Author | Wang Yunpeng

Beijing Electric Vehicle Co., Ltd. (BJEV), the first listed new energy vehicle company in China, is once again in the red.

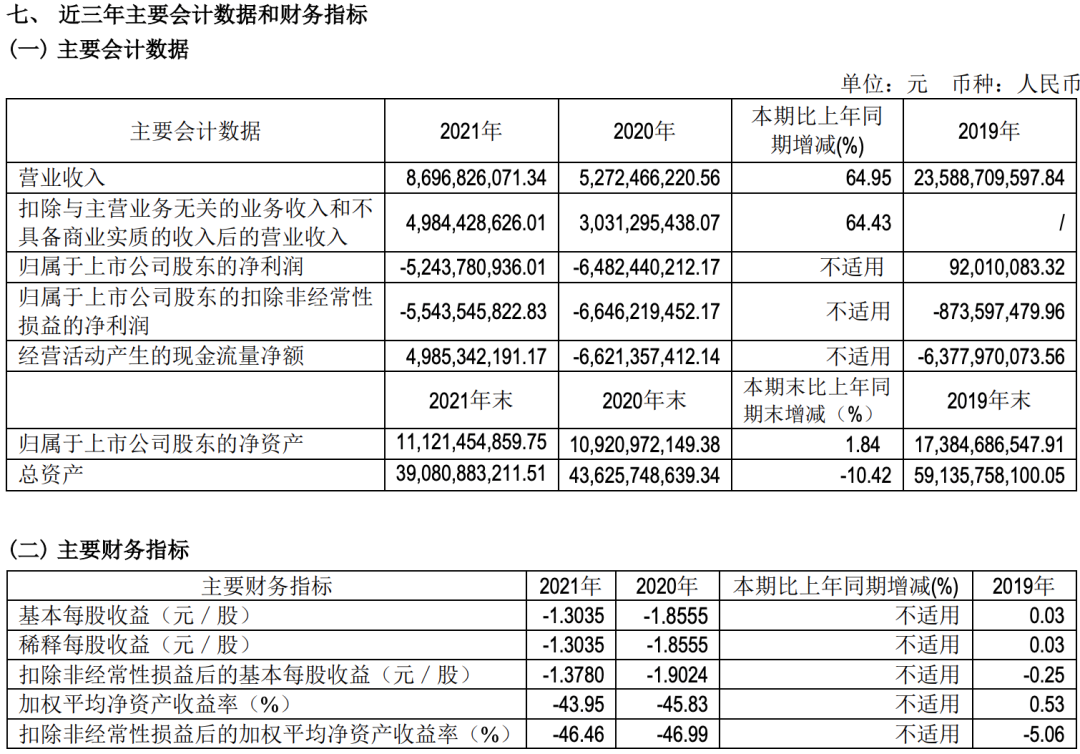

On March 26, BJEV released its annual report, which showed that its operating income for 2021 was approximately RMB 8.697 billion, a year-on-year increase of 46.95%, but its net profit attributable to the parent company’s shareholders was negative RMB 5.244 billion, a 19% decrease in losses compared to the same period last year. The net cash flow generated from operating activities was RMB 4.985 billion, which turned positive.

Looking at the annual report data, BJEV’s performance slightly improved in 2021, but it still failed to reverse the situation of huge losses. BJEV stated that the main reason for the huge losses was the impact of the pandemic, and the production and sales data did not meet expectations.

It is worth mentioning that this is not the first time that BJEV has experienced a severe decline in performance. In 2020, due to the impact of the pandemic and intensified market competition, it already suffered a loss of RMB 6.482 billion. Including the net profit attributable to the parent company’s shareholders of negative RMB 5.244 billion in 2021, BJEV’s losses over the past two years have reached RMB 11.726 billion.

“According to the latest rules, although we have suffered losses for two consecutive years, there will be no ST situation, and we will not be required to wear star labels or face delisting,” said Zhao Ji, secretary of the board of directors of BJEV. He also mentioned that the China Securities Regulatory Commission has adjusted its regulatory approach, focusing not only on the net profit capacity of listed companies, but also on their sustainable operational capabilities. BJEV has core competencies in sustainable operation and its business situation is stable.

In fact, I’m not surprised by BJEV’s huge losses again, as it is quite common for new energy vehicle companies to suffer losses in 2021, with NIO posting a loss of RMB 4.0169 billion and Li Auto a loss of RMB 1.02 billion. However, compared to other new players in the market, BJEV’s losses are still a cause for concern.

Moreover, when combined with the sales performance of 26,127 units in 2021, it is hard to see where BJEV’s future lies.

Former benchmark

Although the current situation is hard to describe with just one word, it cannot hide BJEV’s past glory.# Translation

Let’s go back to 11 years ago. On November 14, 2009, as a core subsidiary of the Beijing Automotive Group New Energy Corporation, Beijing New Energy Automobile was established. The following year in December, the first batch of pure electric vehicles EV150 were produced. According to public data, the sales volume of Beijing New Energy Automobile in the first year was only 1600. However, due to the fact that it was established 5 years earlier than the recognized domestic new energy vehicle year (2014) by the industry, Beijing New Energy Automobile has successfully led the development trend of domestic new energy vehicles in the subsequent years.

In 2015, due to the concept of the sharing economy that began to spread across industries, as a car-sharing industry under the sharing economy, it also grew rapidly under the rapid development of the new energy automobile industry and the guidance of policies such as restriction on purchase, restriction on use, and restriction on number of vehicles. This gave Beijing New Energy Automobile the opportunity to focus on the B-side market, and its product sales began to increase rapidly.

In 2017, Beijing New Energy Automobile’s cumulative sales reached 103,100 vehicles, accounting for 23% of the new energy vehicle market in China that year, making it the first pure electric vehicle company in China with an annual production and sales volume exceeding 100,000 vehicles. Looking at the global new energy vehicle market, Beijing New Energy Automobile’s sales that year were second only to Tesla, ranking second.

It is worth mentioning that in this year, Beijing New Energy Automobile also successfully broke through the mixed-grid sales model, forming 280 sales outlets, 249 service stations, and sales networks covering 25 provinces and 139 cities nationwide.

In 2018, Beijing New Energy Automobile continued to grow rapidly. The 6 major series including EH, EU, EX, EV, EC, and LITE had a total of more than 10 models of pure electric vehicles with a cumulative sales volume exceeding 158,000, a year-on-year increase of 53%, and achieved operating income of approximately RMB 16.438 billion, a year-on-year increase of 43.02%.

At the same time, relevant statistical data showed that by 2018, compared with the early stage of marketization in 2013, Beijing New Energy Automobile’s personnel scale had increased by 12 times, its asset scale had expanded by 47 times, and its product sales had grown by 97 times. The continuous high-speed growth also enabled Beijing New Energy Automobile to go public in S Blue Valley (renamed as Beijing Blue Valley) and listed on the A-share in September 2018.

In 2019, Beijing New Energy Automobile’s sales volume surpassed 150,000 again, and won the title of domestic pure electric vehicle market sales champion for 7 consecutive years.

The outstanding performance of Beijing New Energy Automobile also made Beijing Blue Valley the industry benchmark for a while.

The Halo Fades RapidlyLooking at the situation in 2019, it is undeniable that the sales performance of 150,000 vehicles is impressive.

However, behind the sales performance of Beiqi Blue Valley, there are hidden concerns. The data shows that at the end of 2019, Beiqi Blue Valley’s sales volume fell by 4.69% year-on-year. And this is only the beginning of its sales decline. In 2020, the sales volume of Beiqi Blue Valley continued to plummet, dropping to 25,900 vehicles, an 83% decrease, and its market share fell from its peak of 23% to less than 1%.

If the plummet in sales in 2020 could be attributed to the impact of the pandemic, then in 2021, with the domestic new energy vehicle market booming and sales reaching 3.521 million vehicles, an increase of 160% year-on-year, Beiqi Blue Valley’s cumulative performance of 26,127 vehicles seems to have little excuses.

The continuous decline in sales has made Beiqi Blue Valley’s business performance even more unsightly. Specifically, if the net profit attributable to the parent company in 2021 is included, which was negative 5.244 billion yuan, Beiqi Blue Valley has lost 11.726 billion yuan in two years.

As a former industry giant, why did Beiqi Blue Valley fall into such a state? In fact, its decline is traceable. Data shows that as a subsidiary of Beiqi Blue Valley, when Beiqi New Energy was initially established, its main target market was the B-side, which included taxi, ride-hailing, and car rental industries, whose development was relatively rapid from 2013 to 2019, a period of time when its sales surged.

Using 2019 as an example, 70% of the sales volume of 150,000 vehicles that year came from the B-side, and its products were mainly aimed at ride-hailing, taxi, and official government vehicles, with a contribution rate of less than 30% for the private vehicle market.

However, with the collapse of the new energy B-side market in 2020, Beiqi Blue Valley’s sales volume, which relied solely on one leg, almost “collapsed” overnight. Of course, in the face of the sales downturn in 2020, Beiqi Blue Valley did make efforts, but the C-side market had no place for it at the time.

It is worth mentioning that due to the impact of poor sales and performance, Beiqi Blue Valley’s personnel changes have also been quite frequent in recent years.

In February 2019, Ma Fanglie took over as CEO of BAIC New Energy, but served for less than a year. In June 2020, He Zhangxiang, then Vice President of BAIC New Energy, temporarily took over the position of CEO before officially handing it over to Liu Yu on July 24 of the same year.

In February 2019, Ma Fanglie took over as CEO of BAIC New Energy, but served for less than a year. In June 2020, He Zhangxiang, then Vice President of BAIC New Energy, temporarily took over the position of CEO before officially handing it over to Liu Yu on July 24 of the same year.

However, Liu Yu’s tenure was also short-lived as he resigned from the position of CEO of BAIC Blue Valley by submitting a written resignation report on June 9, 2021, but still held positions such as Chairman of the Board and Chairman of the Board’s Strategic Committee at BAIC Blue Valley. The position of CEO was taken over by Dai Kangwei, the former Vice President of BAIC New Energy Engineering Institute.

In addition to frequent changes in senior personnel, BAIC Blue Valley was also caught up in the layoff storm mid-year and was anonymously reported by employees for “illegal layoffs”.

When will the turning point arise?

In terms of time dimension, BAIC Blue Valley is considered an “old player” in the domestic new energy vehicle market.

However, with the current situation, this “early bird” has not only been overtaken by new carmakers such as NIO, Ideal and XPeng, but also the gap between industry leaders such as Tesla and BYD is getting wider and wider.

So, where is the turning point for BAIC Blue Valley? The answer to this question depends more on its sales performance.

In this regard, both BAIC Blue Valley and BAIC Group have a clearer understanding. “The sales target of BAIC Blue Valley in 2022 is 100,000 units, including 40,000 ARCFOX and aiming to reach 300,000 units in the future.” Zhang Xiyong, CEO of BAIC Group, revealed at a recent communication meeting with the outside world.

At the same time, Dai Kangwei, Manager of BAIC Blue Valley and CEO of BAIC New Energy, also stated that “in order to get out of the slump, BAIC Blue Valley will further focus on its main business, and concentrate its energy and investment on two brands: ARCFOX and BEIJING.”

It is worth mentioning that Zhang Xiyong has a certain degree of confidence in the above sales target.

Take the ARCFOX brand as an example. According to BAIC Blue Valley, by the end of 2021, it had completed the construction of more than 120 authorized service centers. It has achieved 100% coverage in 15 key cities in the high-end pure electric market where sales account for more than 80%. It has also completed the construction of 35 stores in 21 cities with potential. It is expected that the number of marketing stores will reach 150 in 2022, and the marketing and service network scale will cover 100+ cities and have 380+ service centers by 2025. In terms of service, it has authorized 73 authorized service centers, covering 54 cities nationwide, and the direct team provides 24-hour online service.

“In order to cope with the fierce market competition in 2023 and 2024, BAIC Blue Valley’s R&D investment ratio in 2021 exceeds 20%, and will double in 2022.” Dai Kangwei said.

Although a considerable amount of investment has been made, BAIC Blue Valley does not seem to have made much progress in sales. Public data shows that in 2021, the cumulative sales of the two brands, Ji Hu and BEIJING, were only 26,127 vehicles, of which the sales of the BEIJING brand were 21,134, and the high-end-oriented Ji Hu were only 4,993, far below the target of 12,000.

Even entering this year, the sales of BAIC Blue Valley have still not improved. Sales data show that as of the end of February, BAIC Blue Valley’s cumulative sales were only 3,385 vehicles. Although this is a 62.43% increase compared to the same period in 2021, the target completion rate is only 3.4% based on the target of 100,000 vehicles.

In addition, the Alpha S HI version, which once gained considerable attention with “Huawei’s car-making”, has been delayed in delivery time again and again. This also inevitably raises concerns about whether the car can be delivered in large quantities and whether it will have the capability to compete with its peers when delivered.

It can be said that in the face of the current difficulties, when will the turning point of BAIC Blue Valley appear and whether the Ji Hu brand can achieve Zhang Xiyong’s target still remain to be seen.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.