Jia Haonan posted from the co-pilot temple.

Smart car reference | Official account AI4Auto.

Musk is speechless about this because Toyota, the world’s largest car giant, who was still a “traditional car defender” last year, has turned around at the speed of light this year and demonstrated that the “Tesla mode” is “delicious” through action:

Today, Toyota announced that it will follow the pure visual autonomous driving route for passenger cars.

For autonomous driving, has Toyota really understood it, or has it reached a dead end?

By imitating Tesla, can it become the next Tesla?

Toyota Tesla-ization?

So how strong is Toyota’s pure visual autonomous driving?

First, let’s take a look at Toyota’s “real skills” that it has touted:

On the fuel car Lexus LS, Toyota has been able to achieve basic high-speed navigation-assisted driving, which means that basic lane keeping, automatic following, and cruise control are not problems.

Furthermore, Toyota also demonstrated autonomous lane-changing capability at the L3 level:

However, Toyota is very cautious about the autonomous lane-change capability. The system will first issue a lane-change request, and after the driver confirms it, the driver needs to hold the steering wheel and observe the road conditions. After the in-vehicle camera confirms that the driver can provide a backstop, the car will automatically turn on the lights and switch lanes.

These capabilities are not novel, and new forces have already submitted them as required courses.

What is unexpected about Toyota’s autonomous driving ability is the more advanced autonomous entrance and exit of the ramp:

This process also involves another skill, “curve speed control”:

Adjust the speed according to the curvature of the curve to ensure safety and riding comfort. Currently, there are not many publicly acknowledged technologies that can do this well.

In addition, automatic avoidance of large vehicles and pre-avoidance actions beyond the line of sight can also be achieved.In these features, there is still the ability of Toyota’s emphasized Teammate to achieve vehicle-to-road coordination through the Internet of Vehicles, which can not only command the actions of the entire autonomous driving fleet through one car, but also achieve independent operations of a single car.

How many cameras were used and how much computing power is required?

Toyota has not disclosed the information, but they claim that this system can cover all scenarios from the entrance to the exit on highways.

Where did the plan come from?

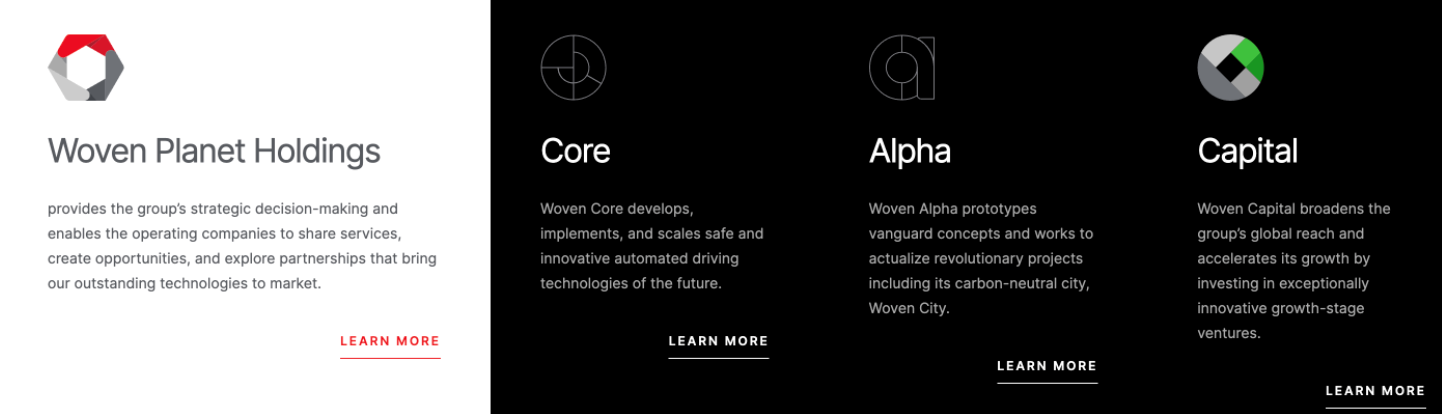

It comes from Toyota’s subsidiary Woven Planet, and it is revealed that this pure vision autonomous driving system will be installed on Toyota’s mass-produced passenger cars in the future.

What is also notable is that the hardware cost of the cameras they used is 90% lower than common commercial products.

As for the development roadmap for autonomous driving, it is exactly the same as Tesla’s:

In the short term, radar may be used as an auxiliary, but the long-term goal is definitely based on deep learning pure vision autonomous driving algorithm.

Since deep learning algorithms are required to explore information from image data, massive data is necessary. Toyota’s annual global sales of over 7 million vehicles are a perfect source of data.

In any case, Toyota is fully Tesla-ized in the advancement of this route.

However, the core of Tesla is the closed loop process of data behind the pure vision solution and the highly automated data processing capability.

Therefore, the real challenge for Toyota is:

Where exactly does the core data intelligence of Woven Planet come from?

Who is providing automatic driving for Toyota?

Woven Planet was formerly the autonomous driving project team of Toyota Research Institute, focusing on the research and development of high-level autonomous driving above L3 from the beginning of its establishment. The earliest publicly available news dates back to 2018.

The leader is James Kuffner, a former Google driverless car veteran and robotics guru, who is also one of the famous inventors of the Rapidly-Exploring Random Tree (RRT) algorithm in the field of AI.

After becoming independent in January 2021, James Kuffner became the CEO of Woven Planet, and Toyota’s fifth-generation heir, Toyoda Daisuke, became the senior vice president.

Other than autonomous driving and vehicle-to-everything communication (V2X), Woven Planet’s another important responsibility is to layout the intelligent automotive industry chain.

Let’s take a closer look.

Firstly, for autonomous driving. Toyota has not disclosed how much of their autonomous driving capabilities are self-developed and whether their data loop is complete.

However, the “flexing muscles” moment came after an unusual acquisition.

In April of last year, Woven Planet announced the acquisition of Lyft’s L5 level autonomous driving department for a total cost of USD 550 million (about CNY 3.5 billion).

The acquisition agreement clearly shows that Lyft’s autonomous driving team’s software algorithms, data permissions, and the testing fleet are open to Toyota without reservation.

We previously reported on Lyft, which, like Uber, went through many setbacks in the implementation of RoboTaxi, ultimately choosing to sell its autonomous driving department. After nine years of accumulation, it finally got married to Toyota.

Almost at the same time as the acquisition announcement, Toyota could not wait to announce the previously demonstrated advanced autonomous driving version of the Lexus LS, so it seems that Toyota’s cooperation with Lyft had long been established.

Perhaps Toyota has been eyeing this ready-made autonomous driving skills package for quite some time.

As for V2X, Toyota is also taking the “from partner to shareholder” route.

Carmera is a high-precision map company founded in 2015, which has been cooperating with Toyota since 2018 until it was acquired by Toyota last year. In addition, Toyota invested in Momenta, reportedly due to Momenta’s qualifications and capabilities related to high-precision maps — especially in China.

At present, in addition to developing autonomous driving algorithms, Woven Planet relies on Carmera’s capabilities and collaborates with Isuzu, Hino, Mitsubishi, and others to develop an autonomous driving mapping platform. In addition, it also cooperates with local governments in Japan to develop hydrogen infrastructure and smart city projects.

At present, in addition to developing autonomous driving algorithms, Woven Planet relies on Carmera’s capabilities and collaborates with Isuzu, Hino, Mitsubishi, and others to develop an autonomous driving mapping platform. In addition, it also cooperates with local governments in Japan to develop hydrogen infrastructure and smart city projects.

In terms of industrial layout, in addition to acquiring core technology suppliers, Woven Planet has also established an $800 million investment fund, and in March last year, the first investment was made in Nuro, the unmanned delivery vehicle company founded by Zhu Jiajun.

Moreover, don’t forget that Toyota has also invested heavily in autonomous driving and took a stake in Pony.ai.

Therefore, in the transformation of intelligent cars, Toyota may not seem to be acting quickly, but it is the leader in sales, and its size and resources are there.

Toyota “Refused to Speak but Acted Honestly”

The background of this photo is that Toyota sold the Fremont plant to Tesla at a low price.

The reason for the low-price sale was that Toyota was still one of Tesla’s shareholders at the time, and in the eyes of Toyota’s big brother, Tesla was still an unstable startup company.

Akio Toyoda, the head of the world’s largest automaker, has faithfully played the role of “traditional automotive guardian” in recent years—

His figure can be seen in topics such as publicly criticizing purely electric vehicles and not encouraging automakers to compete for L5 autonomous driving.

However, he may only be playing along with the occasion. After all, he has also invested in building a battery factory, launched more than 10 pure electric vehicle models, and acquired three companies related to autonomous driving within a year.

In the transformation of intelligent cars, Toyota “refuses to speak but acts honestly” and is the most active among Japanese automakers.

However, the process is not smooth.

In terms of autonomous driving core capabilities, Toyota has actually tried it themselves. The L4 low-speed unmanned bus, which was developed at a huge cost and manpower, collided with an athlete during its debut at the Tokyo Paralympic Games last year.

Perhaps this also made Toyota realize that the route of L4 entry and then downgrading cannot be achieved by themselves. There is no clear support from regulations for the landing of L4, and the division of road rights and responsibilities is still unclear, which limits the scale of the fleet. Moreover, the high cost of L4 vehicles is also a barrier to mass production.

Without achieving mass production, it is difficult for autonomous driving algorithms to iterate and improve.

In addition, unlike China, Japan does not have the advantages of a low-cost supply chain, a large market, and a rich application scene. Therefore, the RoboTaxi model that can be achieved in one step is even more difficult for Toyota.

After stumbling for several years, Toyota might have finally figured it out:

What Musk insists on as “First Principles of Autopilot,” is the way out.

Musk has always preached that image data essentially contains all the information needed for driving, which humans can achieve, and so should AI drivers. The extra sensors are just “crutches” that add complexity and resource consumption to the system.

However, to achieve pure visual autonomous driving, a massive amount of data iteration is required, and for new entrants, low-cost data acquisition is a huge challenge.

Toyota, on the other hand, has a natural advantage in this regard.

So, as Toyota follows Tesla’s pure visual route, it is expected to trigger even greater industry discussion and reassessment.

Musk might have hit the nail on the head again this time.

- End –

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.