Author | Zhu Shiyun

Editor | Qiu Kaijun

No securities analyst asked about the reason for BYD’s profit decline at the performance communication meeting where net profit fell by 28%.

Wang Chuanfu was very relaxed. He said, “BYD’s brand is very different from the past.”

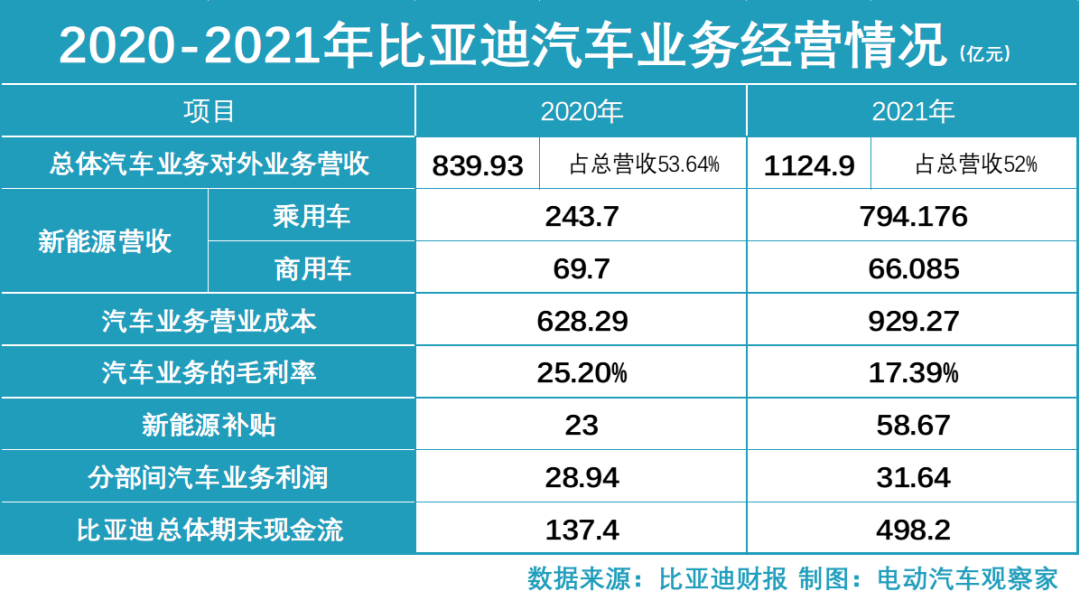

On March 30, BYD released its 2021 financial year report. The operating income for the period increased by 38% year-on-year to RMB 216.14 billion, but the net profit attributable to shareholders of the listed company decreased by 28% year-on-year to RMB 3.045 billion, and the non-GAAP net profit plummeted by 57.53% year-on-year to RMB 1.25 billion.

In this “good year” for new energy vehicles in 2021, BYD, which is at the forefront of the new energy vehicle track, has increased revenue without increasing profits, and even the profit has dropped significantly year-on-year.

Why?

There are both subjective and objective reasons:

-

The upstream raw material price increase causes BYD’s gross profit margin to still decline even after doubling the battery installation volume.

-

The rapid growth of vehicle and battery production capacity has pushed up BYD’s fixed costs, thereby affecting the gross profit of the entire vehicle.

-

The technology dividends of blade batteries and DM-i have just been realized, and the powerful scale effect has not yet been formed.

There is also BYD’s strategic choice behind it-seeking scale first and then seeking profitability. For example, in 2022, BYD hopes to guarantee sales of 1.5 million vehicles and impact sales of 2 million vehicles.

Superficial: Gross Profit is Dragging Profit

BYD’s cars sell well in the market.

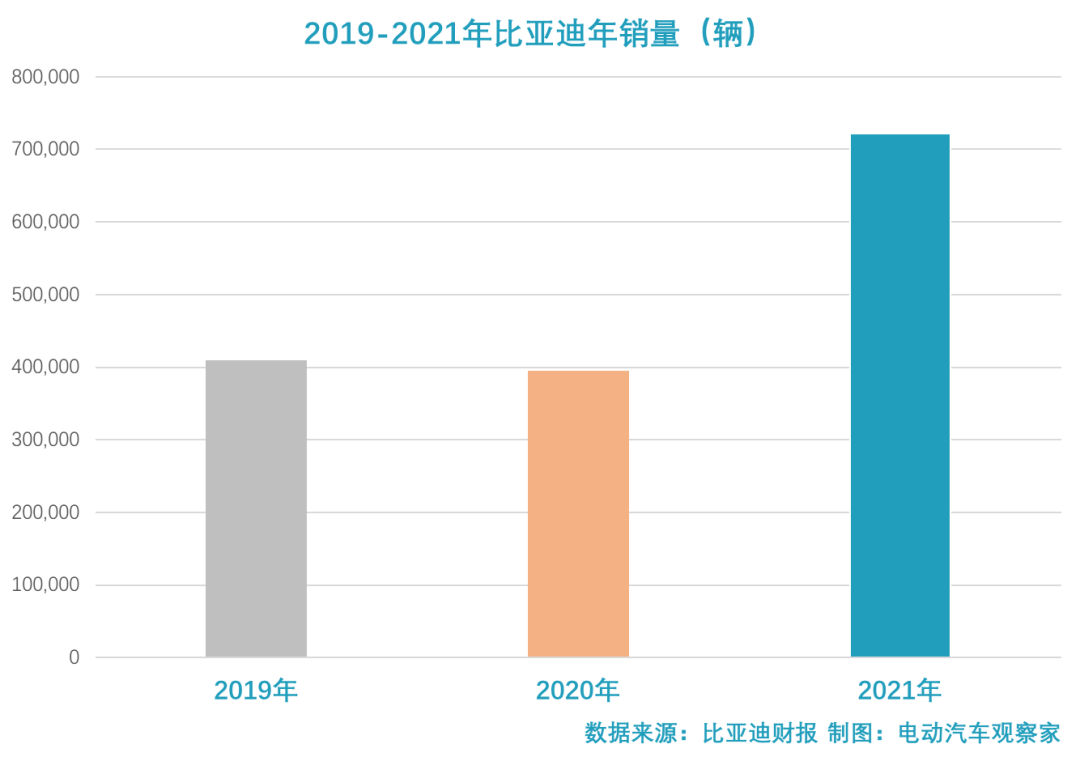

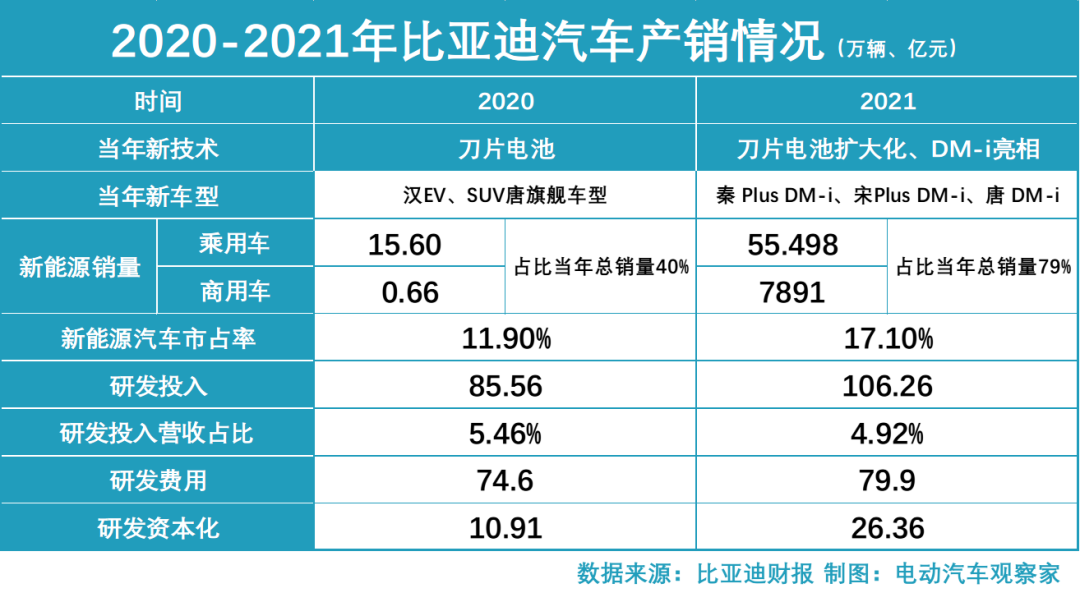

In 2021, BYD’s auto sales reached 713,000 units, almost doubling year-on-year in 2020. Among them, the growth rate of new energy vehicle products is even more rapid, with a year-on-year growth of 245.5%, which can be described as “taking off.”

But BYD didn’t make much money from selling cars in 2021.

According to the financial report, the auto business contributed 52% of BYD’s operating income, reaching 112.49 billion yuan, an increase of nearly 34% year-on-year, but the gross profit has decreased by 7.59% year-on-year to 19.562 billion yuan. Compared with 2019, a year without mask sales, while the sales growth rate reached 74%, the gross profit growth rate was only 41.2%.

The change in gross profit margin can better reflect the problem.

In 2020, the gross profit margin of BYD’s auto business decreased by 7.81 percentage points year-on-year to 17.39%. Prior to this, the gross profit margin of BYD’s auto business had remained at around 20% for three years.

At the same time, BYD’s three expenses did not hold back: sales and management expenses increased by only 20% and 32%, respectively, and financial expenses also decreased by 52.5% due to a reduction in interest.The R&D expenses did not increase too much, with a growth rate of 7.05%.

It can be seen that, as the main revenue-driven business, the sharp drop in gross profit margin has become the core factor that hinders BYD’s profits.

Background: Impact of Upstream Raw Materials

In the year of 2021, which has witnessed a surge in scale, why is BYD’s gross profit margin not falling but rising? The impact of upstream raw material price hikes in new energy vehicles is the first to bear the brunt.

According to data from Shengyi Information, at the end of last year, the average price for battery-grade lithium carbonate in East China was CNY 282,000 per ton, which increased by 416% compared to the price of CNY 54,600 per ton at the beginning of the year.

With the soaring price of lithium, no downstream company can be exempted. In 2021, BYD’s installed battery capacity was 25.06GWh, an increase of more than 250% YoY, surpassing the threshold of 10 GWh that had lingered for several years. However, under the scale effect, the gross profit margin decreased.

The gross profit margin of BYD’s battery business in the current period even decreased by 8.1 percentage points YoY to 11.9%, which is the second-lowest point in the past five years (it was 9.5% in 2018 due to the photovoltaic business loss).

Both the price of battery raw materials and BYD’s new energy vehicle sales soared in 2021.

In 2021, BYD’s new energy vehicle sales volume was 563,000 units, accounting for 79% of the total sales. In 2019 and 2020, the ratios were 45% and 40%, respectively.

In terms of sales contribution, BYD became a true new energy vehicle company in 2021, and naturally bears the cost pain of new energy vehicle companies.

However, Wang Chuanfu believes that the upward pressure on upstream prices faced by BYD will gradually ease.

“Now the growth trend is slowing down, and I believe that as the supply increases, (raw material) prices should gradually come down”; “BYD’s battery system has considered the compatibility with social resources a few years ago. Through structural changes to increase the energy density per pack, it minimizes the use of Chinese elements that are pinned down. Apart from lithium, more iron and phosphorus that are easy to obtain in China are used.”

Moreover, “with large-scale manufacturing, structural optimization, and energy density improvement in the future, blade batteries still have 5%-10% cost reduction space.” Wang Chuanfu said at the briefing.

In addition, BYD is also enhancing the security of its industrial chain. On the evening of March 22nd, Shengxin Lithium Energy announced that it plans to introduce BYD as a strategic investor through private placement, raising no more than CNY 3 billion.

Strategy: Scale Before ProfitEven if raw material prices didn’t go up, it is unlikely that BYD’s 2021 profits will be as impressive as its sales. This is BYD’s proactive choice: to be prepared for the takeoff of the market and quickly seize market share. Therefore, BYD’s capacity expansion is even faster than its sales growth rate, to establish an “advance volume”.

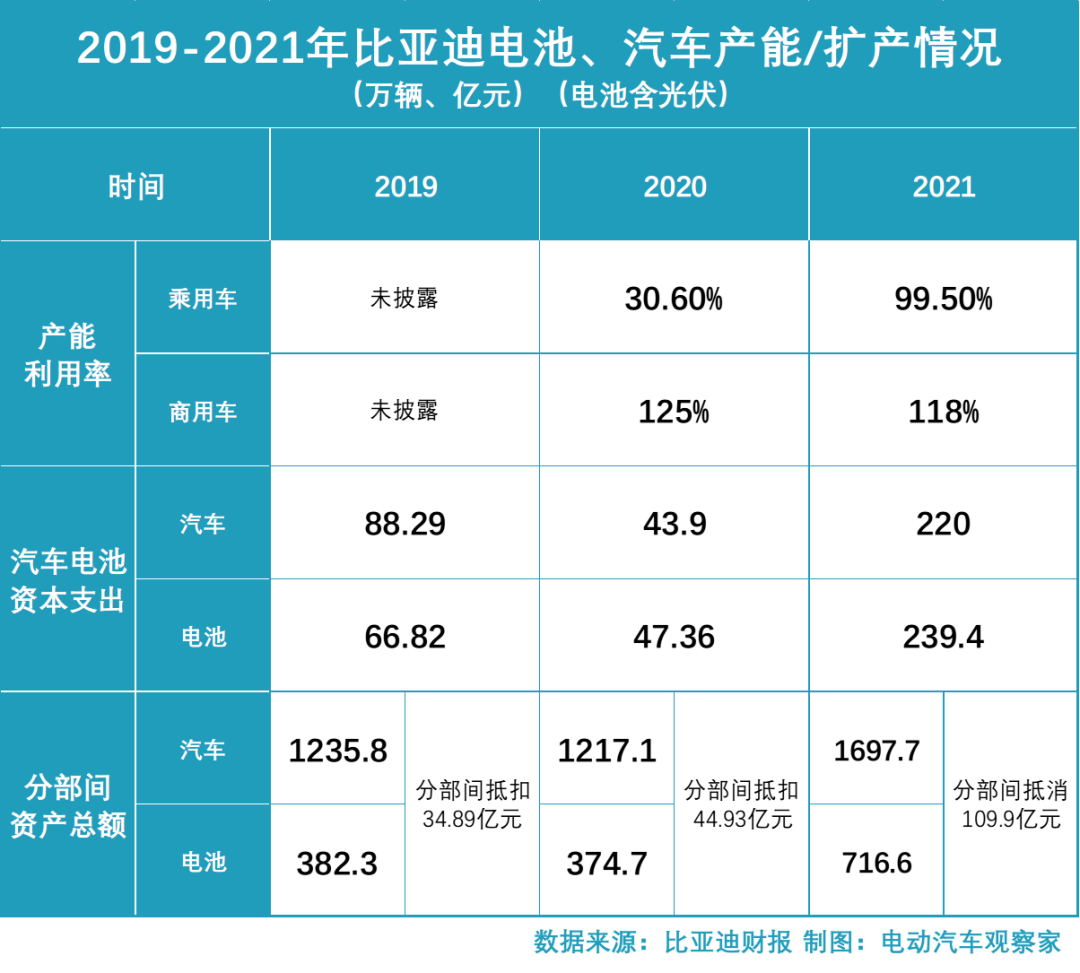

The financial report shows that BYD’s utilization rate of new energy passenger vehicles in 2021 has reached 99.5%, and that of commercial vehicles is 118%. The disclosed production capacity for the period is 600,000 vehicles, the same as in 2020. The only difference is that the production capacity of 600,000 vehicles, which is shared by new energy and conventional fuel vehicles, is now labeled as “exclusive” for new energy vehicles.

However, based on previous planning and implementation, BYD’s production capacity in 2021 is far from “low” at 600,000 vehicles.

BYD is expanding production like “crazy” in 2021. In addition to its three major production bases in Shenzhen, Changsha, and Xi’an, Hefei BYD, which is engaged in the manufacturing of new energy battery cells, modules, and complete vehicles, was just established in July. BYD Jiangsu Changzhou Plant, with an annual production capacity of 200,000 vehicles, completed its production preparation in August. BYD Fushun Industry Co., which is engaged in the production of motor vehicles, quietly appeared in the business registration directory in September.

Based on publicly available information, Snowball author “Painlessly Enjoyable” found that in 2021, BYD’s complete vehicle projects added production bases in Changzhou, Jiangsu, Hefei, Anhui, and Fuzhou, Jiangxi, and its battery business added bases in Yancheng, Jiangsu, Wuwei, Anhui, and Jinan, Shandong.

In terms of production capacity, BYD’s actual production capacity of complete vehicles in 2021 may be 900,000 vehicles, and will reach 1.9 million and 3.3 million vehicles in 2022 and 2023 respectively, in order to match BYD’s sales target of 1.5-2 million vehicles this year. Battery production capacity has experienced a “triple jump” in the past three years, from 40 GWh to 65 GWh to 75 GWh, and could reach 100 GWh this year.

The expansion of production capacity costs a lot of money.

In 2021, BYD’s capital expenditures for batteries (including photovoltaics) and automobile businesses reached RMB 45.9 billion (RMB 23.9 billion for batteries and RMB 22.0 billion for vehicles), an increase of RMB 36.8 billion from 2020.In addition, at the end of 2021, BYD’s construction in progress was CNY 20.277 billion, a year-on-year increase of 231.8% and the proportion of total assets increased from 3.04% at the beginning of the year to 9.9%.

During the period, BYD’s investment activities resulted in a net cash outflow of CNY 45.4 billion, a year-on-year increase of 214.34%, mainly due to the increase in cash payments for acquisition of fixed assets, intangible assets and other long-term assets totaling CNY 37.34 billion (+217%) in the current period.

-

As of the end of 2021, BYD’s fixed assets reached CNY 61.22 billion, an increase of 12.2% from the beginning of the period, significantly exceeding the industry average;

-

The increase in fixed assets resulted in an additional CNY 10.877 billion in depreciation provision, a year-on-year increase of 17.7%, and production depreciation accounted for over 10% of operating costs;

-

Depreciation and amortization, of CNY 2.34 billion, accounted for 17.2% of operating expenses during this period.

The increase in depreciation and amortization pushed up direct and indirect costs, dragging down gross profit and profit performance, but at the same time, it effectively transformed into production capacity, sales and even market share. In 2021, the market share of new energy vehicles reached 17.1%, a year-on-year increase of nearly 8%.

However, the current layout is still insufficient. “Although we have made good preparations in technology platforms, products, and industry chain construction, the supply is still insufficient.” Wang Chuanfu said, “the cumulative number of unfilled orders in hand has reached 400,000 vehicles, and is still increasing month by month, which puts a lot of pressure on the company.”

The decline in profit has not affected BYD’s safety margin. At the end of 2021, BYD held monetary funds of CNY 50.457 billion, an increase of 249% from the beginning of the period, and the proportion of total assets increased by nearly ten percentage points to 17%.

BYD, which has a lot of money, even put in CNY 20 billion to buy low-risk financial products maturing within one year.

Future: Expectation of Technology Dividend + Scale Dividend

At the same time as the increase in market share, BYD’s unit price is also on the rise. According to securities institutions’ calculations, the unit price of BYD passenger cars was CNY 130,000 in 2019 and has been increasing rapidly since then. In 2020, it reached CNY 135,200, and in 2021, it reached CNY 151,000.

“With the release of DM-i and blade batteries, especially the revolutionary product, Han EV, BYD’s brand has undergone a significant change compared to before.” said Wang Chuanfu.

“With the release of DM-i and blade batteries, especially the revolutionary product, Han EV, BYD’s brand has undergone a significant change compared to before.” said Wang Chuanfu.

In April 2020, the Blade Battery was launched, and in July, the first BYD Han EV equipped with the Blade Battery was put on the market. Within a month, the monthly sales exceeded 10,000, making it the first Chinese brand mid-to-large-sized sedan with an annual sales volume exceeding 100,000. It also became the first new energy self-owned sedan brand with a sales volume exceeding 200,000 yuan.

In January 2021, BYD’s third-generation plug-in hybrid technology, DM-i, was unveiled. The three heavyweight models, the Qin PLUS DM-i, the Song PLUS DM-i, and the Tang DM-i, were launched simultaneously. Suddenly, DM-i became a buzzword in the market, and its sales have skyrocketed since May, with a cumulative sales volume of 174,000 vehicles in half a year.

In August 2021, the first product of BYD’s e-platform 3.0, the Dolphin, was launched at the Chengdu Auto Show, with sales volume for the year exceeding 20,000 vehicles. Wang Chuanfu stated that the monthly order for the Dolphin, which planned for 5,000 vehicles per month, had exceeded 30,000 in quantity. Orders for the YUAN PLUS, which was launched on the same platform in March and generated 30,000 orders in a month, also exceeded 30,000. “We are caught off guard,” said Wang Chuanfu.

2021 can be described as BYD’s “big year” of technology, with R&D investment in the period totaling RMB 10.627 billion – a YoY increase of 24.2%. Of this, RMB 2.64 billion has been capitalized, up 141% YoY, which accounts for the proportion of R&D investment, increasing by 12 percentage points to 24.8%.

While a series of new products with new technologies dramatically boosted BYD’s sales, it also raised the unit price. In April, higher-priced Han DM-i, Han DM-p, and battleship series products will be launched.

Behind the increase in both quantity and price is continuous investment in substantial R&D.

From 2019 to 2021 alone, BYD’s total R&D expenditure reached RMB 18.977 billion. Of this, RMB 8.278 billion was expensed, and the remaining RMB 8.862 billion technology investment was transformed into intangible assets in line with the launch of new vehicles, including the Blade Battery, DM-i, Han EV, Dolphin, and Battleship, etc. – which are the “lifelines” for these models in the marketplace.”By the end of 2021, BYD’s technology investment of 2.086 billion RMB “is still in the research and development and trial production stages of projects that are still under development spending.”

“In terms of technology, we develop one generation, store one generation, and then launch one generation,” said Wang Chuanfu, adding that the upcoming Dolphin model will use the “upgraded technology” of blade batteries, with a direct cell-to-battery (CtoB) design. By adding two aluminum plates above and below the blade battery, a high-strength structural component is formed, which greatly enhances the torsional strength of the vehicle body.

Continued investment in technology will also provide support for BYD’s future development.

Wang Chuanfu stated at the press conference that in October, BYD will launch a new high-end brand, forming a brand matrix covering high, medium, and low-end products along with the Dynasty, Ocean, and DENZA brands. “This brand will adopt a super technology of BYD.”

Thus, it is not difficult to understand the “problem of declining profits” that went unaddressed at the communication meeting. The synergies of technological breakthroughs and rapid growth in market demand present an unprecedented opportunity for all tech companies during a “window period.”

Although the newly invested fixed assets of supporting and developing new technology may lower economies of scale, increase direct costs, and lead to a decline in profits, it is still a “growing pain period” for companies entering a new stage of development. Moreover, BYD has already begun to enjoy the “sweetness” of rising prices and sales.

As Wang Chuanfu said, “This is also our past persistence, finally ushering in rapid growth and expected results.”

More “results” are yet to come. Wang Chuanfu said, “If this year’s estimate is conservative, it will probably be 1.5 million vehicles. If the supply chain and delivery are well handled, we are also willing to aim for an annual target of 2 million vehicles.”

Thanks to @痛快舒畅 for their help with this article!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.