Author: Zhu Yulong

At the recent Bairen Conference, several chip companies participated, among which Texas Instruments (TI) deserves a special mention.

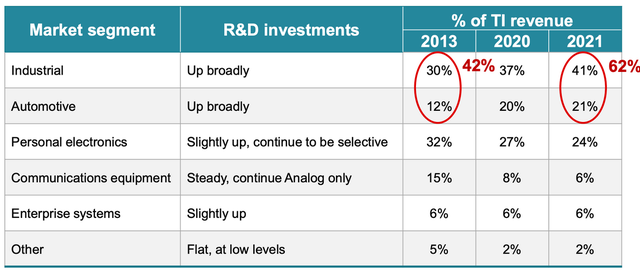

In terms of business in 2021, TI’s total revenue reached USD 18.344 billion, a year-on-year increase of 26.85%. Over 62% of its revenue came from sales to the automotive and industrial markets (while its share in the consumer electronics and communication businesses is gradually decreasing).

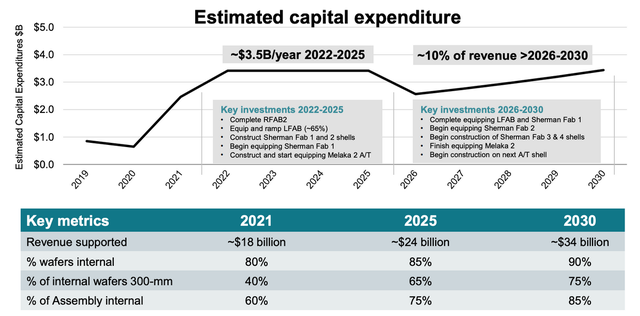

In terms of investment and expansion of production, TI departed from its conservative cash flow strategy, significantly increasing the percentage of future capital expenditures to revenue. In the semiconductor industry, with massive global investment underway, Texas Instruments, with its extensive product line, announced that it will spend roughly USD 3.5 billion annually towards capital expenditures by 2025. This is due to its expectation of increased growth prospects in need of larger production capacity. The company hopes to achieve a Compound Annual Growth Rate of 7% for the next ten years (compared to 4% average annual growth rate achieved from 2010 to 2020).

Manufacturing at Texas Instruments

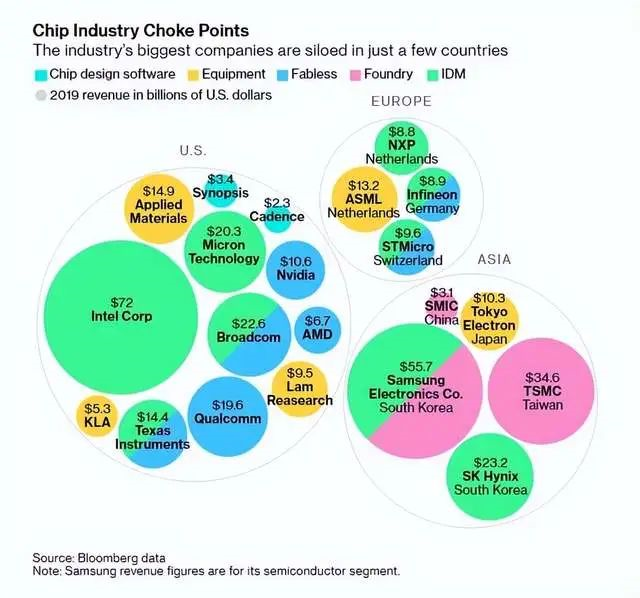

After the US Department of Commerce issued a new investigation, and subsequent legislation (the US Senate approved the “2022 US Competition Act” in March 2022, which provides a subsidy of USD 52 billion for the US semiconductor chip manufacturing industry), American semiconductor companies have been actively expanding their supply chains domestically.

TI’s main capability remains in IDM manufacturing across a wide range of business lines. In 2022 and 2023, new chip production factories will come online, including RFAB2 in Richardson and LFAB in Lehi, Utah. The additional capacity of these two factories will help meet the demand in the short term. In the long run, the sherman campus will potentially invest USD 30 billion to accommodate four capacities of the RFAB2 factory and provide additional capacity after 2025.

My understanding is that companies like Texas Instruments, which focus on industrial and automotive chips (offering conventional chips with a breadth of products), and alliances of American chip companies like Qualcomm and Nvidia focusing on computing power, as well as those centered around power semiconductors such as Wolfspeed and Onsemi based on SiC, will form a strong matrix for the next generation of intelligent electric vehicles worldwide. Here we see Tesla daringly applying chips, which creates a direct stacking effect.

My understanding is that companies like Texas Instruments, which focus on industrial and automotive chips (offering conventional chips with a breadth of products), and alliances of American chip companies like Qualcomm and Nvidia focusing on computing power, as well as those centered around power semiconductors such as Wolfspeed and Onsemi based on SiC, will form a strong matrix for the next generation of intelligent electric vehicles worldwide. Here we see Tesla daringly applying chips, which creates a direct stacking effect.

What did Texas Instruments talk about at the Hundred People’s Conference?

The topic of this talk was “Enhancing Vehicle Safety Using Innovative ADAS Technologies”, which was mainly composed of three parts:

- Perception: mainly providing a millimeter-wave radar chip solution (AWR2944)

- Processing: Jacinto™ 7 processor platform

- Communication: Serializer/Deserializer products to reduce system size and cost

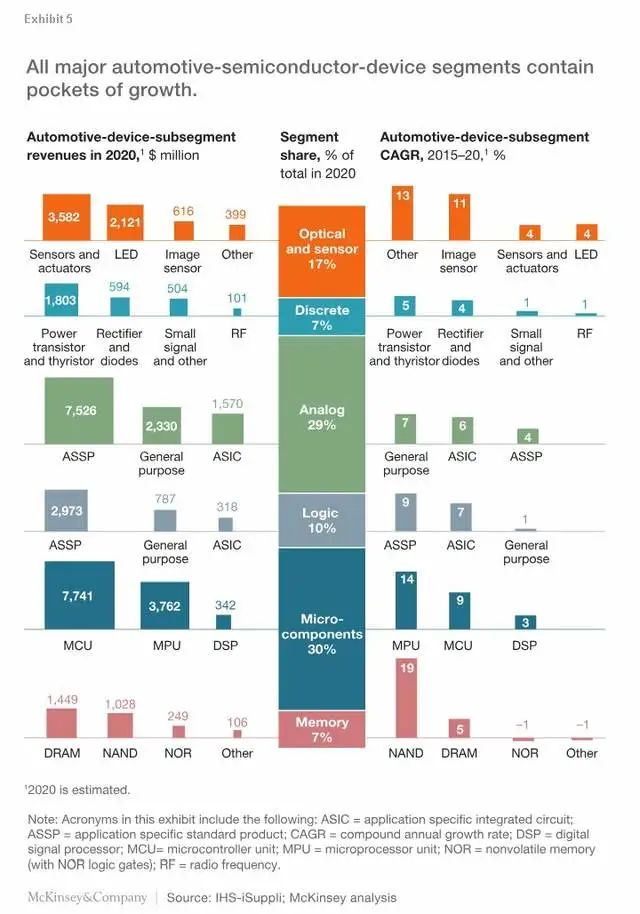

Let’s review the traditional composition of automotive electronics by McKinsey. TI’s main coverage is relatively comprehensive. When I was organizing the products, I couldn’t come up with a very general explanation of the product line. I think that TI’s layer-by-layer approach is actually very solid for business stability, and to respond to the overall changes in the automotive industry, it is simply a matter of investing more and tracking customers to develop (spending money) new products.

Conclusion: I think investment and development in automotive chips should be viewed with a slightly longer time horizon. Currently, most foreign semiconductor companies are increasing their investment efforts with the support of ZF, on the one hand to support the localized production needs of the phase of “de-globalization,” and on the other hand to develop and invest in response to the demands of intelligent electric vehicle changes. It is indeed too difficult to obtain returns from domestic automotive chip companies in the short term.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.