Author: Tian Hui

Editor: Qiu Kaijun

On the 1st day of every month, it is still the day when a group of new energy vehicle companies compete for sales volume.

Even on April Fools’ Day, it cannot affect the release of a group of eager car company data.

Aiways’ monthly sales volume exceeded 20,000 units for the first time, reaching 20,317 units, surpassing all new car forces, and temporarily leading.

Among the new forces, the sales growth rate of various car companies is slowing down, and the former head group, XPeng, is gradually dividing on a monthly sales level. XPeng has become a regular champion, NIO is struggling, first surpassed by NETA, and was also surpassed by Leap Motor this month.

Among the new energy vehicle companies, a monthly scale of 10,000 units is no longer the criterion for the head group. A monthly scale of 15,000 units will soon become the entry threshold for the head group. If you want to take the head position among all industry car companies, you need to have sales of at least 20,000 units per month.

New brands of traditional car companies such as Jinkelan and Tu have not yet seen significant sales improvements.

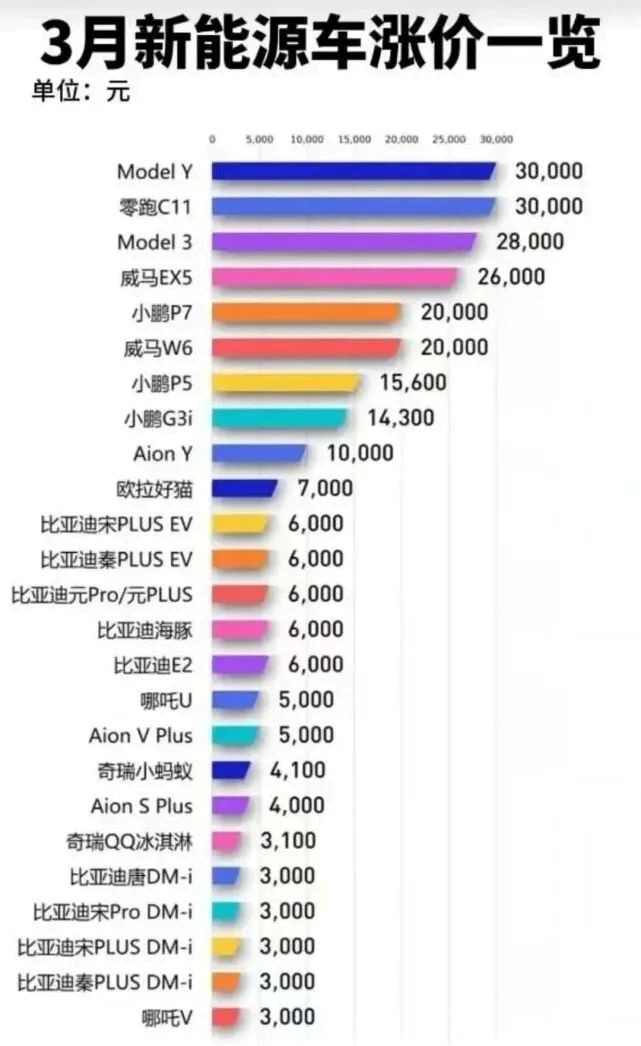

Although the overall sales data of new energy vehicle companies is still rising, the hidden concerns behind sales have quietly emerged. The general price increase across the industry, as well as the impact of chip shortages and the epidemic, will affect sales volume for the next few months.

Price Increases Have Not Affected Sales Yet

New energy vehicle companies have increased in both month-on-month and year-on-year sales in March, indicating that price hikes have not yet affected sales.

Due to the impact of factors such as chip shortages, battery shortages, and the epidemic, most of the vehicles delivered by various car companies in March were ordered before or even before the New Year’s Day, due to the consumer inertia of the significant increase in new energy vehicle sales in 2021.

Leading car companies such as Aiways, XPeng, and NETA generally have a delivery period of more than one month, and some models have delivery periods of up to three months. Extremely special models such as XPeng P5 lithium iron phosphate version and Jinkelan 001 have delivery periods of up to 6-8 months.

But the price increases of various car companies in March will inevitably affect the sales situation in the following months.

Affected by the rise in raw materials, especially the rise in power battery prices, car companies generally raised vehicle prices in March, but also reserved a buffer period, during which pre-orders will not be affected by price increases.

Under the temptation of price increases ranging from thousands to tens of thousands of yuan, various car companies have collected a large number of orders during the buffer period. There are online rumors that the daily order volume of a certain new energy vehicle company has reached 3,000 units.

Car companies with a large number of orders will be busy delivering their orders in the next few months, and sales are expected not to experience a significant decline.## Price hike will inevitably affect sales

In April, automakers may face a second price hike.

So far this year, the prices of power batteries have risen sharply. According to data from “Xinlu Lithium Battery”, in March of this year, the average price of square three-element power batteries reached 0.84 yuan / Wh, and the average price of square iron-lithium batteries reached 0.74 yuan / Wh. Compared with mid-October 2021, the square three-element and iron-lithium batteries increased by 0.18 yuan / Wh and 0.22 yuan / Wh respectively, with an increase of 27% and 40%.

However, the upward trend of power battery prices has not stopped. At present, some analysts believe that the price of power batteries will not decrease in the short term, and it is more likely to continue to rise. Automakers that have already raised prices will face a second price hike.

Although Tesla has raised its selling price several times this year, and BYD has raised its selling price twice, their large sales scale and strong ability to control the supply chain and market have limited the impact of price increases on sales. However, for most companies, the impact of a second price hike on sales will be extremely significant.

Especially for automakers focused on A00 models, the cost of power batteries accounts for a relatively large proportion of the vehicle’s overall cost, and the price hike will have the greatest impact on A00-level cars. For example, Hongguang MINI EV has raised its price by 4,000 yuan at one time, and its starting price has been raised from 28,800 yuan to 32,800 yuan, an increase of 14%, which has significantly reduced its cost-effectiveness.

Similarly, the price hikes of other A00 models, such as Chery New Energy Ant, Dongfeng Fengguang MINI EV, and Zerun T03, are basically the same, with a price increase of about 4,000 yuan, and the cost-effectiveness of the entire vehicle has also significantly decreased.

For A00-level small cars with low profit margins, the rise in battery costs not only affects consumers’ willingness to purchase, but also affects the manufacturer’s production willingness. Previously, the Black Cat and White Cat models under Great Wall’s Ora brand had already stopped accepting orders.

With the high and possibly continuing cost of power batteries, the sales of various automakers may undergo drastic changes. But overall, the impact of price increases on automakers with high-priced mainstream models is relatively small, while the impact on new energy automakers with low-priced mainstream models is relatively large.

Top group threshold is getting higher

Nowadays, it is getting harder to mix into the top-tier automakers.

The sales surge of the Enovate brand is not a coincidence. In fact, Enovate has been plagued by production capacity issues until the production line was upgraded during the Spring Festival, which finally eased the production capacity problem, and the sales exceeded 20,000 vehicles in March.

There are currently 4 models of AION available, namely AION LX Plus, V Plus, S Plus, and Y. During the price increase in March, the price did not increase significantly, and the current order situation is good. The competitiveness of the four models is strong, and it is expected that AION will continue to maintain a monthly sales volume of 20,000 in the next few months.

There are currently 4 models of AION available, namely AION LX Plus, V Plus, S Plus, and Y. During the price increase in March, the price did not increase significantly, and the current order situation is good. The competitiveness of the four models is strong, and it is expected that AION will continue to maintain a monthly sales volume of 20,000 in the next few months.

It is worth noting that AION made substantive progress in stock reform in March, with three state-owned investors jointly investing CNY 2.566 billion. Next, AION will accelerate its efforts in production capacity layout and new model development. AION will launch a supercar model that can accelerate from 0 to 100km/h in 1.9 seconds this year, further enriching its product lineup.

At the same time, AION is building a small-scale power battery production line and conducting power battery self-production trials. Therefore, it is expected to improve the control ability of power battery costs and take the lead in the upcoming power battery price increase wave.

Among the three car companies including WM Motor, XPeng Motors had a significant increase in sales this month, especially the P7 model, which broke through 9,000 units and set a new record. Currently, XPeng Motor has three models for sale, P7, P5, and G3, with a price range between CNY 150,000 and CNY 400,000, and the layout is relatively clear, and the order situation is good.

The P5 model of XPeng Motors has collected a large number of orders in the early stage. Among them, the lithium iron phosphate battery version of the XPeng P5 has a problem of insufficient production capacity, and many ordered consumers were unable to pick up their cars. It is expected that after the production capacity is improved, the conversion rate of the early-stage collected XPeng P5 orders will remain at a high level.

The upcoming XPeng G9 is positioned as an intelligent luxury 5-seater mid-sized SUV, which will have outstanding performance in intelligent assisted driving and is expected to be priced at more than CNY 350,000.

NIO has been in the top group of new forces in sales for several consecutive months, surpassing Xpeng this month and becoming the third-ranked new energy vehicle company, indicating that NIO’s overall operations are good. Currently, NIO has two models for sale, V Pro and UPro, with a price range of CNY 60,000 to CNY 170,000, which is relatively low and vulnerable to the impact of power battery price increases.

In terms of new cars, NETA S, which adopts Huawei’s advanced assisted driving suite, is positioned as a coupe model and is expected to be delivered by the end of this year. Before that, V Pro and U Pro will still be the main sales models.

Currently, only the Ideal ONE model is available for sale, priced at CNY 350,000. The new Ideal L9 will be launched in mid-April with a pre-sale price of CNY 450,000 to CNY 500,000, and it is expected to be officially delivered in the summer. At the end of this year, there will be another model priced between ONE and L9.

As the ideal automobile product line adheres to plug-in hybrid and its price is relatively high, it is expected that the impact of rising power battery costs on the ideal ONE will be limited.

“Leapmotor” sold more than 10,000 vehicles in March, and the C11 model has gradually started to increase in volume, with multiple OTA iterations and upgrades. However, due to the overall small sales volume of “Leapmotor” brand and the large impact of the cost transmission effect of rising power battery costs on sales terminals, C11 model shows significant price hike in the grand scheme of things.

In “Leapmotor’s” current sales structure, the sales proportion of the A00 level small car T03 is relatively large. Whether it can continue to maintain such a scale of sales after the price rise is a test for the “Leapmotor” operation team.

The new car C01, which is expected to be released in the second quarter, can continue the cost performance route of C11 in the high cost of power battery is unknown.

“NIO” may be the automaker least afraid of rising prices. On the one hand, the price of the entire vehicle is relatively high, and the tolerance of the cost increase in power battery is also high; on the other hand, the BaaS battery swapping sales model is adopted, and the power battery cost has been removed from the vehicle price. Therefore, “NIO” has no direct plan for price increase yet but planned the price increase during generational changes.

“NIO” currently sold ES8, ES6, and EC6 models have been on the market for a long time, and the market appeal has declined, so sales have been maintained at around 10,000 vehicles per month in recent times. However, “NIO” plans to release 2022 models of ES8, ES6, and EC6 in May, upgrading the intelligent vehicle system chips, and the price of the entire vehicle will be adjusted upwards. Meanwhile, a brand new model ES7 will also be released. With the upgrade of older models and the delivery of new models ET7, ET5 and ES7 initiated in the second half of this year, NIO’s sales this year are expected to steadily increase.

The ranking pattern of new force vehicle companies is about to be reshaped

With the delivery of new vehicles and the change in power battery costs, the ranking pattern of the sales volume of new force vehicle companies will also be reshaped.

Since “NIO” began publishing sales data of the previous month on the 1st of each month, the three vehicle companies led by “NIO” have always occupied the top three positions in the sales ranking of new energy vehicle companies. However, with the rise of “TELLING” and “Leappower (JUMP)”, the competitive pattern of the ranking of new energy vehicle company sales has changed significantly.

First, the overall sales volume has risen, and the threshold of the top group has increased, and selling 10,000 vehicles per month is no longer sufficient to stabilize the top slot.The second trend is that the number of models has begun to influence sales. The new energy vehicle market is quietly transitioning from a buyer’s market to a seller’s market. Therefore, vehicle manufacturers with more models are beginning to occupy a more obvious advantage. The more models they have, the larger their overall sales will be.

The third trend is that the power battery and chip supply chains have a greater impact on sales. The impact of a single missing component on the sales of the entire vehicle has already been reflected in the sales rankings in some months.

Overall, starting from the second quarter of this year, the monthly sales situation of various new forces will widen the gap, and the sales curve of each car manufacturer will show obvious differences.

Although the overall market is still in an upward trend, the growth rates of various car manufacturers will begin to diverge in the second quarter.

Starting from the second half of this year, traditional car manufacturers’ new energy vehicles will be launched on a large scale. New forces that have not yet obtained a sales moat will face increasingly difficult times.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.