Translation

Author | Leng Zelin

Editor | Wang Pan

Before and after the millennium, the domestic automobile industry promoted the rapid growth of the entire Chinese automobile market for more than 20 years through market-for-technology strategy and the establishment of a large number of joint ventures.

Joint ventures and cooperation were the main themes of this era.

After 2010, due to national policy guidance and the need for energy structure adjustment, a large amount of funds and talents poured into the new energy vehicle industry. Although it also experienced pains and chaos, it finally completed its initial development.

A group of new energy vehicle companies, led by William Li, emerged, and also constantly pushed traditional car companies to transform. However, during the rapid growth stage of new energy vehicles, the legacy system of joint ventures did not disappear with the change of power models and business models. Unlike the previous Sino-foreign joint ventures, it has now become cooperation between traditional car companies and Internet companies, and between old forces and new forces.

NIO once cooperated with Chang’an and GAC to establish Chang’an NIO and GAC NIO joint ventures respectively. SAIC, Alibaba, Geely and Baidu also established Ziji Auto and Jidu Auto through joint ventures. In addition, there are deep cooperation cases, such as Baidu and WM Motor, Huawei and TGOOD, CiHuiSi and AITO.

However, so far, these new brands with a golden spoon in their mouths have not shown brilliant performance, and even perform worse than most waist-level new forces in terms of sales volume, which have been questioned and criticized. It makes people wonder if the 1 + 1 of new car manufacturing can be greater than 2.

A Fanatical and Cold Scene

In the early hours of November 7, 2021, the Chinese LPL team, EDG, defeated the LCK team, DK, by 3:2, in Iceland. For a while, “We are the champions” was everywhere in the live broadcast room and social media, and cheers echoed in the community, universities, and streets.

During the Bilibili S11 event, the peak popularity reached 500 million. The heat of EDG could hardly dissipate on almost every platform such as Zhihu, Weibo, Douyin, and Kuaishou. For brands, this is an excellent exposure opportunity.

In fact, a group of financially strong automakers had already bet on the teams they favored. BMW sponsored FPX, T1, C9, and G2. LYNK & CO sponsored LNG, and Audi chose TES. Behind the champion team EDG was a brand that most people haven’t heard of – Hechuang.

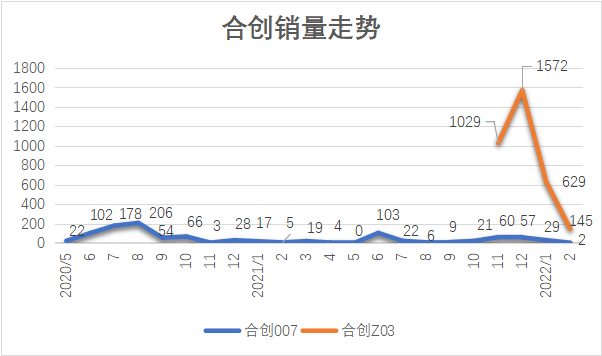

This brand is quite “niche”, with only 1,013 units sold since the launch of its first mass-produced model, the Hechuang 007, nearly two years ago. After winning the championship at EDG, its new model Z03 enjoyed a surge in popularity, thanks to its status as the “champion’s car”. However, sales plummeted rapidly after the heat died down, dropping from over 1,500 to only 145 units in just one month.

This brand is quite “niche”, with only 1,013 units sold since the launch of its first mass-produced model, the Hechuang 007, nearly two years ago. After winning the championship at EDG, its new model Z03 enjoyed a surge in popularity, thanks to its status as the “champion’s car”. However, sales plummeted rapidly after the heat died down, dropping from over 1,500 to only 145 units in just one month.

How can such dismal sales support this car manufacturer’s participation in the “game of the rich”?

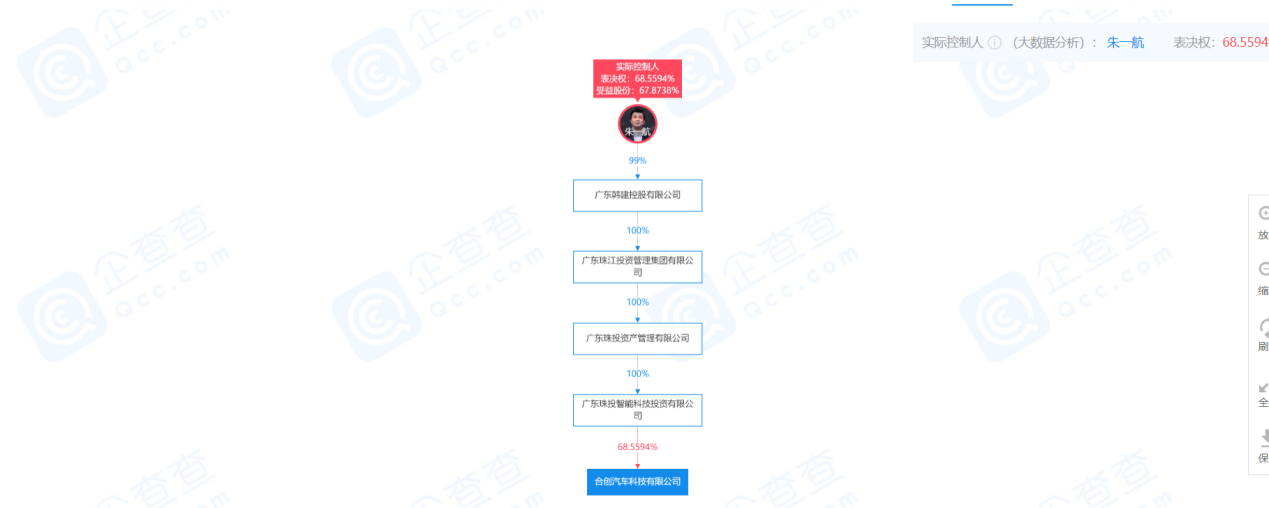

According to publicly available information on shareholder structure, Hechuang’s largest shareholder is “Guangdong Zhuto Intelligent Technology Investment Co., Ltd.,” controlled by Zhu Yihang, the founder of EDG. Zhu’s father is also the founder of Hesheng Chuangzhan Group, and the family ranks 312th on the 2021 Hurun Global Rich List.

However, Hechuang was not actually founded by Zhu Yihang. Its predecessor, GAC NIO, was established in 2018 with investments from NIO and GAC, each company holding 45% of the shares. In early 2021, Guangzhou Zhuto Intelligent Technology Investment Co., Ltd. entered the fray with a strategic investment of RMB 1.923 billion, becoming its largest shareholder.

Other brands in a similar situation include ARCFOX and SAIC Maxus, both of which enjoyed a brief moment in the spotlight due to the “endorsement” of Huawei, but there was a stark contrast between their actual sales figures. SAIC Maxus sold approximately 8,000 units last year, while ARCFOX only delivered 4,993 units throughout the year.

At the same time, with the release of AITO, a new brand co-developed with SAIC Maxus, Huawei’s cooperation has resulted in a rapid decline in sales of the SAIC Maxus SF5, from 1,089 units in December last year to only 2 units in January this year.

The release of the AITO M5 will once again put ARCFOX in the spotlight after almost a year of silence. ARCFOX’s Alpha S Hi Edition gained a huge following by promoting Huawei’s HarmonyOS system, autonomous driving system, and joining Huawei’s distribution channels.

However, the Alpha S Hi Edition has been repeatedly delayed since its small-scale internal deliveries at the end of last year, and as of the time of publication, it has yet to be delivered. Although the first new Alpha S Hi Edition vehicle in China became available in Huawei’s flagship store in Beijing Yintai at the end of January, it has not yet been widely distributed through offline channels, and its claimed first in-car system to be equipped with HarmonyOS has become a phantom.

For most 1+1 brands, it’s not difficult to build momentum, as they can inherit a certain amount of traffic from their parent companies one way or another, such as the “rookie protection period”. However, when the excitement subsides, the remaining emptiness is inevitably lamentable.

Each has their own agendaIn fact, nowadays, the cooperation between new and old powers still can be seen as exchanging market for technology. Traditional Chinese joint venture manufacturers have not been liberated except for BYD, which means that none of them can compete with joint venture brands in terms of sales, after pushing foreign brands out of the market.

The reason for this is that joint venture brands used to face a market that was completely undeveloped, and the three major components of internal combustion engines constituted a barrier imposed by foreign brands. This also means that the three major domestic car manufacturers, Geely, BYD, and Great Wall Motor, have been unable to surpass joint venture brands in sales.

However, BYD and CATL have already entered the top tier of the worldwide EV battery market. With independently developed advanced driving motors, such as flat wire motors used in the entire DM-i series and Flyer ER6 of BYD, they have met the requirements of new energy vehicles. Although there is still a gap in peak power, power density, and efficiency compared with the top tier globally, they have acquired some relevant technologies through independent research and development and acquisitions.

In terms of sales volume, the Chinese market is currently providing a solid guarantee for local brands and the overall EV industry development. In 2021, sales of new energy vehicles reached 2.9398 million in China, ranking first globally with 45% of the market share of passenger EVs.

Therefore, why do car companies choose to cooperate with each other in building brands in a high-growth, lower threshold market compared to the era of internal combustion engine (ICE) vehicles? Behind this, they all have their own considerations.

As early as the establishment of Chang’an NIO, Zhuhua Rong, the President of Chang’an, pointed out that the traditional Chinese joint venture manufacturers’ demand for cooperation was to “find a knowledgeable partner, rather than exploring alone”.

In 2018, before the Darkest Hour, NIO established Chang’an NIO and Guangzhou NIO respectively with Chang’an and GAC. Their equity structure is the same, with traditional Chinese joint venture manufacturers and NIO holding 45% and senior executives hold 10% each.

At first glance, it seems to reflect the spirit of fair cooperation, but it also means mutual restriction after careful thought.

Among these two companies, Guangzhou NIO acted more quickly and launched its first concept car and the HYCAN co- brand soon after one year, while Chang’an NIO released its first model nearly three years after the establishment.

Nowadays, the speed of the two joint ventures mainly depends on the traditional Chinese joint venture manufacturers. Guangzhou’s establishment of Guangzhou new energy (later renamed EA), before cooperating with NIO, enabled Guangzhou to quickly launch new models based on its existing GEP2.0 platform. The first mass-produced EV, HYCAN007, shares the same motor, battery, and AION LX platform as Guangzhou new energy.

For Guangzhou new energy, which has just started, this can effectively increase production capacity utilization, reduce costs, and learn new business models.And NIO provides delivery and charging services. At that time, in some cities, the Joint Venture 007 was delivered by NIO centers, while also enjoying NIO’s one-click charging service and energy supply system. For NIO, the early battery swapping mode and user thinking also require a large number of case studies for verification. However, when conflicts of interest arise between their respective brands and the “Joint Venture” brand, cooperation may become a restraint.

In May 2020, Joint Venture 007 officially started delivery, but the GAC NE factory had only a production capacity of 100,000 at that time. Its Aion brand already has the Aion S, LX, V, and a model that will soon be launched, and production capacity is insufficient.

Liao Bing, the former CEO of GAC NIO, revealed in an interview at that time that GAC NE only produced nearly 400 Joint Venture 007s from May to August.

Another major shareholder of GAC NIO, NIO, was facing a serious financial crisis in 2019 and 2020 and was unable to extend a helping hand.

At the beginning of the following year, Liao Bing left GAC NIO to establish FreeCar, and said in a media interview, “GAC NIO’s capital structure determines that there will be a lot of constraints in all aspects. The resources given by shareholders cannot satisfy the company.”

After GAC NIO and Changan NIO, there have been no cases of joint ventures between old and new automakers in the new energy market. Instead, cooperation between the Internet and traditional automakers has deepened since 2020.

“Regardless of sales or from the current capital market perspective, 2020 is the first year of smart cars, just like the era of smart phones in 2010,” wrote He XPeng on social media in 2020.

That year, NIO released their NOP Navigation Assistant, and the later-selling P7 from XPeng Motors began delivery, which is also a model that is labeled as intelligent. Tesla’s market value exceeded BMW, Volkswagen, and Toyota, making it the world’s number one car company, and at year-end its total market value was equivalent to three Toyotas.

At this time, Internet companies specializing in software and traditional automakers both began to be unable to sit still. Firstly, SAIC and Alibaba set up IM Auto, and Baidu, who never built cars, collaborated with Geely to establish Jidu Auto. Huawei subsequently launched the Seres SF5 and the Arcfox αS Hi edition, and announced cooperation with GAC NIO and Avita (formerly Changan NIO).

Actually, this collaboration logic is very simple. Traditional automakers lack software capabilities and want to quickly make up for shortcomings in intelligence, under the situation that smart car purchases are becoming increasingly important, so cooperation with Internet companies is obviously the best solution.The head of a Tencent car networking project told Photon Planet that traditional car manufacturers need to transform themselves to achieve long-term development, as being pure OEMs will only result in becoming contract manufacturers like NIO and Xiaomi.

For internet companies, they are less interested in building cars themselves, but more concerned about the car as the third traffic entry point after PC and mobile.

In 2018, the three BAT companies gathered in the field of car networking business. First, Alibaba upgraded YunOS to AliOS. Afterwards, Tencent TAI and Baidu DuerOS followed suit. The three giants bet on the same track, which shows the importance of car networking traffic.

The logic of “getting on the car” of the three companies is also very simple. In addition to strong software capabilities, the ecological system constructed over the years is another moat that is difficult to surpass. Although there are still differences in the interaction logic between the car and the mobile terminal, it is still much faster than building an ecosystem exclusively for the car from scratch.

By 2022, both BA are standing in the foreground and joining the army of car makers, while Tencent is still “hiding” behind the scenes. Actually, as early as 2015, Alibaba established Banma Network through the investment of the Internet car fund jointly initiated with SAIC, and the first Internet car model, Roewe RX5 co-created by the two companies, was a great success. It sold around 100,000 units in just three months.

At this point, AliOS came to a crossroads. For car manufacturers, eating the sweet really is desirable, and for technology companies, expanding influence and increasing partners is the ultimate goal. Although Banma Network denied the existence of any conflict of interest, the Banma Intelligent Driving System did experience a year of stagnation after partnering with Dongfeng Motor Corporation.

Baidu is also in a similar situation. In 2013, Baidu started related technology research and development and launched the Apollo autonomous driving open platform in 2017, which is the earliest enterprise to research and develop autonomous driving in China. The advantage of technology and data accumulation is obvious, but its disadvantages are equally obvious– many collaborations but few ground results. The only passenger vehicle, WM Motor W6, that uses Baidu’s technology is not performing well, with sales of only 761 and 415 units in January and February respectively.

Baidu has also explored cooperation with XPeng Motors and Li Auto, but was still shut out while demanding to use Apollo autonomous driving technology and offering financing for the project.

Compared to Baidu, Tencent is more competitive in the entertainment and social sectors, and doesn’t have to appear too anxious. From QQ to WeChat, Tencent has extended its social chain to a series of fields such as games and entertainment.

There may be other applications on the car’s terminal, but WeChat has always been Tencent’s trump card. A Tencent car networking project leader told Photon Planet that users cannot rebuild their entire social relationship chain for just a few hours in the car.

And in the current user environment, the demand for WeChat is also very strong.Another industry insider revealed to Photon Planet that the Changan CS75 with WeChat onboard has been selling like hotcakes since its launch, with a trend even surpassing the Haval H6. Thus, after noticing this situation, Great Wall Motors quickly reached out to Tencent, hoping to get on board with WeChat.

“When SAIC Ali met, they were superior to countless people in the world.”

“Cooperating with third-party companies like Huawei on autonomous driving is unacceptable for SAIC.”

From the initial friendly encounter with technology companies to the “soul debate”, perhaps it is the technology companies’ efforts on the smart car system that have made traditional automakers feel considerable pressure. It only took five years for the Chairman of the SAIC Group, Chen Hong, to change her views.

Similarly, Huawei, which does not make cars, needs to balance the interests between car manufacturers and dealers since most of its channels are not self-operated. This situation becomes even more important in the context of unsalable inventory. If it cannot bring income to the dealers but instead causes excessive inventory and store space occupation, it will also be a blow to Huawei’s future car sales business.

We can see that Huawei strategy “abandoned” the Sailisu brand after poor sales performance and instead started to create a new brand. Similarly, Jidu Auto’s sales performance was also poor last year, has it now been strategically “abandoned”?

“No innovation” in the homogenized market

It is not difficult to see that homogenization has become increasingly serious in today’s new energy vehicle market, not only in terms of functions, appearance, and business models but even in marketing strategies. Numerous latecomers poured into this track and embarked on their own path of making cars, following the experience of their predecessors.

In fact, we had a similar view in our article “Replaying the Theory of Xiaoli Wei” last year. Thanks to the mature supply chain system in China, automakers can integrate different schemes and components from different suppliers to create a new energy vehicle very rapidly. However, the homogenization phenomenon in the current new energy market is becoming increasingly serious, and cars are becoming more and more like mobile phones.

Automakers can “borrow” platforms and production lines to latecomers to reduce costs and increase efficiency, while technology companies open their systems to expand their influence and maximize profits.

JiDu Auto, based on the Geely SEA architecture, took only six months from its establishment to entering the SIMUCar road test stage. Zhiqi Auto, based on SAIC’s pure electric chassis developed since 2016, took only a little over a year from registration completion to delivery in April of this year.

However, the most concerning thing in today’s new energy vehicle market is monotony.

It is not difficult to see that whether it is transformation or starting anew, once a new energy model is launched, most automakers must create a concept and tell a story to the capital market and consumers. The plot seems to be increasingly common: choose a well-known car model, pick out a particular function, and then let the company’s car surpass it.At present, new energy vehicle companies are unable to achieve self-sufficiency. Taking NIO as an example, the three companies sold a total of 280,000 cars last year, but the financial loss was as high as 9.8 billion.

Therefore, although IM has SAIC’s support on hardware and Alibaba’s on software, the L9 model did not show enough differentiation. The only impressive thing is the “ORV” tech, which is cloaked in blockchain.

Looking back at NIO’s expenses, it seems that they spend it on the right things. It is unknown whether Li Bin anticipated the serious homogenization of the market, he established a higher safeguard than the technology and hardware threshold for NIO.

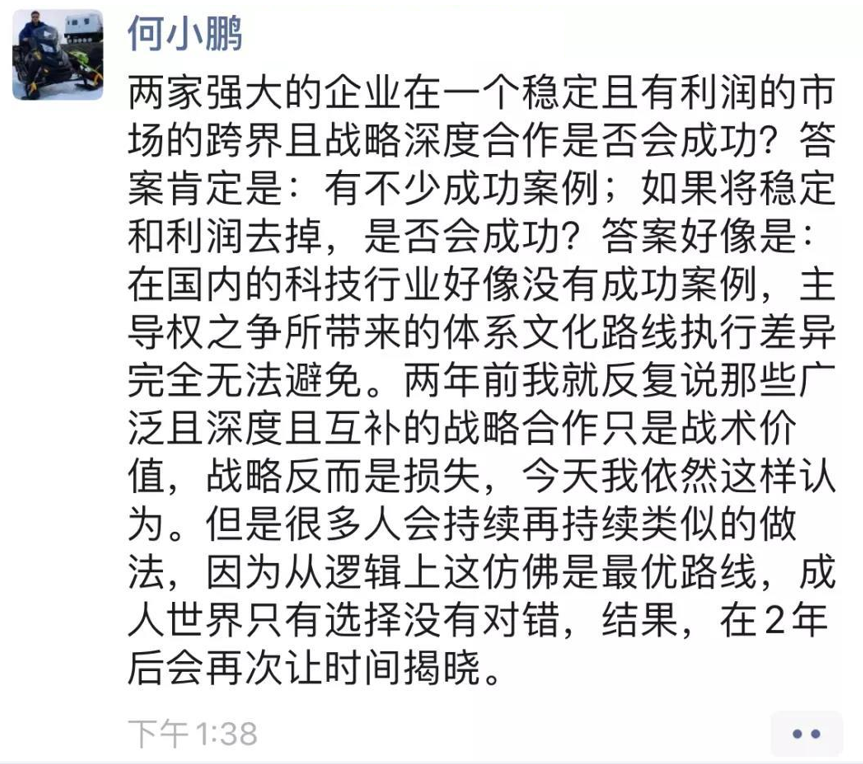

Meanwhile, He XPeng pointed out the shortcomings of “cross-border and strategic depth cooperation” early on, in the market of high-speed growth and alternate phases between new and old, 1+1 is not necessarily greater than 2.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.