Special Author | Zhu Yulong

Editor | Qiu Kaijun

There is a close relationship between fortune and misfortune. In 2021, the explosive growth of new energy vehicles in China is both a great achievement and a potential problem.

In 2021, new energy vehicles became the biggest highlight of China’s automotive industry, with sales ranking first globally for 7 consecutive years. Throughout 2021, the production and sales of new energy vehicles reached 3.545 million and 3.521 million respectively, both doubling the figures of the previous year, and the market share reached 13.4%, an increase of 8% from the year 2020.

In December 2021, the penetration rate of new energy vehicles reached 19.1%, and that of new energy passenger vehicles reached 20.6%. Overall, the development of the new energy vehicle market has shifted from policy-driven to market-driven, presenting a good development trend with the dual improvement of market size and quality.

However, the value of new energy vehicle credits in 2021 may be reduced.

On April 8, the First Department of the Ministry of Industry and Information Technology of China announced the credit situation of passenger car companies for 2021 in regard to average fuel consumption and new energy vehicle credits. The accounts of credits for the year 2021 for various car companies have been basically identified.

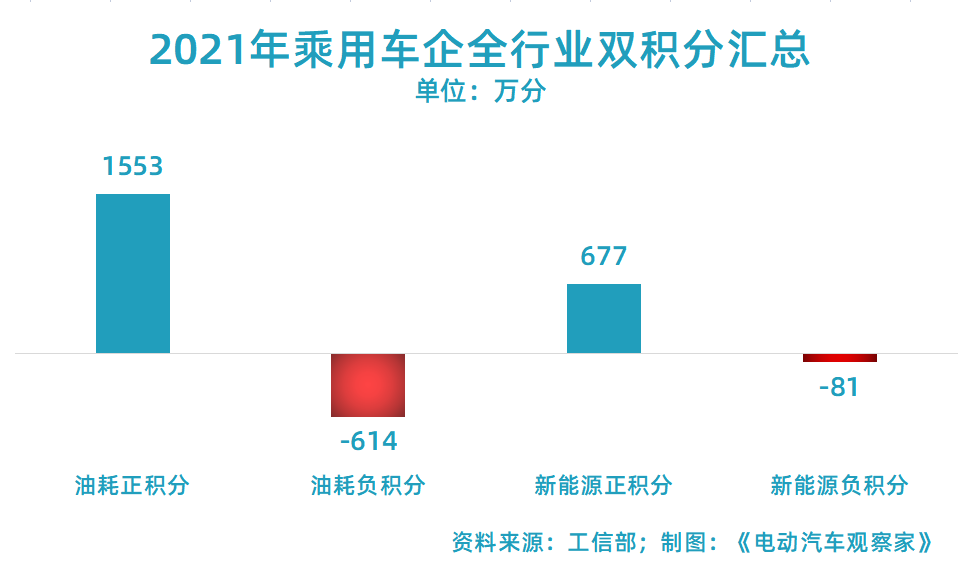

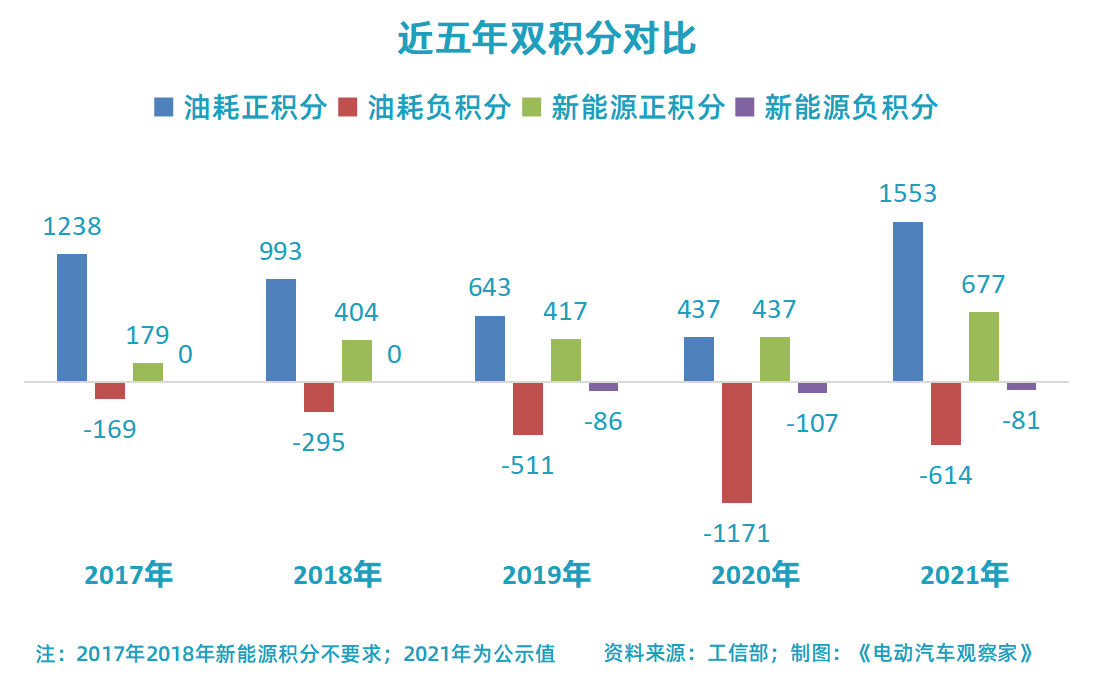

In 2021, the China’s automotive industry generated a total of 15.5349 million oil-positive credits, an increase of 255.7% year-on-year, and 6.1366 million oil-negative credits, a decrease of 47.6% year-on-year.

Regarding new energy vehicle credits, although the assessment ratio has been raised from 12% to 14%, 6.7672 million positive credits for new energy were generated, a year-on-year increase of 54.9%, and 0.8100 million negative credits for new energy were generated, a year-on-year decrease of 24%.

In other words, in terms of the total scale, the two factors of oil-positive credits and new energy-positive credits created nearly 22 million, while the sum of oil-negative credits and new energy-negative credits was less than 7 million, with a gap of nearly 3 times.

The comparison is clear, and many negative credits can be transferred or traded through associated enterprises, without being purchased in public credit market, the price of new energy vehicle credits in 2021 will inevitably plummet.

The situation of credit trading

The speed of development of new energy vehicles is far beyond the plan, and beyond the expectations of the department responsible for the formulation of double credit policy.

China’s passenger car market peaked at 24.744 million vehicles in 2017 and has been gradually stabilizing since then.# New Energy Vehicles in China

From 330,000 units in 2016, the sales of new energy vehicles in China have steadily risen and reached 1.2 million units in 2020 and 3.334 million units in 2021. The penetration rate of new energy passenger cars has increased from 2% in 2017 to 17% in 2021. This growth rate far exceeds the overall expectations and plan.

The introduction of new energy vehicles has contributed to the reduction of the average fuel consumption of Chinese passenger cars (including new energy vehicles) from 6.61 L/100 km in 2017 to 5.75 L/100 km in 2020. The estimated fuel consumption for 2021 is 5.51 L/100 km.

In this process, we have seen that the maximum critical value of -11.71 million points for negative fuel consumption credits in 2020 represents the failure of fuel-efficient strategies of traditional car manufacturers.

In the past year, the negative credits for Chinese new energy vehicles ranged from approximately 800,000 to 1.06 million. This represents the dual credits trading between companies having positive credits for new energy vehicles and those needing to offset their negative fuel consumption credits.

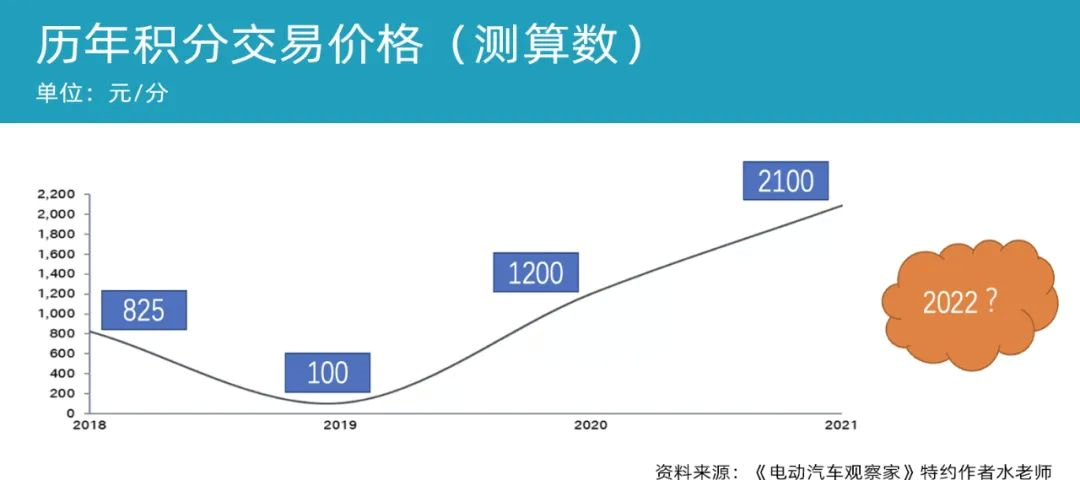

As the dual-credits trading market began running, driven by the negative fuel consumption credits, the price fluctuated from CNY 825 per point in 2018 to as low as CNY 100 per point, then reached around CNY 2,100 per point in 2021. In this process, the cumulative trading volume is close to 10 million credits, and the accumulated profit of the market is about CNY 14 billion, mainly occurring in 2021.

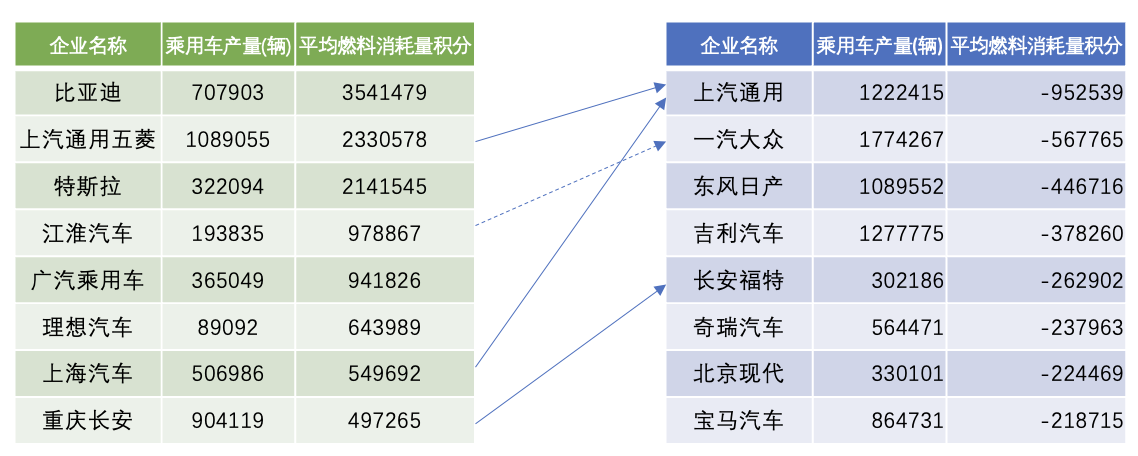

However, in 2021, due to the shortage of chips that reduced the supply of gasoline vehicles, the overall negative credits for fuel consumption was only -7 million. The largest negative credits gap in fuel consumption of 952,000 points was in SAIC-GM. The positive credits of Wuling alone, 2.33 million points, can fully meet this gap. The only company on the negative credit list with a gap exceeding 500,000 points is FAW-Volkswagen.The negative fuel consumption score can have a good trading plan within the joint venture company without the need to purchase new energy positive scores externally, according to the average fuel consumption positive score of passenger car companies, which can be carried over or transferred between affiliated enterprises.

Under the whole SAIC Group system, SAIC-GM, which seems to lack scores, does not lack fuel consumption scores and new energy scores under the group accounting. SAIC-GM Wuling’s fuel consumption score generated a total of 2.33 million positive scores, which is particularly excellent based on Wuling Hong Guang Mini. Due to model restrictions, the new energy score is only 120,000, which is enough for SAIC-GM. SAIC passenger cars also have 550,000 positive fuel consumption scores, plus 260,000 new energy scores, which are sufficient for 2021 accounting.

The fuel consumption score difficulty also includes FAW-Volkswagen. However, through Volkswagen’s investment in JAC, JAC’s positive fuel consumption score is 978,800, which can effectively alleviate FAW-Volkswagen’s demand. FAW-Volkswagen’s new energy score is -1.37, which is not a concern due to its small quantity.

For Nissan, Dongfeng Automobile offers 400,000 positive fuel consumption scores, and the overall demand is also relatively small.

Beijing Benz and Beijing Hyundai need some fuel consumption scores, and they may not be able to provide them from BAIC passenger cars internally, which may require the purchase of about 400,000 new energy scores from external sources.

There is only about Geely’s negative score left, and some of it needs to be offset by new energy scores.

Adding up the accounts, of the 6.1366 million negative fuel consumption scores, only about 15% need to be purchased and offset by new energy vehicle scores, which is the largest scale at about 900,000-1.2 million points.

Overall, the total negative new energy vehicle score is only -810,000 points, and it can be traded within the group, whether or not to purchase.Estimates show that the total internal and external demand for purchasing new energy vehicles with positive credits is 2 million. The corresponding total supply is about 6 million, and the supply-demand ratio has returned to the 3:1 ratio, which is basically the same as in 2019.

The Future of Dual Credits

The penetration rate of new energy vehicles is still increasing.

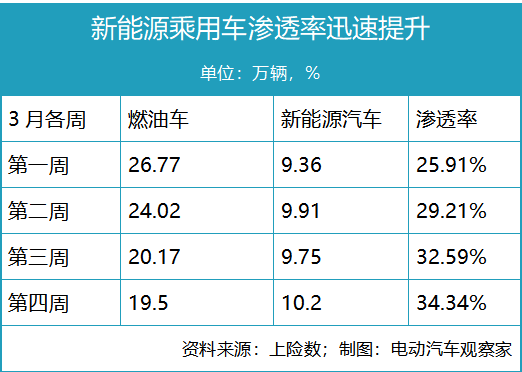

In the case of soaring oil prices, the overall passenger car sales from March 1 to March 27 were 1.214 million. In the latest week from March 21 to March 27, the total passenger car market was 296,000, including 195,000 fuel vehicles and 102,000 new energy vehicles. The penetration rate is 34.2%, which has truly reached the previous expert’s prediction of a 35% high penetration rate.

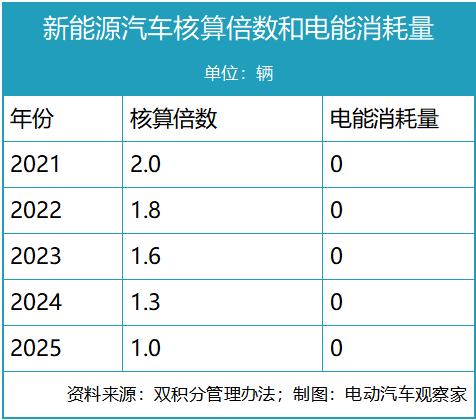

To encourage the development of new energy vehicles, the dual credit design also allows car companies to count new energy vehicles into the total number according to multiples, thereby reducing the fuel consumption level of car companies.

Before 2025, pure electric passenger cars, plug-in hybrid passenger cars, and fuel cell passenger cars will calculate enterprise average fuel consumption with electricity consumption counted as 0, but the accounting multiple will gradually decrease from 2.0 times (in 2021) to 1.0 times (in 2025).

However, because the growth rate of new energy vehicle sales is too fast, the decrease range cannot accurately reflect the real decrease rate of fuel consumption and it masks the fuel consumption problem.

That is to say, if the ratio of 20% penetration rate is followed, when calculated at 1.6 times in 2023, the overall fuel consumption will still be greatly reduced, and corresponding fuel consumption credits will be greatly improved. This means that the negative fuel credit in 2023 will not be so significant.

From the current situation, with the establishment of the plug-in mixed dynamic DHT technology route, independent brands will also vigorously promote this field. Therefore, generally speaking, the fuel consumption credit is still a challenge for joint ventures, but independent brands will gradually move away from the transitional route of mixed dynamics (including plug-in hybrid and extended range).

However, from the overall supply and demand pattern, the price of the new energy credits in 2022 and even in 2023 may still maintain a very low range.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.