Jia Haonan from Co-driver Temple

Reference for Intelligent Cars | AI4Auto WeChat Official Account

Has SAIC lost its edge or has the times changed?

The brand-new smart electric vehicle brand, IM Auto, under SAIC showcased its L7 Pro, priced at CNY 408,800.

Why call it an expansion? Most independent-brand cars under SAIC are still priced below CNY 200,000.

Therefore, the price itself has been a topic of discussion.

Is it a luxury car, an electric vehicle or a smart car that one can buy for CNY 400,000?

What is the core competitiveness of L7 and where does it come from?

This article explains whether the SAIC car priced at CNY 400,000 is worth it.

What makes IM L7 Pro a CNY 400,000 car?

SAIC has put in efforts to sell cars.

The CNY 408,800 price is for the high-end Pro model.

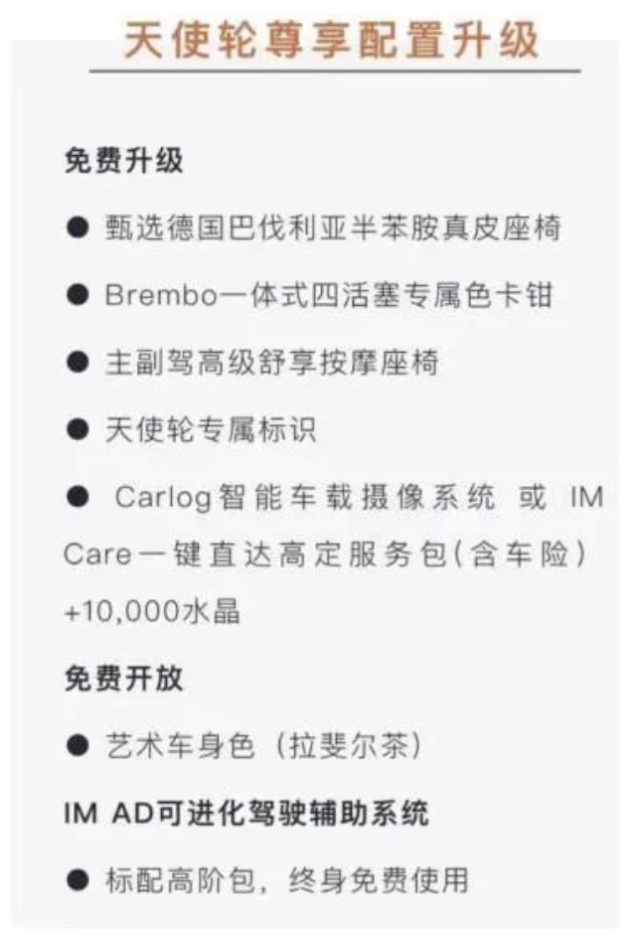

The buyers can choose between the Angel round and the A round.

Buying cars seem like an investment but it is a privilege exclusive to the first batch of car owners.

From this list, you can see the main selling point of the “transitional escape” first work promoted by SAIC.

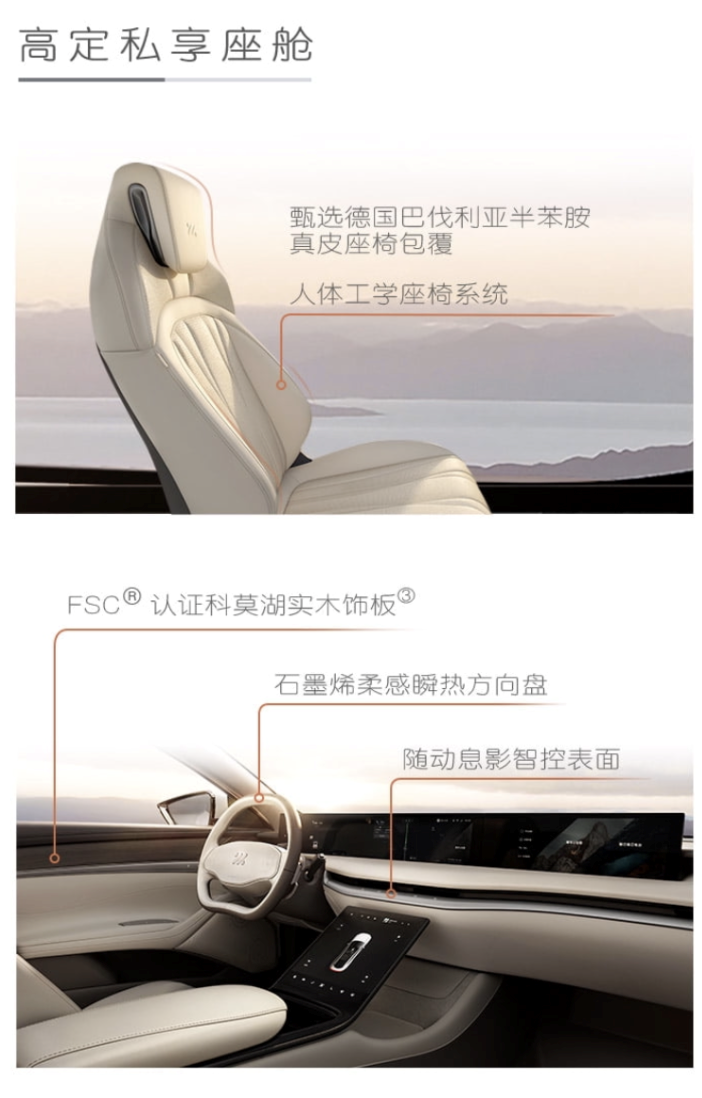

In addition to luxurious and comfortable configurations such as leather seats, brake calipers, massage, and car paint, IM’s selling points also include:

1. Intelligence

2. Individuality

3. Digital Currency

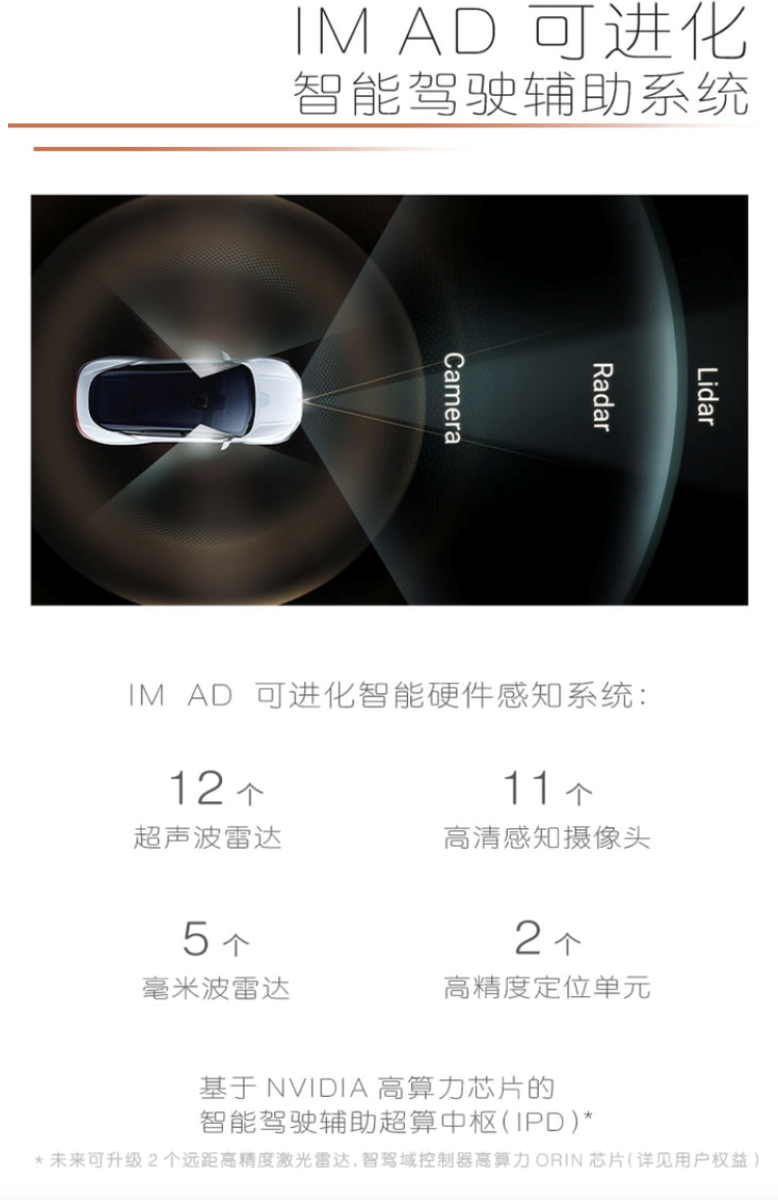

Apart from luxury, the most important thing about L7 is the IM AD Intelligent Auxiliary Driving System. The official calibration of the system is relatively conservative, rated at L2+. However, in terms of functional descriptions, it can already achieve “end-to-end” intelligent driving.

Salespeople at IM stores specialize in showing customers videos of Guangzhou’s highway that are completely unmanned.

The concept of “end-to-end” for IM L7 does not mean advanced auxiliary driving that includes navigating complex urban roads.

From the sales demo video, it is seen that it is a leading assistant driving function on a high-speed road that is covered with high-precision maps.

However, the auxiliary driving functions in the high-speed and parking domains can be seamlessly linked.

In terms of personalization, IM L7’s greatest selling point is Carlog:

The car roof is raised, whereupon a laser radar can be fitted no matter which automaker it is.Markdown Text in English:

You can, however, squeeze 3 cameras with a total of 150 million pixels into this particular location in the car, but SAIC didn’t.

What for? To take high-quality pictures while driving and edit them on the spot before uploading them, making your car a smartphone/drone hybrid.

In terms of customization, the L7 has front and rear light groups that can be used to create light shows.

The front headlights have a 2.6 million pixel DLP screen, and the ISC taillight group has a total of 5000 LED light sources on the interior that can interact with other cars and pedestrians in different scenes, projecting various emojis and symbols such as “yield to pedestrians,” “like,” “holiday greetings,” and so on.

If I were an L7 owner, I know exactly what I’d want to project on my taillights.

In the benefit sheet, 10,000 crystals are the biggest difference between Qijie L7 and every other new energy vehicle: digital currency.

Crystals are a currency used in the Qijie car owner community, and they can be exchanged for various services or goods, which isn’t particularly remarkable.

What makes this digital currency different is that, aside from community activity, the primary way to acquire crystals is by driving.

The official term for this process is “mining,” where you accumulate “stones” by driving and then exchange them for crystals.

And the stones themselves are similar to Bitcoin in that they are issued by the official Qijie organization, have a limited supply, and each one has a unique identification number that can be freely traded within the community.

Furthermore, it is said that the stones in users’ hands can be exchanged for shares in Qijie Motors.

Well, a car company that doesn’t mine digital currency is no longer a good bank.

So, can all these things really justify a 400,000 yuan car? According to SAIC, they’re not enough.

The 400,000 yuan Qijie L7 comes with the same features and services as a million-yuan luxury car, as well as bespoke concierge-style services, like NIO.

As previously mentioned, the leather seats are the same as those found in the S-Class Mercedes. Additionally, the Qijie L7 Pro includes a four-wheel steering system that allows for a smaller turning radius and more agile handling.

Four-wheel steering is usually an optional add-on for million-yuan luxury cars, but Qijie L7 Pro offers it for 400,000 yuan. Isn’t that amazing?

Concierge-style service is something that Qijie has in common with NIO. Lifetime quality assurance and free roadside assistance, as well as free door-to-door service for car washing and maintenance, are all included, and you don’t have to lift a finger.Let me translate the Chinese Markdown text to English Markdown text, while keeping the HTML tags and only outputting the result.

By the way, the IM L7 Pro also supports 11 kW wireless charging. The price is unknown, but if you have your own fixed parking space, the official offers free installation service.

Summarizing why SAIC thinks IM L7 Pro can sell for 400,000 yuan:

Intelligent capabilities, luxurious configuration, intimate service, and even cost-effectiveness. There is no additional surcharge for IM L7 Pro.

Do you think it’s worth it?

However, despite being fully equipped with all the luxurious technology features, IM L7 still has one optional feature:

Lidar.

Is IM smart enough?

We mentioned earlier that IM L7 Pro uses the car-top camera to “simulate” lidar, but in fact, it is equipped with lidar sensors.

The mass-produced IM L7 Pro has reserved positions and interfaces for lidar installation on both sides of the A-pillar on the roof.

Users who need them can exchange lidar with accumulated mileage or install it for free if they are angel round car owners.

We will discuss the commercial considerations of this strategy later. Let’s first take a closer look at the IM L7 intelligent driving solution itself.

It is no secret where IM L7’s intelligent driving solution comes from: Momenta.

This is not surprising. In the race for intelligent electrification transformation, SAIC’s approach is core cooperation plus independent research and development. They quickly obtain intelligent skills packs through investment and joint venture methods.

SAIC became a shareholder of Momenta, and the intelligent driving and Robotaxi landing of its high-end models are all part of the cooperation.

From the reserved lidar interface on the IM L7 project, the intelligent driving solution provided by Momenta was aimed at high-end capabilities from the beginning.

On the hardware level, there are 11 high-definition cameras, 5 millimeter-wave radars, 11 ultrasonic radars, and 2 positioning units throughout the vehicle. The underlying computing power is very generous with 4 NVIDIA Orin chips and computing power of up to 1024T.

With the subsequent lidar, the intelligent driving capabilities that these hardware configurations serve should at least achieve “three-domain fusion,” that is, city roads, highways, and parking lots.

When IM was released, it promised “end-to-end” intelligent driving capabilities, which seems unlikely to be stripped down.

Of course, high-end intelligent driving capabilities have both technical difficulties and policy limitations. The functions that users are likely to get first are most likely those related to high-speed and parking domains.Translated English Markdown Text with HTML tags preserved:

Later, laser radar can be installed as an option by using accumulated points, which seems to give the right of choice to users:

You can use advanced intelligent driving for free. Of course, you don’t have to use it either.

However, starting from basic business logic, it can be understood that it’s impossible to give out laser radar for free since enterprise procurement costs have long been divided into selling prices.

Therefore, for the owners of JIMU L7, not installing laser radar is actually a loss, which is equivalent to sharing the cost with enterprises and other car owners.

This is also a means by which SAIC actively guides users to use intelligent driving.

Another means is to motivate everyone to turn on the auxiliary driving actively by exchanging mileage for points.

Why do this?

It’s simple. The key to winning the future of intelligent cars lies in automatic driving, and the key to the leap of automatic driving ability lies in data.

In this regard, SAIC, Momenta, and Tesla or any other players are no different.

It’s just that SAIC’s “emotional intelligence” appears much higher.

In addition to intelligent driving, JIMU L7 adopts two large screens in the front row to control the lift separately.

The voice interaction capability and in-car applications are not yet disclosed.

However, the technology solution for the intelligent cockpit comes from Banma Zhixing. This is a company jointly established by SAIC and Alibaba, specializing in the intelligent cockpit and in-car OS.

Momenta and Banma Zhixing are the intelligent capabilities complemented by SAIC through investment and joint venture, respectively, and the underlying architecture is completely SAIC’s own research achievements.

Zero Bundle, formerly known as SAIC’s software development center, is now an independent subsidiary. Its role is described by SAIC as a “store second,” which develops hard and soft decoupling, highly integration, and open automobile electronic and electrical architecture.

The goal is to facilitate the development and definition of intelligent cars for all SAIC partners and suppliers on it.

JIMU L7 is the first species under this platform.

JIMU L7, SAIC’s “Escape Ticket”

For a whole year, what impressed the public most about SAIC was “Soul Talk.”

At that time, SAIC Chairman Chen Hong clearly stated that he refused Huawei’s autonomous driving solution, saying he was afraid of losing his soul.

The remark caused a huge sensation, partly due to SAIC’s situation at the time.

Chairman Chen made the comment at SAIC’s shareholders’ meeting.

At that time, emotional shareholders jumped on stage and asked him why the stock price was so low and why the new energy transformation was so lagging behind.

This is a fact. SAIC Motor fell from its position as the top domestic car maker since 2020, and its market value has been declining, even lower than the group’s net assets…

Behind this are the difficulties SAIC has faced in its transformation towards intelligent and new energy vehicles.

The New Four Modernizations were proposed earliest, which involved an investment of 60 billion yuan, with strong support from the government of Shanghai. However, the only product that sold well was the low-profit Wuling MiniEV, and sales of its own brands have been declining year by year. Financial reports can only be supported by SAIC Volkswagen and SAIC GM.

The larger trend than car networking, whether it is Tesla or China’s new forces in car manufacturing, is clear and unmistakable.

If transformation towards intelligence cannot be achieved, no matter how old the car maker is or how large its scale, it will become the Motorola or Nokia of the car industry.

No one wants that, least of all SAIC.

Therefore, the significance of the Ji brand to SAIC is of utmost importance.

The first car, Ji L7, is not only SAIC’s answer to how to understand intelligence, but also a key to breaking into the high-end market, and a complete transformation in thinking from a state-owned enterprise with a secure position to one that is competitive and open.

In short, the Ji L7 is SAIC Motor’s ticket to survival.

And such a ticket is only possible with this one.

- The End –

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.