万博 from 副驾寺

Smart Car Reference | AI4Auto Public Account

Faraday Future (FF), under severe scrutiny by the US Securities and Exchange Commission, has suffered from continuous losses, and the number of cars produced and delivered is uncertain…

“Returning to China next week”, Jia Yueting, once again faces a financial crisis due to the breaking of the capital chain.

And this time, the time given to Jia is also very clear:

34 days.

If FF cannot prove compliance within 34 days, it will be delisted, and the stock market fundraising channel will be closed to FF. Based on Jia’s existing reputation and credibility, it may be difficult for him to raise money from private financing channels in both China and the US. Even if he can borrow, there might be insufficient funds available.

Jia Yueting is hammered again by the SEC

According to FF’s recent filing of an 8-k performance forecast to the US Securities and Exchange Commission (SEC), as of the third quarter of last year, FF’s asset balance was $1 billion, with only $666 million cash on hand, and a net loss of $304 million in the third quarter.

The management said that funding is sufficient for the development and production of FF91, but additional funding is still needed to sustain operations.

The problem is that FF’s best opportunity to raise funds is to submit a formal financial report in a timely manner, otherwise, it will be closed after 34 days.

Based on this situation, the management of FF has issued a nearly lethal sentence:

There are significant doubts as to whether FF can sustain operations for another year.

This time, the US Securities and Exchange Commission may have dealt a fatal blow to Jia Yueting and his Faraday Future.

In Faraday Future’s submission of the 8-k performance forecast for the third quarter of 2021 to the SEC, it is expected that the company’s operating losses for the third quarter of last year will reach $186 million, an increase of 933% from $18 million in the same period last year.

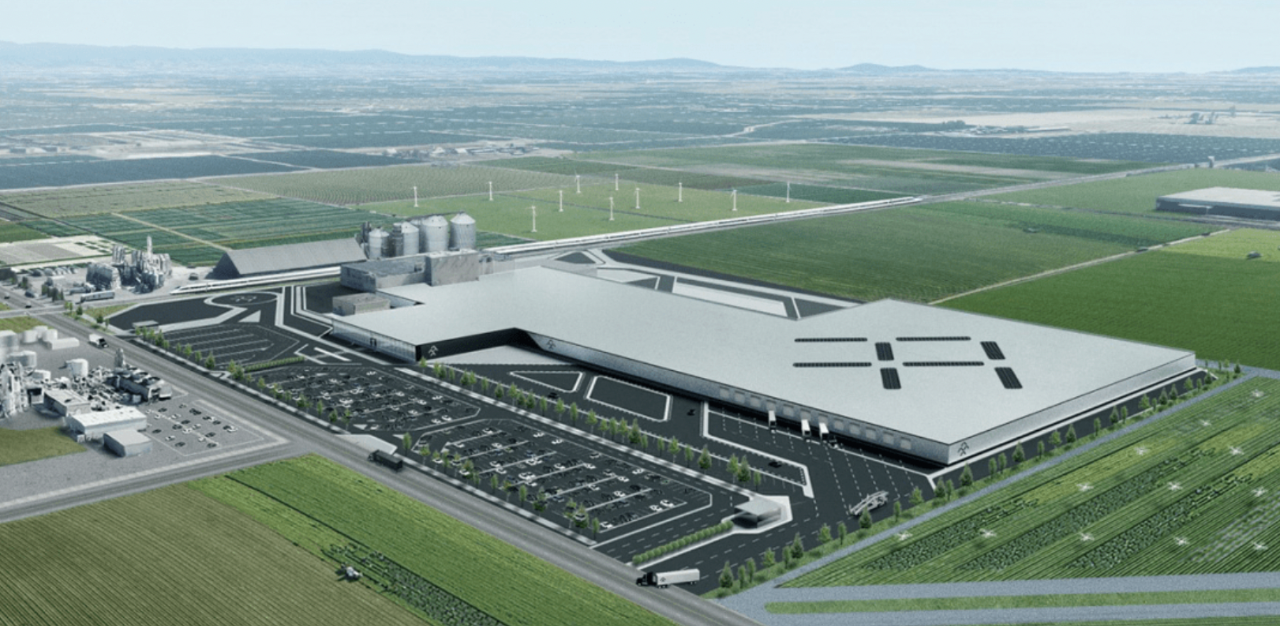

The reason for the significant increase in losses is due to increased capital expenditure on production line construction at the Hanford factory in California.

The net loss is $304 million, an increase of 821% from the same period last year, mainly due to a significant increase in operating expenses and the loss resulting from the fair value measurement of accounts payable and convertible bonds payable by related parties.

As for assets, as of September 30th of last year, Faraday Future had total assets of about $1 billion on hand, an increase of 216% over the same period last year, of which cash and cash equivalents were about $666 million.

The increase in assets is mainly due to funding from the merger and fundraising of special purpose acquisition companies — shell companies.The total liabilities amount to approximately USD 378 million, a decrease of 58% from the previous year. This was mainly due to Faraday Future’s repayment of some debt after its IPO and debt-to-equity swaps.

In addition to its operating performance, the company disclosed in the documents that due to an ongoing investigation, Faraday Future’s official financial report for 2021 cannot be submitted within the SEC’s specified time frame. It is also expected that the annual report will not be submitted within the extended period provided by the SEC’s exemption regulations.

Nevertheless, despite the unfavorable situation, the management of Faraday Future still believes that the company’s current funds are sufficient to develop and produce its first model- the FF91.

However, even if the cars can be manufactured and produced, without orders or large-scale orders, there will still be a lack of cash flow. Furthermore, the actual number of orders for the FF’s car is still a mystery, and even the production capacity has yet to be tested.

Under these circumstances, losses and continued losses may still be the norm, and Faraday Future currently has no blood-making ability. Therefore, additional funds must be raised to ensure business operations and delivery, even after the FF91 is launched in July this year.

However, for Faraday Future, raising additional funds is becoming increasingly difficult- not only from external suggestions but also the consensus among the management. According to Faraday Future’s current situation, the management team pessimistically estimates that FF’s ability to continue operating for another year is in serious doubt. In other words, Faraday Future’s existing cash flow cannot last until next year.

If funds are not raised in a timely manner, Faraday Future may well be signing its “death warrant”.

In reality, there are only 34 days left for Faraday Future and Jia Yueting to find a solution to raise funds- either through debt financing, equity financing, or issuing new shares. However, with Faraday Future’s current credit status, the first two options are virtually hopeless, so the only remaining option is to seek funds in the secondary market, namely through issuing new shares, which will soon be closing.# March 9th 8-k filing by Faraday Future shows that the NASDAQ has written to them stating that Faraday Future must submit their Q3 2021 formal financial report by May 6th of this year in accordance with rule 5250(c)(1) of the NASDAQ listing rules. If not, Faraday Future faces the risk of being delisted and the risk of facing complete shutdown as their last source of funding.

Faraday Future has subsequently stated that they expect to be able to submit the report before the extended deadline.

Based on the closing time, Faraday Future has 34 days left in their time window.

In addition to this quarterly financial report, Faraday Future also owes its 2021 annual report, and Faraday Future has already taken preventive measures in the filing:

Unable to submit within the specified extended period.

This means that even if they are able to submit their quarterly financial report on time, Faraday Future’s Damocles sword of being delisted still looms over them.

Moreover, even if they are able to increase their offerings, it is difficult to say whether investors will be willing to take on this plate given Faraday Future’s stock price performance. Whether it is targeted issuance or large-scale public offering, public news shows that after Mithril Capital issued a short report on Faraday Future in October last year, the stock price of Faraday Future plummeted, closing yesterday at $4.91 per share with a total market value of $1.593 billion.

FF, listed in July last year, closed at $13.98 per share on the day of issue with a market value of about $4.5 billion.

In 10 months, the market value evaporated by 2/3.

Furthermore, at $4.88 per share, Faraday Future is fast approaching the NASDAQ $1 delisting rule boundary.

In addition to the slump in the stock market, Faraday Future also faces a great crisis of trust in the management level:

Recently, the SEC report on Faraday Future was released, and the outcome was surprising.

Of the more than 14,000 FF91 orders that Faraday Future claimed in the early stages, only less than 100 actual and valid orders with down payments were placed.

And it was also revealed by foreign media that although Jia Yueting publicly retreated behind the scenes, he was actually controlling Faraday Future through his nephew, Wang jiawei.

Under these circumstances, can Faraday Future still replenish its blood through the issuance of additional shares and survive?

Is there any other news?

The biggest news is that Faraday Future’s first mass-produced car FF91, which has been on the PPT for so long, is finally going from the two-dimensional world to the real world.According to the official information from Faraday Future, its first model FF91 has already been mass produced at the end of February, and the delivery time is set in July this year.

As part of Faraday Future’s product plan, they will continue to release FF81 and FF71 after FF91.

Faraday Future stated that FF81 will be mass-produced and listed next year, and the production of FF81 will be outsourced to Myoung Shin, a South Korean car maker.

FF71 is also expected to meet users in 2024.

However… for Faraday Future, all of these product plans have one big prerequisite:

Raise enough money and survive.

However, there is no need to worry about Jia Yueting. Even if FF’s financial chain is finally broken, he will at most only “lose his job”.

Jia Yueting also does not have the risk of being repatriated because his luxurious seaside villa in Los Angeles has been clearly separated and will not bear any joint liability.

With an accounting background, he is good at calculating. What do you think?

SEC file link:

https://www.sec.gov/Archives/edgar/data/0001805521/000121390022016371/0001213900-22-016371-index.htm

— End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.