Author: Zhu Yulong

Recently, there has been a lot of discussion on car networking issues in connection with the intelligent cockpit activity organized by Zhihu. I would like to start by discussing the universal Onstar Gen 12, and then touch upon the development and investment ideas in the field of car networking.

In essence, after vehicles are connected to the network, a core unit for interaction, such as the cockpit, is needed to achieve functions. This means that the function of simple voice calls, data, and backend connections is very limited. To achieve an expanded development process, traditional car companies find it difficult to play this role due to their modes of thinking.

General T-box

This was the definition given to T-box by GM around 2006, 17 years ago. In fact, from a long time ago, the task carried by this TCU was a voice call, GPS, and connection pipeline.

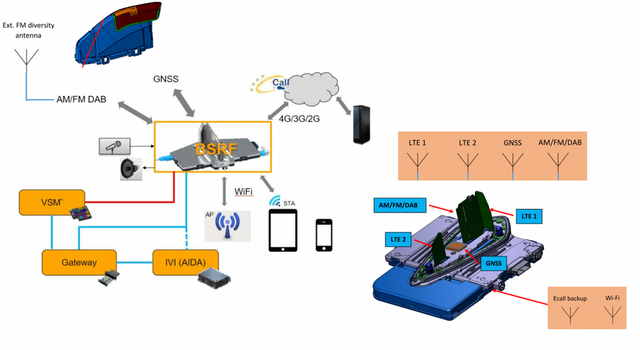

Fast forward to 2022, the 12th generation TCU developed by Continental for GM is also used in many other automakers’ vehicles (Volvo, Mercedes-Benz, PSA, among others). The TCU includes:

-

NAD with 3G/4G/LTE, GNSS

-

External and internal antennas

-

Voice and data

-

Glonass, Beidou, Galileo, GPS

-

2×2 DL-MIMO for 4G

-

Internal embedded Sim-IC

-

Audio subsystem, including analog microphone input and speaker output

-

Digital audio interface, including CODEC and audio power amplifier

-

Phone services and emergency calling and requests for assistance

-

Internal backup battery (BUB)

-

High precision GNSS L1/L5

-

From the interface perspective, it mainly includes:The main power supply input (8-16V, 250mA, with a power consumption of 5.5W), the main LTE antenna, GPS input, three Onstar button inputs, LED control, external microphone input and output, external speaker output, CAN communication, Ethernet 100Base T1 (100MB) or 1000BaseT1 (1GB), and diagnostic interface (USB, UART).

-

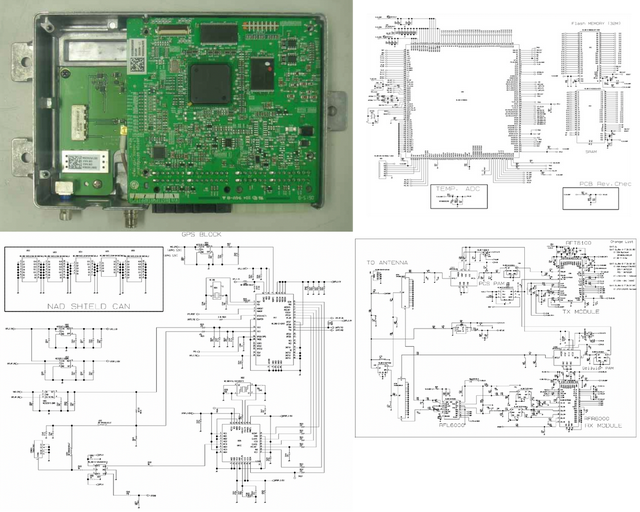

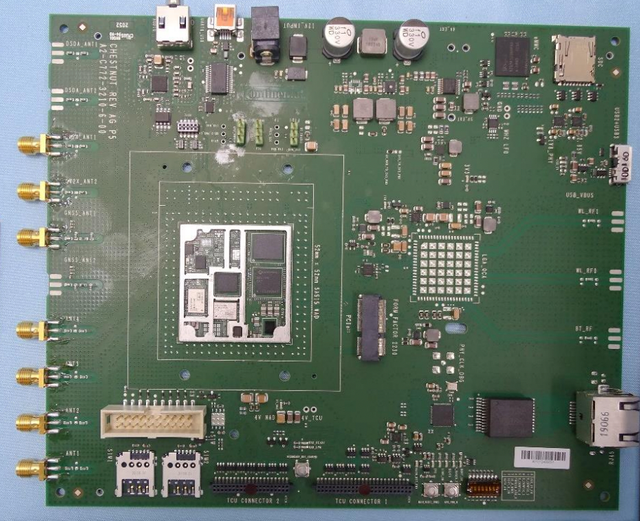

In terms of components, the internal design is as follows:

In fact, the overall scheme is the same as that of more than ten years ago, but more functional modules have been added, integrated around chip-based communication components.

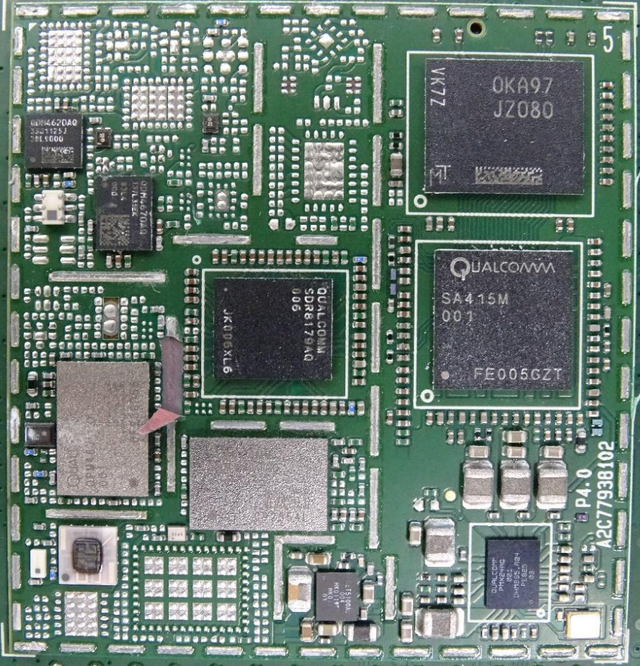

The main communication module shielding cover can be opened to reveal the main communication blocks, which are the Qualcomm SA415M and SDR8179AQ. The chip above is the JZ080, and the QPM4620AQQDM4670AQ.

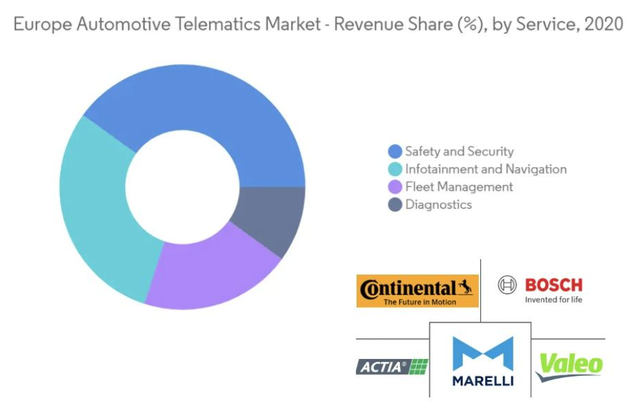

From this unit’s perspective, the definition of Telematics for traditional car companies includes the following services and categories, mainly covering safety and information security, information entertainment systems, fleet management and diagnostic services, and the main competitive landscape mainly revolves around physical units such as T-boxes.

Business Structure of Connected Vehicles

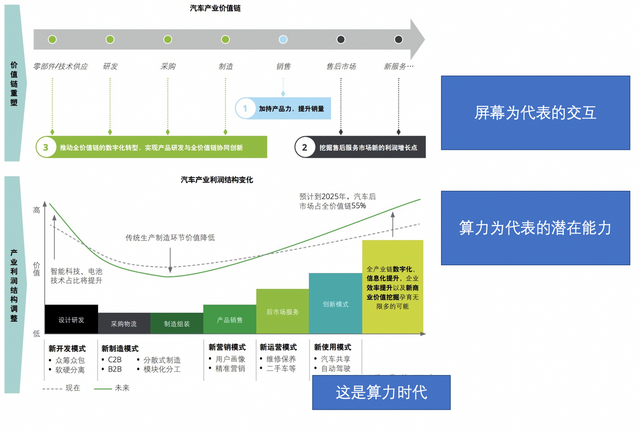

Taking the broad digital economy service provider map of the connected vehicle industry that we have seen in China as an example, it covers a very wide range, including digital operation services, connected vehicle big data, intelligent cabin, intelligent driving and vehicle-road coordination. People have different understandings, and in China, we can think about it from the perspective of the road environment. The general connected vehicle industry chain in the entire automotive industry should include the supply side, operation side, and user side, with the value chain expanding in sequence.

(1) On the supply side, it mainly includes roadside facilities, cloud control platforms, high-precision positioning, high-definition maps, vehicle-mounted terminals and other devices and services.

(2) On the operation side, the connected vehicle infrastructure operator provides various forms of services for various types of users to obtain service returns.

(3) Associated entities such as parking lots obtain revenue by attracting traffic through the platform.(4) On the user end, whole vehicle enterprise can obtain vehicle premiums by providing connected car services to both individual and business users. Meanwhile, public transportation services such as bus and taxi companies can improve their operational efficiency and service level.

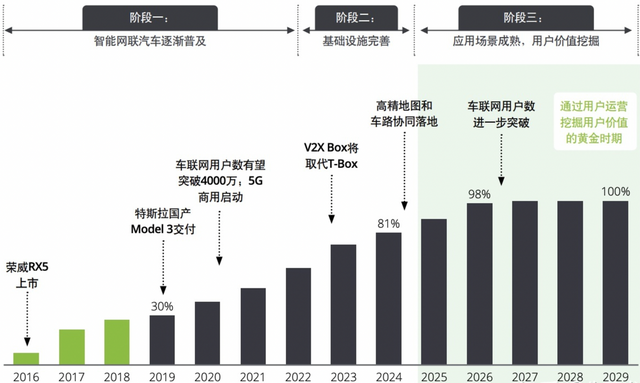

In fact, the basis for this lies in exporting massive amounts of data effectively through T-box and increasing the number of connected vehicles. The value of the entire connected car industry is not just about the price of T-boxes or successfully implementing V2X. Rather, it is a transitional phase in the development of cars, transforming hardware products centered around mechanics into electric vehicles centered around electronics and then further connecting to the internet through various sensors and high-performance computing platforms (Automotive Computer).

At this point, it is similar to the gradual liberation of phone functionality beyond just making calls. In fact, we cannot predict what kinds of functions vehicles will develop beyond just mobility. What we can anticipate is that vehicles will increasingly have screens, high-performance chips, and storage to create enough space for the development of vehicle operating systems and software services, allowing for in-car payments.

In summary, I believe that General Motors’ attempts over the past 30 years have been focused on functionalization. Now, the logic of connected cars has shifted from the vehicle itself to the system. After digitalization, vehicles have become armed to the teeth with intelligent cockpits, autonomous driving, and vehicle-to-infrastructure connectivity. I think these can be divided into functional areas that we can understand. To be honest, a car that can play games and project images, coupled with L4 fully autonomous driving capabilities, can truly be imagined to serve the needs of the next generation. It may serve passengers, or it may autonomously purchase and deliver items for me, for example, when there’s nothing to buy in Shanghai right now, I could send it out to buy something for me. I think the foundation of connected cars is to pull up data and connect vehicles with us. As various functions expand, it can truly achieve a variety of digital services, just as we could not imagine that phones could be used as wallets. In 2022, I rely entirely on my phone to buy groceries every day.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.