103,000 vehicles, second only to FAW-Volkswagen and Changan Auto, and became the third-largest manufacturer in terms of sales in March. Concurrently, they also became the leader in the new energy vehicle market in March.

BYD, as a leading independent new energy brand, has had an even sales trend over the past year. Except for a small MoM decline in February of this year, sales in other months have shown a steady MoM increase, and surpassed Tesla and SAIC GM Wuling in June last year, after which they have pulled away.

Judging from BYD’s determination to cut its fuel vehicle business and fully focus on new energy vehicles, as well as taking strong moves to expand production capacity and promote brand high-end, BYD should be prepared to take advantage of this opportunity of the new energy vehicle sales explosion and continue to climb higher.In March, two self-owned new energy vehicle brands, Jia An from Guangqi and another one which entered the growth period, achieved remarkable sales performance. Guangqi’s Jia An had a wholesale volume of over 20,000 vehicles, and rapidly cemented its position in the grade-A pure electric vehicle market, demonstrating its impressive growth potential.

Similarly, in March, some other self-owned vehicle companies witnessed substantial growth in sales of new energy vehicles. For instance, Chery and Changan sold 20,400 and 15,200 vehicles respectively, with 261% and 274% year-on-year growth.

Nonetheless, Chery and Changan mainly depended on A0 and A00 level pure electric vehicles such as the Chery little ant and QQ ice cream, and the Changan Benben. To expand their market share, these companies need to diversify their product lines and develop more high-end models.

Contrastingly, Great Wall Motors, Geely, and SAIC Motor have bolder and more diverse product strategies in the new energy market. All of these companies’ wholesale sales volumes exceeded 10,000 units in March. Among them, Great Wall Motors had a sales volume of 15,100, Geely had 14,200, and SAIC Motor had 10,900 units of their new energy brands.

In the new energy vehicle sector, Tesla remained as an outstanding brand. Despite shutting down its Shanghai factory for two days in mid-March and announcing another shutdown on March 28, Tesla China’s wholesale sales achieved 65,800 units, ranking second only to BYD.

Other new energy vehicle brands with sales reaching ten thousand units in March include Xpeng, NIO, Li Auto, and Leap Motor.

Although March, which was shrouded by the pandemic, has come to an end, the domestic auto market in April remained challenged by the ongoing battle against the epidemic.

On April 9th, NIO CEO Li Bin stated that due to the pandemic, suppliers in many regions, including Geelyn, Shanghai, and Jiangsu, had stopped production, which has affected the overall production of NIO.The outbreak of COVID-19 is putting tremendous pressure on many automakers and component suppliers in various aspects such as production, supply chain, logistics, and sales. As for the impact on April’s car sales, we can only try to stabilize as much as possible and wait and see.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.