Karakush

Last night, Langtu Dreamer announced the pre-sale price: seven-seater version ranges from 380,000 to 480,000 yuan, and the four-seater custom version starts at 600,000 yuan.

This marks the beginning of the high-end MPV sports market this year. There are also several high-priced MPVs that will be launched, including but not limited to:

-

Hongqi B-MPV (code-named C095), a mid-large MPV, competing with Buick GL8 Avia and Toyota Alphard, which is estimated to be not cheap;

-

Geek 002, a pure electric mid-large MPV, rumored to cost between 450,000 and 500,000 yuan;

-

DENZAwei, a mid-large MPV with two types of power, pure electric or DM hybrid, rumored to cost at least 450,000 yuan;

-

Weipai’s code names M81 and M83, medium and mid-large MPVs, most likely DHT hybrid, rumored to cost between 250,000 and 350,000 yuan;

-

BYD Landing Ship, DM-i hybrid, rumored to cost between 200,000 and 300,000 yuan;

-

Roewe iMAX8 EV, a pure electric mid-large MPV, with a new pure electric version released for an estimated price of 200,000 to 300,000 yuan, while the fuel version costs 180,000 to 250,000 yuan;

-

FAW Toyota GRANVIA, DM hybrid mid-large MPV, sister model of the Saina, starting at more than 300,000 yuan;

For those who are still full of enthusiasm, they will also pay attention to Mercedes-Benz’s mid-size pure electric MPV EQT, which is expected to be launched in 2022.

Last year’s mid-to-high-end MPV market was already lively, mainly because joint venture companies introduced overseas products, such as GAC Toyota Senna (300,000-410,000 yuan), Dongfeng Yueda K5 (280,000-340,000 yuan), Beijing Hyundai KUSOTH (160,000-220,000 yuan), and so on.

This year’s focus is obviously on independent brands and new energy. Only Red Flag has a pure fuel vehicle, featuring a 3.0L V6 engine, which is rare in the market.

The last time the racetrack was so crowded was in 2015-2016, when China’s two-child policy was fully opened, and seven-seaters were considered hotspots. Seven-seaters SUVs and MPVs were eagerly expanding in the market, driven by the perceived need for a larger family.

Today, history is amazingly self-plagiarizing itself. This wave of product launches in 2021-2022 is riding on top of China’s third-child policy.

Car companies seem to be more concerned about whether you are going to have children than your mom does, and what to do once they are born. They need to arrange a family of five clearly, from three rows of seating that are designed to match the “pseudo-demand of three generations travelling together,” to a strategic position of necessity. For a family of three children, the seating arrangement should be as follows:

Third row: the dog, a helpful older child, backup wipes and snacks

Second row: the third child, the all-knowing and all-powerful motherFirst Row: The second child who seeks good fortune on his own without driving, and the old one who is useless in driving and might even shift the blame onto others.

Third row, sitting comfortably, theoretically has the potential to naturally eliminate the competition from six or seven-seat SUVs. Six or seven-seat SUVs are often seen as an important obstacle to the full development of family MPVs because their user bases overlap significantly.

However, after 2016, several common understandings were established in the MPV market, which may still make the new products piled up hastily:

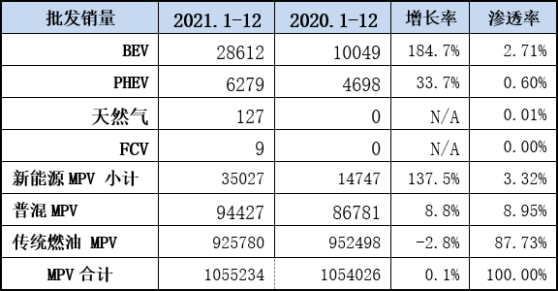

First, the market capacity itself is not large. In 2016, MPV sales peaked, with a cumulative sales of 2.467 million vehicles, accounting for nearly 10% of the passenger car market. Since 2017, it has continued to decline rapidly, with total sales of 1.055 million vehicles last year, accounting for 5%.

The overall market capacity of the entire variety is around 1-2 million. There are 40 domestic MPV products that are currently in production and sales.

Second, the inverted pyramid structure is becoming more and more prominent, and the trend is obvious. Last year, MPV sales remained stable, with a 12.7% year-on-year growth in the middle and high-end market, which is much higher than the 6.2% growth rate of the overall passenger car market. However, the low-end market is shrinking quickly and widely.

Going up is becoming a trend for everyone. However, the growth rate does not mean that everyone can share the “blue ocean” dividend equally, because MPV’s structure is top-heavy, and the market concentration is very high.

Last year, the top ten MPV manufacturers in terms of sales collectively sold 936,000 vehicles, a year-on-year increase of 3.6%, accounting for 88.7% of the total MPV sales.

Especially in the middle and high-end market of above 200,000 yuan, it has always been steadily grasped by individuals like Buick and Japanese car models. A typical example is the Buick GL8, which has dominated the 20-year, almost covering the market of 200,000-500,000 yuan. The unit share exceeded 16% last year. So every time a new car comes out, it always politely greets the GL8.

A trend that is different from the past is that new cars are emerging, such as the Saina, which accounted for 7.1% in January and February this year; and the Kusitu, which can also reach a share of 2.5%. However, it did not have too much impact on the GL8, whose share in January-February exceeded 20%. Latecomers are mainly due to further declines in low-end models, and most of them are still joint ventures.

Self-owned breakthroughs do exist, such as Guangzhou Automobile Group’s Trumpchi M8, but they are rare cases. Most self-owned vehicles are still in the mid-to-low-end range of 150,000 yuan or even 100,000 yuan.One shackle is that high-end market customers mainly target business needs and maintain stable sales. This year, some domestic new cars are actually targeting this blank precisely, such as Hongqi and DENZA, both of which have outstanding business positioning, while Dreamer also emphasizes both commercial and residential legs.

How to persuade large customers to purchase based on business needs? Rather than looking at the product, it is better to focus on brand and reputation.

Before, I once asked many professional car drivers, why do they all like to buy GL8? Is it because passengers say it’s good after sitting in it? They replied that it was because of the company’s standards. Only GL8 and Mercedes-Benz V are allowed to accept high-end business reception orders. Other cars do not meet the specifications. Moreover, GL8 is relatively cheaper, so buying a mid-range one for more than 200,000 yuan and renovating it is the most cost-effective production material combination.

Therefore, I personally feel that Hongqi will be the most stress-free player.

The competitive pressure on other competitors is extremely high. In yesterday’s pre-sales live broadcast Danmu, the high-frequency presence of SAIC Datong MIFA 9 is a portrayal of anxiety.

It’s not that there is no chance, there are two –

One is power switching and the rise of new energy. Currently, the penetration rate of new energy in the MPV category is extremely low, only 3.32% last year, of which pure electric vehicles accounted for 2.71%. The intention of this batch of new cars is clear, to iterate the market power while it is hot, and perhaps complete it ahead of schedule by overtaking with a lane change, in a product pattern that cannot be overturned by fuel vehicles.

The other is incremental customer groups. Business needs are stable, making it a stock market, while industry insiders believe that the incremental market will still come from the home.

However, the impact of the third child may not be significant. The premise of the third-child policy is to have a second child or even a child.

Although according to data from the National Bureau of Statistics, the proportion of second children has risen from 30% in 2013 to 43% in 2021, with more than 40% of births being the second child; its peak was in 2017, reaching 50%. However, the total birth rate was only 7.52 ‰; the natural population growth rate was 0.34 ‰.

In 2021, the number of births was only 10.62 million, hitting a new low in recent years and a decline of 43.6% compared to 2016. The home MPV market has been sluggish over the past five years, and there are reasons for this, with base indicators affecting it…

It’s not that the car is not good, it’s that the family is not good.

In the Zhihu questioning “Why is MPV the best family car?” Mass responses indicate that only when you have a complete family, can you truly understand its value. Those who are indecisive about MPV or SUV are not truly sincere in their desire to buy a family car.# MPV, a high threshold vehicle

An upvoted answer explains why MPVs are a high threshold vehicle like this: “Because driving an MPV is equivalent to giving up on picking up girls. You only do it out of a deep love for your family and a willingness to abandon your dream of being a player. An MPV is the epitome of a man’s commitment to his family”.

Few good family men, serve more men who wish. MPVs have small windows.

Therefore, rather than relying on illusions, the future should be placed under the slowly growing population of old men – the aging society, the middle-aged and elderly population is the continuous majority, how to make this group of middle-aged and elderly people spend money, rather than relying on young people who are poor to have children, is the true vision.

Speaking of the Voyah Dream Family (after all, they announced that they will have an official launch, so I won’t dwell on this) – this might be very popular among middle-aged and elderly people: Equipped with double doors for easy access, air suspension for easy getting in and out, Denon audio, and obtained C-NCAP five-star safety.

It meets the fundamental needs of middle-aged and elderly people for spaciousness, knee comfort, entertainment, and longevity.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.