Ningde Times disclosed on April 6th that its first overseas factory located in Thuringia, Germany officially obtained the cell production license on April 4th. On the same day, Anja Siegesmund, the Minister of Environment, Energy and Nature Conservation, and Wolfgang Tiefensee, the Minister of Economics, officially issued the second phase of the license to Matthias Zentgraf, Co-President of Ningde Times Europe. Ningde Times’ German factory thereby obtained a cell production capacity license of 8 GWh.

The Ningde Times German factory mainly consists of two parts: G1 is a purchased plant and is used to assemble cells into modules. G2 is a newly-built plant and is used for cell production. This license is aimed at G2’s cell production.

In addition, the factory started construction in 2019 and plans to be put into operation at the end of 2022, with a planned total investment of 1.8 billion euros and a planned production capacity of 14 GWh.

Moreover, Zentgraf, Co-President of Ningde Times Europe, stated that the Ningde Times German factory is almost as complex as a chip factory and has strict requirements for clean rooms, technical cleanliness, and constant humidity. In addition, in order to achieve sustainable battery production, part of the factory’s energy comes from solar panels on the roof of the plant.

Currently, the electrification transformation in Germany is very urgent. Germany previously stated that it will stop selling gasoline-powered cars in 2030. In 2021, as Europe’s largest electric vehicle (EV) market, Germany sold 681,000 EVs, a year-on-year increase of 72.7\%.

However, with regard to the EV industry, Germany’s core battery technology has long been dependent on domestic resources. In addition, the surge in international freight rates since last year has resulted in the difficulty of reducing the cost of EVs in Germany. With the start of production at the Ningde Times German factory, the competitiveness of local German car companies will be significantly improved.

Ningde Times accelerates its overseas layout

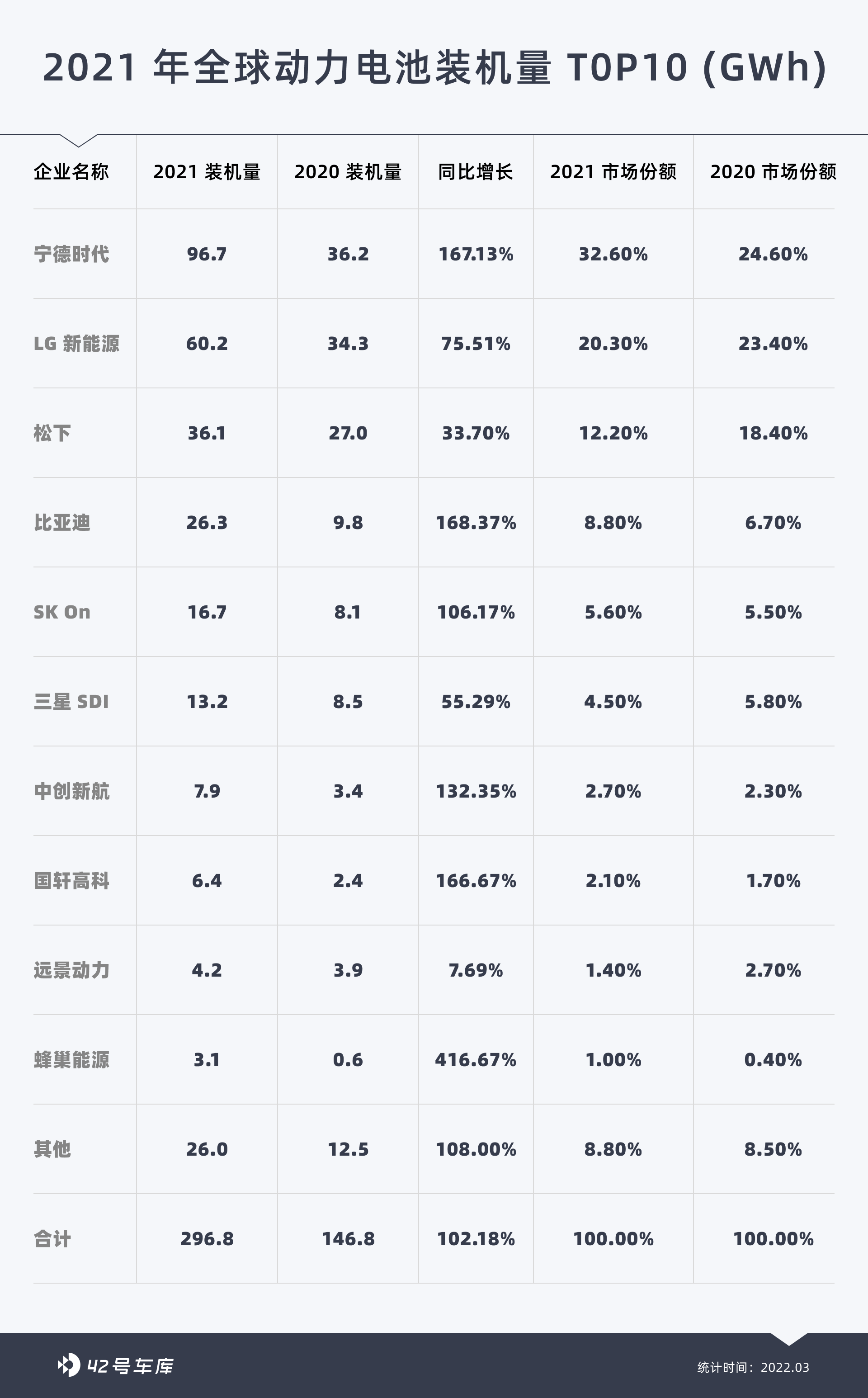

In 2021, Ningde Times installed 96.7 GWh of batteries and had a global market share of about 32.6\%, monopolizing about one-third of the world’s market share.#

However, the dominant position of CATL is not stable. Currently, the majority of CATL’s market share comes from domestic sales, and domestic new energy vehicle companies are finding ways to “dethrone” CATL. Earlier this year, “Xiaoli” invested in Xinwanda, and XPeng Motors even included Xinwanda in its G9 A-supply chain.

NIO and Xiaomi have just announced their cooperation with Fudy Battery, and they will purchase BYD’s blade batteries. In January and February of this year, BYD’s domestic battery market share exceeded 20.7%, narrowing the gap with CATL.

Therefore, if CATL wants to maintain its leading position, relying solely on domestic sales is not enough. In addition, with the rapid acceleration of electrification in Europe and America in recent years, it is very reasonable for CATL to accelerate its layout in overseas markets. In addition to the battery factory in Germany, it is reported that CATL has recently disclosed a plan to invest $5 billion to build a battery factory in the United States with a production capacity of 80 GWh, which is significantly larger than the factory in Germany.

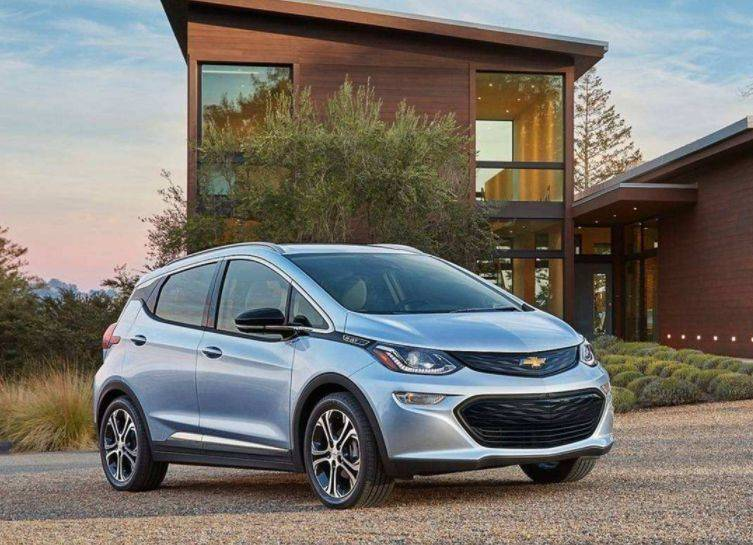

According to President Biden’s plan, half of the new cars in the United States will be new energy vehicles by 2030, which contains huge opportunities. At the same time, Chevrolet Bolt in the United States is currently in an indefinite production halt due to battery fire defects. It happens to use LG Chem’s battery. If CATL can quickly establish its factory in North America, it has the opportunity to snatch this large customer from LG. In addition, Tesla and newcomer Lucid both have demand for lithium iron phosphate batteries, and CATL may be able to take a big slice of the cake with the accumulation of technology and experience.

However, there are also risks in building factories in the United States. Previously, some media pointed out that the United States forced three South Korean battery factories, LG Chem, Samsung SDI, and SK On, to deliver their core technologies. CATL’s road in the United States will not be easy.

European battery factories begin to counterattack

As a pioneer in the era of fuel vehicles, Europe has lagged behind in electrification. Although the sales of electric vehicles are growing rapidly, in 2021…In the year, “11 European countries” sold a total of 850,000 electric vehicles, a year-on-year increase of 30.4%, but the core component, batteries, were mostly purchased from overseas.

However, as the birthplace of the automobile, Europe certainly does not want to be “dependent on others” in this way. In December 2021, a milestone in the European automotive industry was reached- the first electric vehicle battery pack designed and manufactured entirely in Europe went offline at a Northvolt battery factory in Sweden. Northvolt has received orders worth $30 billion from clients including BMW, Fluence, Scania, Volkswagen, and Volvo Cars. The super factory will expand its production capacity to 60 GWh per year in the next few years.

According to a report by the European Union non-governmental organization Transport & Environment (T&E), there are currently 38 super factories under construction or completed in Europe, with a total projected annual production capacity of 1,000 GWh and are expected to produce enough electric vehicle batteries for 16.7 million cars.

Volkswagen plans to reach 240 GWh of battery demand in Europe by 2030. Volkswagen plans to build six battery factories in Europe with its partners to ensure the supply; Mercedes-Benz plans to invest hundreds of millions of euros to produce electric vehicle battery packs at its major production base in Stuttgart in southern Germany, and start small-scale production in 2023, transforming from external lithium battery procurement to internal production.

It is foreseeable that Europe will become an important competitive market in the global power battery field in the future. In addition to Ningde Times, domestic battery factories such as Funeng, CATL, and EVE Energy, as well as Japanese and Korean enterprises such as LG Chem and Samsung SDI will build factories in Europe to seize the lead, and the competition in the European battery market will be very intense and exciting.

However, for Ningde Times to maintain its current market share and position, one German factory is clearly not enough. But with the approval of the production license for the German factory, the acceleration key of Ningde’s global expansion has been pressed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.