On the first day of April, Ideanomics, NIO, and Xpeng successively released their March delivery data, which showed some unexpected results:

- Xpeng topped the list again with 15,414 vehicles delivered

- Ideanomics ranked second with 11,034 vehicles

- NIO came in third with 9,985 vehicles

However, looking at the sales trends of the three companies over the past two quarters, it’s not hard to see that this situation has been going on for some time.

Why does Xpeng have such a high sales volume? Why can Ideanomics still break ten thousand with only one car? What happened to NIO’s sales volume? In the following content, we will briefly analyze these questions.

Behind the Rank Change

Xpeng: Turnaround and “Risk Taking”

Xpeng’s sales performance was excellent again in March, exceeding 15,000 vehicles sold, which can be described as a leap forward compared to the same period last year.

Following their top ranking in March, from October last year to the present, Xpeng has been the top seller among the top three new forces four times, with sales exceeding 10,000 for five months, and the highest monthly delivery reaching 16,000 vehicles.

To make it more intuitive, we have compiled a chart of Xpeng’s car sales trends from January 2021 to March 2022. Combining Xpeng’s actions over the past year, we can roughly see several reasons behind this growth.

The first reason is the sustained growth of P7 delivery volume.

Xpeng P7 was officially delivered on June 28, 2020. At that time, people did not have high expectations for this car. Their main target product was Tesla Model 3, which was still in the “discount period” at that time. In terms of driving control, brand, and popularity, Xpeng P7 was not comparable to the latter, and Xpeng’s intelligent label was not as prominent as it is today. Therefore, P7 at that time gave people the feeling of a more cost-effective “model 3 with a larger size,” and the product positioning was slightly awkward.After a period of ramping up production capacity, the sales of P7 reached the level of around 3,000 units and fluctuated up and down for about half a year. However, starting from April 2021, P7 suddenly entered the second wave of growth and achieved continuous month-over-month growth for 6 months, with monthly sales increasing from the 3,000-unit level to the 7,000-unit level, contributing significantly to XPeng’s delivery volume during the same period. Afterward, P7 entered a stable period again, with sales fluctuating around 7,000 units.

However, in the past March, P7’s sales once again greeted growth, reaching a new historical high of 9,183 units, and the goal of exceeding ten thousand units seemed to be within reach.

If we continue to analyze the internal reasons for the sales growth of P7, we can find that there are mainly two points:

-

XPeng conducted multiple OTA updates last year, among which the NGP high-speed lane navigation assisted driving was pushed in January, highlighting the overall intelligent experience;

-

XPeng P7 launched a lithium iron phosphate battery model in March last year, which is equipped with XPLIOT 2.5 as standard, and the starting price is reduced by 20,000 yuan. Opting for XPLIOT 3.0 only requires an additional payment of one thousand yuan.

In addition to the two internal factors mentioned above, in combination with the overall growth trend of the new energy vehicle market last year, P7 gradually became the most intelligent vehicle model in this hot price range.

Another reason for XPeng’s rising deliveries is the expansion of its vehicle product line.

Last year, XPeng launched three new cars, G3i, P5, and G9, among which G3i and P5 have been delivered last year. The arrival of new products brought XPeng another part of growth aside from P7.

However, apart from the obvious growth in the first few months after the facelift of G3i, it subsequently fell back to the level of 2,000 units sold per month before the facelift. So the real sales growth came from P5.

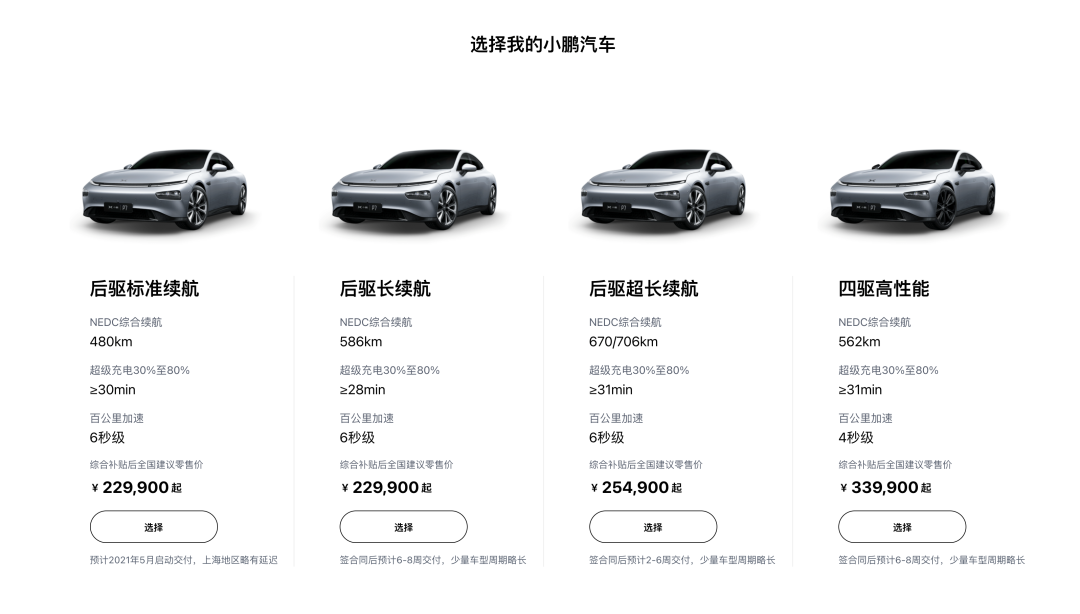

P5 can be said to be XPeng’s daring attempt. Previously, no independent brand had ever sold a large compact sedan for 200,000 yuan, a price that can buy a midsize sedan from a first-line joint venture brand.

Moreover, it should be noted that although P5 has more space and higher configurations overall, it is a same-platform model as G3i, and the sedan model sold for more than the SUV model also represents a counter-market rule. Therefore, P5’s market performance can largely explain whether the market is willing to pay for intelligent technology.

Translated Markdown text with preserved HTML tags:

Translated Markdown text with preserved HTML tags:

According to the sales results since the delivery of P5, it seems that XPeng has made the right bet again. In the last four months, the sales volume of P5, which is more expensive than G3i, is nearly twice that of the former, which is a very rare phenomenon in XPeng’s current product line: the more expensive models sell better, while the cheaper ones sell worse.

Such a situation indicates that the competition in today’s pure electric vehicle market is not a situation of “low price wins all”, and there are not few consumers who can afford higher prices. Among the factors that affect sales, the importance of comprehensive product strength has even begun to surpass absolute price. The sales of P7, P5, and G3i reflect this rule that the sales volume is positively correlated with the product strength of the three cars.

Ideal: Winning with Precision

The sales performance of Ideal in March was normal, and the data of 11,034 units was the fourth month that Ideal’s sales volume exceeded ten thousand. As the only enterprise among the top three new forces that relied on the sales of a single model in the past, Ideal’s delivery volume has not lagged behind.

The key node for the sharp rise in Ideal’s sales volume in 2021 is the delivery of the 2021 Ideal ONE. From June, Ideal’s delivery volume began to climb significantly. The first month of the redesigned model set a new record for monthly deliveries, and in December, it set a record of selling 14,087 units in a month. The sales increase effect brought by the redesign is significant.

Another point worth noting is that in 2021, there are also many new SUV models on the market, such as the new Highlander, Landfort, Lynk & Co 09, and Voyah Free, with similar prices or positioning. However, even in the face of numerous new models, Ideal ONE still achieved growth. The direct reason that is closely related to this result is Ideal’s extremely precise positioning as a “family car for families with children”, which has helped Ideal ONE find the key growth point. By starting from market demand, it adapts to changes without changing its basic tactics, thereby withstanding various differentiated product competitions.

In addition, as a large-size SUV that can be refueled, Ideal ONE has performed well in penetrating the sinking market, and its sales volume proportion in non-limit cities has grown from about 65% in 2020 to about 80% in 2021.

However, it should be noted that the overall outdated architecture has also made Ideal ONE’s performance only average in high-end assisted driving and mechanical quality, and it has become increasingly difficult to compare with recent new cars. Before the arrival of the new L9, the subsequent growth momentum may slow down.

Overall, Ideal’s blockbuster strategy has achieved good practical results in the past, and compared with XPeng’s “winning with wisdom” in assisted driving and voice interaction, Ideal’s growth is more reasonable but harder to be truly understood.

NIO: The Pain Period of New and Old IterationsNIO was only 15 vehicles short of breaking 10,000 monthly sales in March for the third time. Overall, its performance remained steady and as expected.

Compared to XPeng and Li Auto, NIO delivered 91,429 vehicles in 2021, a YoY increase of 109.1%, but it achieved the least growth among the three companies. If we look at Q1 2022, NIO’s delivery YoY growth was only 28.5%, while XPeng and Li Auto saw increases of 159% and 152.1%, respectively.

Based on the sales chart, it is easy to see that NIO’s sales have been relatively stable over the past year, with only slight increases in monthly sales of ES6 and virtually no significant growth for EC6 and ES8 except for a few months.

Although NIO’s sales growth has clearly slowed compared to the other two companies, we need to acknowledge that there are several special reasons behind NIO’s situation. These factors mainly include:

- NIO’s sales in 2020 and 2021Q1 were already the best among the top three new Chinese EV makers, making YoY comparisons less favorable for NIO.

- NIO is the only one of the top three new Chinese EV makers that did not update its product line in 2021.

- NIO’s models have the highest average price.

Furthermore, NIO’s growth was also limited in 2021 due to a very important external factor, Tesla Model Y’s domestic production. The arrival of this strong competing product has greatly increased the substitutability of NIO’s main sales models, ES6 and EC6, in the market.

Considering these factors, NIO’s slowed growth is somewhat understandable. From another perspective, it’s actually impressive that NIO achieved triple-digit growth in 2021 with three old models, including its sister product line, in such a challenging market environment.

In 2021, NIO made a lot of efforts to reduce the cost of entry to its entire product line, such as BaaS (Battery-as-a-Service), which was introduced ahead of schedule in 2020. In its latest official information, the penetration rate of BaaS has reached 55%. Surprisingly, the Navigation on Pilot feature in autonomous driving was successfully implemented on old vehicle platforms.

Another important thing that is worth noting is NIO’s efforts to accelerate the construction of its energy system in 2021. The number of battery swapping stations has increased from just over 100 at the beginning of the year to more than 700 by the end of the year, and most of the newly built stations are more efficient second-generation stations. In addition, the launch of 100 kWh and 75 kWh batteries has laid a foundation and guarantee for the company’s energy supply experience.However, the fact that the core content of the 866 model that is currently on sale has been lacking updates and upgrades for too long has objectively resulted in a decline in its market competitiveness, and the problem of stagnant growth still needs to wait for the delivery of new cars to climb the slope before any real improvement can be achieved.

In fact, the source of NIO’s growth slowdown from 2021 to the present day still lies in the aftermath of 2019. The EC6 released in 2020 was a cost-oriented product of NIO’s economic crisis, whereas the original plan was to build a sedan project in Shanghai. It was the pace adjustment forced in 2019 that led to the product vacuum period of NIO in 2021.

However, with the successive launch of NIO ET5, ET7, ES7, and other models this year, the painful period of the new and old iterations of NIO will also come to an end.

Summary

With the gradual development and growth of the three new forces in recent years, each has begun to form its unique advantages. XPeng targets the mid-to-high-end market with intelligent technology, Li Auto captures family users with product definition, and NIO uses high-end image and service to capture the mainstream luxury market.

The comparison of sales volume among the three companies is no longer just a comparison of numbers, and the evaluation indicators have become increasingly multidimensional. Total volume, incremental volume, average price, model sales volume, and market ranking in segmented markets all have their own reasoning and emphasis. We need not expect to “see the old in three years” from the current sales data. Instead, we should pay attention to the differentiated variables and market logic behind the sales volumes of each company. With this thinking, let us take a look at a sales forecast for the three new forces in 2022.

2022 Forecast: Alternating Front-runners Under Multiple Challenges

Common Challenges: Subsidies Reductions, Pandemic, and Supply Shortages

The cost increases of electric vehicles have been the hot topic in the new energy market in Q1 of this year, mainly due to the reduction of new energy subsidies and the rise in raw material prices of batteries. Except for Li Auto, the three new forces have all been affected by these two factors.

Both Li Auto and XPeng have announced price increases. The price increase of the Li ONE and the diversion of L9 might pose a challenge to the new additions of Li ONE in the next few months, but users who rushed to purchase in March before the official price increase will still have some buffering effect.

Compared with Li Auto, the product line of XPeng is more affected by the rise in battery raw material prices due to its larger battery capacity, and the negative impact of price increases on sales volume will theoretically be greater since its average selling price is relatively lower than the other two companies. The sales volume of P5 and G3i may reflect this.

NIO has not announced any price increase yet. However, the company has recently revealed that it will adjust its pricing strategy according to the situation. If the cost of battery continues to rise, NIO will not withstand it either.

In addition, we cannot ignore the problems of parts supply and pandemic. The shortage of parts such as the MCU chip for vehicle regulations and power batteries and the current new wave of the pandemic are bigger problems for sales volume amid the price increase trend.The current estimate for the shortage of automotive chips in the industry is that it will continue and may last throughout this year, covering even the whole year. In the second half of last year, three new energy vehicle (NEV) companies all encountered supply shortages caused by the chip shortage. This year, growth will continue to face this unfavorable condition.

The situation in Shanghai became severe starting in March due to the pandemic, and since April 1st, the entire city has been under lockdown. Based on the insurance data from the past few months, the top three NEV companies in Shanghai might face a loss of approximately 1,000 units in deliveries during March and April, while other areas heavily affected by the pandemic will face similar challenges. Fortunately, the NEV companies have not had to shut down their factories due to the pandemic. If the overall production capacity cannot meet demand, it is possible that orders from affected areas will be transferred to other regions. This is conditional on the pandemic being effectively controlled to prevent more massive lockdowns.

Recently, XPeng Motors (XPeng) was rumored to have conflicts with CATL, and battery supply was then at risk. Currently, XPeng’s supply of power batteries comes from SKI and XWd, as announced last year and according to rumors. XPeng has already taken action regarding battery shortages that may occur during growth stages this year. NIO and LEADING IDEAL have no significant changes, but they are most likely preparing on the supply side actively.

In short, the new energy vehicle market this year has fewer favorable factors, and the supply shortage in the industry will continue. The pandemic has brought more uncertainty to the market. These uncontrollable variables will likely greatly affect the growth of the top three NEV companies.

Sales Forecast: Alternating with Each Other

The chief factor behind XPeng’s leading sales comes mainly from the growth of the P7 and P5 models. It is easy to confirm a continuation of this momentum for at least another period, particularly with the P5. As for NIO, they have the combination of the ES8 and ET7, and LEADING IDEAL only has one vehicle. If XPeng’s sales of the P7 can remain stable above 8,000 units in the short term, then XPeng will have the opportunity to defend its position.

Next, we look at new models from each company. XPeng will introduce the G9 and a modified version of the P7. Information about the G9 and the modified P7 has already been released. The price of the modified P7, as an upgraded version, is not expected to change significantly. After improving the pain points, it will still have room for sales growth. The price of the G9 is still unknown, but the information released suggests it will be a five-seater vehicle priced between 300,000 and 400,000 RMB, which will overlap with product lines from NIO and Tesla.

It is difficult to predict G9 sales, similar to previous XPeng models. The actual capabilities of XPILOT 4.0 and the 800V electric platform will be essential for the prospective buyers of this car. XPeng officially announced a Q3 delivery date for the G9. Together with revised P7 deliveries this year, the estimated incremental volume should be between 30,000 and 50,000 vehicles.Then comes NIO, the ET7 has been delivered and is expected to climb to a monthly sales of 5,000 vehicles over the next few months. With the upgraded 866 model coming in May, NIO is expected to experience a small growth before Q3, which may surpass both Li Auto and XPeng. Moreover, the ET5 also has the potential to surpass 10,000 monthly sales. With the delivery of the ES7, NIO’s growth will be further accelerated.

Li Auto’s trump card this year is the L9, whose price may exceed 450,000 RMB. Despite its high price tag, its sales have a good chance of exceeding the 2021 Li ONE, given its current product positioning. However, before the L9 is delivered in Q3, Li Auto’s prospects rely solely on the incremental growth of the 2021 Li ONE, which does not seem optimistic compared to the other two companies, as they are basically in a defensive stage.

Final Thoughts

Q1 2022 has officially ended, and the Beijing Auto Show in Q2 will be a new car explosion event. The three top new forces’ flagship products will be unveiled during the same period in Q2 and delivered in Q3. I believe that, prior to that, the sales changes among the top three new forces will continue the trends from 2021. Given the current situation of supply shortage, the COVID situation in various regions, and the rise in raw materials’ prices in the market, the sales of each company will further reflect the factory’s production capacity and the enterprise’s supply chain control ability.

On the product side, although the top three new forces appear to be taking different routes this year, they are actually facing more direct competition factors, such as convergence toward intelligent trends and simultaneously pricing their product lineup. Therefore, the growth strategies adopted during the 1.0 stage will inevitably need to be adjusted to this new environment.

Having children is an important condition for a fistfight. Similarly, a lower price is the premise of better selling, so the product strength should exceed the average price line. The prerequisite for successful sustained explosive growth strategies is no internal conflicts among product lines.

In my opinion, the top three new forces have the chance to break through 200,000 vehicles in 2022, each with its own strengths and weaknesses. Although differences in strategies and paces have emerged, their overall level is still in the same tier.

However, when it comes to data, there is always a first-place winner. Sales figures are the easiest to distinguish among the top three and the easiest to understand as ranking one, two, and three. The delivery volume will remain a significant indicator of the top three new forces’ performance, and we will continue to monitor their trends. We hope that XPeng, Li Auto, and NIO can maintain this benign competition with even better results.

Finally, we welcome everyone to download the “Cheku” app to stay updated with the latest news on new energy vehicles. If you wish to communicate in real-time, you can join our community by clicking here.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.