Wanbo DENG Simao from the co-driver’s temple

Smart Car Reference|AI4Auto Official Account

Tesla delivers in Q1:

310,000 cars, setting a new record for quarterly deliveries.

Moreover, the results were achieved under the circumstances of the COVID outbreak in the Shanghai factory and supply chain instability.

Looking domestically, the competition among China’s new automakers has been growing:

The 10,000-car-delivery club has a new member, and it’s Legendarium Motors, which is making a dash for an IPO.

NIO, on the other hand, is expected to have deliveries of less than 10,000 cars, indicating a bottleneck for high-end models.

Tesla delivers 310,000 cars in Q1

Tesla announced Q1 production and delivery data, both of which reached historic highs:

In Q1 2022, Tesla delivered 310,048 vehicles worldwide, an increase of 67.8% compared to the same period last year, setting a new record for quarterly deliveries.

Of these, Model 3 and Model Y accounted for 95% of total deliveries at 295,300 units, while Model S and Model X delivered 14,748 units.

In terms of production, Tesla produced a total of 305,407 vehicles in Q1, of which Model 3 and Model Y accounted for 291,189 units, while Model S and Model X accounted for 14,218 units.

In practice, Tesla’s growth has not come easily.

Since March, the COVID outbreak in Shanghai has become increasingly severe, and the flow of parts has been disrupted, affecting production.

After the city implemented “zone-based” lockdown measures on March 28, the Tesla Shanghai Gigafactory was also impacted and had to stop production for four days.

Given that the Shanghai factory has always pursued a zero-inventory policy, there were no inventories to make up the losses after the shutdown, putting great pressure on the company.

Last year, the Shanghai Gigafactory already took on more than half of Tesla’s production tasks and became Tesla’s export center.

After announcing the delivery data, Musk tweeted:

The sudden outbreak caught us off guard, and this quarter was too difficult.

While it was indeed a difficult quarter, there was an indescribable sense of joy in Musk’s words, as Tesla has had quite a few positive developments recently.

After a two-year delay, the Berlin Gigafactory has finally started production, and the Texas Gigafactory, Tesla’s second domestic factory, has also recently started its production line.The main task for Tesla in 2022 is to increase production capacity. As of now, whether in the US or in China, the delivery cycle of Tesla vehicles is generally around 3-6 months due to backlogs in orders and insufficient production capacity. It is foreseeable that the delivery data for Tesla will show faster growth after the Berlin and Texas factories start production.

Speaking of this, I wonder if the German car makers who have been hit hard by Tesla have felt the pressure. It is said that the recent production speed of one Model Y car every 10 hours in Tesla’s Berlin factory has made Volkswagen unable to sit still. Christian Vollmer, Volkswagen’s head of production, recently stated that Volkswagen’s goal is to catch up with Tesla and produce one car every 10 hours!

So, what about the delivery data for domestic new energy vehicle companies? Overall, growth is the main theme. Domestic new energy vehicle companies have basically escaped the collective failure of sales in February, and deliveries have rebounded with the arrival of early spring. There is also an unexpected new member in the monthly delivery of 10,000+ club: electric vehicle brand, Zero Run.

Looking at the performance of various companies in March:

Xpeng Motors, ranked first, reversed the delivery slump in February and delivered 15,414 vehicles in March, a year-on-year increase of 202%. Looking at the breakdown of vehicle models, Xpeng P7 contributed the majority of the shipments, delivering 9,183 vehicles, exceeding 9,000 vehicles in a single month for the first time, with a delivery share of 60%. In addition, Xpeng P5 is also becoming a new sales support for Xpeng, with 4,398 vehicles delivered in March.

NIO Holdings remained stable as always, firmly occupying second place. NIO delivered 12,026 vehicles in March, a year-on-year increase of 270%. Among them, NIO’s V-series delivered 8,122 vehicles, and NIO’s U Pro delivered 3,904 vehicles.

IDEAL Automotive ranked third, relying on its fresh design – the IDEAL ONE – to deliver 11,034 vehicles in March, a year-on-year increase of 125.2%.

In addition to the above three companies, the biggest surprise came from Zero Run: 10,059 vehicles were delivered in March, a year-on-year increase of 908.9%, ranking fourth among domestic new energy vehicle companies.# Quarterly Delivery Performance of Tesla and Domestic New Energy Vehicles

Last year, the delivery of Seres vehicles was less than 1,000 units in the same period. Recently, Seres submitted its listing prospectus to the Hong Kong Stock Exchange aimed at IPO. They have delivered a good performance.

NIO ranked fifth with 9,985 deliveries, a 37.6% year-over-year growth. This included 1,726 ES8s, 5,064 ES6s, 3,026 EC6s and 163 ET7s. It is worth noting that the deliveries of ET7 to customers started on March 28th.

From the delivery performance perspective, it is again confirmed that NIO’s three luxury SUVs are bottlenecked and urgently need new models and mid-to-low end market to boost sales.

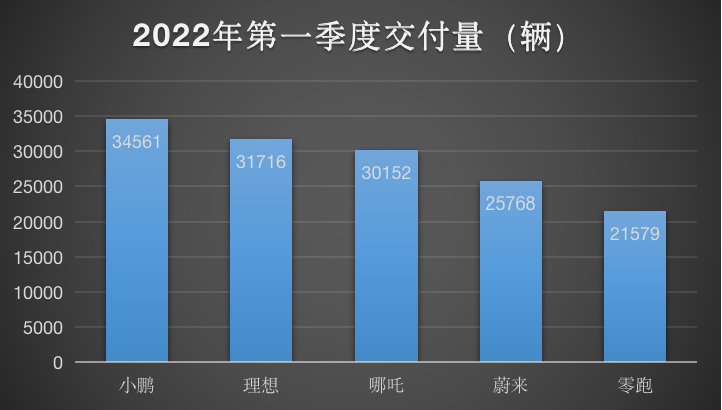

Now let’s take a look at the overall performance of Q1:

XPeng still maintains its leading position, having delivered 34,561 vehicles in three months, which is 2.6 times the number of deliveries in the same period last year, a YoY growth of 159%.

Li Auto ranked second, delivering a total of 31,716 vehicles in the first quarter of this year, a YoY growth of 152.1%.

WM Motor ranked third, with 30,152 deliveries. In Q1 last year, they delivered 7,443 vehicles, a YoY growth of 305%.

NIO ranked fourth, delivering 25,768 vehicles, a YoY growth of 28.5%.

Due to insufficient accumulation in the early stage, Seres delivered 21,579 vehicles, a YoY growth of 410%, ranking fifth.

These are the delivery performance data of Tesla and domestic new energy vehicle manufacturers.

Comparing Tesla with domestic new energy vehicles is a comparison of quantity. It is only by putting them together that we can see the gap.

In addition, the number of deliveries is just one aspect of the competitive strength of car companies. True strength also includes “internal strength.”

Seres and WM Motor, which have achieved deliveries in tens of thousands, depend on low-priced small cars with meager profits to increase sales.

Meanwhile, NIO has stayed at high-end for too long and needs to explore a bigger growth space in the lower-end market.

To survive and thrive, domestic new energy vehicle manufacturers still need to cultivate internal strength in other areas, such as intelligentization, premium pricing, and growth potential.

What do you think?

— 完 —

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.