Author: Zhu Yulong

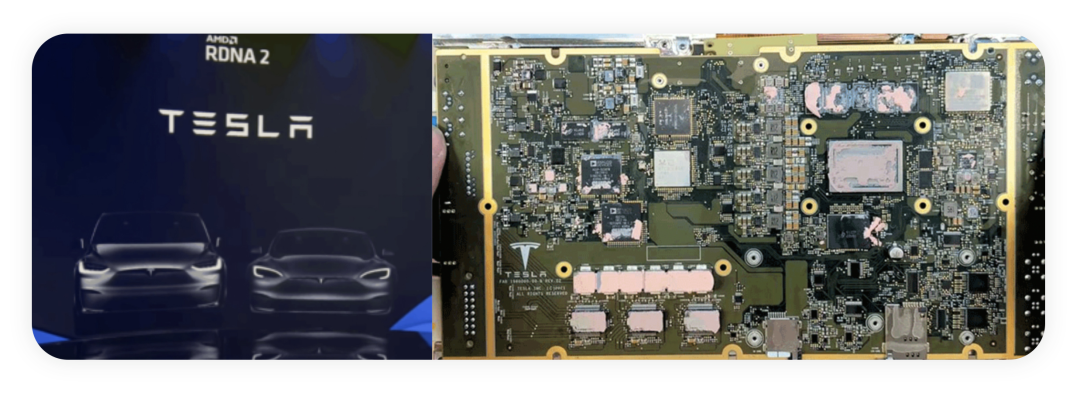

In 2021, Tesla’s Model S Plaid is equipped with AMD’s Ryzen RDNA 2 processor, gradually replacing Intel’s A3950 processor, and is used in the infotainment systems of the high-end versions of Model 3 and Model Y.

After completing the acquisition of FPGA company Xilinx in February, does AMD have a clear automotive strategy like Qualcomm and Nvidia? Will they promise a 5-10 year plan, and truly become an important player in the automotive chip market? This is indeed interesting. In the era of high computing power, cross-domain strategies often come suddenly.

FPGA in Cars

The demand for high-performance SoCs in smart cars is steadily increasing. After acquiring Xilinx, AMD actively expanded into the automotive field (and it has become AMD’s FPGA department), focusing on FPGA, adaptive SoC, and software roadmap work.

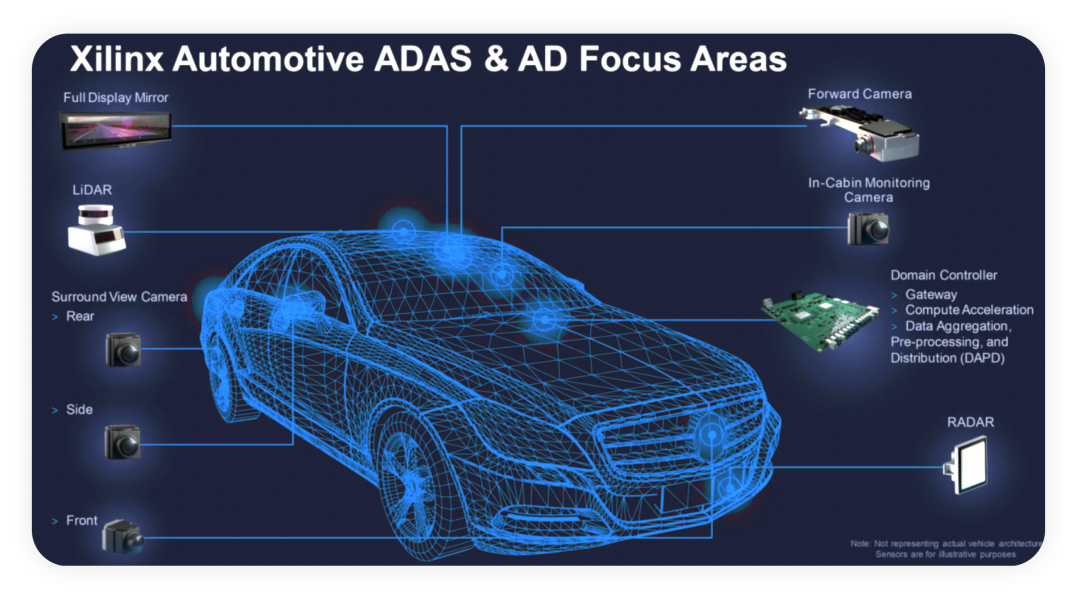

Traditionally, FPGAs are temporarily used in automotive systems, but with acceleration of the iterations, Xilinx FPGAs have been designed into ADAS embedded controllers to process data from cameras, 4D imaging radar, and lidar.

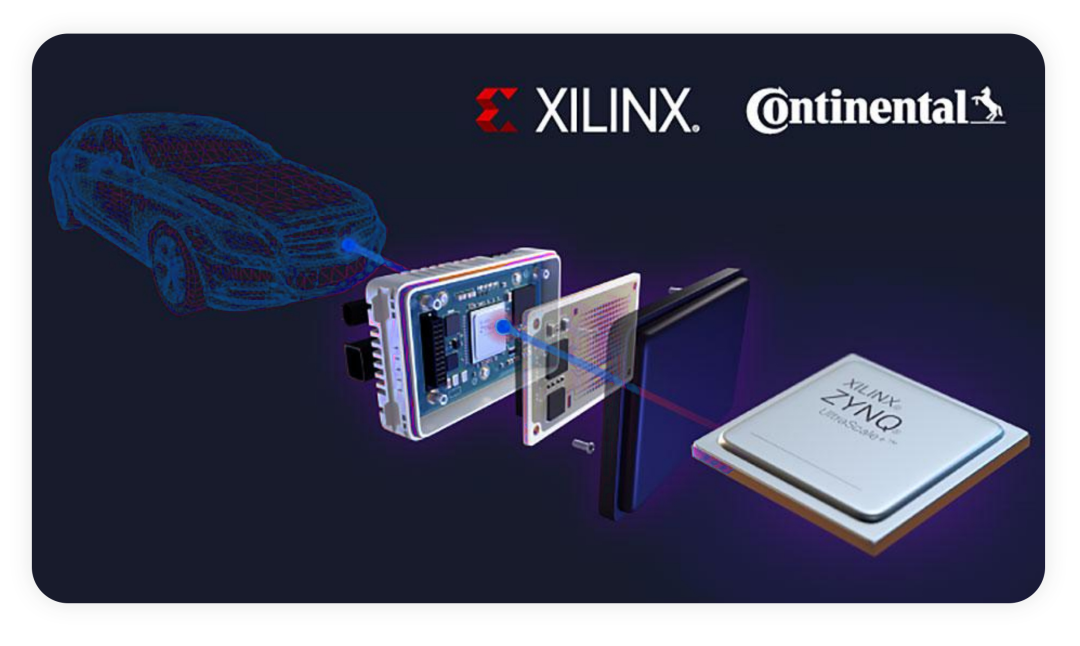

From specific applications, Xilinx provided a semi-custom version of its automotive-grade chips for Seeing Machines’ Fovio chip through collaboration with Seeing Machines. Subaru has adopted Xilinx’s FPGA solution. Xilinx is also allied with Veoneer, and the previous generation of Bosch and Japan Electric’s front view camera based on Xilinx FPGA is still in production.

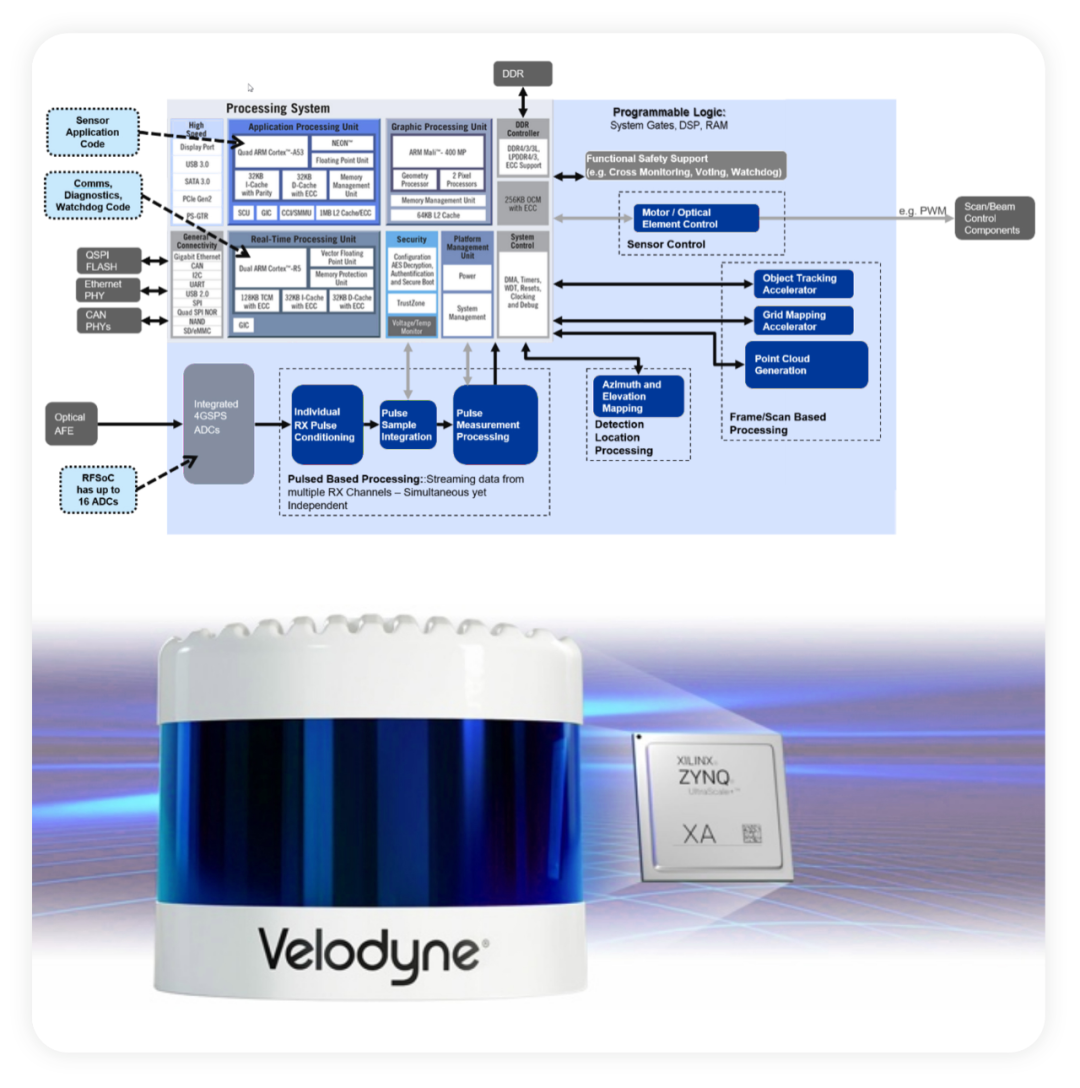

Xilinx is the main chip supplier for processing surround view camera data, including Bosch and Magna’s products, which have been put into production. Several other major Tier 1s will be put into production next year.Xilinx dominates in the emerging 4D imaging radar processors due to its high degree of freedom (occupying 85-90% of small-scale innovative markets), with NXP being its primary competitor.

In the field of lidar, with the rapid iteration of a large number of start-up companies, customers also design and use Innoviz’s independent research and development based on Xilinx chips. Overall, FPGA is still more commonly used in the early stages.

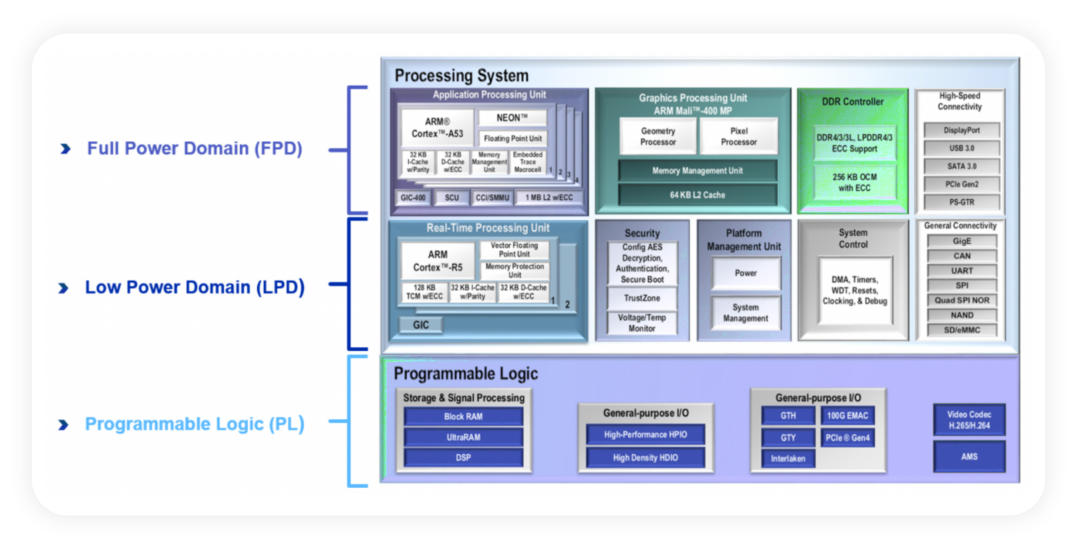

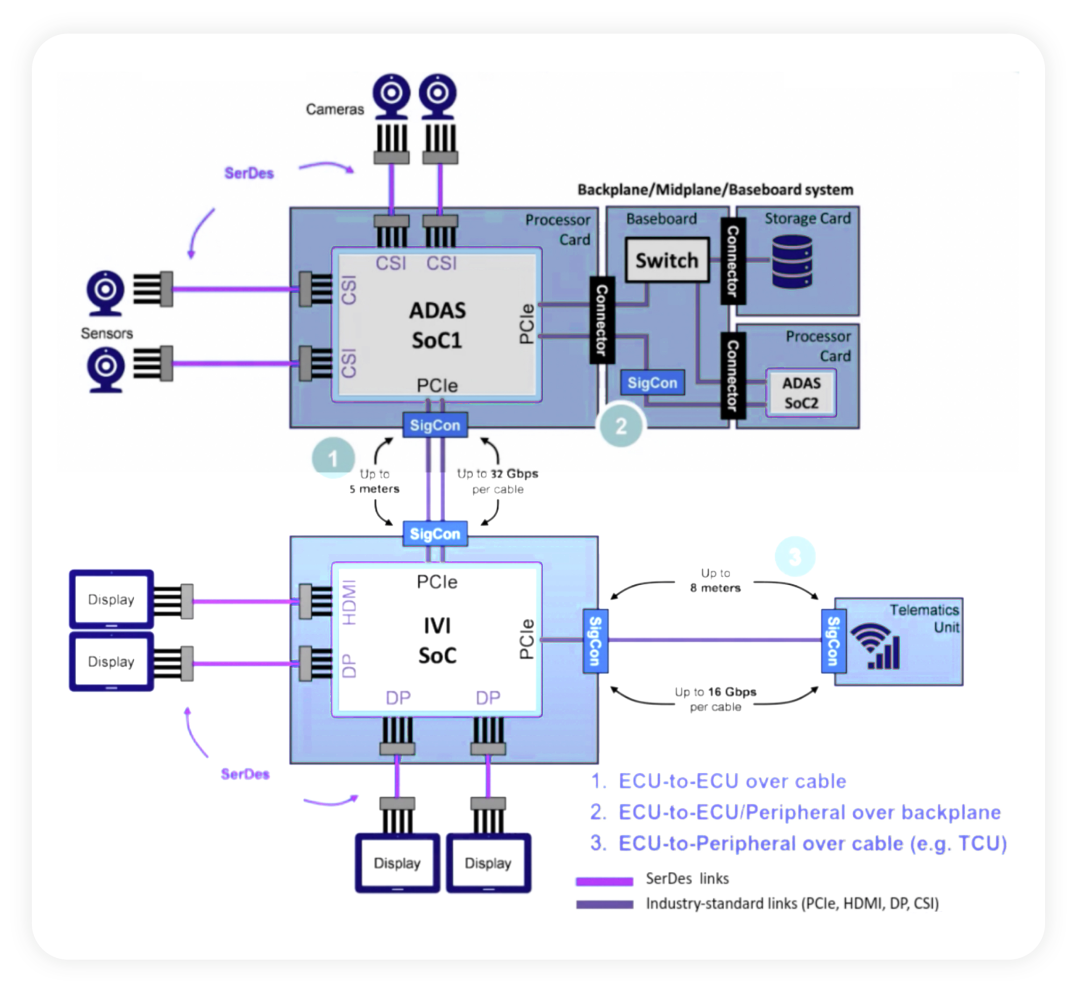

In the advanced automatic assisted driving field, Xilinx Automotive (XA) platform plays a key role in providing power for autonomous driving modules to achieve high-speed data aggregation, pre-processing, and distribution (DAPD) and calculation acceleration. The adaptive XA SoC platform can not only optimize the processing of increasingly complex safety-critical applications, but also meet the requirements of computing latency, performance, power efficiency, and functional safety between sensors and domain controllers. This product suite includes XA Zynq-7000 and Zynq UltraScale+ MPSoC platforms.

In terms of cost, FPGA platforms are more expensive than other SoC platforms, but the overall development cost of SoC platforms is too high, which makes up for the high cost of FPGA platforms. Currently, the advantage of FPGA lies in the rapid development of sensor technology. As the performance of automotive sensors improves, SoC designers are working hard to adapt. When a 1-megapixel camera is upgraded to 2, 4, or even 8 million pixels, logic devices must keep up with this rapid iteration. As sensors continue to upgrade, this difference will become more apparent.

Regarding AMD-Xilinx’s automotive strategy, it effectively utilizes AMD’s high-performance computing power and Xilinx’s flexibility in the domain controllers and zonal controllers growth areas in the automotive system architecture. Chip manufacturers need to provide solutions from the board level to succeed in the automotive market, instead of just offering chips.

Starting from Tesla’s use of AMD’s high-performance processors, the combination of AMD and Xilinx provides top-level capabilities, including top-notch x86 CPUs, top-notch GPUs (used on all public gaming platforms, which is very advanced in terms of entertainment), and first-class adaptive SoCs with programmable logic. For specific automotive needs, AMD can provide Arm Cortex A or R cores to provide complete solutions. AMD has gained the most critical parts of automotive chip manufacturers from Xilinx, including relationships with automakers, and embedded solutions with completed states and Xilinx software.

Starting from Tesla’s use of AMD’s high-performance processors, the combination of AMD and Xilinx provides top-level capabilities, including top-notch x86 CPUs, top-notch GPUs (used on all public gaming platforms, which is very advanced in terms of entertainment), and first-class adaptive SoCs with programmable logic. For specific automotive needs, AMD can provide Arm Cortex A or R cores to provide complete solutions. AMD has gained the most critical parts of automotive chip manufacturers from Xilinx, including relationships with automakers, and embedded solutions with completed states and Xilinx software.

In this sense, AMD-Xilinx is more like a novice in the automotive chip industry, but their synergy is strategically feasible. AMD also acknowledges the needs of automotive customers, working on the Arm platform or embedding Arm cores in its chipsets, and can develop some unique solutions.

Summary: In the era of automobiles, differentiation and meeting user needs are king in a sense. Through the acquisition of Xilinx, AMD has made a good start in the automotive market. However, if AMD wants to continue to compete with rivals such as Qualcomm, Nvidia, and Mobileye in this field, it needs to use its advantages in high computing power to break the development rules of the automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.