Author | Nie Yiyao

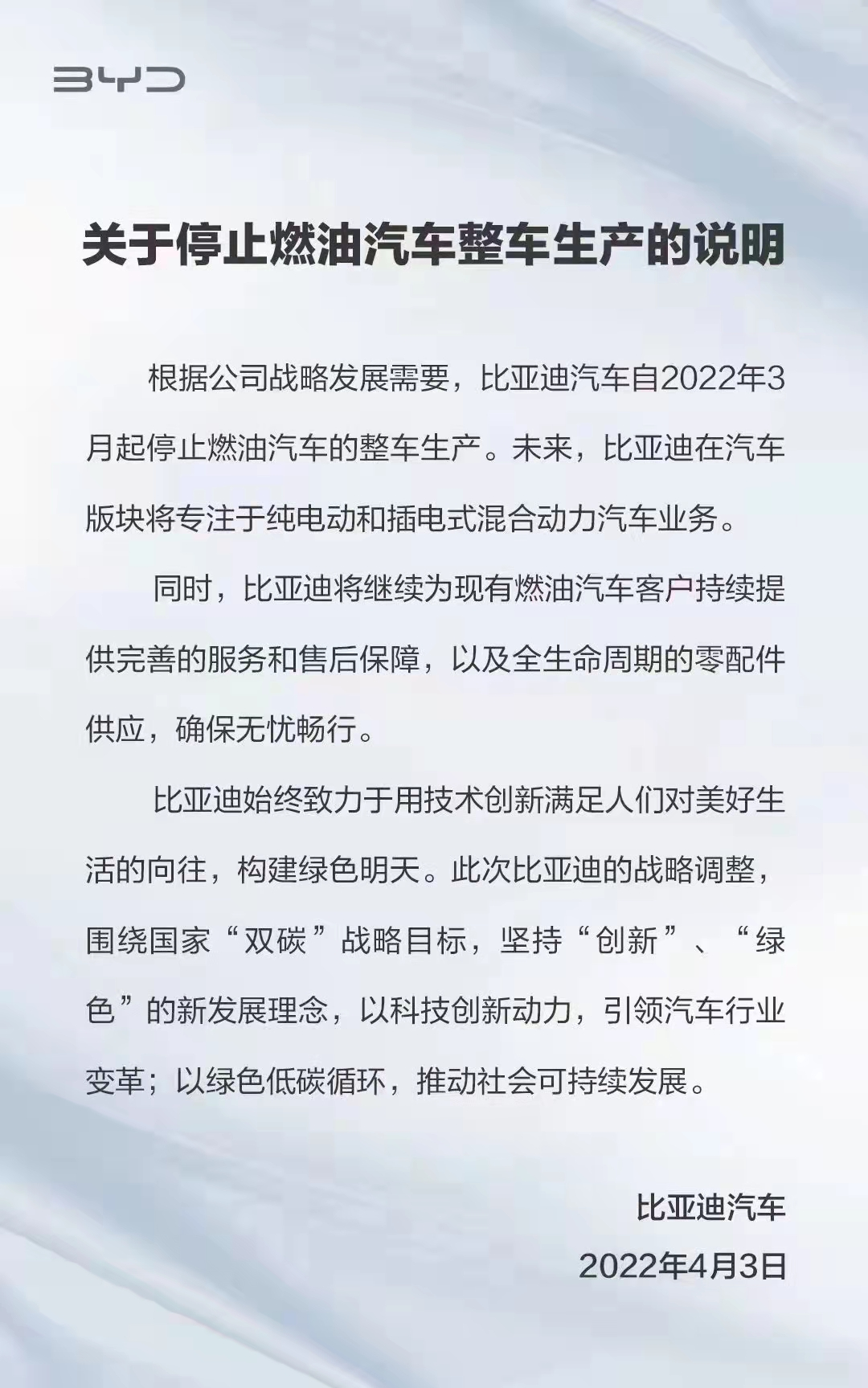

On April 3, 2022, BYD announced the suspension of production of fuel vehicles. This is not news anymore, and the industry has already surrounded it at first sight, offering applause and thumbs up.

However, compared to the attention everyone paid to BYD’s bold move of cutting off their fuel vehicle business, it seems that few people paid attention to who will be happy after this move, and who will be worried.

Who Will Be Happy?

BYD’s withdrawal from the fuel vehicle market on the surface means that its original market share of fuel vehicles will be given to its competitors who remain in this arena.

However, delving deeper, it’s not that simple. Data shows that from 2019 to 2021, BYD’s fuel passenger car sales volumes were 231,900, 237,300, and 136,300, accounting for 1.18%, 1.31%, and 0.79% of the domestic fuel passenger car market share, respectively. The main models responsible for BYD’s fuel passenger car sales were F3, Song Classic, and Song Pro.

At first glance, although the market share is not large and dropped significantly in 2021, it at least cleared up space for competing models. I wonder if competing models who learned of BYD’s suspension of fuel vehicle production secretly rejoiced at that time. However, digging further, it is discovered that this matter may not be worth anyone’s rejoicing. The market share of BYD’s withdrawal from the fuel vehicle market may not be able to be entirely absorbed by the competing models, and even new energy vehicles, including BYD itself, may not leave much interest to fuel vehicle competitors.

In 2021, BYD’s fuel car sales volume was 136,300, a year-on-year decrease of 42.56%, but its new energy passenger car sales volume reached 593,700, a year-on-year increase of 231.6%.

At the same time, in 2021, the terminal sales volume of domestic fuel passenger cars was 17.157 million, a year-on-year decrease of 5.6%. The sales volume of domestic new energy passenger cars in 2021 was 2.989 million, a year-on-year increase of 169.5%.

The rise and fall of these two sales volumes indicate two points. Firstly, BYD has made up for the market share lost in the fuel vehicle market in the new energy vehicle market. This is due to two factors, one is BYD’s excellent market feedback from its blade battery and DM technology, which is outstanding among new energy brands and demonstrates excellent brand competitiveness, thereby achieving more and more prominent sales performance in the new energy vehicle market.

On the other hand, BYD is largely converting its gasoline vehicle customers into new energy vehicle customers. For example, when the demand for Song Classic and Song Pro has decreased, the demand for the two PHEVs, Song Plus DM-i and Song Pro DM-i, has increased, especially the Song Plus DM-i that was launched in March 2021 and has maintained strong sales in the past few months.

Secondly, all new energy vehicle brands including BYD are quickly seizing the market share of gasoline vehicle market in all price ranges, from low-end to high-end, by virtue of the continuous penetration of new energy vehicles into the gasoline vehicle market. Wang Chuanfu pointed out at the electric vehicle 100-person forum last month that the penetration rate of new energy vehicles in China increased from 6% in January last year to 22% in December, with an average increase of 1.3 percentage points per month. The penetration rate in the first half of March this year has exceeded 28%, and it is expected that the penetration rate of new energy vehicles in China will reach 35% by the end of this year.

If this prediction comes true, gasoline vehicle brands will continue to lose more sales. Then, BYD, who has withdrawn from the gasoline vehicle market, may be cut off by other new energy vehicle brands including itself instead of its competitors.

Therefore, if anyone is really happy that there is one less competitor in the gasoline vehicle market, they should be careful, because competitors who have taken off their gasoline vehicle masks are teaming up with other new energy vehicle brands to prepare to sweep the gasoline vehicle market.

Who will worry?

This announcement of stopping the production of gasoline vehicles has made BYD the first traditional carmaker in the world to formally stop the production of gasoline cars. This also makes BYD a leading brand of new energy vehicles and an example for global car companies.

Because at the United Nations Climate Change Conference held at the end of 2021, traditional car companies including BYD, Volvo, General Motors, Ford, Mercedes-Benz, Jaguar and Land Rover signed an agreement on the cessation of selling gasoline vehicles and replacing them completely with new energy vehicles by 2040.

Meanwhile, other traditional car companies, such as Volkswagen, Toyota, BMW, Nissan, and Stellantis, refused to sign such a commitment.

Now, BYD has announced the cessation of gasoline vehicle production, which is 8 years earlier than its promise half a year ago. Can any other traditional car company make a rapid and resolute decision to stop using gasoline as BYD did? It is highly unlikely.The reason is mainly that other traditional fuel vehicle brands do not currently have a similar sales structure and proportion of new energy vehicles like BYD. Of course, they are also unable to abandon the dividend of fuel vehicles to develop new energy vehicles at all costs.

In fact, compared with the growth rate and scale of its new energy vehicles, BYD’s fuel vehicles have become meaningless. In 2021, BYD sold 136,300 fuel vehicles and 593,700 new energy passenger vehicles, which is quite evident. In 2022, BYD’s new energy vehicles are gaining momentum, with a cumulative of 400,000 unfilled orders and still increasing month by month. In March, BYD’s sales have surpassed 100,000 vehicles.

If they do not boldly cut down fuel vehicles, it will instead impede and affect BYD’s investment and determination in new energy vehicles. Therefore, although the current profitability of BYD’s new energy vehicles is not as good as that of new forces such as Tesla, Nio, and Ideal due to the rise in raw material prices and changes in vehicle structure, it has been criticized by the outside world for “increased revenue but not increased profit.” BYD chooses to stop producing fuel vehicles and expand the scale and capacity of new energy vehicles to enhance the security of the supply chain. It has set a sales target of 2 million vehicles in 2022, conservatively estimated at 1.5 million.

By comparison, there is currently no second traditional automaker that has the conditions for BYD to shut down fuel vehicles.

For example, in 2021, Toyota Motor Group, which ranked first in global sales, delivered 10.4955 million vehicles (including Toyota, Lexus, Daihatsu, and Hino), but only 2.6219 million were new energy vehicles (14,000 pure electric and 2.6079 million hybrid).

Volkswagen Group, which ranked second in global sales in 2021 (including Volkswagen, Audi, Porsche, Skoda, SEAT, etc.), sold 8.882 million vehicles, of which only 762,400 were new energy vehicles (452,900 pure electric and 309,500 hybrid).

Furthermore, SAIC-GM-Wuling ranked third in China’s new energy vehicle sales with 456,000 vehicles sold in 2021, second only to Tesla and BYD. However, SAIC-GM-Wuling’s total vehicle sales in 2021 were 1.76 million.

Almost all traditional automakers still rely heavily on the market share obtained by fuel vehicles, and it is almost impossible for them to turn completely to new energy vehicles.

However, new energy vehicles have become the trend of the global automotive industry, and this trend is becoming more and more definite and rapid. If traditional automakers do not show action and seize market share in the new energy vehicle market as soon as possible, they will be even more passive in the future. In the tide of the transformation of old and new cars, automakers are no exception.

Perhaps due to the above-mentioned concerns, traditional car companies have announced their new energy goals and plans from 2025 to 2030.

For example, Toyota announced a target of selling 500,000 pure electric vehicles in 2025 and 3.5 million in 2030. Volkswagen aims to sell 1 million pure electric vehicles annually by 2025 and 5 million globally by 2030. The Renault-Nissan-Mitsubishi alliance has stated that new energy vehicles will account for 50% of its total car sales by 2030. General Motors also aims to sell more than 1 million pure electric vehicles by 2025.

As we can see, traditional car companies are making efforts to enter the new energy vehicle market, especially the pure electric vehicle market. Whether they can successfully become a dominant force in the new energy vehicle market, as they have been in the traditional car market, will depend on their subsequent actions, efficiency, and ability to seize opportunities.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.